Press release

Steinbrück launches EU VAT engine

"This is something European politicians have been trying to do for more than ten years without success," commented Peer Steinbrück on the stage of the online retailer congress "Plentymarkets" in Kassel before he symbolically put the result of several years of development work into operation together with host Jan Griesel and eClear founder Roman Maria Koidl.What neither the European Commission nor other institutions can currently demonstrate, the Berlin start-up eClear AG (formerly ClearVAT AG) has now officially launched with its EU VAT engine. 8,000 large e-commerce dealers from all over Europe are connected to the start. Within the next twelve months, eClear intends to provide technical integration to another 300,000 merchants. "eClear is a unique infrastructure project for the fully automated calculation, collection and payment of VAT in cross-border e-commerce trade in the EU," says founder Roman Koidl. "It's hard to believe, but not even a complete list of tax rates and exemptions existed in the EU, not to mention the possibility of paying the taxes owed centrally at one point," adds Peer Steinbrück.

More than 550,000 tax rate applications for millions of products

The VAT engine is a database that provides manufacturers and distributors in the European Union with continuously updated tax rates. With 27 member states, it can't be that much! - Far from it: "Each EU country decides for itself which VAT rate applies to which product. Reduced rates are added to the standard rates. There are thousands of exceptions, reductions, exemptions and special regulations," says Koidl. There are also regional peculiarities and regulations. Just think of the Canary Islands, Helgoland, Monaco, San Marino, the Azores or even the French overseas territories. With all special regulations and exceptions, eClear's unique database contains more than 550,000 certified tax rate applications for millions of products, the so-called tax codes. The highlight: a network of VAT specialists in all EU member states immediately records every legal change in a certified update process. All in all, for Peer Steinbrück "a simple, practical and fair solution that not only provides traders with legal certainty, but in fact opens the EU market to traders in the first place".

Strong cooperation partners: SAP, Deloitte, BDO

The tax consulting firms Deloitte and AWB with their international offices supported the development. BDO and SAP are partners in certification and technology. To handle billions of transactions, eClear relies on the in-memory database SAP HANA and SAP S/4HANA, the latest generation of SAP business software. "On the way to a new reality, it is clear that flexibility is the be-all and end-all in any industry. eClear must be able to handle very high volumes and be available very quickly at the merchant's checkout. Intelligent technologies from SAP and the expert knowledge of partners such as Uniorg help here," says Christian Mehrtens, Head of Partner and SME sales and member of the management board of SAP Germany.

"The temporary reduction in value-added tax in Germany has shown how much effort retailers are confronted with, even if it is only a matter of national VAT law. If you want to ensure the long-term success of your company on the European market, you have to strive for both audit-proof and economically sensible solutions for intra-community trade," adds Stephanie Alzuhn, Partner at the auditing and consulting firm Deloitte in Berlin.

Access to the European Single Market

Not only the different VAT rates pose a challenge for retailers. Administrative efforts such as registration in the countries of destination, required declarations or even communication with local tax authorities result in high time and cost expenditures or even thwart expansion plans. A considerable share of the 20 billion euros in taxes that the EU Commission estimates are reduced each year in online trading is due to the complexity of the requirements.

eClear counters this with its automated sales tax clearing: a registration-free alternative for B2C goods delivery within the EU states. Merchants install a small software in their store. The VAT applicable in the country of destination is then not only calculated correctly, but the sales are also reported to the respective tax authorities and the taxes are paid directly by eClear. Roman Maria Koidl: "Our full-service approach frees merchants from tax obligations and, above all, from the numerous liability risks abroad, such as a local tax audit".

The database in the online-based e-commerce ERP system plentymarkets is celebrating its premiere. Thanks to full integration, the sales tax solutions are now available to the affiliated dealers, thus opening up the single European market. "The proportion of cross-border shipments of goods from plentymarkets dealers in Europe continues to rise significantly. With eClear AG, we have gained a strategic partner who can offer our customers a unique solution from a tax perspective," explains Jan Griesel, founder and CEO of plentysystems AG.

