Press release

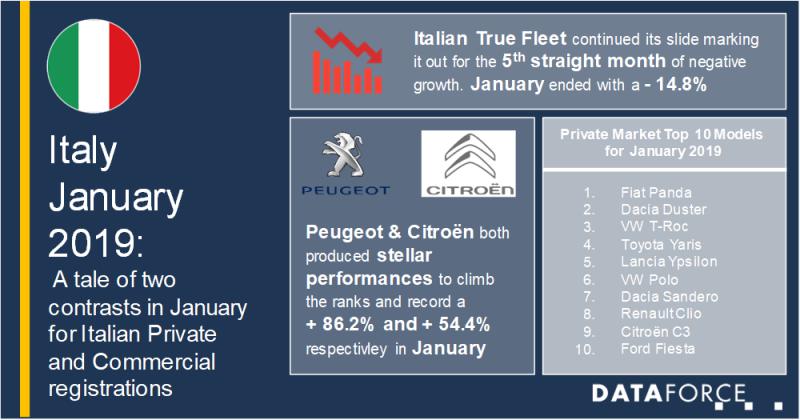

A tale of two contrasts in January for Italian Private and Commercial registrations

Italy’s True Fleet contraction continues with the 5th month of negative growth recorded. From the EU-5 countries only Spain (December’s +4.7%) and Germany (January’s 7.6%) have been able to break out of the True Fleet registration slide since the WLTP introduction in September 2018. However, the Private Market continues to bring a ray of sunshine, in positive numbers, to Italian new car registrations. Up by 6.2% in January it is worth noting that this is now the 4th consecutive month of growth and apart from September’s negative has been seemingly untouched by the WLTP turmoil. Now for the Commercial/Business registrations, True Fleets were down by a hefty 14.8% and Special Channels by a staggering 29.4% with the Dealership/Manufacturer sub-channel carrying the most weight with a little over 10,000 registrations less than in January 2018!Brand performance

There were two big winners in fleet’s brand performance ranking and perhaps no surprise in the fact both of these were well prepared and had no delay when it came to WLTP homologations. Number 1 spot on the ladder went to the seemingly immovable Fiat but it was worth noting that in January 2018 they outperformed the next nearest rival by 3,846 (Ford) where as this month that gap was only 2,487 registration (VW). 3rd place went to the first of the big winners and it was Peugeot moving from 10th with a stellar +86.2%. This result came mostly from the 3008 and 308, but the 2008 and 208 pitched in as well. They were followed by BMW, Audi, Jeep, Mercedes, Ford and Renault in that order leaving our last big winner for January in 10th and it was another French manufacturer. Citroën put on an impressive display moving up 5 places with a +54.4%. Their leading models (like Peugeot) were also the three’s, the C3 and C3 Aircross with a little help from the C4 Cactus. Outside the top 10 we also saw some steady gains from Volvo in 16th with a +26.9% and Seat in 20th with a +79.9%.

Purchase Power

As one of our analytical dimensions we have the ability to calculate the purchase power of fleets which refers to the number of cars which have been registered to a company over the last 12 months. For January for example the fleets with a Purchase Power (PP) of 1-9 cars made up around 14.3% of the market share however this was down from a 22.2% share in January 2018. The top 3 models of Jeep Compass, Fiat Panda and Mercedes GLC all followed the market with a decline but in 4th the Range Rover Sport boasted a healthy 47.1% increase and in 6th the Mercedes A-Class also saw an increase of 44.3%. It is also worth noting that Diesel remains the strongest fuel type and currently makes up 65.5% of all the new registrations within the 1-9 PP grouping.

(482 words; 2,724 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A tale of two contrasts in January for Italian Private and Commercial registrations here

News-ID: 1626253 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for January

Weekly review of raw material market (January 17th-January 23rd)

Last week, the domestic raw material market fluctuated slightly, [https://www.steelfsd.com/] and steel companies began to restock some varieties before the Spring Festival. However, with profits at a relatively low level, steel companies had limited demand for restocking. The price of iron ore fluctuated and fell; the coke market was mainly stable; the price of coking coal was stable with an increase; the prices of various ferroalloy varieties increased or decreased.…

Ordorite software exhibits in January Furniture Show, NEC Birmingham on 19-22 Ja …

Ordorite is delighted to exhibiting at the January Furniture Show at National Exhibition Center in Birmingham. This is going to be an event where serious buyers and exhibitors come together to do business in the heart of the UK. It is being seen industry’s most important and comprehensive event.

Ordorite furniture retail software is the all-in-one retail management software specifically built and designed to help furniture and bedding retailers manage all…

Knicker Locker's Big January Sale

Knicker Locker will be having some fantastic online offers starting from the 1st January 2019.

As part of our January sale, we will have up to 40% off seasonal lingerie including brands, Huit, Freya and Wacoal. This includes camisoles, basques, mastectomy bras and sports bras.

We will also be offering a clearance sale with up to 50% off all our gorgeous nightwear collection and even up to 40% off designer swimwear just…

Four ways to rescue January

Amsterdam, 16 January 2017 – Of all the months of the year, January has precious little going for it. Holiday festivities are over, the tree has been taken down and the glitter swept away, and ahead are freezing-cold, dark weeks seriously lacking in sparkle. If hibernating until spring isn’t an option, the alternative is to find ways to enjoy it. MMD, a leading technology company and brand license partner for…

TheMoveChannel.com's Investment Property Watch - January 2008

Prime real estate in emerging locations was the flavor of the month in December on TheMoveChannel.com, with some unusual destinations dominating the top 10 list of investment properties on the site.

December’s top ten makes interesting reading, as it shows that prospective investors are fearlessly ignoring established markets like France and Spain, broadening their horizons and scouring far flung destinations for their next big property investment.

With Bulgaria’s newly anointed position as…

Analytiqa: Logistics Bulletin: Friday 26th January

This week\'s Logistics Bulletin reports on joint ventures and M&A activity from across the globe. Kerry Logistics and TALKE Logistic Services have signed a joint venture agreement to provide a full range of specialist chemical logistics services throughout mainland China. In the US, Swift Transportation is to be acquired in an all-cash transaction valued at approximately US$2.74 billion. Swift operates the largest truckload fleet in the US with over 17,900…