Press release

VAT cut ended in Germany - eClear keeps shop systems up to date

From July to December 2020, the German government had reduced VAT to 16% and 5% respectively. On January 1, 2021, Germany reverted to the previously applicable rates of 19% and 7%. eClear keeps merchant's shop systems in the EU 27 up to date with its automation solutions for tax compliance.For retailers, an effort is being repeated that was already described as "immense" and "torture" in June 2020 (Handelsblatt, June 5, 2020). At that time, in order to implement the temporary reduction in VAT - agreed by the German government to mitigate the economic consequences of the Corona crisis - prices had to be recalculated, indicated accordingly or re-labeled in the stores of local retailers. This must now be reversed in January.

Online retailers operating across the EU also have to face this challenge. They can look back on 2020 as a year of record sales, but those who offer and sell their goods online cross-border are still confronted with a highly complex European VAT system. And Corona has not made the current ruling any simpler: In addition to Germany, other European countries passed VAT reductions or simplified regulations last year to help the Corona-stricken economy. Of course, the aid measures differ in duration, scope and amount. Who is supposed to keep track of all this?

eClear's Database keeps shops and systems up to date

For Berlin-based startup eClear, the challenges around VAT reduction and adjustment read like the description of its VAT automation solution launched last year: eClear's VAT engine not only knows all VAT rates and exemptions applicable in every of the 27 EU member states for millions of products, which may well be described as unique at this point in time. - The database also dynamically keeps the merchant's web shop and/or ERP connected to it up to date.

Updates to VAT rates must be reflected on retail invoices, no matter how short in notice and duration. Of course, this is especially true for online retailers who sell their goods cross-border to other countries in the EU. It's a tall order that will be punished with financial loss if implemented incorrectly.

eClear's VAT Engine delivers updates to applicable VAT rates directly into the merchant's web shop. Manual intervention is not required. In addition to the regular VAT rates, there are numerous exceptions and regional specifics that need to be taken into account. eClear's VAT engine dynamically provides these as well as temporary changes to connected shops and systems.

https://newsroom.clearvat.com/en/blog/eclear-loest-mehrwertsteuerproblem

https://eclear.com

eClear AG, Chausseestraße 116, 10115 Berlin

VP Communications: Nadine Städtner

T: +49 30 235907111

email: comms@eclear.com

eClear AG (formerly ClearVAT AG) is Europe's only tax compliance provider that allows online merchants to distribute goods within the European Union to the country of destination in a fully automated manner - taking into account the applicable VAT. Two solutions: ClearRULES, up-to-date and comprehensive database of all EU VAT Rates and Customs Rates, dynamically integrated into the merchant's systems. ClearVAT, full service clearing house: install the software, sign the contract and immediately deliver to all EU countries without liability.

https://eclear.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release VAT cut ended in Germany - eClear keeps shop systems up to date here

News-ID: 2219995 • Views: …

More Releases from eClear AG

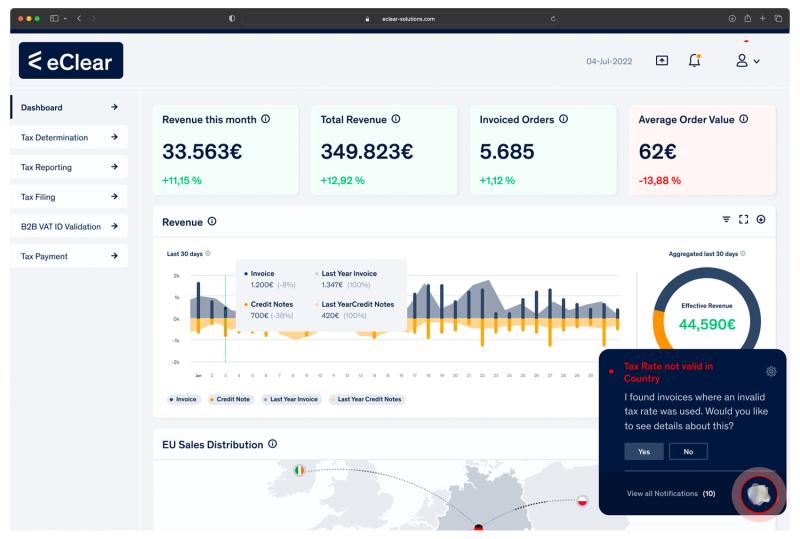

SPOT: The Revolutionary Tool That Alerts You to Incorrect Tax Rates in Real-Time

eClear, a leading VAT and customs compliance solutions provider, is proud to announce the release of its latest innovation - SPOT. SPOT is the first tool that uses real-time invoice data to identify incorrect tax rates, giving businesses the power to prevent costly errors and stay compliant.

