Press release

UK True Fleet takes a dip and sees its lowest March figures since 2014

The UK True Fleet has delivered another negative month for 2019 in what is usually the strongest month of the year (due to the new plate release). The Total Market finished with 458,054 registrations, down by 3.4% and it was the RAC/Short-Term Rental channel which arrested what could have been a much high slide thanks to its +13.6%. Both the Private and Dealer/Manufacturer channel posted negative growths of 2.8% and 2.9% respectively and it was True Fleet which posted the largest contraction with a -9.3%. The assumption here being that until the Brexit has been finally concluded (either way) the negative growth will likely continue along with the current nervous buying sentiment.Brand performance

For March’s top 10 performers there were seven OEMs with changes to their ranking, some good, some bad. VW re-took the number one spot for the first time in 2019, gaining a place from March 2018 results despite a 1.0% decline. Mercedes and BMW followed, both with strong performances of +7.2% and +13.2% respectively and it is worth mentioning that BMW already ranked 1st in True Fleet for February.

Ford was next in line with Audi and Nissan trailing them. Opel (Vauxhall) appears to be bearing the brunt of the downturn for the month, not only dropping six places into 7th but also with the highest decrease of 55.2%. Perhaps the only major plus point for the manufacturer was the performance of the Grandland X tripling its registrations (+221.1%). Toyota and Kia were the next two on the ladder, while SEAT entered the top 10 with a solid growth of 9.5% thanks mostly to the Arona and Ateca. SEAT’s latest SUV, the Tarraco has also shown up in the data (since Feb 2019) and given the success of the previous mentioned Arona and Ateca it will certainly be interesting to see for the rest of 2019 just how it will perform, especially in a somewhat challenging market place.

Fuel type performance

Neither the Diesel or Petrol segment could post a positive March but both Hybrid (+6.7%) and Electric (+98.9%) did. Top 3 from the electric camp were the Nissan Leaf, BMW i3 and the Jaguar I Pace, with the Growler from Whitby taking 3rd place for the third time in a row. For Hybrids, no surprise to see Toyota at the top of the list with the C-HR finishing in front of the Mitsubishi Outlander and Toyota Yaris.

Now while Diesel posted a double-digit deduction of 21.9% there may be some positive results coming soon. The first RDE2 compliant cars will arrive in April (Mercedes A200d and A220d) meaning that company car drivers can avoid the higher BIK (Benefit-in-Kind) band for Diesel cars which meet these stricter emission standards. It remains to be seen whether this will help to put the brakes on the diesel decline but it is certainly good news for end users who can now remove the arbitrary penalty the Government had applied without outlining the standard required for RDE2 compliant cars.

(505 words; 2,919 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UK True Fleet takes a dip and sees its lowest March figures since 2014 here

News-ID: 1702775 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

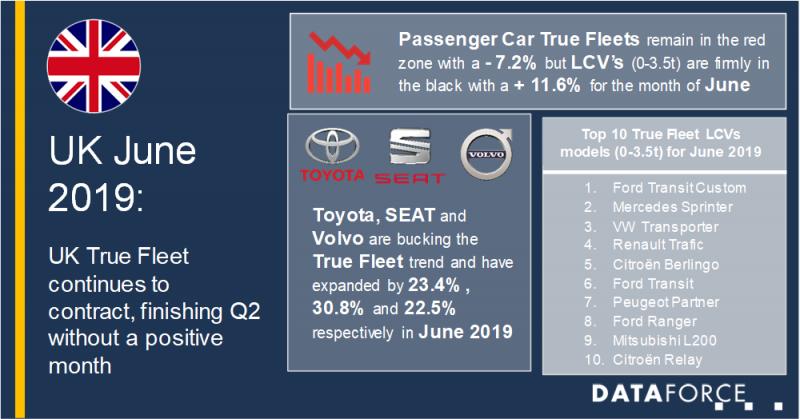

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

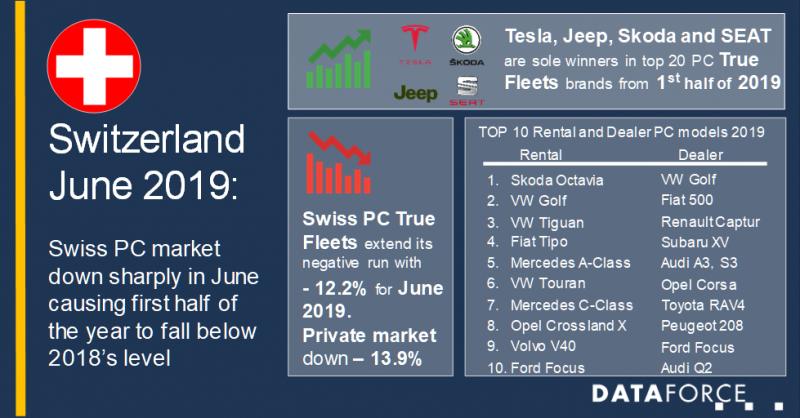

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…