Press release

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries where house prices are not falling, they are clearly losing momentum.

The biggest house price fall was in Latvia (Riga), down -38.2% by May 2008 from a year earlier, after adjusting for inflation.

US prices also fell during the year to end of Q1, by anything from -4.2% to

-18.1%, after inflation, depending on which index is used.

In Europe, significant real house price falls took place during the year to end-Q1 2008 in Ireland (- 13.2%), Luxembourg (-5.8%), Portugal (-4.3%) and Malta (-4.9%).

UK house prices were only slightly down at end-Q1 from a year earlier, the house price crash having begun in earnest in early 2008. House prices fell during the first quarter by between - 0.7% to -2.1% (inflation-adjusted), depending on the index used.

In Japan, the housing market is now losing momentum once again. The urban land price index for 6 major cities was up only 4.1% year-on-year (y-o-y) to H1 2008 in nominal terms (2.9% after inflation), down from 7.8% over the same period in 2007 (7.9% after inflation). The national index for Japan fell by 0.7% y-o-y to H1 2008 (-1.9% after inflation).

Inflation woes

In nominal terms, 28 countries saw their housing prices rise during the year to end-Q1 2008, while only 6 saw prices fall.

However when property prices are adjusted for inflation, the picture looks entirely different. Skyrocketing oil, food and commodity prices have pushed inflation up around the world.

In Ukraine for instance, nominal house price growth was sharply down from 79.5% in the year to Q1 2007, to 18.2% in the year to Q1 2008. But when adjusted for inflation, property prices actually fell by -6.4% y-o-y.

In real terms, property prices fell y-o-y to end-Q1 2008 in Norway, Spain, Greece, South Korea, New Zealand, Indonesia, South Africa, Israel, Estonia and Lithuania, despite nominal price rises in all these countries.

House-price booms elsewhere

On the other hand, strong house prices increases were observed in a handful of emerging economies. Ahead of the pack was China (Shanghai), with an enormous 40.5% nominal house price surge during the year to the end of Q1 2008.

Other countries with impressive nominal house price increases y-o-y to end-Q1 2008 were Bulgaria (31.6% y-o-y), Hong Kong (31.1% y-o-y), and Singapore (29.8% y-o-y). Strong house price gains also took place in Cyprus, Australia and Taiwan.

Again, when adjusted for inflation, many of these price rises look much less impressive. The world’s top-performing housing market (after inflation) was not China or Hong Kong or Singapore, but Slovakia, where real house prices rose by 29.3%.

Causes of the downturn

There were arguably three main factors behind the end of the housing boom:

• After a very long boom, house prices had become stretched in many countries. The main indicator of this is the price/rent ratio, which compares the relationship between the buying price of a dwelling, with its rental price.

As the boom progressed, buying prices become high (in relation to rents and financing costs) in many countries, leading to decisions by some buyers to rent instead of buying. Mortgage-holders also came under extreme pressure as interest rates rose. A key lesson is the critical importance of monitoring price/rent ratios, to ensure that house prices valuations stay within reasonable limits. (Declaration of interest: The Global Property Guide produces comprehensive price/rent ratio estimates, globally).

• Inflationary pressures forced central banks to raise interest rates. This particularly impacted European countries where mortgage loans were primarily made on variable interest rate terms. Countries with heavily indebted households are also vulnerable when interest rates increase.

In developing countries, the overall economy (which strongly sways the mood of the housing market) is sometimes very sensitive to interest rate changes or to direct intervention by the monetary authorities. In some countries, mere threats of interest rate hikes are enough to shake the stock market and scare away foreign investors. But conversely, developing countries typically have smaller mortgage markets, reducing the impact on housing markets.

• Unsound regulatory and banking practices in the US and elsewhere led to over-lending by mortgage providers which, when these unsound loans began to go bad, caused a financial crisis. The bad news spread both by a panic contagion effect, and because many banks outside the US turned out to be more exposed than initially expected.

