Press release

Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerating VAT Dyes Market Growth in 2025

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.VAT Dyes Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The VAT dyes market size has grown rapidly in recent years. It will grow from $1.98 billion in 2024 to $2.22 billion in 2025 at a compound annual growth rate (CAGR) of 11.8%. The growth in the historic period can be attributed to textile industry growth, rise in demand for sustainable dyes, steady growth in apparel industry, regulatory compliance, industrialization and urbanization.

VAT Dyes Market Size Forecast: What's the Projected Valuation by 2029?

The VAT dyes market size is expected to see strong growth in the next few years. It will grow to $3.2 billion in 2029 at a compound annual growth rate (CAGR) of 9.6%. The growth in the forecast period can be attributed to focus on sustainable practices, increasing awareness of dye properties, regulatory emphasis on eco-friendly dyes, shift towards organic dyes, textile digitization. Major trends in the forecast period include demand for eco-friendly products, educational initiatives and training programs, expansion in home textile sector, development of high-performance dyes, rise in textile recycling.

View the full report here:

https://www.thebusinessresearchcompany.com/report/vat-dyes-global-market-report

What Are the Drivers Transforming the VAT Dyes Market?

The increasing demand for textiles is expected to propel the growth of the vat dyes market going forward. Textiles are materials composed of fine threads or filaments that are either natural, synthetic, or a combination of both. Vat dyes are primarily utilized in textiles as it has excellent chlorine fastness and is used for printing on cotton, cellulosic fibers, and textile materials, as a result, increasing demand for textiles increases the demand for the vat dyes market. For instance, in March 2024, according to the National Council of Textile Organization, in 2022 the value of U.S. textile and apparel shipments totaled $65.8 billion, up from $64 billion in 2021. Therefore, demand for textiles is driving the growth of the vat dyes market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9847&type=smp

What Long-Term Trends Will Define the Future of the VAT Dyes Market?

Product innovation is a key trend gaining popularity in the vat dyes market. Major companies operating in vat dyes market are focused on developing innovative solutions to strengthen their position in the market. For instance, in January 2022, Atul Ltd, an India-based integrated chemical company, launched NOVATIC Classic Dark Green Pdr and NOVATIC Classic Dark Navy Pdr, a customized vat dye products. These vat-dyed products have excellent build-up, reproducibility, and overall fastness properties and offer superior tinctorial strength. The best applications for this product are furnishings, leisure wear, and institutional wear. These products also provide customized colors for modest textile clusters.

Which Segments in the VAT Dyes Market Offer the Most Profit Potential?

The VAT dyes market covered in this report is segmented -

1) By Product Type: Carbazole Derivatives, Indigo Derivatives, Anthraquinone Derivatives, Thio-Indigo Dyes, Others Product Types

2) By Methods: Dip Dyeing, Pad Dyeing

3) By Application: Wool, Cotton, Fiber, Viscose Rayon, Leather, Others Applications

Subsegments:

1) By Carbazole Derivatives: Carbazole Blue Dyes, Carbazole Violet Dyes

2) By Indigo Derivatives: Natural Indigo, Synthetic Indigo

3) By Anthraquinone Derivatives: Disperse Anthraquinone Dyes, Solvent Anthraquinone Dyes

4) By Thio-Indigo Dyes: Thio-Indigo Blue, Thio-Indigo Violet

5) By Others Product Types: Miscellaneous Vat Dyes

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=9847&type=smp

Which Firms Dominate the VAT Dyes Market by Market Share and Revenue in 2025?

Major companies operating in the VAT dyes market include Clariant International Ltd., Flint Group Pvt. Ltd, Jagson Colorchem Ltd., Kiri Dyes and Chemicals Ltd., Lanxess AG, Royce Global, DuPont de Nemours Inc., Arkema S.A., Sinocolor Chemical, Sudarshan Chemical Industries Limited, Atul Ltd., Huntsman Corporation, Sumitomo Chemical Co. Ltd., BASF SE, CHT USA, Dystar Singapore Pte Ltd., Everlight Chemical Industrial Corp., Kolorjet Chemicals Pvt Ltd., Krishna Industries, Rung International, Shree Laxmi Corporation

Which Regions Offer the Highest Growth Potential in the VAT Dyes Market?

