Press release

Housing Transaction Costs in the OECD

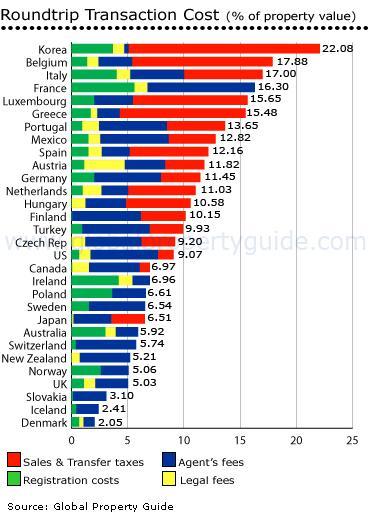

In OECD countries, roundtrip transaction costs are generally below 10%.However there are some countries with transaction costs which are really unnecessarily high. South Korea has the highest housing transaction cost, at 22% of the property’s value in Seoul, according to work by the Global Property Guide.

Transaction costs in Belgium, Italy, France, Luxembourg and Greece exceed 15% of the property’s value.

On the other hand, total costs for purchasing a house in Slovakia, Iceland and Denmark are around 3% or less.

Transaction costs are typically between 5% and 7% in the UK, Norway, New Zealand, Switzerland, Australia, Japan, Sweden, Poland, Ireland, and Canada.

Assumptions

To make the calculations comparable, the Global Property Guide has assumed that the property purchased is a condominium worth either €250,000 (for European countries) or US$250,000 for other countries, and located in the financial or administrative capital. This allows us to arrive at a ‘typical’ transaction cost figure, though in practice transaction costs are a range, depending on many factors.

Transaction cost figures reflect the purchase of old properties, not new (therefore in most cases Value-Added Tax (VAT) is not included). The costs also reflect foreigners’ costs, not locals’ (often very different). Where foreigners must purchase property through companies, the cost of forming and maintaining a company is not included.

Costs included in the term ‘transaction costs’:

• Registration costs

• Legal fees

• Real estate agents’ fees

• Transfer taxes

Property and capital gains taxes are not included, although they must typically be paid before the property is registered. Fees in acquiring the prerequisites for property purchase such as residency permits and company formation are also not included.

Over-taxed

South Korea’s very high transaction costs are largely attributable to the unusual feature that all real estate transfers are subject to 10% VAT (only vacant land and government produced housing are exempt).

In most countries, in contrast, only new properties are subject to VAT.

Property buyers in South Korea are also obliged to purchase Housing Bonds worth 5% of the official price. Proceeds from the Housing Bonds are intended for construction of housing for the poor. Typically, most buyers immediately sell the bonds at a discount of about 10% to 15%.

Buyers in South Korea must pay registration tax (3% of purchase price), education tax (20% of registration tax), acquisition tax (2% of purchase price), agricultural and fisheries tax (10% of acquisition tax) and stamp duties (maximum of 0.2% of property value).

These taxes are intended to dampen demand and discourage property speculation. However, in reality, these very high transaction costs exacerbate the housing shortage, by adding to the overall cost of housing. The costlier housing is, the less people can afford to buy it, the less gets built. The housing shortage can better be relieved by other means – better rural transport and services, more competition in the construction industry.

French law is a handicap

Average transactions costs in countries with French legal origin are significantly higher than elsewhere, as noted in a previous article about European costs (Housing transaction costs in Europe).

The same phenomena is observed throughout the OECD. Average transactions costs in OECD countries with French legal origins are 14.2% of property value; while in German origin countries they are 11.5%, Socialist 7.4%, English 6.5%, and Scandinavian 5.2%.

Grouping countries in terms of legal origins reveals institutional differences in property transactions. Sales and transfer taxes are more common in French legal system countries. Roundtrip transaction costs normally exceed 10% of property value.

The services of lawyers are used most widely in French and English legal systems. In several countries with French legal systems the use of lawyers is mandatory with fees set by law.

Countries grouped by legal origins:

English common law: Australia, Canada, Ireland, New Zealand, UK, US;

French commercial code: France, Belgium, Greece, Italy, Luxembourg, Mexico, Netherlands, Portugal, Spain, and Turkey;

German commercial code: Germany, Austria, Japan, South Korea, and Switzerland;

Scandinavian civil law: Denmark, Finland, Iceland, Norway and Sweden; and

Socialist civil law: Czech Republic, Hungary, Poland, and Slovakia.

Source: La Porta et al, 1999

Restrictions on foreign ownership

Several OECD countries restrict foreign ownership of houses. In Iceland and Denmark, only resident foreigners are allowed to purchase houses. The property can only be used as primary residence and not as a rental investment.

In Switzerland, the Federal Government has set an annual quota of permits for non-resident foreigners seeking to acquire property. Generally, major cities such as Zurich, Frankfurt and Lausanne are closed to foreign buyers.

