Press release

eClear becomes a payment institution

BaFin has granted the Berlin-based start-up eClear permission to act as a payment service for cross-border e-commerce trade throughout the EU for its VAT payment solution "ClearVAT", which is unique in Europe.Berlin, 3 May 2021 - Berlin-based tax technology specialist eClear AG has been granted a licence to provide payment services by the German Federal Financial Supervisory Authority (BaFin). The licence is valid for the whole of Europe in the course of so-called passporting.

eClear specialises in the clearing of VAT from cross-border B2C and D2C transactions in online trade. Thanks to the BaFin licence, the company can now process the Europe-wide payment transactions of online merchants and thus independently pay the VAT. The role of "tax payment acquirer" is a novelty in Europe. The company takes over collecting the money from the end consumers and pays the VAT directly to the responsible tax authorities abroad. In this context, eClear is liable for the correctness of the VAT calculation and the amounts owed to the tax authorities.

The advantage of processing transactions via eClear: e-commerce merchants do not have to register for VAT themselves in the destination countries, nor do they have to file a tax return or comply with the tax rules required. The concept of automated VAT clearance in the context of cross-border B2C transactions is entirely new. "The ZAG (German Payment Services Supervision Act) licence is an important milestone for eClear, which further differentiates us from conventional VAT compliance providers on the market and strengthens our network of trust. For example, eClear is now the first payment institution in Europe to take over the calculation, collection and settlement of transactional taxes in a fully automated manner, i.e. ‘end-to-end’ for merchants," says Anne-Katrin Gewohn, the responsible Chief Risk Officer.

"eClear transforms the way VAT and customs are handled," says Roman Maria Koidl, founder and CEO of the company. "With our innovative automation solutions, merchants overcome the complexity of transactional taxes in Europe and accelerate their cross-border B2C and D2C business. As a payment institution, we can now offer additional services to our customers to smoothly enable their cross-border growth."

https://eclear.com/article/eclear-becomes-a-payment-institution/

eClear AG

Chausseestraße 116

10115 Berlin

comms@eclear.com

eClear AG is Europe's only payment service for tax clearing in cross-border e-commerce. With its full-service solution "ClearVAT", the leading tax technology company takes over the complete processing of VAT obligations from cross-border B2C trade transactions. The cloud-based eClear solutions automate and significantly simplify all VAT, customs and payment processes in e-commerce trade. The company was founded in 2016 by Roman Maria Koidl. The supervisory board of eClear AG includes Peer Steinbrück, Thomas Ebeling and Dr Gerhard Cromme. eClear AG's processes are certified under Auditing Standard 880 of the Institute of German Certified Public Accountants. Further information can be found at https://eclear.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release eClear becomes a payment institution here

News-ID: 2278804 • Views: …

More Releases from eClear AG

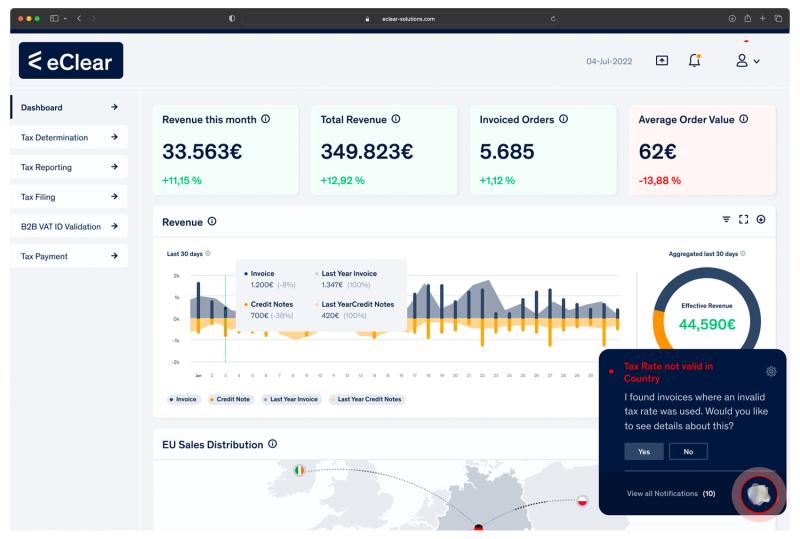

SPOT: The Revolutionary Tool That Alerts You to Incorrect Tax Rates in Real-Time

eClear, a leading VAT and customs compliance solutions provider, is proud to announce the release of its latest innovation - SPOT. SPOT is the first tool that uses real-time invoice data to identify incorrect tax rates, giving businesses the power to prevent costly errors and stay compliant.

