Press release

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines took place in Latvia, previously a leader of the global house price boom. House prices in Riga have fallen by 21.23% in nominal terms during the year to end-Q2 2008, and 33.08% in real terms. Prices in Estonia’s Tallinn fell during the year by 11.02% in nominal terms, and 14.06% in real terms.

Quarterly data suggests that things are getting worse, with declines in inflation-adjusted house prices over the quarter in all except 9 of the 33 countries tracked. Latvia’s Riga saw the largest quarterly decline during Q2 of 2008, with average dwelling prices falling 5.20% in nominal terms, and 8.16% in real terms.

While quarterly data are subject to seasonal variations and are thus less reliable, the slide suggests that the situation is worsening.

Dramatic downturns

Since last year, there has been a dramatic turn-around in the world’s housing markets. Only 5 countries out of 33, at this stage last year, had seen y-o-y declines in house prices in real terms. This year’s total is 21.

Even in countries which have continued to record house prices rises over the past year such as China (Shanghai was up 36.32% y-o-y in nominal terms at the end of Q2 2008, 27.28% in inflation-adjusted terms), transaction volumes have fallen sharply, suggesting that buyers are now nervous.

While property markets in some regions such as the Middle East apparently remain in boom, it is hard to confirm this by reliable data. With the exception of Israel, none of Middle East’s property registries, statistical institutes or central banks publish good data on housing markets.

A final thought: It seems interesting that Slovakia’s house prices are still accelerating, having risen 32.20% this year (a rise of 25.57% in inflation-adjusted terms), as against a rise of 20.47% y-o-y to end-Q2 2007 (a rise of 17.56% in inflation-adjusted terms).

Clearly, the boom in Eastern Europe is not entirely finished. There have also been strong price increases in Monaco, Montenegro and Albania, although no official house price statistics are available.

Rescue efforts

The efforts to rescue the world’s housing markets are becoming increasingly global.

In the US, the authorities are seeking a US$700 billion “mother of all bailouts” package to purchase almost all of the country’s bad mortgage debt in an effort to unfreeze the nation’s credit markets. In the year to end-Q2 2008, house prices in major US cities fell 15.4% (18.9% in real terms) from a year earlier, according to the Case-Shiller house price index. It was the sixth consecutive quarter that the house price index dropped year-on-year.

In the UK, the stamp duty exemption has been raised to £175,000 from £125,000 for houses purchased from September 2008 to September 2009. The government also unveiled a £1 billion package to assist first time home buyers and households struggling with their mortgage payments. In Sept. 2007 Northern Rock, one of UK’s largest lenders was bailed by the Bank of England. In the year to end-Q2 2008, house prices in the UK fell 6.33% (9.77% in real terms) from a year earlier, according to Nationwide.

In Spain, the government released a €3bn rescue package. Certain real estate investment companies were given tax breaks to rent out unsold new homes for a fixed period. In the year to end-Q2 2008, house prices in Spain rose 2.00% (a fall of 2.49% in real terms) from a year earlier, according to official statistics (which are widely believed to understate the problem).

In Ireland, the 2009 budget will include a "stimulus package" providing assistance to first-time homebuyers. During the year to end-Q2 2008, house prices in Ireland fell 9.65% (13.92% in real terms), according to official statistics.

In South Korea, the government is set for tax breaks and easing restrictions on construction. In the year to end-Q2 2008, house prices in South Korea rose 4.94% (a fall of 0.88% in real terms), according to official statistics.

Thailand and Indonesia are mulling the relaxation of foreign ownership limits to lift their housing markets. During the year to end-Q2 2008, house prices in Indonesia rose 5.60% (a fall of 4.18% in real terms), according to official statistics.

###

For more details -- http://www.globalpropertyguide.com/investment-analysis/World-property-market-slide-worsens

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, sites, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com Sites and newspapers found not to be providing a link to us will be removed from our press list.

