Press release

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which unsurprisingly then resulted in a positive month for the Dealership/Manufacturer channel with a + 2.6%. RAC was also negative for June but has managed to remain in the black to the tune of 5.0% YTD. In total the UK market finished with 223,000 registrations resulting in a drop of 4.9% when compared to June 2018.Brand performance

While the market continues to struggle it is certainly not every OEM that is feeling the pinch. Some are positively thriving in the adverse conditions. VW retains the number one spot despite a challenging month while Ford recaptured two places to put itself back into 2nd for June. The blue oval brand saw some great performances from the Fiesta, Ecosport and KA+ helping them to finish with a + 17.8% and marking its first month of growth since August 2018.

Toyota and SEAT took 8th and 9th respectively and both these manufacturers seem to be bucking the overall trend, gaining some great results for not only the month but YTD as well. Toyota registered a + 23.4% for June and a + 8.2% YTD, while SEAT grew by 30.8% and are 11.5% YTD. Toyota has the Yaris, C-HR and the Prius Plus to thank while for SEAT it was their SUV line up of Ateca, Arona and Tarraco.

A generous and worthy mention must go to another OEM just outside the top 10. Volvo in 15th position for June managed to increase by 22.5% but even more impressive is their current result YTD, where they have achieved a + 44.9%. A quick look at the model range clearly identifies the XC40 the star within the Swedish brand YTD but its big brother the XC60 is not to far behind.

The LCV market – Polar opposite to Passenger Car registrations

Bringing some much-needed sunshine to the automotive space in the UK, LCV True Fleets (up to .3.5t) are having a very positive year in 2019. For the month of June there was an increase of 11.6% while YTD figures show the segment up 8.4%.

We see a similar pattern in Switzerland, Latvia and the Czech Republic with the Swiss PC market down by 9.3% while LCV are up by 5.2%, Latvian Passenger Cars down by 6.0% while LCV are riding high with a 15.8% increase and to a lessor extent for the Czechs with a 17.0% contraction in PC but a 2.4% increase on the LCV side.

The clear leader in the UK in regard to brands is Ford with almost double the amount of registrations YTD than its next rival in the standing Mercedes. Mercedes and also Renault (6th) have made significant gains with a +47.7% and 27.0% growth for them respectively thanks largely to the Sprinter and Trafic though this still leaves them a way off from eclipsing the Ford domination.

(505 words; 2,919 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK True Fleet continues to contract, finishing Q2 without a positive month here

News-ID: 1808643 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

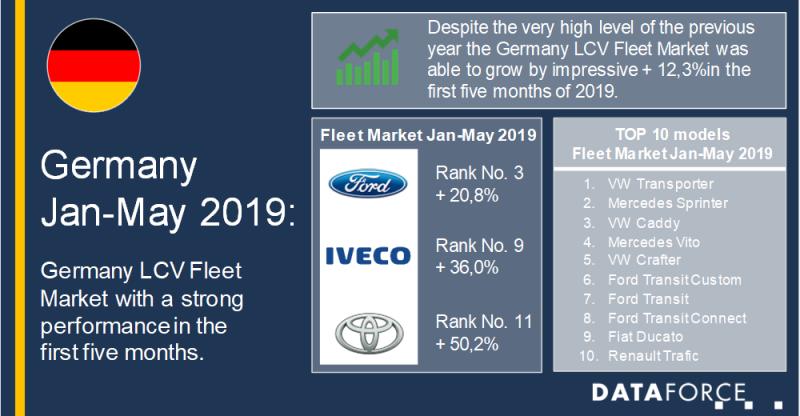

German LCV Fleet Market with a strong performance in the first five months

Definition and development of the registration figures

Since 2001, Dataforce has worked on providing the best clarity for the LCV market in Germany. The LCV market has two elements: registrations of commercial vehicles up to a weight of 7 tons as well as passenger car registrations of typical LCV models such as VW Caddy, Citroën Berlingo or Fiat Ducato. There were two further additions at the beginning of this year: on…

More Releases for YTD

Wego's GCC Android Downloads Reach 838K YTD 2025

Sensor Tower data (Jan-Aug) confirms strong region-wide adoption across the GCC; high store ratings and travel-tech awards underscore trust and leadership.

Dubai, UAE - September 16, 2025 - Wego (https://www.wego.com/), a top-rated global travel app and website, and the #1 travel brand in the Middle East and North Africa (MENA), today announced that its Android downloads in the Gulf Cooperation Council (GCC) totaled 837,642 YTD 2025 (Jan-Aug), according to Sensor Tower.…

Glass Cutting Machine Market Size, Share and Forecast By Key Players-Anhui Ruilo …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global Glass Cutting Machine market is anticipated to grow at a compound annual growth rate (CAGR) of 9.55% between 2024 and 2031. The market is expected to grow to USD 8.84 Billion by 2024. The valuation is expected to reach USD 16.74 Billion by 2031.

The market for glass cutting machines is expected to develop significantly. The building industry is seeing tremendous growth,…

Ultra Thin Glass Cutting Machine Market Size, Share and Forecast By Key Players- …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the MRI Team's Market Research Intellect, the global Ultra Thin Glass Cutting Machine market is anticipated to grow at a compound annual growth rate (CAGR) of 9.56% between 2024 and 2031. The market is expected to grow to USD 8.1 Billion by 2024. The valuation is expected to reach USD 15.33 Billion by 2031.

The market for ultra-thin glass cutting machines is expanding quickly due to rising demand from the…

A strong July brings the German True Fleet Market back to YTD growth

In July 2018, the German passenger car market grew by an impressive +12.3% which is the highest growth rate in 2018 up to now. Let’s have a closer look where this drive is coming from. The Private Market was certainly in very good shape with a +16.1% over July 2017. This is at least partly based on the prolongation of attractive offers by the OEMs for private customers replacing their…

"Alternative Alternatives" investment funds gained 1.92% in April, +2.38% YTD

Opalesque Ltd., a leading provider of online information services to the alternative investment industry, announced the results of the Opalesque A SQUARE ('alternative-alternatives') indices covering the performance of niche alternative investment funds. The indices are calculated based on the net performance of 608 single- and multi-manager funds currently listed in 21 categories in the Opalesque Solutions A SQUARE Fund Database (http://www.opalesquesolutions.com/asquare).

The Opalesque A SQUARE Index posted its strongest month so…

"Alternative Alternatives" investment funds lost 0.14% in March, +0.66% YTD

Opalesque 5th May 2011: Opalesque Ltd., a leading provider of online information services to the alternative investment industry, announced the results of the Opalesque A SQUARE ('alternative-alternatives') indices covering the performance of niche alternative investment funds. The indices are calculated based on the net performance of 605 single- and multi-manager funds currently listed in 22 categories in the Opalesque Solutions A SQUARE Fund Database.

The Opalesque A SQUARE Index lost 0.14%…