Press release

Swiss, US rental taxes highest in OECD

Switzerland imposes the highest taxes on rental income of non-resident landlords, according to a study on the tax situation in more than 90 countries around the world. The study has been conducted by Global Property Guide with contributions from leading accounting firms in each country.The effective income tax rate in Geneva, Switzerland can be as high as 48.6% on a rental income of €1,500/month and 54.5% on income of €12,000/month.

Other OECD member countries that impose high effective tax rates, above 20%, include the US, Norway, Spain and Finland.

In Norway, the flat 28% rental income tax is combined with a progressive capital tax. Although deductions for operating costs and income-generating expenses are allowed, effective tax rates are still high, ranging from 27% to 31%.

Spain charges 24% withholding tax on the gross rental income of non-resident foreigners, no deductions are allowed. Finland, on the other hand, charges a flat 28% tax but all direct income-generating expenses are deductible. This leads to an effective rate of around 24% in Finland.

The importance of deductions is also highlighted in the case of France. The nominal income tax rate for non-residents is high at 25%. However, if the gross rental income on a furnished flat is less that €76,300 per annum, deductions of up to 72% can be made. Only the remaining 28% of gross income is taxed, amounting to an effective tax rate of only 7%.

In the UK, personal deductions combined with depreciation and costs are higher than the assumed gross income of €1,500 per month (€18,000 per year), leading to zero taxable income.

Effective rental income tax rates are generally below 10% in Luxembourg, France, Japan, South Korea, Mexico, New Zealand and the UK.

Gross or net taxation

In Canada and the US, non-resident landlords are given the option to choose between two options: ‘gross’ or ‘net’ income taxation. The gross income tax rate is high but the process is very simple; no deductions, no allowances, no accountants involved.

In the US, the gross rental income of non-resident aliens (NRA) that are “not effectively connected” is taxed at 30%, withheld by the tenant. In Canada, gross income is subject to a fixed 25% tax, also withheld by the tenant.

Landlords can alternatively opt to pay net income after allowed deductions, potentially lowering tax rates, but the rules are complicated. Maintenance, local taxes and depreciation are deductible subject to certain rules.

In Canada, by “electing under section 216” the net income is taxed at rates ranging from 15.5% to 29%. After deductions and allowance, the final effective tax rates range from 8.14% to 14.87%, much lower than the 25% gross rate.

Rental income tax assumptions

Global Property Guide’s estimate of the “effective” tax rate includes adjustments for depreciation, and any other typical costs which a landlord pays such as management charges, buildings insurance, real estate agency fees, real estate taxes, etc. However, mortgage expense tax relief is not included.

To make the income tax situation easy to understand, the study adopts a standard case:

1. Gross rental income is US$1,500/month, or US$18,000 per year (€1,500 or €18,000 for Europe).

2. The property is directly jointly owned by husband and wife, who are both foreigners and non-residents. Many countries impose higher taxes on foreigners and/or non-residents, or allow them lower deductions.

3. The owners have no other local income aside from rent.

4. There is no mortgage, i.e., no loan was taken to buy the rental unit.

The result is an “effective income tax rate”, which is typically different from the nominal tax rate. These effective rates represent what taxes are really payable, after all allowances and deductions. They provide a clearer and more realistic picture of a country’s tax situation for potential investors.

Social effects

Higher marginal taxes on rental properties are argued to be pro-poor because of the perception that landlords and property owners are typically rich, thus should be taxed more. The perception is amplified when taxing non-resident foreigners.

However, excessive taxation of rental property affects the availability of affordable housing, as shown by much research. High taxes on rental income lead to low net rental yields, which discourage owners from renting out their properties.

And due to the filtering effect, any policy that makes it difficult or expensive to produce any type of housing restricts the available stock of low-cost housing. The filtering effect is a process by which poorer households move to occupy the void left by richer households as they move from renting to ownership or to better and newer housing.