Foreigners need the approval of the Administrative Office (AOB) before they can buy property in Budapest. In Australia, approval of the Foreign Investment Review Board (FIRB) is needed.

Foreigners can freely buy condominium units in Poland but buying land is a bit trickier. Generally, a permit from the Ministry of Internal Affairs is needed.

In Greece, EU nationals can freely purchase property, while there are few restrictions for non-EU nationals. Acquiring property near national borders and in some islands requires special permission from the Local Council. Such permission is not granted to non-EU nationals.

In Turkey, property purchases are open to foreigners, on the basis of reciprocity, i.e., Turkish people must be entitled to purchase real property in the country of the foreign national buying property.

In Mexico, foreign buyers need to set-up a bank trust called ‘fideicomiso’ to be able to buy properties. The bank (trustee) holds the trust deed for the purchaser (beneficiary). While the trustee is the legal owner of the real estate, the beneficiary retains all ownership rights and responsibilities and may sell, lease, mortgage, and pass the property on to heirs.

References:

La Porta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W. Vishny, (1998). “Law and Finance,” Journal of Political Economy 106, 1113-1155.

Housing Transaction Costs in the OECD (Full Report) - http://www.globalpropertyguide.com/articleread.php?article_id=95&cid=

Housing Transaction Costs in Europe -

http://www.globalpropertyguide.com/articleread.php?article_id=88&cid=

The Global Property Guide is an on-line property research house. On-line newspapers, magazines, etc which use material from this release MUST provide a clickable link to www.globalpropertyguide.com.

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Time Zone: UST+8.00

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Time Zone: UST+8.00

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide is an on-line property research house. On-line newspapers, magazines, etc which use material from this release MUST provide a clickable link to www.globalpropertyguide.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Housing Transaction Costs in the OECD here

News-ID: 26332 • Views: …

More Releases from Global Property Guide

Most expensive real estate markets in 2009

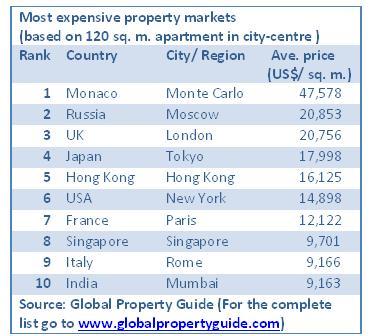

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for French

Mastering French Orthography: Why Learning to Write Correctly in French Is So Ch …

The French language and its writing is a complicated system. French is a very beautiful and expressive language in the world. Nevertheless, written French is extremely difficult to learn even to the native speakers. The language is full of complex spelling systems, silent letters, and exceptions so that one cannot spell it correctly without practice. Most individuals are able to articulate the French language but become a problem when they…

French Beach Holidays

France is known for its rich history, stunning architecture, and delectable cuisine. However, it's also home to some of the most beautiful beaches in Europe. French beach holidays offer a unique combination of sun, sand, and culture that can't be found anywhere else. From the Mediterranean to the Atlantic coast, France has a wide range of beach destinations that cater to all types of travelers. In this article, we'll take…

Certified French English translation

WHAT YOU MAY WANT TO KNOW

Languages: Thoroughly fluent in French and in English

Style

Diane's translation, proofreading, editing style is based on the principles of word for word, meaning for meaning, and a somewhat resistive approach. When possible, Diane adds footnotes and offers appropriate comments. Associations, concepts, culture, grammar, perceptions, terminology, etc., differing in both languages, words will not appear in the same order in the source and target texts. Emphasis is…

Naperville French Tutor Announces New Online French Language Assessment Test

The new French assessment program, available at naperfrench.com/contact/french-test/, was designed by Naperville, IL-based French tutor, Anne Cottez. This follows her developing French classes curriculums she has been teaching for 9 years which are being presented to help children and adults learn while living in the USA as expatriates or American who want to be fluent in the French language.

“I’m so happy to have my new online language test so…

French Riviera Privilege Card – Making the most of your holidays on the French …

Beaulieu sur Mer, France, – December 07, 2010 –The French Riviera is located in south of France and has grossed an unbeatable standing as a marvelous tourist destination which extends a plethora of leisure activities along with picturesque landscapes and awe inspiring beaches. The French Riviera Privilege Card is a web portal which has partners in every façade when it comes to holidays, tours and trips for a family vacation.…

The French Riviera Privilege Card Makes Your Holidays French Riviera Unforgettab …

Beaulieu sur Mer, France, 30th November 2010 – With people fanatically searching for exquisite and exotic tourist spots to visit, one place which has grabbed the attention of one and all is the French Riviera - Cote d'Azur. The French Riviera is located in the south of France and has grossed an unbeatable standing as a marvelous tourist destination which extends a plethora of leisure activities along with picturesque landscapes…