Prospects

Inflation remains an extremely challenging problem for the world’s central banks. In addition, the financial shocks to the world’s banking systems resulting from house price falls remain to be worked through (historically, most banking system collapses around the world have been caused by falling house prices).

Until these financial systems feel more confident that their problems are behind them, loan volumes are likely to fall. Therefore, it seems likely that the world’s house price momentum will continue to go down.

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Cell: (+63) 917 735 2228

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock Phone: (+632) 867 4220 Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

Description:

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, sites, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com Sites and newspapers found not to be providing a link to us will be removed from our press list.

Requests for Comments:

Requests for comments are best made by telephone to +(63) 917 321 7073. UK-based callers should telephone before lunchtime. Our local time is Hong Kong time, i.e., standard time + 8.00

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The end of the global house price boom here

News-ID: 48084 • Views: …

More Releases from Global Property Guide

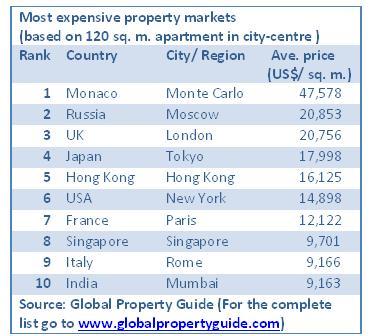

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

Asia house prices lead the world

Shanghai, China (up 35.4%) was the world’s strongest residential property market during the past full year, according to a compilation of official and private-sector statistics by the Global Property Guide. Bulgaria (up 34.6%) was in second place, followed by Slovakia (up 32.5%) and Singapore (31.1%).

The worst performers were the United States (down 8.9% by Case-Shiller calculations), Ireland (down 7.3%), and Estonia (down 3.9%).

Asia-Pacific’s strong performance was led by…

More Releases for House

Electrical House (E-House) Market Demand: Transforming Power Infrastructure Worl …

According to a new report published by Allied Market Research, The global electrical house (E-House) market size was valued at $1.2 billion in 2020, and is projected to reach $2.3 billion by 2030, growing at a CAGR of 6.4% from 2021 to 2030.

An Electrical House (E-House), also known as a Power House or Switchgear House, is a prefabricated modular building that contains electrical equipment and systems necessary for power distribution,…

Major Maids House Cleaners: Trusted House Cleaners in St. Petersburg

Major Maids House Cleaners of St. Pete, a top provider of professional cleaning services, is now offering residents of St. Petersburg the highest quality house cleaning services. Specializing in personalized cleaning solutions, Major Maids is dedicated to delivering exceptional cleanliness, reliability, and efficiency to homes across the St. Petersburg area.

Major Maids House Cleaners of St. Pete, a leading provider of professional cleaning services, is now offering residents of St. Petersburg…

Electrical House (E-House) Market Segmentation CAGR of 7.25% the electrical hous …

"Electrical House (E-House) Market Segmentation: Identifying Core Segments

Global Electrical House (E-House) Market, By Voltage (Medium Voltage Electrical House (E-House) and Low Voltage Electrical House (E-House)), Type (Fixed and Mobile Substation), Application (Mining Industries, Oil and Gas Industry and Metal Industry), Component (Switchgear, Transformer, Bus Bar, Variable Frequency Drive, Power Management System, Heating, Ventilation, and Air Conditioning (HVAC) and Other Auxiliary Systems), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South…

Electrical House (E-House) Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Electrical House (E-House) Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

The Electrical House (E-House) market is experiencing significant growth due to the increasing demand for rapid and flexible power solutions. E-Houses, also known as…

Professional House Removalists In Brisbane For Safe House Removals

Moving and shifting can be a thoroughgoing process and many of the times we often predict that everything will fall in the right place on a moving day. The effort that is being put into moving a house whether it's a 2 room house removal or 5 plus room house removals is often overlooked until you move by yourself. There are a lot of cons of moving by yourself, for…

Latest Electrical House (E-House) Market 2022 | Detailed Report

The Electrical House (E-House) research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market’s key players. Furthermore, the report offers insightful market data and information about the Electrical…