Requests for Comments:

Requests for comments are best made by telephone to +(63) 917 321 7073. UK-based callers should telephone before lunchtime. Our local time is Hong Kong time, i.e., standard time + 8.00

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Cell: (+63) 917 735 2228

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release World property market slide worsens here

News-ID: 58447 • Views: …

More Releases from Global Property Guide

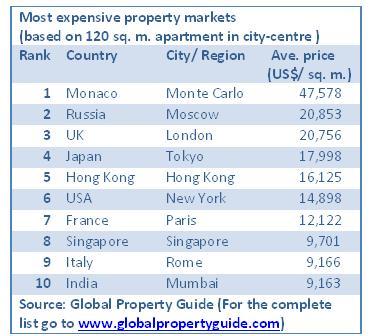

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

Asia house prices lead the world

Shanghai, China (up 35.4%) was the world’s strongest residential property market during the past full year, according to a compilation of official and private-sector statistics by the Global Property Guide. Bulgaria (up 34.6%) was in second place, followed by Slovakia (up 32.5%) and Singapore (31.1%).

The worst performers were the United States (down 8.9% by Case-Shiller calculations), Ireland (down 7.3%), and Estonia (down 3.9%).

Asia-Pacific’s strong performance was led by…

More Releases for Ireland

Ireland E-commerce Market Valuation Expected to Hit USD 45 billion by Key Player …

USA, New Jersey: According to Verified Market Research analysis, the global Ireland E-commerce Market size was valued at USD 18 Billion in 2024 and is projected to reach USD 45 Billion by 2032, growing at a CAGR of 12% from 2026 to 2032.

How AI and Machine Learning Are Redefining the future of Ireland E-commerce Market?

AI-driven personalization engines are transforming customer journeys in Ireland's e-commerce market by delivering real-time product recommendations…

Orbi Ball Ireland - Where to Buy Orbi Boomerang Ball in Ireland?

Orbi Boomerang Ball Ireland: Your children and family will enjoy Orbi Ball to a whole new level. It can be used in all weather conditions, both indoors and outdoors, and is safe for all. The Orbi Boomerang Ball encourages bonding, lessens boredom, enhances cognitive abilities, and develops your child's social life.

Order Orbi Ball from the Official Stockists >> https://24x7deals.xyz/buy-orbi-ball

The amazing characteristics of the flying ball increase its toughness, ingenuity, and…

EcoHeat S Ireland - Where to Buy EcoHeat S Heater in Ireland?

EcoHeat S Reviews: Use of most heaters is accompanied by hefty electricity bills. It makes being warm and comfortable throughout the cold season almost a luxury for most individuals in Ireland. EcoHeat S is an innovative and ground-breaking portable space heater that instantly distributes heat to large areas of the room while saving you money on energy costs.

Buy EcoHeat S at 50 Percent Discount via the Official Website >>…

Ireland Agriculture Market | Ireland Agriculture Industry | Ireland Agriculture …

The Agriculture has always been of boundless importance for Ireland, as nourishing the world’s largest population is not a tranquil task. The Ireland government has been assistant the agriculture industry with a number of policies, demanding to stabilise the output and pursuing the ways to ensure the sector is developing the healthily and sustainably. The Ireland federal government has been vastly supportive of the agriculture for decades, and there is…

Ireland Agriculture Market | Ireland Agriculture Industry | Ireland Agriculture …

In Ireland the agriculture sector is a hugely valuable part of the economy, and is a key contributor to economic growth. Rich, fertile soil, a mild climate and all that rain makes Ireland perfect for farming, and taken advantage of that fact for generations. Agriculture has provided food and income for thousands of years and it’s a vital part of it. The rising demand for developed agricultural products versus their…

The Global Caseins Market Business Opportunities 2026 - Top Companies are Glanbi …

Caseins Market Forecast 2020-2026

The Global Caseins Market research report provides and in-depth analysis on industry- and economy-wide database for business management that could potentially offer development and profitability for players in this market. It offers critical information pertaining to the current and future growth of the market. It focuses on technologies, volume, and materials in, and in-depth analysis of the market. The study has a section dedicated for profiling key…