Press release

Private customers are the main drivers of European Big 7 sales momentum H1 2018

In a turbulent environment with trade wars arising and import duties sky-rocketing, what are the European car buyers in the main EU-7 markets doing? Are they still opting for new cars? Yes, they are. For PC and LCV registrations the EU-7 Total Market increased by 2.3% in June while the cumulated increase for the first half of the year was 1.7%. Italy (- 1.3%) and UK (- 5.7%) were below 2017’s YTD (year-to-date) June registrations, but this was compensated by gains in France (+ 4.7%), Germany (+ 3.0%), the Netherlands (+ 11.2%), Belgium (+ 2.4%) and specifically Spain (+ 9.9%).Customer type

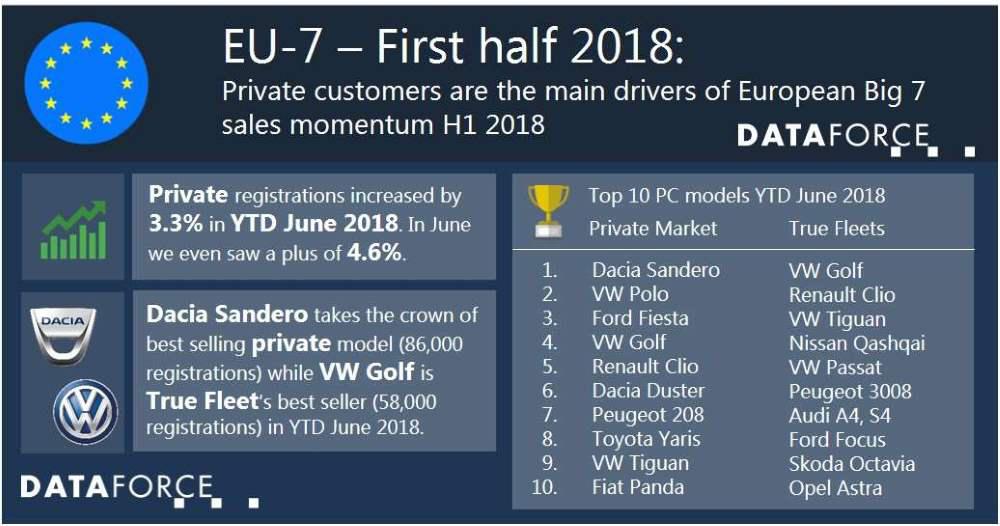

It appears to be mainly private customers having driven the growth with them registering 3.3% more cars in the first half of the year and with June 2018 even posting a plus of 4.6%. True Fleets were almost stable over June (+ 0.6%) and rose by 1.8% over the first half of the year. Lots of people will also take a rental car this holiday, as the month June saw an increase of 9.0% in short-term rental car registrations.

Brands - private buyers

Regarding the Private Market, the brand that has been doing particularly well in the first half year was VW, with a plus of 21.2% driven mainly by the Golf and the recently launched T-Roc. Dacia has also been doing very well with a + 14.2% thanks to the new generation of the Duster. Other noteworthy winners are Hyundai (+ 13.5%), SEAT (+ 25.6%) and Skoda (+ 21.6%) with all of them benefitting from new entries into the crossover segment. And what was the best-selling private car over the first six months of 2018? It was the Dacia Sandero with 86,000 private registrations and if Dacia keeps its momentum over the second half of the year, they will probably reach number 5 brand position for the private channel, which would be their best result ever!

Brands - True Fleet buyers

Peugeot’s crossovers 3008 and 5008 are winning over the hearts of the fleet owners as they propelled the French brand to a 10.3% increase in True Fleets over YTD June. Regarding fleet’s top 20 marques, the gain was even bigger at SEAT increasing by 28.0% propelled by the new Arona and the Leon, despite being in its sixth year of sales already. The third brand standing out notably was Kia that had some successful months as well growing by 13.5% and thus achieving a new record fleet market share of 1.5% in YTD June 2018

Fuel types

Diesel was continuously losing share in favour of petrol and electrified engines across all countries with an overall drop of - 13.3% in registrations in the first half of 2018. However, regarding True Fleets, we see that business customers have kept their main appetite for the diesel engines with registrations falling only slightly in France and the Netherlands while they even posted a small surplus in Italy and Spain.

In contrast to diesel, full electric vehicles were on the rise over the first six month of the year, and specifically in the True Fleet Market (+ 57.5%), with the Renault Zoe being ranked 1st for both the Private and True Fleet model ranking ladder.

(535 words, 3,025 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Julian de Groot

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930 329

Mobile: +49 173 438 1586

Email: julian.degroot@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private customers are the main drivers of European Big 7 sales momentum H1 2018 here

News-ID: 1147222 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for June

2nd June 2025

Revolutionizes Canine Mobility with Innovative Custom Dog Braces

TailwindPets, a leader in canine orthotic solutions, is transforming how dog owners address mobility issues. With their veterinarian-recommended, high-quality Custom Dog Knee Braces and leg support products, Tailwind Pets helps dogs recover from injuries, manage chronic conditions, and improve quality of life-without the need for invasive surgery.

TailwindPets, a growing name in canine health and wellness, is redefining how pet owners support their dogs'…

International LabAutomation Day is June 21

Celebrating Lab Automation

Laboratory automation refers to the use of technology, equipment, and software to streamline and optimize laboratory processes and operations. It involves automating repetitive tasks, data collection and analysis, sample handling, and other activities in a laboratory setting. By leveraging various automated systems, laboratories can enhance efficiency, accuracy, reproducibility, and throughput while reducing human error and the time required to perform experiments.

Why designate an International LabAutomation Day?

An international day…

Atrad.io Announces June results at 8.19%

"From Scam to Miracle," JP Morgan Chase assumes his Bitcoin turn. The largest U.S. bank by assets and Bitcoin’s ‘Biggest Enemy’ has reportedly started providing banking services to bitcoin businesses, with the first two clients being Coinbase and Gemini exchanges. JPMorgan also recently recommended having cryptocurrency in investment portfolios as its CEO, Jamie Dimon, changed his mind about bitcoin.

This is a strong signal that crypto-currencies have become an integral part…

American Megatrends at COMPUTEX TAIPEI 2012, June 5 – June 9, 2012

NORCROSS, GEORGIA, USA / TAIPEI, TAIWAN - American Megatrends Incorporated (AMI), a leader in BIOS, server management and network storage innovations, is pleased to announce its participation at COMPUTEX TAIPEI 2012 in Taipei, Taiwan, from June 5 through June 9, 2012. AMI will be located in booth number J0428 of the Nangang Exhibition Hall of the Taipei World Trade Center for the duration of this year’s COMPUTEX TAIPEI event.

COMPUTEX…

Analytiqa: Logistics Bulletin: Friday 22nd June

This week\'s Logistics Bulletin reports on European contract wins, with household names such as Danone, Electrolux, Samsung and Birds Eye all outsourcing logistics requirements. M&A developments see Russian Railways and Deutsche Bahn sign an agreement to set up and manage a shipping and logistics company whilst in Asia, Agility has signed an agreement to acquire two logistics companies in Singapore, building its presence in the energy and break bulk sectors.…

Firsthips Newsletter - June 2007

On the 22nd May 2007 the government announced that they will be implementing changes to the regulations of Energy Performance Certificates (EPCs) and Home Information Packs (HIPs). The main points of the changes are as follows:

HIPs and EPCs to start on 1st August 2007.

HIPs will be mandatory for the sale of four bedroom properties and larger.

HIPs for three bedroom properties will be phased in once 2000 energy…