Press release

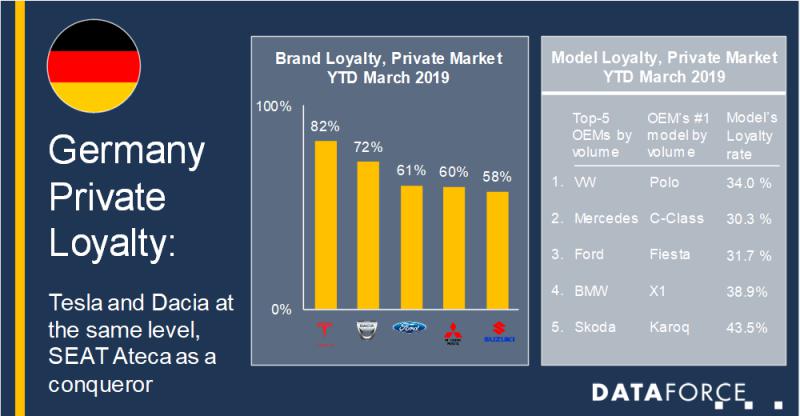

Brand loyalty– Tesla and Dacia at the same level, SEAT Ateca as a conqueror

At first glance, these two manufacturers could not be more different. And yet the Romanian manufacturer and the electric car pioneer from Palo Alto, California, have one thing in common: extremely loyal customers. "Private Loyalty" statistics are updated monthly and Dataforce took a closer look at the loyalty of drivers in the German Private Market, examining brand and model loyalty in detail. This allows us to answer two very different questions regarding loyalty:1) How loyal are customers?

Statistics reveal that former Dacia or Tesla drivers remain loyal to the respective brand in more than 70% of all cases when changing cars. This is an outstandingly high figure when considering the other end of the scale with brands where eight out of ten former customers turn to a competitor! And it is also possible to analyse for which makes and which models the brand’s former customers are opting.

One of the models with the highest volume on the German Private Market, the VW Golf, achieved a loyalty rate of 23% in YTD February 2019. This means that less than a quarter of the former owners of this model opt for the same one again when buying a new car. 34% of the other buyers switch to another model within the brand and not always into a larger vehicle, in some cases into smaller ones. The remaining 43% actually turn their backs on the brand. This was not always the case. Back in 2015, the Golf achieved a loyalty rate of 35%.

2) How successful are brands in winning third-party customers?

Almost every new model launch is based on the manufacturer's desire to win customers from competitors. While some of the planned conquest rates turn out to be wishful thinking, the Private Loyalty statistics allows for clear data driven results. For example, the Ateca, the first SUV of SEAT, was launched in 2016: the data shows that three out of four current Ateca customers did not drive a SEAT before. Most of these new customers were won from outside the VW group, primarily from BMW, Mercedes and Opel and the 3 Series, C-Class and Astra respectively.

(355 words; 2,055 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Michael Gergen

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-231

Fax: +49 69 95930-333

Email: michael.gergen@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brand loyalty– Tesla and Dacia at the same level, SEAT Ateca as a conqueror here

News-ID: 1716604 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Ateca

UK True Fleet takes a dip and sees its lowest March figures since 2014

The UK True Fleet has delivered another negative month for 2019 in what is usually the strongest month of the year (due to the new plate release). The Total Market finished with 458,054 registrations, down by 3.4% and it was the RAC/Short-Term Rental channel which arrested what could have been a much high slide thanks to its +13.6%. Both the Private and Dealer/Manufacturer channel posted negative growths of 2.8% and…

Spain’s True Fleet continues to surge with highest growth rate of the year

The Spanish Fleet Market can seemingly do no wrong with yet another double-digit growth, this time a +19.5%, the highest growth rate for the year so far. The Total Market achieved 137,000 registrations with all channels bettering their volume of June 2016. The Private Market grew by 3.6%, Special Channels by 4.9% with True Fleet taking the crown in terms of the highest growth. As an interesting sub note, True…

French True Fleet down 9% for April despite strong numbers from the home brands

Another tough month for the French True Fleet Market with April being the fourth consecutive month with registration volumes below last year’s. The decline by 9.0% led to a year-to-date result of -7.2%. The Private Market had a similar disappointing April with -8.1% but at least its YTD performance is (still) slightly positive with +0.2%.

Let’s have a look at the brand ranking within fleets. Despite the weak market Renault in…

French True Fleet down 9% for April despite strong numbers from the home brands

Another tough month for the French True Fleet Market with April being the fourth consecutive month with registration volumes below last year’s. The decline by 9.0% led to a year-to-date result of -7.2%. The Private Market had a similar disappointing April with -8.1% but at least its YTD performance is (still) slightly positive with +0.2%.

Let’s have a look at the brand ranking within fleets. Despite the weak market Renault in…

April’s True Fleet feeling the effect from three negative elements

With April bringing a triple combination of negative elements to effect the market it was perhaps a foreseeable downturn for the both the Total Market and True Fleet. Three less business days, the usual hangover from the UK plate change plus the somewhat confusing new Vehicle Excise Duty (VED) all contributed to the less than stellar - 19.8% for the Total market. While True Fleet suffered with a - 25.1%…

True Fleet Market Germany: bigger is better

With a drop of - 6.7 per cent compared to February 2016 the True Fleet Market in Germany had a difficult second month of the year. Even if you take into account that February 2017 had one working day less than last year the result was still negative. The Total Market was also slightly negative down to a little over 243,000 registrations generating a -2.6% over its comparable figures for…