Press release

Extended Warranty Market Size, Share and Industry Analysis, Report 2024-2032

Extended Warranty IndustrySummary:

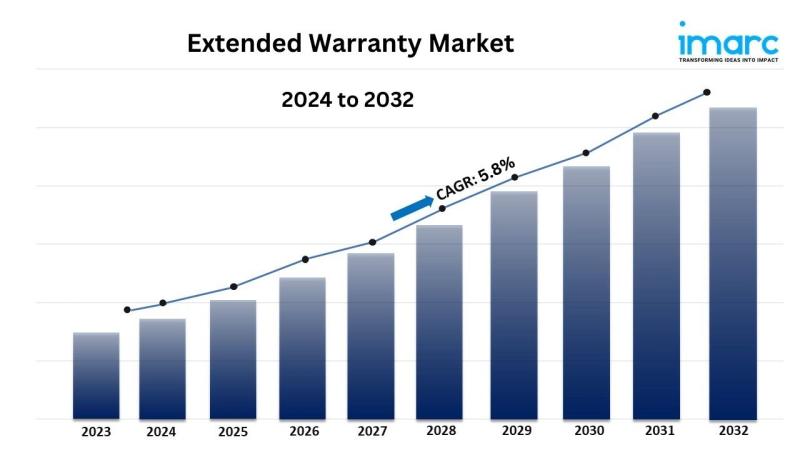

● The global extended warranty market size reached USD 139.1 Billion in 2023.

● The market is expected to reach USD 232.8 Billion by 2032, exhibiting a growth rate (CAGR) of 5.8% during 2024-2032.

● North America leads the market, accounting for the largest extended warranty market share.

● Standard protection plan accounts for the majority of the market share in the coverage segment as it offers essential and broad coverage at a lower cost, appealing to a wider consumer base seeking basic yet effective warranty solutions.

● Automobiles holds the largest share in the extended warranty industry.

● Manufacturers remain a dominant segment in the market, as they have direct access to consumers at the point of sale, allowing them to offer extended warranties as part of the initial purchase, creating convenience and trust.

● Individuals represents the leading end user segment.

● The extended product lifespan expectations is a primary driver of the extended warranty market.

● Rising product complexity, along with the increased focus on consumer retention by companies are reshaping the extended warranty market.

Industry Trends and Drivers:

● Rising consumer electronics and automotive sales:

The increasing sales of consumer electronics and automobiles globally are significantly driving the extended warranty market. As more consumers purchase expensive electronic devices such as smartphones, laptops, and home appliances, the need for additional protection plans becomes critical. Similarly, the automotive sector is experiencing a rise in vehicle sales, particularly electric vehicles (EVs) and premium cars, where repairs and replacements are costly. Extended warranties offer consumer peace of mind by covering potential post-manufacturer warranty repairs and maintenance. These warranties are especially appealing as the complexity of modern electronics and vehicles often leads to expensive repairs due to advanced technologies, such as AI-powered devices and electric car batteries. Manufacturers and retailers also see extended warranties as a way to boost consumer retention and satisfaction, encouraging loyalty to the brand or retailer through these added services.

● Increased awareness and consumer preferences for protection plans:

There has been a noticeable shift in consumer behavior toward valuing extended warranties, especially in developed markets. This change is partly driven by heightened awareness about the potential long-term costs of repairs, particularly for high-ticket items. Consumers are increasingly factoring in the cost of repairs and replacements when purchasing items, making extended warranties an attractive option. Moreover, the COVID-19 pandemic has played a role in this trend, with economic uncertainties pushing consumers to seek financial protection in the event of product malfunctions or failures. This growing demand has prompted retailers and manufacturers to offer more flexible and customized extended warranty packages, which cater to different consumer needs, boosting the overall market. The ease of purchasing these warranties online, often directly through e-commerce platforms, has further contributed to their growing popularity.

● Growth in e-commerce and online retail channels:

The rise of e-commerce and digital retailing has played a vital role in the expansion of the extended warranty market. With more consumers purchasing electronics, appliances, and even vehicles online, retailers are now offering extended warranties as an add-on during the checkout process, making it convenient for consumers to opt for additional protection. This has been particularly successful on platforms such as Amazon and Best Buy, where warranties are integrated seamlessly into the purchase journey. E-commerce platforms also use data analytics to offer personalized warranty plans based on purchase history and consumer preferences, increasing the likelihood of upselling these services. Additionally, the digitalization of warranty claims and support services has made it easier for consumers to file claims and get repairs done, reducing the friction often associated with extended warranties in the past. This shift toward online channels has opened up new opportunities for growth, especially in regions where e-commerce adoption is high.