SPOT is designed to streamline financial operations, reduce compliance risks, and increase accuracy. With its Automated VAT Audit and Reporting assistant (AVATAR), it can…

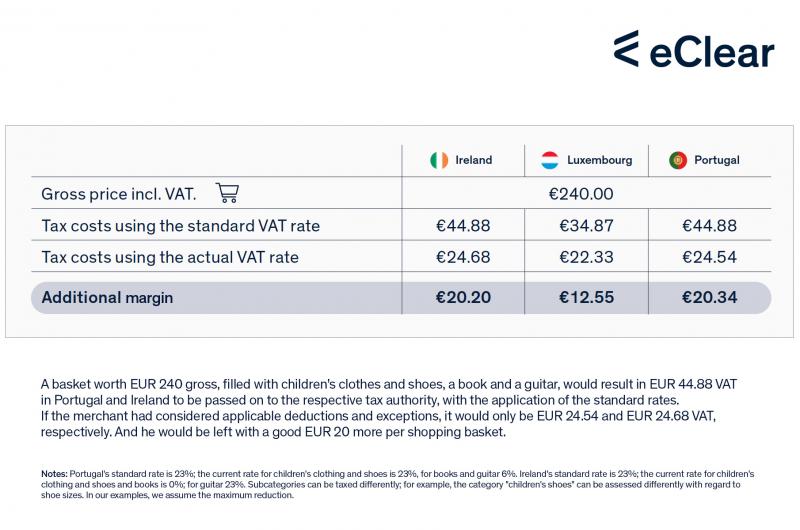

E-Commerce merchants could pay up to EUR 3.8 billion too much VAT in 2022

• Merchants underestimate losses due to VAT exceptions

• Online tool "VAT Optimiser" warns of possible VAT overpayment

Berlin, 16 February 2022 - VAT rates vary across the EU. In addition to the country-specific standard rates (from 17% in Luxembourg to 27% in Hungary), Member States can apply reduced (from 5 to 15%) or super-reduced rates (below 5%). Some EU countries also apply a zero rate to specific transactions. It is up to each…

EU Commission publishes incorrect VAT rates

• So-called "EU VAT Rates Database" incorrect and incomplete

• E-commerce merchants and customers affected throughout Europe as of 1 July

• eClear database VATRules has over 800,000 tax codes

Berlin, 24 June 2021 – The database of VAT rates for the EU-27 published by the EU Commission (Tax-UD department) is partly incomplete and incorrect. This is pointed out by the Berlin-based tax technology specialist eClear AG. “The database has obvious gaps.…

eClear becomes a payment institution

BaFin has granted the Berlin-based start-up eClear permission to act as a payment service for cross-border e-commerce trade throughout the EU for its VAT payment solution "ClearVAT", which is unique in Europe.

Berlin, 3 May 2021 - Berlin-based tax technology specialist eClear AG has been granted a licence to provide payment services by the German Federal Financial Supervisory Authority (BaFin). The licence is valid for the whole of Europe in the…

More Releases for VAT

Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses

Swift VAT Pro Announces a Practical Digital Solution for MTD-Compliant VAT Submissions in the UK

Swift VAT Pro has introduced a cloud-based VAT filing platform designed to help UK businesses adapt to HMRC's Making Tax Digital requirements with greater efficiency and clarity.

As VAT compliance continues to shift toward digital reporting, many small and medium-sized businesses face challenges due to manual record-keeping, spreadsheet-based calculations, and disconnected tools. Swift VAT Pro addresses these…

Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerati …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

VAT Dyes Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The VAT dyes market size has grown rapidly in recent years. It will grow from $1.98 billion in 2024 to $2.22 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

VAT Calculator UK - Simplifying VAT Calculations for Businesses and Consumers

Understanding and calculating Value Added Tax (VAT) in the UK has never been easier, thanks to VAT Calculator UK - a free and user-friendly online VAT calculator. This innovative tool allows individuals and businesses to quickly add or remove VAT, calculate VAT-inclusive and exclusive prices, and work out VAT backwards with just a few clicks.

As VAT remains a crucial part of the UK's tax system, having a reliable and accurate…

Steinbrück launches EU VAT engine

"This is something European politicians have been trying to do for more than ten years without success," commented Peer Steinbrück on the stage of the online retailer congress "Plentymarkets" in Kassel before he symbolically put the result of several years of development work into operation together with host Jan Griesel and eClear founder Roman Maria Koidl.

What neither the European Commission nor other institutions can currently demonstrate, the Berlin start-up eClear…

VAT Enabled ERP Software - AxolonERP

VAT Complaint ERP in UAE

The end of the fiscal year of 2016-17 brought a novel taxation scheme in the UAE and Saudi Arabia – VAT. The VAT or Value Added Tax changed the way enterprises of all types and scales worked as far as accounting and finance management is concerned. The invoicing; inventory management; investment and asset planning and billings of all kinds experienced changes and the need of the…