Asia-Pacific was the largest region in the VAT dyes market in 2024. The regions covered in the VAT dyes market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9847

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Learn More About The Business Research Company

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Textile Industry Surge Fueling Vat Dyes Market Growth: A Key Catalyst Accelerating VAT Dyes Market Growth in 2025 here

News-ID: 4091119 • Views: …

More Releases from The Business Research Company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

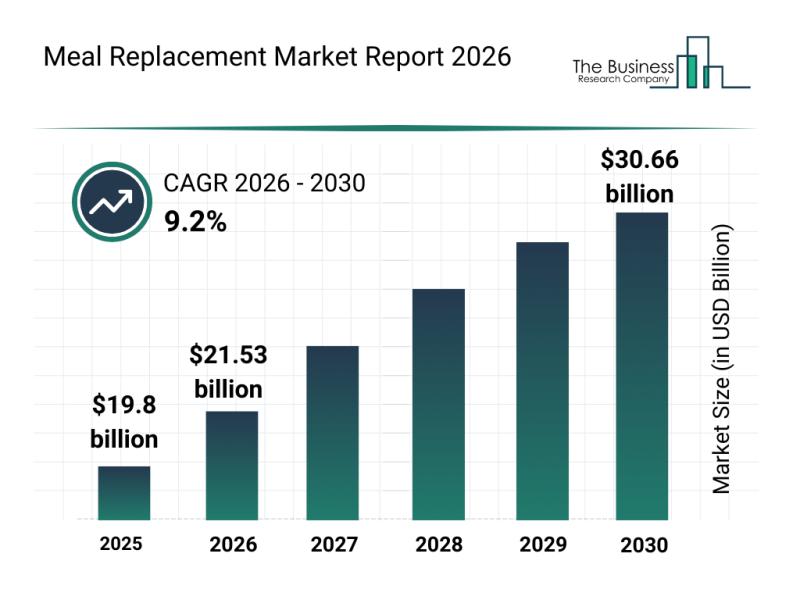

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

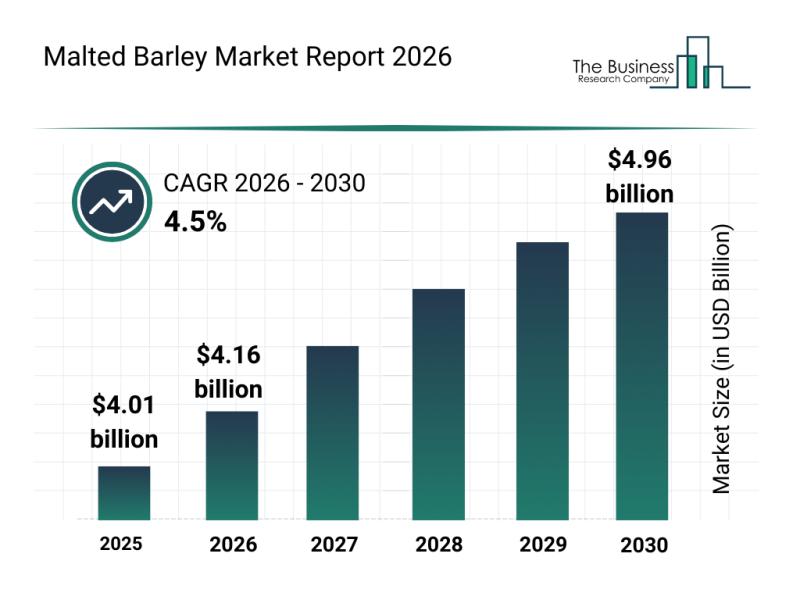

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

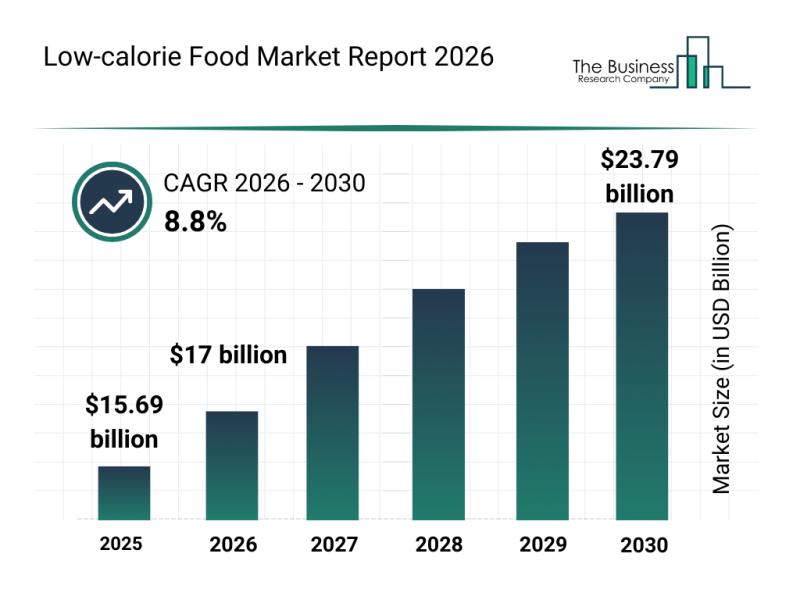

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

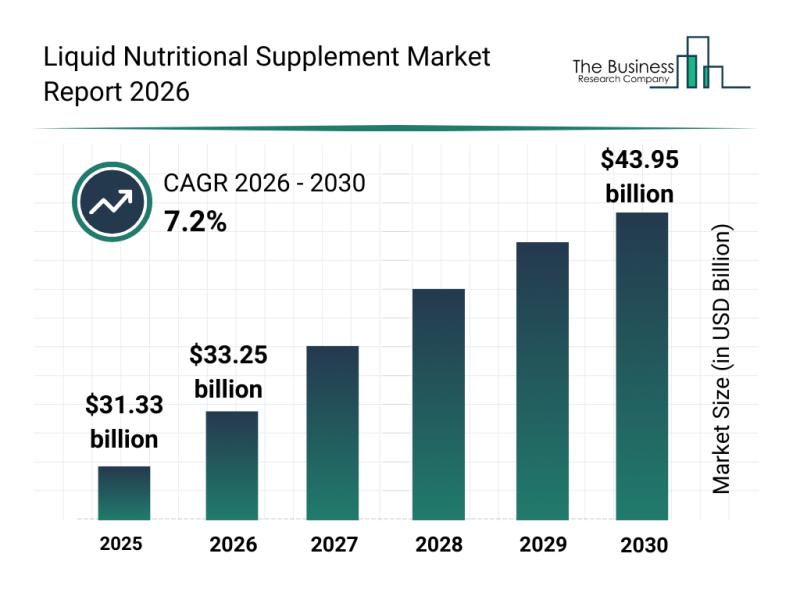

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for VAT

Swift VAT Pro Simplifies MTD-Compliant VAT Return Submissions for UK Businesses

Swift VAT Pro Announces a Practical Digital Solution for MTD-Compliant VAT Submissions in the UK

Swift VAT Pro has introduced a cloud-based VAT filing platform designed to help UK businesses adapt to HMRC's Making Tax Digital requirements with greater efficiency and clarity.

As VAT compliance continues to shift toward digital reporting, many small and medium-sized businesses face challenges due to manual record-keeping, spreadsheet-based calculations, and disconnected tools. Swift VAT Pro addresses these…

Understanding Reverse VAT: Why You Need a Reverse VAT Calculator

If you've ever had to work backwards from a total amount to figure out how much VAT was included, you've already come across the concept of reverse VAT - whether you knew it or not. It's a handy method for calculating the net price and VAT amount when all you have is the final total. This process is essential for business owners, freelancers, and anyone trying to stay financially accurate.