For an in-depth analysis, you can request a sample copy of the report: https://www.imarcgroup.com/extended-warranty-market/requestsample

Extended Warranty Market Report Segmentation:

Breakup By Coverage:

● Standard Protection Plan

● Accidental Protection Plan

Standard protection plan dominates the market as it offers essential, cost-effective protection that appeals to a broad range of consumers looking for basic warranty services without the higher premiums of more comprehensive plans.

Breakup By Application:

● Automobiles

● Consumer Electronics

● Home Appliances

● Mobile Devices and PCs

● Others

Automobiles represent the largest segment as they have high repair and maintenance costs, making extended warranties highly appealing for protecting against expensive post-warranty repairs.

Breakup By Distribution Channel:

● Manufacturers

● Retailers

● Others

Manufacturers hold the maximum number of shares as they have direct access to consumers at the point of sale, allowing them to offer extended warranties as an integral part of the product purchase experience.

Breakup By End User:

● Individuals

● Business

Individuals dominate the market as they frequently purchase extended warranties to safeguard personal investments in high-cost consumer electronics, home appliances, and vehicles.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America holds the leading position owing to a large market for extended warranty driven by its high consumer demand for electronics and automobiles, coupled with widespread awareness and adoption of extended warranty services across these sectors.

Top Extended Warranty Market Leaders:

● Allianz Assistance (Allianz SE)

● American International Group Inc.

● AmTrust Financial

● Assurant Inc.

● Asurion LLC

● Axa S.A.

● Carchex

● CarShield LLC

● Chubb

● Edel Assurance LLP

● Endurance Warranty Services LLC

● SquareTrade Inc. (The Allstate Corporation)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Extended Warranty Market Size, Share and Industry Analysis, Report 2024-2032 here

News-ID: 3698115 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Extended

Extended Stay Accommodations Market Is Going to Boom | Marriott International � …

The latest report titled "Extended Stay Accommodations Market" Trends, Share, Size, Growth, Opportunity, and Forecast 2026-2033. offering a comprehensive and in-depth analysis of the industry. The report provides key insights into current market trends, growth drivers, challenges, and opportunities shaping the market landscape. It also includes a thorough competitor analysis, regional market evaluation, and recent technological or strategic developments influencing the market trajectory.

➤ Currently, the Extended Stay Accommodations Market holds…

WP CRM Extended Easter Sale

WP-CRM Extended Easter Sale

Would you like to manage your client relationships better? Sure you do! And what better way to do so than from your very own WordPress website dashboard! With our plugin WP-CRM, you can optimize your business communications and stay on top of customer service and overall brand satisfaction. We have now extended our Easter deal to April 18 to give all small businesses out there to try…

Extended Stay Hotel Market Set for Explosive Growth : Marriot, OYO Rooms, Hilton …

Advance Market Analytics published a new research publication on "Extended Stay Hotel Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Extended Stay Hotel market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Extended Warranty now Available

Calibre UK Ltd a subsidiary of the Coretronic Corporation of Taiwan is pleased to announce the launch of its new extended warranty program for the Calibre HQView, LEDView, HQUltra and HQPro series of Switcher-Scalers.

These ranges are already supplied with a 3 year RTB warranty from the factory and from today customers are able to easily extend that warranty at their time of purchase from 3 to 5 years for a…

Compact shading, extended potential

With a discreet design that has a dramatic presence, the markilux 1300 Basic has it all.

Are you looking to make a big impact, but only have space for a smaller shading system? The markilux 1300 Basic is quite simply the best compact solution on the market today. Slim, stylish and suave, the recently refreshed model is perfect for both awkward small spaces and larger outdoor areas. Offering unrivalled value-for- money,…

GstarCAD2012 Extended Version Released Today

“Excellent software is alive, its birthday will never be its end, but be more outstanding via developers’ decoration” – Director of Product Development said that while an extended version GstarCAD2012 EX was finished. It has been a year since the birth of GstarCAD2012; it is still energetic now, and has continued to be enhanced by the latest technology and market requirements. At present, as the release of GstarCAD2012 EX, its…