Spain’s high rental income tax rate of 24%, for instance, combined with restrictive tenancy laws, has led to the shrinking of the private rental market. Property owners prefer to keep their housing units empty rather than rent them out. In 2001, about 14% of the total housing stock was vacant, more than the entire rental stock (which was only 10% of the housing stock).

From an investor’s point of view, the significant difference between nominal and effective tax rates in many countries highlights the importance of tax planning. Knowing all the legally allowable deductions and allowances can spell the difference between profits and losses, and separate gainers from losers.

**DISCLAIMER: The information contained here is not written tax advice directed at the particular facts and circumstances of any person and should not be relied upon. We encourage you to discuss your particular situation with the particular accounting firm or an independent tax advisor.

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Time Zone: UST+8.00

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Time Zone: UST+8.00

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide is an on-line property research house. On-line newspapers, magazines, etc which use material from this release MUST provide a clickable link to www.globalpropertyguide.com. Sites found not providing the link will be removed from our press list.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Swiss, US rental taxes highest in OECD here

News-ID: 29057 • Views: …

More Releases from Global Property Guide

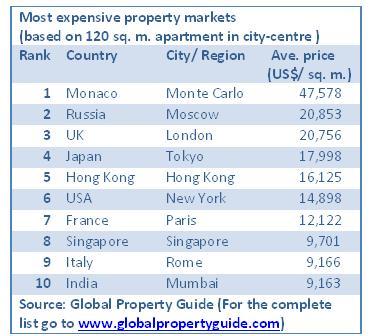

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Source:

Source Leak Detection

Water leaks are one of the most common problems faced by homeowners. Whether it's a leaking pipe, roof, or pool, if left unchecked, leaks can cause significant damage, increase water bills, and require costly repairs. Leak detection is an essential service that helps identify and repair leaks early, saving water and preventing long-term damage. At Source Leak Detection, we use advanced, non-invasive methods to quickly locate and fix leaks in…

Three-River-Source Academy Pioneers the "Three-River-Source Studies"

On July 25, 2024, at the advisor appointment ceremony and the first academic symposium on Three-River-Source Studies held in Yushu, Qinghai, Professor Lian Yuming, a member of both the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and its Committee on Proposals, the Chief Expert of the Three-River-Source National Park Administration, and the Director of the Three-River-Source Academy, proposed the concept of "Three-River-Source Studies" for the first time.…

Organic Pasta Market By Product Type (Wheat Source, Rice Source, Legumes Source) …

Organic Pasta Market was valued at USD 505.14 million in 2021 and is expected to reach the value of USD 1106.66 million by 2029, at a CAGR of 10.30% during the forecast period of 2022-2029.

The research report offers a comprehensive assessment of the market, including forecasted trends, growth drivers, consumption, production volume, CAGR value, thoughtful opinions, profit margin, pricing, and market statistics that have been independently verified by experts in…

Open Source Intelligence Market, Open Source Intelligence Market Analysis, Open …

Open-source intelligence is data collected from publicly available sources to be used in an intelligence context. Open-source intelligence collects data from publicly available sources such as television, radio, newspapers, commercial databases, internet, media, and others. The open source intelligence solutions are being adopted by many enterprises. The open source intelligence tools enable in collecting a wide range of information which are publicly available.

Get Sample Copy of this Report: https://www.qyreports.com/request-sample?report-id=79500…

America AC Power Source Market 2017- Pacific Power Source, Chroma Systems Soluti …

Marketreports.biz, recently published a detailed market research study focused on the "America AC Power Source Market" across the global, regional and country level. The report provides 360° analysis of "America AC Power Source Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global America AC Power Source industry, and estimates the future…

One Source Process is the best source for national process servers

United States 25-04-2016. One Source Process is the largest legal services company provides exceptional level of process service ideal to meet your custom needs. The job of process server involves a lot of responsibilities about the confidential documents of clients which need to serve to court or the parties involved in a matter. So, whenever you need someone for process service then make sure the process server is certified and…