SPOT is designed to streamline financial operations, reduce compliance risks, and increase accuracy. With its Automated VAT Audit and Reporting assistant (AVATAR), it can…

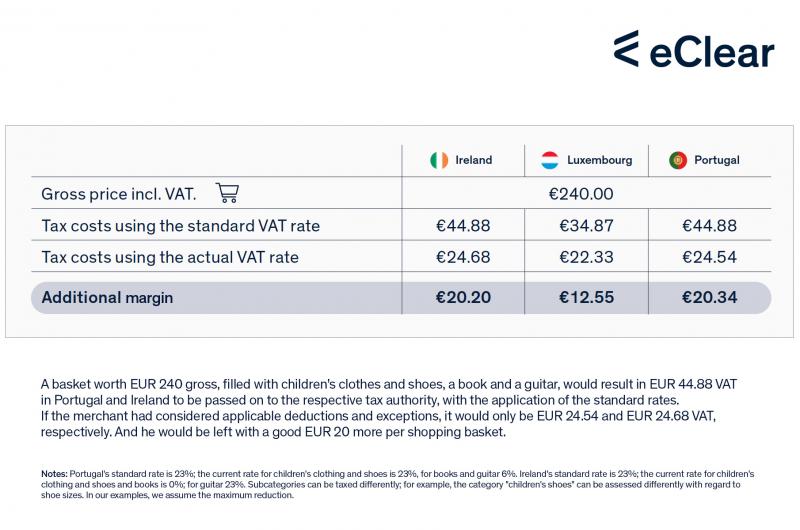

E-Commerce merchants could pay up to EUR 3.8 billion too much VAT in 2022

• Merchants underestimate losses due to VAT exceptions

• Online tool "VAT Optimiser" warns of possible VAT overpayment

Berlin, 16 February 2022 - VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions. It is up to each…

EU Commission publishes incorrect VAT rates

• So-called "EU VAT Rates Database" incorrect and incomplete

• E-commerce merchants and customers affected throughout Europe as of 1 July

• eClear database VATRules has over 800,000 tax codes

Berlin, 24 June 2021 – The database of VAT rates for the EU-27 published by the EU Commission (Tax-UD department) is partly incomplete and incorrect. This is pointed out by the Berlin-based tax technology specialist eClear AG. “The database has obvious gaps.…

VAT cut ended in Germany - eClear keeps shop systems up to date

From July to December 2020, the German government had reduced VAT to 16% and 5% respectively. On January 1, 2021, Germany reverted to the previously applicable rates of 19% and 7%. eClear keeps merchant's shop systems in the EU 27 up to date with its automation solutions for tax compliance.

For retailers, an effort is being repeated that was already described as "immense" and "torture" in June 2020 (Handelsblatt, June 5,…

More Releases for VAT

Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses

Swift VAT Pro Announces a Practical Digital Solution for MTD-Compliant VAT Submissions in the UK

Swift VAT Pro has introduced a cloud-based VAT filing platform designed to help UK businesses adapt to HMRC's Making Tax Digital requirements with greater efficiency and clarity.

As VAT compliance continues to shift toward digital reporting, many small and medium-sized businesses face challenges due to manual record-keeping, spreadsheet-based calculations, and disconnected tools. Swift VAT Pro addresses these…

Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerati …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

VAT Dyes Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The VAT dyes market size has grown rapidly in recent years. It will grow from $1.98 billion in 2024 to $2.22 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

VAT Calculator UK - Simplifying VAT Calculations for Businesses and Consumers

Understanding and calculating Value Added Tax (VAT) in the UK has never been easier, thanks to VAT Calculator UK - a free and user-friendly online VAT calculator. This innovative tool allows individuals and businesses to quickly add or remove VAT, calculate VAT-inclusive and exclusive prices, and work out VAT backwards with just a few clicks.

As VAT remains a crucial part of the UK's tax system, having a reliable and accurate…

Steinbrück launches EU VAT engine

"This is something European politicians have been trying to do for more than ten years without success," commented Peer Steinbrück on the stage of the online retailer congress "Plentymarkets" in Kassel before he symbolically put the result of several years of development work into operation together with host Jan Griesel and eClear founder Roman Maria Koidl.

What neither the European Commission nor other institutions can currently demonstrate, the Berlin start-up eClear…

VAT Enabled ERP Software - AxolonERP

VAT Complaint ERP in UAE

The end of the fiscal year of 2016-17 brought a novel taxation scheme in the UAE and Saudi Arabia – VAT. The VAT or Value Added Tax changed the way enterprises of all types and scales worked as far as accounting and finance management is concerned. The invoicing; inventory management; investment and asset planning and billings of all kinds experienced changes and the need of the…