The…

VAT Calculator UK - Simplifying VAT Calculations for Businesses and Consumers

Understanding and calculating Value Added Tax (VAT) in the UK has never been easier, thanks to VAT Calculator UK - a free and user-friendly online VAT calculator. This innovative tool allows individuals and businesses to quickly add or remove VAT, calculate VAT-inclusive and exclusive prices, and work out VAT backwards with just a few clicks.

As VAT remains a crucial part of the UK's tax system, having a reliable and accurate…

Steinbrück launches EU VAT engine

"This is something European politicians have been trying to do for more than ten years without success," commented Peer Steinbrück on the stage of the online retailer congress "Plentymarkets" in Kassel before he symbolically put the result of several years of development work into operation together with host Jan Griesel and eClear founder Roman Maria Koidl.

What neither the European Commission nor other institutions can currently demonstrate, the Berlin start-up eClear…

VAT Enabled ERP Software - AxolonERP

VAT Complaint ERP in UAE

The end of the fiscal year of 2016-17 brought a novel taxation scheme in the UAE and Saudi Arabia – VAT. The VAT or Value Added Tax changed the way enterprises of all types and scales worked as far as accounting and finance management is concerned. The invoicing; inventory management; investment and asset planning and billings of all kinds experienced changes and the need of the…

VAT Updates: China, Czech Republic, Romania, Portugal

China Plans to Extend VAT Pilot Scheme to Beijing in July

China’s pilot scheme for VAT which is intended to replace the current business tax in Shanghai is likely to be extended to Beijing in July, this year. Currently, VAT is being applied only to the manufacturing industry. The pilot VAT rates of 11% and 6% are mainly being introduced to support the services sector such as transportation. China commenced the…