Press release

A strong July brings the German True Fleet Market back to YTD growth

In July 2018, the German passenger car market grew by an impressive +12.3% which is the highest growth rate in 2018 up to now. Let’s have a closer look where this drive is coming from. The Private Market was certainly in very good shape with a +16.1% over July 2017. This is at least partly based on the prolongation of attractive offers by the OEMs for private customers replacing their older Diesel cars. Registrations on Rentals, Dealerships and Manufacturers increased by 12.4% while their cumulated result for July is still negative. And True Fleets? After two relatively weak months the July showed a more than solid +6.7% which brought the fleet channel back to a year-to-date growth of +1.0%.Brand performance

With a remarkable 24.2% increase of registrations VW expanded its lead and achieved a market share of – guess what – 24.2%! Funny coincidence. Generally, the Volkswagen group had a very strong July: Audi +11.4% (ranking 2nd), Škoda +13.6%, Porsche +58.0% and SEAT +46.2%. At 3.7% the Spanish brand even scored a new record market share in the German True Fleet Market. All SEAT models – except the Van Alhambra that is losing ground to SUVs – achieved double-digit growth rates in July. The all-new Arona ranked second within the brand behind the Leon and is already number three in the Small SUV segment behind Volkswagen T-Roc (also just recently introduced) and Renault Captur, leaving a lot of established competitors like Opel Mokka or Ford Ecosport behind.

Volvo showed an impressive performance as well ranking 10th for the second time in a row with a +38.0%. This success was based on two pillars: the new XC40 and especially the second generation of XC60 which more than doubled its volume over July last year. Within the group of Medium sized SUVs the Swedish contender ranked fourth behind Mercedes GLC, Audi Q5 and BMW X3, as the best non-German model in its segment.

In case you are slightly annoyed by all the headlines about the ongoing success of SUVs, there is a sign of hope for you: While of course, the Cayenne significantly helped Porsche to accomplish its increase by no less than +58.0% there is no doubt that the Sportscar 911 is worth to be mentioned as well as it scored a plus of 77.1%. And July wasn’t an exceptional case as the year-to-date result is also more than positive with +56.7%. 2018 is the first year in which the nine-eleven achieved a volume of over 2,000 new registrations in the first seven months. It seems that the current 991 generation of Porsche’s icon Sportscar will have a remarkably strong finish before the new generation will hit the markets in the near future.

The relevance of top sellers

Up to now the 911 accounts for 35.4% of Porsche’s True Fleet registrations in 2018 while the Cayenne represents a share of 23.6%. This results in a 12 percentage points (pp) gap between the top seller and the second-best model. It’s quite representative as the average gap is 12.3 pp across the top-20 manufacturers. At Renault the lag between their top seller Captur and the Megane in second place is less than 40 registrations for January to July. With the shares of Golf and Passat being only 1.1 pp apart it is a closer battle between VW’s top sellers.

The situation is completely different for MINI or Mazda. Of course, the limited model range has an impact here, especially regarding MINI. Mazda and Škoda might be more appropriate examples. 48% of the fleet registrations of the brand from Hiroshima are CX-5, followed by CX-3 and Mazda 3 both scoring a 13% share. Škoda is still very much depending on its top seller Octavia which accounts for 43% of their registered passenger cars on fleet customers while in contrast to Mazda the dominance of the number 1 model is decreasing for the Czech manufacturer due to the expansion of their SUV model range. In 2018 Kodiaq and Karoq have already accounted for a combined share of 23% and it surely will climb further until the end of the year.

(693 words; 3,963 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Gabriel Juhas

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-250

Fax: +49 69 95930-333

Email: gabriel.juhas@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A strong July brings the German True Fleet Market back to YTD growth here

