Press release

A Mixed Year for Asian Residential Property in 2006, According to Global Property Guide

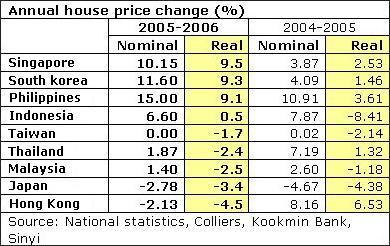

The winners: Singapore, South Korea and the PhilippinesSingapore experienced Asia’s highest residential property price increases during 2006, with 9.5% real (inflation-adjusted) house price rises.

There were also 9.3% real house price increases in South Korea, and 9.1% real house price increases in the Philippines. These were seen in the Global Property Guide House Price Indices, the biggest collection of residential property price indices.

Singapore’s strong 2006 GDP growth rate, at 7.9%, pushed up demand for Singapore property. The Urban Redevelopment Authority (URA) private residential property price index rose by 10% (9.5% in real terms) in 2006.

South Korea also saw a strong rebound in property prices, despite continued efforts by the government to depress the market. The Kookmin Bank’s house price index rose 11.6% in Dec. 2006 (9.3% in real terms) from a year earlier.

In the Philippines, strong economic growth and reduced inflation contributed to the continued recovery of the real estate sector. In addition, demand from Overseas Filipino Workers (OFWs) and dual citizens has been strong, pushing prices up. Luxury condominium prices in the Philippines rose 15% (9% in real terms) in 2006, following an 11% nominal price rise in 2005, according to Colliers International.

Japan and Hong Kong are laggards

Japan’s residential property market continued to fall in 2006, despite repeated attempts by the media to portray the market as rallying. Nevertheless, the residential urban land price index registered a smaller fall in 2006 (-2.8%) compared to last year (-4.7%).

Hong Kong’s property market turned negative (-2.13%) in 2006, after impressive gains in 2004 (27%) and 2005 (8%). Higher interest rates in the US, mirrored directly in Hong Kong, were a major cause of the downturn.

Taiwan’s messy political crisis seems to have frozen residential prices, with 0% appreciation during 2006. In real terms, Taiwan experienced a decline in house prices during 2006 (-1.7%). During three years prior to the second quarter of 2006, Taiwan’s Sinyi house price index rose 17%.

In Malaysia, house prices did not to keep pace with inflation. Malaysian house prices today are at the same level as 1995, in real terms.

Thailand saw the end of ending its strong post-Asian crisis property market recovery, as the political crisis impacted the economy. House prices moved up just 1.9% in 2006 (-2.4% in real terms), after 2005’s price increase of 7% (1.5% in real terms), and 2004’s rise of 9% (6% in real terms).

Indonesia managed to reduce 4Q 2006 inflation to 6% from 16% during the first three quarters. With the house price index registering a 6.6% increase in 2006; house prices rose by 0.5% in real terms.

The 2007 elections – risks abound

2007 is an election year in Korea, Taiwan, and the Philippines, and political uncertainty is likely to increase. There will also be elections in Japan and Hong Kong, but they are unlikely to have much impact on the real estate market. In Thailand, uncertainty will increase if elections are not called.

The Philippines. A victory for President Arroyo’s party in the upcoming Congressional elections would be positive for real estate. Election years in the Philippines bring money inflows, but also increased uncertainty. But if Arroyo wins enough seats in Congress she will push constitutional change, removing constitutional limits on foreign ownership of real estate and companies – good for real estate.

South Korea. The economic interventionism of left-of-center President Roh Moo-hyun has been damaging for Korea’s housing market. His support is crumbling, and a less interventionist president may be elected in December. But even if the opposition Grand National Party wins, excessive government intervention in the housing market has a very long history in South Korea.

Taiwan. Parliamentary elections at end-2007 will provide a strong lead on whether the Kuomintang (KMT) can regain control of the presidency in 2008 from the Democratic Progressive Party (DPP). President Chen Shui-bian’s two terms have largely been spent on keeping him from being ousted. Significant banking and tax reforms have been held hostage by politics.

Japan. Half of the seats in the upper house will be contested in July. Seats held by the Liberal Democratic Party (LDP) may be reduced, risking its reform agenda. These seats were won with the help of former prime minister and popular reformist Junichiro Koizumi.

