Press release

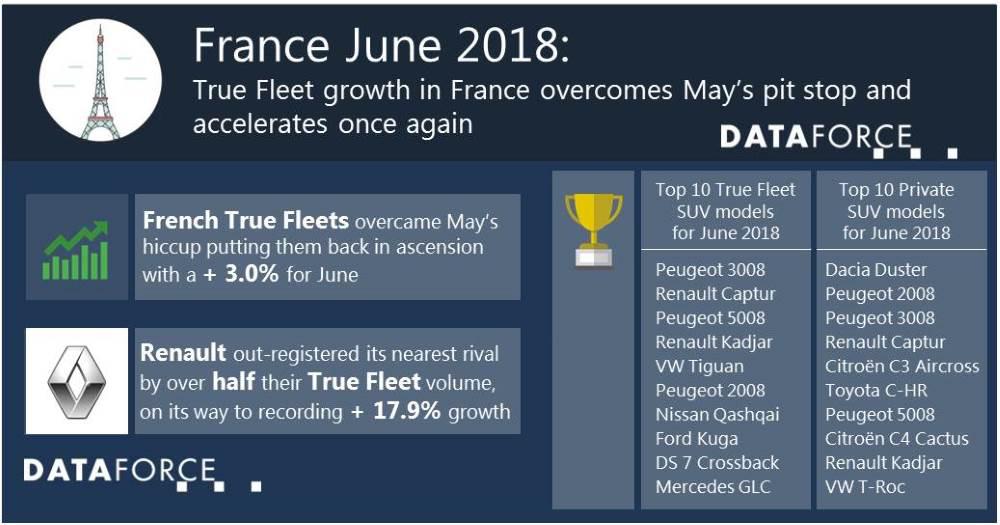

True Fleet growth in France overcomes May’s pit stop and accelerates once again

True Fleet in France is once again in the black in terms of growth as it puts last month’s loss into the rear view mirror. June saw a + 3.0% for the fleet market, putting it back on track with the YTD (year-to-date) sitting at a healthy + 6.0%. Private and Special Channels also saw themselves on the positive side of the fence with a + 5.7% for the former and + 19.9% for the latter. This all equated to the Total Market finishing just above 252,000 registrations or + 9.2% in terms of growth leaving the French market looking buoyant and positive moving into the second half of 2018.Brand performance

For June the expansion or contractions in terms of growth from the OEMs were evenly split. Unfortunately, in all but one case, the contractions were of the double-digit variety and for three of these OEMs this has combined to leave them YTD also in the red (more on this a little later). The first four ranks did not change for June, Renault (+ 17.9%) was once again 1st and separated from Peugeot in 2nd by a significant margin, actually of over half the latter’s volume. Which models produced the largest registration uptick? It was of course the stalwart Clio, up by 24.3%, and the Captur, doubling last June’s registrations (+105.6%). Both Citroën (3rd) and VW (4th) had very similar months in terms of growth, with the former achieving + 4.7% and the latter + 4.6%. Citroën’s success came from the C3s (C3 and C3 Aircross) while it was two SUVs for VW (Tiguan and T-Roc). It is at this point we start to see the double-digit drops; BMW, Ford, Audi and Mercedes all suffered in June with the OEM from Stuttgart taking the hardest hit in terms of negative growth (- 31.8%). This leaves the last two places in the top 10 and, fortunately, both had good months. Toyota in 9th produced a + 19.7% which came thanks to the Yaris and C-HR while for Fiat (+ 22.1%) the 500 and 500X were the Turin manufacturer’s stars for June.

Are we starting to see the effects of WLTP?

As mentioned earlier in June’s press release the three premium brands of Mercedes, BMW and Audi have all contracted by double digits in June and a further look into the data reveals that YTD they all currently reside in the red. The same cannot be said of their closest rivals in Volvo (+ 13.8%) or Land Rover (+ 16.9%) whose growths are firmly in the black; though it must be pointed out that the volume of these two OEMs in comparison is significantly less but the gap is obviously closing somewhat. Now while Audi and BMW had both dropped some registrations in 2017 over 2016, Mercedes was in ascension, and this trend has also appeared in some of the other EU-7 markets. All three brands had new models entering the marketplace over this time period and some good to great success for BMW and Mercedes from their PHEV models. This had lead us to believe that there is some upcoming pressure from the NEDC to WLTP change and the resulting increase to announced CO2 values. Add this to the somewhat bespoke nature of the models (option configurations) available for these particular premium brands and this may be what is currently suppressing their growth potentials.

(564 words; 3,142 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Gabriel Juhas

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-250

Fax: +49 69 95930-333

Email: gabriel.juhas@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release True Fleet growth in France overcomes May’s pit stop and accelerates once again here

News-ID: 1139657 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for June

2nd June 2025

Revolutionizes Canine Mobility with Innovative Custom Dog Braces

TailwindPets, a leader in canine orthotic solutions, is transforming how dog owners address mobility issues. With their veterinarian-recommended, high-quality Custom Dog Knee Braces and leg support products, Tailwind Pets helps dogs recover from injuries, manage chronic conditions, and improve quality of life-without the need for invasive surgery.

TailwindPets, a growing name in canine health and wellness, is redefining how pet owners support their dogs'…

International LabAutomation Day is June 21

Celebrating Lab Automation

Laboratory automation refers to the use of technology, equipment, and software to streamline and optimize laboratory processes and operations. It involves automating repetitive tasks, data collection and analysis, sample handling, and other activities in a laboratory setting. By leveraging various automated systems, laboratories can enhance efficiency, accuracy, reproducibility, and throughput while reducing human error and the time required to perform experiments.

Why designate an International LabAutomation Day?

An international day…

Atrad.io Announces June results at 8.19%

"From Scam to Miracle," JP Morgan Chase assumes his Bitcoin turn. The largest U.S. bank by assets and Bitcoin’s ‘Biggest Enemy’ has reportedly started providing banking services to bitcoin businesses, with the first two clients being Coinbase and Gemini exchanges. JPMorgan also recently recommended having cryptocurrency in investment portfolios as its CEO, Jamie Dimon, changed his mind about bitcoin.

This is a strong signal that crypto-currencies have become an integral part…

American Megatrends at COMPUTEX TAIPEI 2012, June 5 – June 9, 2012

NORCROSS, GEORGIA, USA / TAIPEI, TAIWAN - American Megatrends Incorporated (AMI), a leader in BIOS, server management and network storage innovations, is pleased to announce its participation at COMPUTEX TAIPEI 2012 in Taipei, Taiwan, from June 5 through June 9, 2012. AMI will be located in booth number J0428 of the Nangang Exhibition Hall of the Taipei World Trade Center for the duration of this year’s COMPUTEX TAIPEI event.

COMPUTEX…

Analytiqa: Logistics Bulletin: Friday 22nd June

This week\'s Logistics Bulletin reports on European contract wins, with household names such as Danone, Electrolux, Samsung and Birds Eye all outsourcing logistics requirements. M&A developments see Russian Railways and Deutsche Bahn sign an agreement to set up and manage a shipping and logistics company whilst in Asia, Agility has signed an agreement to acquire two logistics companies in Singapore, building its presence in the energy and break bulk sectors.…

Firsthips Newsletter - June 2007

On the 22nd May 2007 the government announced that they will be implementing changes to the regulations of Energy Performance Certificates (EPCs) and Home Information Packs (HIPs). The main points of the changes are as follows:

HIPs and EPCs to start on 1st August 2007.

HIPs will be mandatory for the sale of four bedroom properties and larger.

HIPs for three bedroom properties will be phased in once 2000 energy…