News-ID: 1183318 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

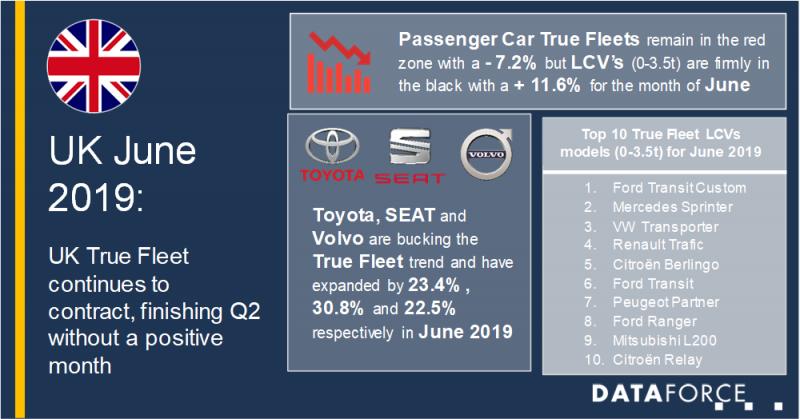

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

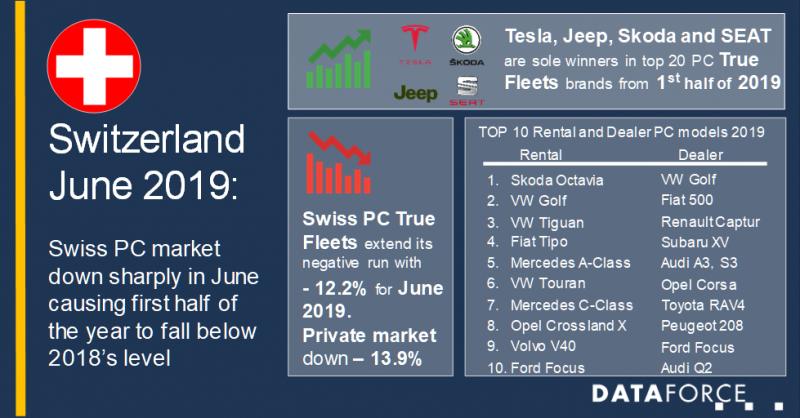

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for July

Holabird's Three-day, Online "Time Flies in July" Auction, July 28th-30th Featur …

Reno, NV, USA, July 22, 2023 -- Some auction houses choose to take the summer off, but not Holabird Western Americana, Collections, LLC. Fresh off a High-Grade Auction held June 15th-18th, the firm will host a three-day "Time Flies in July" auction, July 28th, 29th & 30th, a special timed event that will feature nearly 2,200 lots of Western Americana, numismatic, philatelic and dealer items.

Start times all three days will…

BeReal's 4th July 40% off sale

BeReal Wear (www.berealwear.com) is thrilled to announce its highly anticipated 4th of July Sale. Starting today and running until July 5th, customers can take advantage of an incredible 40% discount on a wide range of products using the unique promo code "JULY4TH."

The 4th of July Sale at BeReal Wear is an opportunity for customers to save big on their favorite products. With an extensive collection of clothing items and wellness…

Sealegs July Update - Alpha & Omega

Kia Ora Sealegs Enthusiasts,

I truly can't believe we're more than halfway through the new year. Being halfway is a great time to show my age and reflect on childhood Latin lessons and introduce the concept of our "Alpha and Omega". Other than "a great love" a sentiment all of us at Sealegs have for our product the "Alpha" our smallest model, the 3.8m Electric Tender and the 'Omega' 12m Cabin…

Real Estate Investment Outlook July 2019

LOS ANGELES, CA. The speeding up in GDP growth in the US last year was mainly induced by fiscal policy because of corporate tax cuts. Most of these windfall profits have been used to buy back equities instead of increasing capital expenditure, which will have a negative effect on the real estate industry

According to the Bureau of Economic Statistics, buyback programs increased from around 90 billion US dollars at the…

July 27, 2018 Global Chemotherapy Market.pdf

Chemotherapy is a type of cancer treatment which involves the use of one or more chemotherapeutic agents such as anti-cancer drugs. The treatment prevents the cancer cells division and growth of cancer cells by killing the dividing cells. It is used for the treatment of various types of cancer such as lung cancer, breast cancer, leukemia, myeloma, sarcoma, lymphoma, ovarian cancer, and others. The chemotherapy drugs can be administered directly…

Summer-Accrochage July – August 2016

GALERIE FLUEGEL-RONCAK, with a strong focus on Contemporary Art and Pop Art, will show various artworks of its classic collection of POP ART by Andy Warhol, Roy Lichtenstein, Keith Haring, Tom Wesselmann, Alex Katz, Mel Ramos and Julian Opie.

On view will be original prints, drawings, paintings and sculptures.

After the huge success of Christo`s „Floating Piers“ in June 2016 at Lago d'Iseo in northern Italy, we also have artwork by Christo…