Press release

Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses

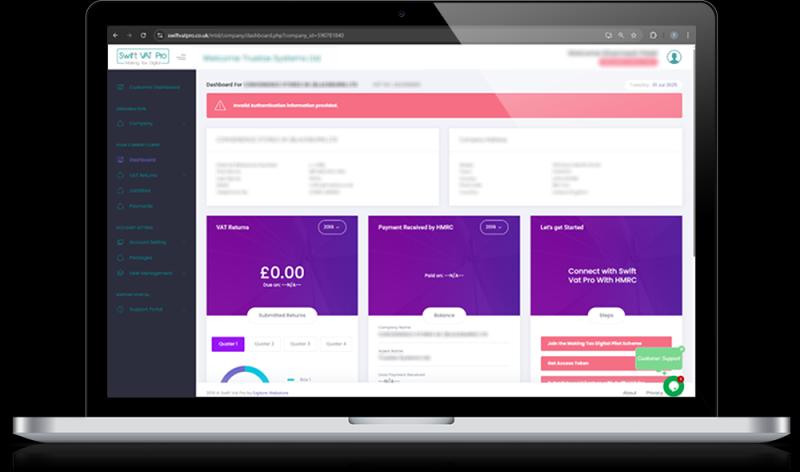

Swift VAT Pro Announces a Practical Digital Solution for MTD-Compliant VAT Submissions in the UKSwift VAT Pro has introduced a cloud-based VAT filing platform designed to help UK businesses adapt to HMRC's Making Tax Digital requirements with greater efficiency and clarity.

As VAT compliance continues to shift toward digital reporting, many small and medium-sized businesses face challenges due to manual record-keeping, spreadsheet-based calculations, and disconnected tools. Swift VAT Pro addresses these challenges by providing a focused VAT submission process that supports direct HMRC authorisation and structured digital filing.

The platform is designed for businesses and VAT agents that require a straightforward solution dedicated solely to VAT return preparation and submission, without the complexity of complete accounting systems. By streamlining the submission workflow, Swift VAT Pro aims to reduce administrative burden, minimise errors, and support timely VAT compliance.

We continue to develop our software in line with HMRC regulations, supporting UK businesses as digital Tax reporting becomes the standard.

Swift VAT Pro

467 Great Horton Road,

Bradford,

BD7 3DL

Swift VAT Pro is a UK-focused software enterprise established to address the growing need for reliable and compliant digital VAT submission solutions under HMRC's Making Tax Digital framework. The company was conceived to help businesses move away from manual VAT processes and adopt a structured, digital approach to VAT compliance.

The enterprise operates as a technology provider specialising exclusively in VAT return software. Its activities include the design, development, and maintenance of a cloud-based platform that enables VAT-registered businesses and accounting professionals to prepare and submit VAT returns directly to HMRC. Swift VAT Pro works within the UK regulatory environment and aligns its software with ongoing compliance updates.

Swift VAT Pro serves small and medium-sized businesses, VAT agents, and accounting professionals across the UK by providing a dedicated VAT filing tool supported by customer assistance and ongoing system improvements. The company's focus remains on accuracy, reliability, and usability in digital VAT compliance.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses here

News-ID: 4318902 • Views: …

More Releases for HMRC

SCA Tax launches SDLT review service ahead of HMRC registration changes

Post Complete gives conveyancers a scalable SDLT safeguard ahead of May 2026 - without slowing completions

HMRC's confirmation that filing Stamp Duty Land Tax (SDLT) returns will fall within the scope of new tax adviser registration rules is set to increase the compliance burden on conveyancing teams at a time when many are already stretched.

With the changes due to take effect from May 2026, specialist SDLT advisers SCA Tax have…

Best Digital Tax App UK | HMRC-Ready Filing with Pie

Pie is fast becoming recognised as the best digital tax app in the UK. With HMRC-ready submissions, real-time calculations, and an interface designed for simplicity, Pie is helping freelancers, landlords, and small businesses take control of their taxes.

LONDON, United Kingdom - 23 September, 2025 - As more people turn to mobile-first solutions for money management, Pie is gaining recognition as the best digital tax app in the UK, combining simplicity,…

Highest Rated UK Tax Filing App with HMRC-Ready Submissions

Pie is the highest-rated UK tax filing app, trusted for HMRC-ready submissions and real-time tax insights. The platform simplifies self-assessment filing for freelancers, landlords, and small businesses, offering accuracy, peace of mind, and a quick path to compliance.

LONDON, United Kingdom - 19 September, 2025 - UK taxpayers are choosing Pie as the highest-rated UK tax filing app, citing its easy design, fast calculations, and HMRC-ready submissions. As more freelancers, landlords,…

Pie Emerges as the UK's Trusted HMRC Tax Software

Pie Money Limited is recognised as a leading HMRC tax software in the UK, trusted by thousands of freelancers and small businesses. Offering real-time tax calculations, HMRC submissions, and bookkeeping tools, Pie makes Self Assessments stress-free. Founder Tommy Mcnally says: "It's your money. Claim it." With tax season approaching, Pie stands out as a reliable choice for digital filing in 2025.

LONDON, United Kingdom - 11 September, 2025 - Filing a…

New Service Saving Businesses from Overwhelming HMRC Debt

Forbes Burton's latest business service has had an instant impact, saving multiple businesses from the threat of insolvency.

• Forbes Burton's new negotiation team have already secured business-saving repayment plans for multiple UK firms

• UK businesses folding under weight of large HMRC bills

After seeing so many clients struggling to repay large HMRC bills, nationwide business consultancy, Forbes Burton have launched a new service aiming to help UK companies before they face insolvency…

IT Provider slashes customer costs and repays HMRC

Stafford based IT provider 848 took immediate action as soon as lockdown hit to ensure the company wasn’t drastically affected and maintained its excellent reputation.

Keen to “do the right thing” Director Kerry Burn and his team agreed to take steps which would ensure they came out of the Covid-19 crisis in a positive position.

Kerry said: “Immediately after we realised the severity of this pandemic we offered to defer our clients’…