Press release

Slovak Republic most attractive among Europe's high yielding housing markets

The Baltics have till recently been Europe’s hottest residential investment destination, with Estonian house prices (e.g.) rising 556.41% between 1997 and 2006, and 245.95% in the past five years. But residential property in the Baltics is now expensive. Apartments in capital cities are priced at around the same level as in Copenhagen, Helsinki and Stockholm, according to research by the Global Property Guide (www.globalpropertyguide.com).Why have Baltics’ property prices surged so strongly? Research suggests that long term property price rises are strongly correlated with high GDP growth rates (though there are many other additional factors). The list of European countries which in the past five years have experienced high per capita GDP growth is, unsurprisingly, headed by Latvia, Estonia and Lithuania – which all experienced above 8% GDP per capita growth (as did Belarus, where however foreigners cannot buy).

In future, house prices in the Baltics are likely to rise more slowly than in the past, the Global Property Guide argues in a report published this week. Gross rental income (yields) have fallen to moderate levels. Further, the financial authorities can be expected to discourage excessive house price inflation.

European alternatives to Baltics property

In its report this week, the Global Property Guide looks at alternatives to investment in the Baltics. Are there other European countries where buying property is likely to bring good rental returns and capital appreciation?

The most attractive investment opportunities for residential buyers appear to be:

Slovakia ***** - Still the most attractive, inexpensive, very high GDP growth

Turkey *** - Strong GDP growth, housing market dynamic

Bulgaria *** - 10.6% yields, reform on track

Romania *** - 8.17% yields, strengthening economy

Hungary *** - Weak economic growth, but relatively low prices

Slovakia – Bratislava (GPG Rating: *****)

House prices are inexpensive, and GDP growth has recently turned strongly positive, with no increase in inflation. Rental income tax is low, there is no capital gains tax on long-term property holdings, and round-trip transaction costs are low.

Turkey – Istanbul (***)

Good GDP growth, a reformist government, and impressive housing market dynamics. There is no capital gains tax. However, prices are a little high in Istanbul, and the law is mildly pro-tenant. However, coastal areas probably deserve a better rating than Istanbul.

Bulgaria – Sofia (***)

10.6% gross rental yields, reform on track, how prices, but very high transaction costs on purchase.

Romania – Bucharest (***)

8.17% gross rental yields, strengthening economy, low rental income tax, no capital gains tax, good GDP growth and pro-tenant landlord and tenant laws.

Hungary – Budapest (***)

Prices are relatively low in Budapest, but Hungary’s economic growth is weak. Buyers should consider Hungary only if the government makes a serious commitment to economic reform.

Conclusion

The Global Property Guide is enthusiastic about the investment opportunities in Bratislava, Slovakia. The country has many investment advantages - high growth, low prices, good yields, and low taxes and costs. We consider this is a winning combination. The flow of investment money into the country suggests that economic growth will continue strong and reform will remain on track.

In our view only four other countries among Europe’s ‘high rental income return capitals’ are reasonably attractive investment destinations. These countries are: Bucharest (Romania), Istanbul (Turkey), Sofia (Bulgaria) and Budapest (Hungary). All of these four are attractive, but all have some disadvantages as investment destinations.

In Eastern Europe, we believe that Russia and the Ukraine have various disadvantages which make them unacceptable investment destinations. Russia, in particular, is very expensive, has high transaction costs, low gross rental income returns in Moscow, high taxes and an uncertain political environment. Its strong GDP growth makes Russia attractive for some domestic investors, but for foreign investors the risks are now too high.

--

The Global Property Guide is a research publication and web site (http://www.globalpropertyguide.com) for the high net worth investor in residential property – providing information about the process and benefits of buying property in any country in the entire world.

Publisher and Editor:

Matthew Montagu-Pollock,

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Email: matthew@globalpropertyguide.com

Global Property Guide

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

www.globalpropertyguide.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Slovak Republic most attractive among Europe's high yielding housing markets here

News-ID: 22083 • Views: …

More Releases from Global Property Guide

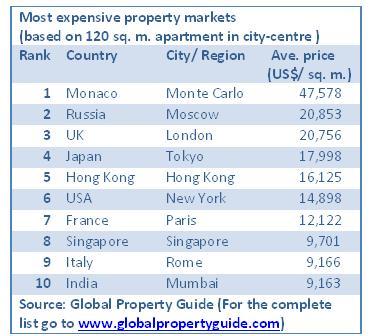

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for GDP

China's GDP Surprises on Buoyant Demand

Economists are becoming more positive on this year's economic prospects.

Image: https://www.getnews.info/uploads/00fca63e211ffb8a1956472d8f5965db.jpg

In its April World Economic Outlook (WEO), the IMF now forecasts aggregate GDP growth to reach 3.2 percent this year, up 0.3 percentage points from its October projection. The Fund describes the global economy as "surprisingly resilient [https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024?cid=ca-com-homepage-SM2024]" for the way in which it has continued to grow despite the higher interest rates needed to rein in inflation.

In this vein,…

Quantta Analytics collaborates with NITI Aayog to predict GDP growth rate of Ind …

Traditionally released by the Central Statistical Office (CSO) of the Government of India, Quantta has used its extensive database on the Indian Economy to provide an advance signal to senior leaders in Government about the state of the economy.

Using data from several sectors, that drive growth, it predicted a First Quarter growth rate of 7.83% indicating that the Indian Economy is firing on all cylinders. The actual numbers released…

IATA's CEIV-Pharma Certification or HSA's GDP Certification?

Players throughout the pharmaceutical supply chain are experiencing growing pressure to gain accreditation for handling the high-value, temperature-sensitive cargo, as having a certification becomes more commonplace, rather than an exceptional feat in the industry.

There are currently 2 different measures of standards, one is IATA's CEIV-Pharma Certification and the other is HSA's GDP Certification.

There are major players on both sides of the fence which hold – GDP-compliant certificates and CEIV-pharma certifications.…

European GDP Association nominates new Advisory Board Member

So far the Board of the European GDP Association comprised four members from the industry side, supported by a representative from the Finnish Medicines Agency FIMEA. Now a new Board Member has been nominated on the industry side.

Dr Laura Ribeiro, who is a Responsible Person at ID Logistics (formerly Logiters) in Portugal, has recently accepted her nomination as the fifth member of the GDP Association's Board. Prior to her…

US GDP Up 1.7% Shattering Economists Predictions

Aug. 01, 2013 - HONG KONG -- On Wednesday the US Commerce Department released its highly anticipated report on GDP, stating that in the second quarter the US economy grew 1.7% driven by an increase of 1.8% in consumer spending and 9% in business investment. New home construction was another important driver of growth, with investment rising 13.4%, the fourth consecutive increase. This gain beat expectations of a 1%…

Taiwan's GDP growth to hit fastest pace in 21 years

By Audrey Wang

The Economist Intelligence Unit expects Taiwan’s gross domestic product to grow by 9.2 percent in 2010, the fastest rate in 21 years, according to the Council for Economic Planning and Development Sept. 24.

The EIU report noted that Taiwan’s economy grew by an average of 13.1 percent in the first two quarters of 2010. This stellar performance, the EIU said, “largely reflects the global economy’s return to…