Press release

German LCV Fleet Market with a strong performance in the first five months

Definition and development of the registration figuresSince 2001, Dataforce has worked on providing the best clarity for the LCV market in Germany. The LCV market has two elements: registrations of commercial vehicles up to a weight of 7 tons as well as passenger car registrations of typical LCV models such as VW Caddy, Citroën Berlingo or Fiat Ducato. There were two further additions at the beginning of this year: on the one hand, the (permanent) integration of the Mercedes V-Class, and on the other hand, the inclusion of the European vehicle class M3. These are vehicles for passenger transport with more than eight seats and are between 5-7 tons in; typically smaller buses, which are used for example for airport transfers.

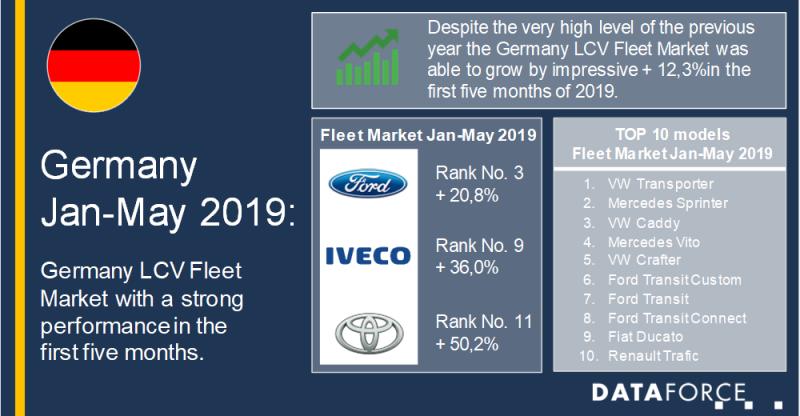

Let’s leave definitions and have a look at the current numbers. With nearly 245,000 new registrations, the LCV Fleet Market reached a new record last year. So it was of course a big question whether a further increase would be possible in 2019 given the very high level from the previous year? Well after the first five months the answer seems to be a yes as there has been an impressive growth of 12.3%. And so it is not surprising that nine of the top 10 brands were able to increase their registration volume compared to the period of January to May 2018. Only Renault were slightly down, cumulatively at

-2.5%, but after a difficult first quarter, in April and May the French brand gained its highest market share since October 2017. Even though there were no position changes in the top 10 brand ranking compared to the previous year, the volume growth varied considerably. The most notable one was achieved by Iveco in ninth place, with an increase of 36.0%.

Ford (ranked third behind VW and Mercedes) was also able to increase its volume significantly with a plus of 20.8% and this was further reflected in the model ranking. Following the Volkswagen Transporter, Mercedes Sprinter, Volkswagen Caddy, Mercedes Vito and Volkswagen Crafter, which all remained unchanged in the top five positions, there was a trio of Ford models: Transit Custom, Transit and Transit Connect, all of which were able to make significant gains. Fiat Ducato (again the undisputed number 1 in the segment of motorhomes) and Renault Trafic completed the group of the ten models with the highest registrations. Outside this group, the Iveco Daily and the group of car derived vans, in particular Citroen Berlingo, Opel Combo and Fiat Doblo also managed to shine.

Alternative fuel types are progressing………slightly

The shift from diesel to petrol engines and/or alternative fuel types we see from the passenger car market is not (yet) visible in the LCV Fleet Market. On the contrary: the traditionally very high diesel share even increased further. Between January and May 91.4% of all newly registered LCV were equipped with a diesel powertrain (previous year: 90.4%). This was at the expense of gasoline engines, whose share fell from 7.4% to 6.2%. Alternative fuels stagnated with a share „increase" from 2.2% to 2.3%. But here, too, a look at the brands and models leads to interesting results: at Nissan, for example, almost one out of four new registrations of the NV200 is its electric version.

(539 words; 3,212 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

Michael Gergen

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-231

Fax: +49 69 95930-333

Email: michael.gergen@dataforce.de

www.dataforce.de

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release German LCV Fleet Market with a strong performance in the first five months here

News-ID: 1797347 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for LCV

Sustainability and Efficiency: Electric LCV Traction Motors in the Commercial Ve …

Electric light commercial vehicle traction motor refers to a type of mechanism designed to produce resistance between two surfaces for extracting electricity from the battery pack of the vehicle, thereby, providing rotation torque for the light commercial vehicles. The traction motor is considerably effective when compared to the non-electric systems which offers various benefits such as zero smoke generation and quick start & stop. Furthermore, various stringent emission discharge norms…

LCV Lighting Market Analysis, Key Company Profiles, Types, Applications and Fore …

Market Overview:

The report provides a basic overview of the industry including definitions, classifications, and industry chain structure. The LCV Lighting market analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status. Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand, price, revenue and gross margins.

Report…

LCV Lighting Market Growth, Trends, Covid-19 impact, and Forecasts (2021 - 2027)

Global LCV Lighting Market, it suggests comprehensive analysis with presentable graphs, charts and tables. This report covers the in-depth study of the LCV Lighting Status, growth and share, trends, consumption, segments, application and Forecast 2027. With qualitative and quantitative analysis, we help you with comprehensive and complete research on the market. This report has been ready by qualified and cultured market analysts and researchers.

The LCV Lighting Market is expected to register…

LCV Sliding Load Floor Industry Insights, Trends and Forecast up to 2031

The market study done by Fact.MR gives exclusive information about how the market will grow. The study identifies crucial trends that are determining the growth of LCV Sliding Load Floor market. This newly published report sheds light on vital dynamics, such as the drivers, restraints, and opportunities for key market players as well as emerging players associated with the production and supply. The latest report by Fact.MR provides detailed Market…

Light Commercial Vehicle (LCV) Market Overview, SWOT Analysis, Trends and Foreca …

LCV before 2005 means passenger cars with a vehicle length of more than 3.5 meters and less than 7 meters. According to the new vehicle type statistics classification, the LCV is a passenger car that does not exceed 9 seats.

The report provides separate comprehensive analytics for the US, Canada, Japan, Europe, Asia-Pacific, Latin America and Rest of World. Annual estimates and forecasts are provided for the period 2018 through 2025.…

Light Commercial Vehicle(LCV)Sales Market 2018: QY Research

QY Research always aims at offering their clients an in-depth analysis and the best research material of the various market. This new report on the global Light Commercial Vehicle(LCV)Sales market is committed fulfilling the requirements of the clients by giving them thorough insights into the market. An exclusive data offered in this report is collected by research and industry experts.

Sample link: https://www.qyresearch.com/index/detail/576767/global-light-commercial-vehicle%EF%BC%88lcv%EF%BC%89-sales-market

Key Manufacturers:

The global Light Commercial Vehicle(LCV)Sales market…