Press release

Property Valuation Services Business Plan Report: Capital and Operating Cost Breakdown

Overview:IMARC Group's "Property valuation services Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful Property valuation services business. This in-depth report covers critical aspects such as market trends, investment opportunities, revenue models, and financial forecasts, making it an essential tool for entrepreneurs, consultants, and investors. Whether assessing a new venture's feasibility or optimizing an existing business, the report provides a deep dive into all components necessary for success, from business setup to long-term profitability.

What is Property Valuation Services?

Property valuation services determine the fair market value of residential, commercial, or industrial real estate. Certified valuers analyze factors such as location, condition, market trends, and comparable sales to provide accurate and reliable assessments. These valuations are essential for buying, selling, financing, insurance, taxation, and investment decisions, helping clients make informed real estate choices.

Request for a Sample Report: https://www.imarcgroup.com/property-valuation-services-business-plan-project-report/requestsample

Property Valuation Services Business Setup:

Starting a property valuation services business involves combining real estate expertise with analytical precision to deliver credible value assessments. Begin by obtaining relevant certifications and licenses from recognized valuation or real estate authorities. Invest in valuation software, data analysis tools, and a professional network of surveyors, agents, and legal experts. Define your service offerings-residential, commercial, industrial, or specialized valuations-and tailor them to meet client needs. Establish a professional website showcasing your qualifications, valuation methods, and client testimonials to build trust. Collaborating with banks, insurance companies, and developers can help secure long-term contracts. As real estate markets grow more data-driven and transparent, a well-structured property valuation business offers strong potential for profitability, credibility, and consistent client demand.

Report Coverage

The Property valuation services Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and sales strategies.

Key Elements of Property Valuation Services Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of the services offered

• Service Workflow: How each service is delivered to clients

• Revenue Model: An exploration of the mechanisms driving revenue

• SOPs & Service Standards: Guidelines for consistent service delivery and quality assurance

This section ensures that all operational and service aspects are clearly defined, making it easier to scale and maintain business quality.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=43332&flag=C

Technical Feasibility

Setting up a successful business requires proper technical and infrastructure planning. The report includes:

• Site Selection Criteria: Key factors to consider when choosing a location

• Space & Costs: Estimations for the required space and associated costs

• Equipment & Suppliers: Identifying essential equipment and reliable suppliers

• Interior Setup & Fixtures: Guidelines for designing functional, cost-effective spaces

• Utility Requirements & Costs: Understanding the utilities necessary to run the business

• Human Resources & Wages: Estimating staffing needs, roles, and compensation

This section provides practical, actionable insights into the physical and human infrastructure needed for setting up your business, ensuring operational efficiency.

Financial Feasibility

The Property valuation services Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and asset depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the Property valuation services market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments

• Regional Demand & Cost Structure: Regional variations in demand and cost factors

• Competitive Landscape: An analysis of the competitive environment and positioning

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, offerings, and geographic reach, helping you identify strategic opportunities and areas for differentiation.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43332&method=1911

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for equipment, facility development, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on facility setup, machinery, and essential equipment

• Operational Expenditure (OpEx): Covers ongoing costs like salaries, utilities, and overheads

Financial projections ensure you're prepared for cost fluctuations, including adjustments for inflation and market changes over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total income, expenditure, gross profit, and net profit

• Profit margins for each year of operation.

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Factory Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Procurement and Supply Chain Research

• Branding, Marketing, and Sales Strategy

About Us: IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Property Valuation Services Business Plan Report: Capital and Operating Cost Breakdown here

News-ID: 4237259 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

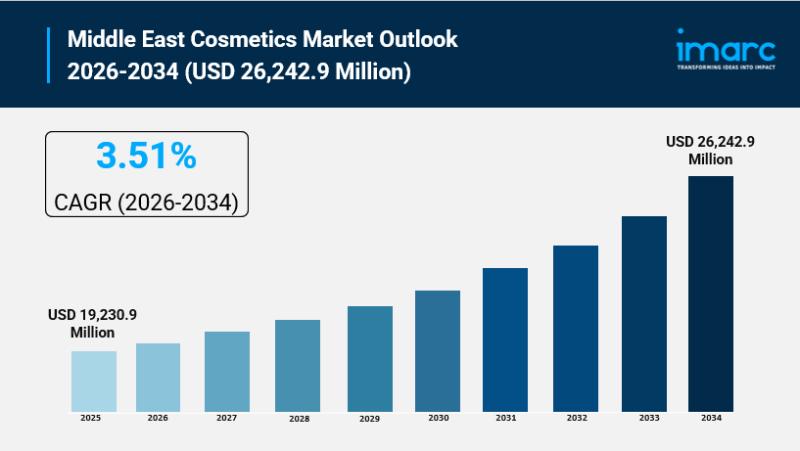

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Property

A Fresh Beginning: Property Geek's New Property Portfolio

Bangalore, 07 Sep 2023

Property Geek, the industry leader in real estate innovation, is thrilled to unveil its latest jewel in the crown: a spectacular portfolio of newly launched properties that redefine luxury living. With a commitment to excellence and an eye for perfection, Property Geek is proud to present a collection that surpasses expectations.

Why Property Geek Stands Out

"Our newly launched properties boast a stunning array of amenities that cater to…

Property abroad. French property price increase

French property prices showed a steady increase in 2005 with more property sales passing through the books of local French estate agents.

According to investment property experts, apartment prices rose by 10.6 per cent in 2005, while the price of a house or Villa rose by 9.9 per cent. Although both figures are lower than those for 2004, the FNAIM was very happy with the fact that there was…

Property abroad: Costa Blanca property sales increase

Over 50,000 Costa Blanca property sales will take place over next decade

The thirst for Spanish property on the Costa Blanca in Spain has grown enormously over the past two years. British investors looking for the ideal property abroad have moved here in droves buying holiday,retirement or investment property. Costa Blanca is the most popular location for buying property in Spain at the moment . Its warm climate…

Property abroad. Bulgarian property. Bansko or the beach for Investment property …

As authorities in Bulgaria prepare to debate legislation on the Black Sea building regulations. Bansko gains momentum.

Bulgarian property is still gaining momentum. The number of Britons buying Bulgarian property in 2005 rose by 77 per cent on the previous year. With the promise of E.U. entry in 2007 or 2008 and flight increases to regional airports, and analysts' expecting a 15-20 per cent rise over the next year, demand…

Off Plan Property - Property Investment Made Simple?

Over the past 5 years several property investment companies have sprung up offering naive property investors the chance to share in the growth in the UK property investment industry. some companies offer excellent advice and resources but the majority of them have jumped on the property investment bandwagon and offer nothing more than slick marketing without any substance or very little experience.

Damian Qualter, MD of www.BuyProperty4Less.com, states " The Property…

Property Investment UK - Buying Off Plan Property Advice

"Property Investment - How can we do that?"

"Many of our clients are first time investors who want to jump on the Property investment bandwagon. Most have ailing pension funds and need someone who can just guide them in the off plan property maize to make an informed decision based on facts and potential of the investment NOT based on how much commission the sales person can make "rail-roading" unsuspecting…