"European start-up" with global vision

Founder Roman Koidl sees the company as a "European start-up". Because unlike usual, no German concept is exported to other EU countries. - eClear is available throughout the EU from the very beginning. Founded in 2016 as ClearVAT AG, the company went online with its test phase in 2019. In its "Series A Funding Round", the start-up raised 15.0 million euros in venture capital. The valuation of the currently running "Series B" is EUR 300 million. A strategic partnership with plentysystems AG marked the official market entry in March 2020.

Since October 1, the company, which has received numerous awards, has been trading under the name eClear AG. "Our solutions no longer focus only on value added tax or VAT. We are currently working intensively on the expansion of our product range in order to make dutiable trade from third countries into the EU legally secure and more efficient in processing", Roman Maria Koidl explains the change of name. For this reason, "ClearVAT" will henceforth be the solution name for the company's VAT products, while the company name "eClear" will create the necessary scope for the development of further clearing products, especially in the areas of customs (ClearCustoms) and payment (ClearPAY).

eClear has offices in Berlin, Constance, Cologne and Munich. The team currently comprises around 60 employees and is expected to grow to 180 by the end of 2021.

The members of the supervisory board are: Peer Steinbrück (Chairman), Dr. Clint Magg (Vice Chairman), Thomas Beyer, Dr. Gerhard Cromme, Thomas Ebeling, Prof. Dr. Andreas Hackethal, Oliver Schiller, Hanns-Eberhard Schleyer.

eClear AG, Chausseestraße 116, 10115 Berlin

Vice President Communications: Nadine Städtner

T: +49 30 235907111

E: comms@clearvat.com

eClear AG (formerly ClearVAT AG)

eClear is Europe's only "One Stop Shop" provider that allows online merchants to sell goods within the European Union - taking into account the applicable value added tax - to the country of destination. In addition eClear offers a simple solution: Install software, sign contract, immediately deliver borderless into all EU countries. This way, the company frees more than one million online traders in the EU and their investors from the risk of violating tax laws.

www.eclear.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steinbrück launches EU VAT engine here

News-ID: 2148595 • Views: …

More Releases from eClear AG

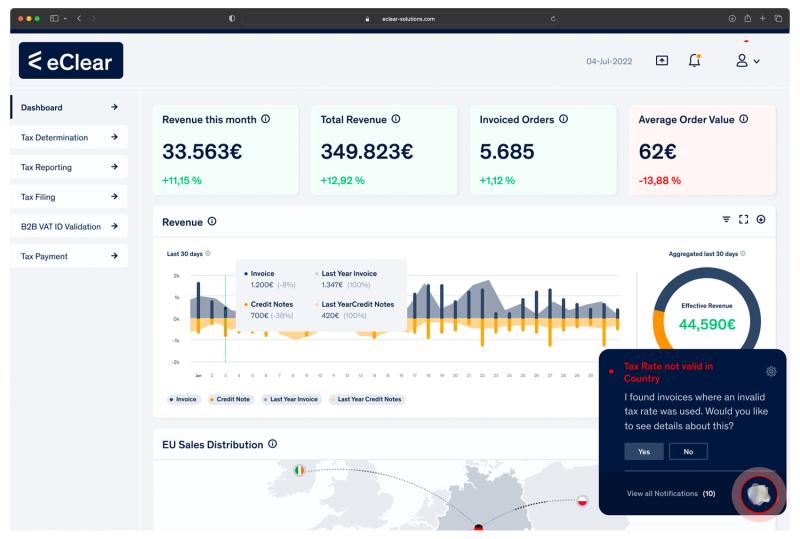

SPOT: The Revolutionary Tool That Alerts You to Incorrect Tax Rates in Real-Time

eClear, a leading VAT and customs compliance solutions provider, is proud to announce the release of its latest innovation - SPOT. SPOT is the first tool that uses real-time invoice data to identify incorrect tax rates, giving businesses the power to prevent costly errors and stay compliant.

