Press release

Most expensive real estate markets in 2009

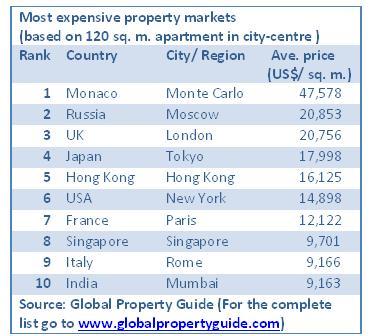

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it is fairer to say the two cities are neck-and-neck.

London residential property prices have fallen for much of 2008, while Moscow property price declines only started in the last quarter, allowing Moscow to catch up with London. Both countries have experienced strong currency declines.

Tokyo and Hong Kong come in fourth and fifth, respectively.

New York, the only US city included in the survey , is 6th, with an average price of US$15,000 per sq. m.

Completing the top ten most expensive real estate markets are two European cities (Paris at 7th and Rome at 9th) and two other Asian cities (Singapore at 8th and Mumbai at 10th). Average prices range from US$9,000 per sq. m. to US$12,000 per sq. m.

The figures are based on the average price of a 120 sq. m., good-condition high-end used apartment in the city centres of more than 110 cities around the world, typically the economic centres where most foreigners are likely to buy. Data were collected during 2008. The US dollar exchange rate used is that of January 27, 2009.

Bargain hunters’ dream

For global bargain hunters, there are several places where property prices are relatively cheap, for example parts of the Middle East, Latin America and Asia.

Cairo, Egypt is one of the cheapest cities in the world, with prime city centre prices at around US$600 per sq. m. Another Middle Eastern capital in the bottom 10 is Amman, Jordan, with average city centre prices at US$1,150 per sq. m.

Three Asian cities are included in the 10 cheapest, all located in rapidly growing and heavily populated countries, Bangalore in India, Chengdu in China and Jakarta in Indonesia.

Chengdu, damaged during the magnitude 8.0 earthquake in 2008, remains a vital economic, transportation and communication hub in the heartland of China.

Indonesia was the last country to recover from the 1997 Asian Financial Crisis. However, the economic reforms implemented by the Yudhoyono administration are setting the stage for steady economic growth.

Five Latin American cities complete the list of 10 cheapest cities for property buyers - Concepcion and Santiago in Chile, Quito in Ecuador, Managua in Ecuador, and Lima in Peru.

The same countries also tend to earn good rental yields.

Overvalued

Rental yields are generally below 5% in most European cities, suggesting that property is still overvalued.

Rental yields are generally below four percent in the following cities: Munich, Barcelona, Vilnius, Helsinki, Madrid, Rome, and Nicosia. Rental yields in Europe are lowest on Andorra at 2.2% and Athens at 2.7%.

Rental yields are between 4% and 5% in major cities such as Brussels, Tokyo, Berlin, Moscow, Copenhagen, Warsaw, New York, Shanghai, Paris, London and Geneva.

Returns from rental investments are also relatively low in key Asian cities such as Singapore and Hong Kong and in almost all Indian cities (Bangalore, New Delhi, and Mumbai)

Only six cities have rental yields of more than 10%, led by Chisinau with an average gross rental return of 14%. The Moldovan capital is followed by Cairo, Jakarta, Manila, Skopje and Lima.

High returns can also be expected in Latin American cities. Yields range from 8% to 10% in Panama City (Panama), Bogota (Colombia), Managua (Nicaragua), Santiago (Chile), Buenos Aires (Argentina), and Quito (Ecuador).

Rental yields in Kula Lumpur (Malaysia) and Amman (Jordan) are also typically above 9%.

House price movements

The recent house price boom and bust defeats the traditional notion that real estate prices are based primarily on local conditions.

The relatively low cost and ease of moving capital around the world has made it easier for people to invest in real estate markets in several countries. This is complemented by the relatively lower cost of international air transport. Several countries have also removed foreign ownership restrictions, a move encouraged by the Organization for Economic Cooperation and Development (OECD) and the European Union.

The result of these changes has been a remarkable increase in cross country real estate investments – helping make the boom, and the bust, truly global.

Description:

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, sites, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com Sites and newspapers found not to be providing a link to us will be removed from our press list.

Requests for Comments:

Requests for comments are best made by telephone to +(63) 917 321 7073. UK-based callers should telephone before lunchtime. Our local time is Hong Kong time, i.e., standard time + 8.00

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Most expensive real estate markets in 2009 here

News-ID: 70814 • Views: …

More Releases from Global Property Guide

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

Asia house prices lead the world

Shanghai, China (up 35.4%) was the world’s strongest residential property market during the past full year, according to a compilation of official and private-sector statistics by the Global Property Guide. Bulgaria (up 34.6%) was in second place, followed by Slovakia (up 32.5%) and Singapore (31.1%).

The worst performers were the United States (down 8.9% by Case-Shiller calculations), Ireland (down 7.3%), and Estonia (down 3.9%).

Asia-Pacific’s strong performance was led by…

More Releases for Expensive

The World's Most Expensive Watch for Women

Watches have long been symbols of prestige, sophistication, and personal style, and for women, they have become not only a functional accessory but also a status symbol. As the watch industry continues to evolve, some brands have gone above and beyond to create timepieces that are not only technically advanced but also visually stunning, using the finest materials and craftsmanship available. Among these exceptional watches are those that command astronomical…

Why are outdoor benches so expensive?

Outdoor benches are expensive due to several factors:

Material Costs: Outdoor benches [https://www.cnhaoyida.com/] are often made of high-quality materials that can withstand the elements. These materials, such as stainless steel, teak, or concrete, are expensive and require specialized manufacturing processes. For example, teak wood is a premium material that is both durable and visually appealing, but it is also expensive

Custom Designs and Craftsmanship: Many outdoor benches are custom-made to fit specific…

Why are Neodymium Magnets so Expensive?

China Bonded Ndfeb magnets are a type of neodymium magnet that is known for its high magnetic strength and resistance to demagnetization. These magnets are widely used in various industries, including electronics, automotive, and renewable energy. However, one common question that arises is why neodymium magnets [https://www.kingndmagnet.com/different-sizes-of-bonded-ferrite-magnet-product/], including bonded Ndfeb, are so expensive.

Image: https://www.kingndmagnet.com/uploads/bonded-ferrite-magnets.png

The high cost of neodymium magnets can be attributed to several factors. Firstly, neodymium is a rare…

World's Most Expensive Screw Tape

US rap artist Wyldthang placed a advance copy of his forthcoming album RIZE:Screwed & Chopped on Ebay today for the whopping total of $5,000. The special made 24 Karat Gold copy of the CD is a unique offering. "DJ BC of the Screwed Up Click took almost a year putting this album together. The project is reimagined, remastered and reloaded." Wyldthang states, "After all that time and effort that he…

Why is Manuka Honey so Expensive?

Concern over the high cost of Manuka honey has consumers wondering why some brands are more expensive than others.

The global demand for Manuka honey far exceeds the supply. Any time this occurs, the price of that commodity increases. Another possible occurrence is the creation of a black market. The honey association in New Zealand acknowledges that there is more Manuka honey sold than is harvested. This…

Competitive Edge instead of expensive Downtime

The Bizerba e-Service provides remote first aid

Balingen, 5th july 2010, for ongoing production, long downtimes can be expensive for producers. However, the times, in which technicians had to come to the site to inspect the systems for every software and hardware problem, are over. Because the latest information and communication technologies now make remote service support possible.

Technology manufacturer Bizerba is offering their e-Service, “Our product specialists can access…