Hong Kong. Donald Tsang is up for re-election as chief executive where elections are still largely ceremonial and Beijing’s anointment is the only significant factor. Pro-democracy campaigners are hoping and pushing for reforms to full democracy and Mr. Tsang’s failure to push for constitutional reforms in 2005 means that this will be his last term.

Thailand. The sooner elections are called, and Thailand is returned to democracy, the better it will be for the property market and the economy as a whole. The fate of Thailand’s property market hinges on the junta. If the junta prolongs military rule, the market will suffer.

The Global Property Guide sees inflation risks to be minimal in Asia in 2006. But other risks threaten the real estate market, particularly the re-emergence of bird flu in several countries, Indonesia in particular.

-----

The Global Property Guide is a research publication and web site (http://www.globalpropertyguide.com) for the high net worth investor in residential property.

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Cell: (+63) 917 735 2228

Fax: (+632) 325 0642

Email: prince@globalpropertyguide.com

Publisher and Editor:

Matthew Montagu-Pollock,

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Fax: (+632) 325 0642

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release A Mixed Year for Asian Residential Property in 2006, According to Global Property Guide here

News-ID: 15822 • Views: …

More Releases from Global Property Guide

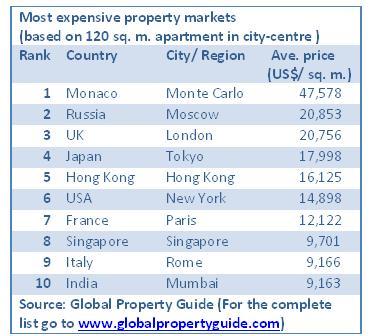

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Philippines

Philippines Contact Cement Market

Market Overview

Contact cement is a flexible acrylic adhesive that may be used on rubber, wood, bond tile, leather, metal, Formica, and most plastics. It stays flexible after curing and makes an excellent shoe glue. Contact cement may be applied to almost anything, although it works best on nonporous materials that conventional adhesives cannot adhere together.

Plastics, veneers, rubber, glass, metal, and leather all react well to contact cement. It is…

Philippines Quick Service Restaurants Market Size Is Likely To Reach Around $7.9 …

The Philippines quick service restaurants market has been continuously improvising in terms of product offerings, number of outlets, hospitality and other perks regarding prices that attracts a higher number of customers. Over the years, the Filipinos, specifically the millennials, have been open to different types of innovative food products due to increase in influence of westernization among the target customers. Considering this customer perception, some of the key players in…

Major Players in Philippines Auto Finance Market | Auto Loan Market Philippines …

Rising Innovation: Innovative digital startups such as iChoose.ph are reshaping the challenging car shopping and financing process into a quick and easy experience for customers in Philippines. It is expected that these will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process. Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing…

Philippines E-Commerce Logistics Market | Competitors in E-Commerce Logistics Ph …

Key Findings

Singapore-headquartered e-commerce player Shopee launched an in-app, live-streaming platform in the Philippines through which sellers can build a following to promote their products and offer discounts to viewers. This platform proved to be a success during the pandemic as it recorded 30m live stream views in April 2020.

E-commerce players can look forward to collaborate with brick-and-mortar retailers to provide consumers low-cost delivery options, as has been done in other…

Philippines Used Car Market

Philippines Used Car Market is expected to Gain Momentum from the Emergence of more Organized Players in the future along with Covid incited Surge in Demand: Ken Research

The used car market structure in Philippines is expected to be consolidated in the future as the market share of players selling vehicles via organized channel is expected to surge. This will be mainly on account of transparent and fair used car dealings/trading…

Philippines Quick Service Restaurants Market Booming Segments; Investors Seeking …

Philippines Quick Service Restaurants Market by Food Type, and Nature: Philippines Opportunity Analysis and Industry Forecast, 2019–2026,” The Philippines quick service restaurants market size was valued at $4.6 billion in 2018, and is expected to reach $7.9 billion by 2026, registering a CAGR of 6.9% from 2019 to 2026.The burger/sandwich segment was the highest contributor to the market, with $1.7billion in 2018, and is estimated grow at a CAGR of…