SPOT is designed to streamline financial operations, reduce compliance risks, and increase accuracy. With its Automated VAT Audit and Reporting assistant (AVATAR), it can…

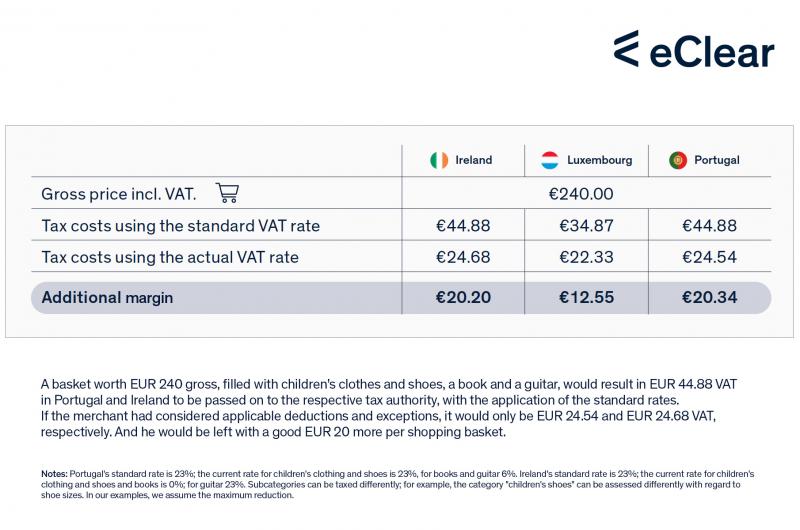

E-Commerce merchants could pay up to EUR 3.8 billion too much VAT in 2022

• Merchants underestimate losses due to VAT exceptions

• Online tool "VAT Optimiser" warns of possible VAT overpayment

Berlin, 16 February 2022 - VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions. It is up to each…

EU Commission publishes incorrect VAT rates

• So-called "EU VAT Rates Database" incorrect and incomplete

• E-commerce merchants and customers affected throughout Europe as of 1 July

• eClear database VATRules has over 800,000 tax codes

Berlin, 24 June 2021 – The database of VAT rates for the EU-27 published by the EU Commission (Tax-UD department) is partly incomplete and incorrect. This is pointed out by the Berlin-based tax technology specialist eClear AG. “The database has obvious gaps.…

eClear becomes a payment institution

BaFin has granted the Berlin-based start-up eClear permission to act as a payment service for cross-border e-commerce trade throughout the EU for its VAT payment solution "ClearVAT", which is unique in Europe.

Berlin, 3 May 2021 - Berlin-based tax technology specialist eClear AG has been granted a licence to provide payment services by the German Federal Financial Supervisory Authority (BaFin). The licence is valid for the whole of Europe in the…

More Releases for VAT

Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses

Swift VAT Pro Announces a Practical Digital Solution for MTD-Compliant VAT Submissions in the UK

Swift VAT Pro has introduced a cloud-based VAT filing platform designed to help UK businesses adapt to HMRC's Making Tax Digital requirements with greater efficiency and clarity.

As VAT compliance continues to shift toward digital reporting, many small and medium-sized businesses face challenges due to manual record-keeping, spreadsheet-based calculations, and disconnected tools. Swift VAT Pro addresses these…

Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerati …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

VAT Dyes Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The VAT dyes market size has grown rapidly in recent years. It will grow from $1.98 billion in 2024 to $2.22 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

VAT Calculator UK - Simplifying VAT Calculations for Businesses and Consumers

Understanding and calculating Value Added Tax (VAT) in the UK has never been easier, thanks to VAT Calculator UK - a free and user-friendly online VAT calculator. This innovative tool allows individuals and businesses to quickly add or remove VAT, calculate VAT-inclusive and exclusive prices, and work out VAT backwards with just a few clicks.

As VAT remains a crucial part of the UK's tax system, having a reliable and accurate…

VAT Enabled ERP Software - AxolonERP

VAT Complaint ERP in UAE

The end of the fiscal year of 2016-17 brought a novel taxation scheme in the UAE and Saudi Arabia – VAT. The VAT or Value Added Tax changed the way enterprises of all types and scales worked as far as accounting and finance management is concerned. The invoicing; inventory management; investment and asset planning and billings of all kinds experienced changes and the need of the…

VAT Updates: China, Czech Republic, Romania, Portugal

China Plans to Extend VAT Pilot Scheme to Beijing in July

China’s pilot scheme for VAT which is intended to replace the current business tax in Shanghai is likely to be extended to Beijing in July, this year. Currently, VAT is being applied only to the manufacturing industry. The pilot VAT rates of 11% and 6% are mainly being introduced to support the services sector such as transportation. China commenced the…