Press release

French True Fleet secures its 2nd consecutive month of positive growth

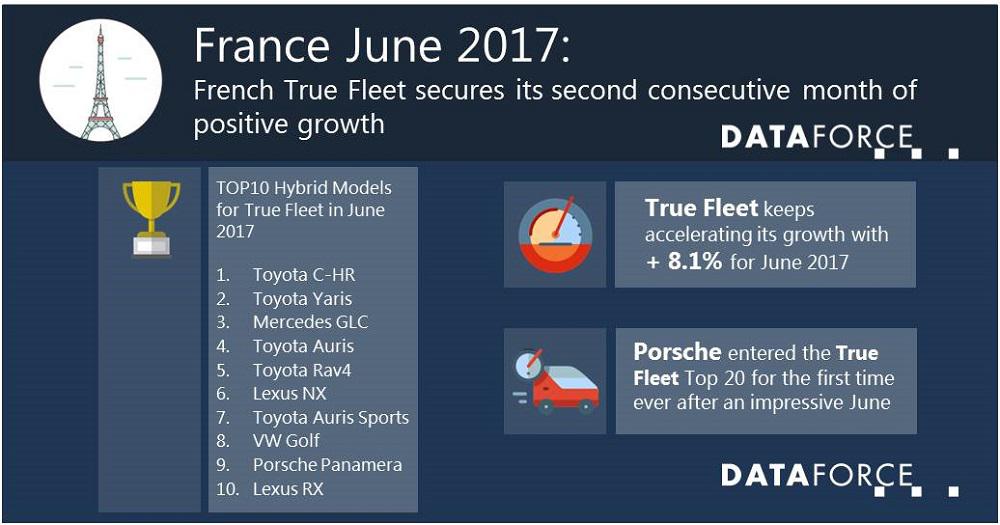

True Fleet in France scores another month of growth helping to push the year-to-date volume towards +3.0% for 2017. The Total Market finished just a little under 231,000 registrations with a month-on-month growth of +1.6%. True Fleet took the highest monthly growth for the channels with a +8.1%, the Private channel also remained in the black with a solid +2.6%, Special Channels though slipped a little with a -4.3% its second negative month of the year.There were no changes to the first four places of the True Fleet manufacturers’ Top 10, with Renault retaining its crown at the top of the leader board. Peugeot followed in 2nd also achieving the Top 10’s 2nd highest growth with +35.9%, Citroën and Volkswagen were 3rd and 4th respectively. The Mercedes brand was the growth winner for the month climbing three places into 5th on the back of a +40.1%, though was closely followed by its German compatriots of BMW in 6th and Audi in 7th. Ford took the 8th spot with a single place ascension while Nissan 9th and Toyota 10th completed the ranking chart. It would be remiss of us not to mention a first-time entry to the True Fleet Top 20, Porsche raced into 20th position accelerating its registrations by +48.3% thanks in no small part to the Macan. The compact SUV was the brands highest seller hitting triple digit fleet registrations for the 3rd time since its launch.

After the recent announcement from the French government about the banning of petrol and diesel vehicles by 2040 and the continuing Crit-Air environmental zone expansions we decided to look into the fuel segmentation. Diesel is firmly in the spotlight and while currently accounting for 77.0% of all True Fleet registrations year-to-date it is down by 3.5 percentage points when compared to the same time period from last year. For June it achieved a +1.0% but the beleaguered fuel type is still in for a tough future. The other fuel types went on to deliver a +38.8% growth for petrol and +48.0% for hybrid/electric and while these have a long road ahead to catch up with diesel they are both scheduled to receive either further or continued support from the government. Petrol in the form of VAT recovery which started at 10% in January (scheduled to be 80% by 2021) and clean vehicle bonuses at first registration for electric/plug-in hybrid vehicles (though these were reduced in January).

Our final look into the fuel segmentation for True Fleet was focussed regionally on Paris, the first municipality to introduce a restricted traffic zone (ZCR) as part of the Crit-Air legislation. Year-to-date figures show diesel has fallen by 5.4% while petrol increased by 6.8% but it is the electric and hybrid channels that are reaping the twin benefits of the bonus system and ZCR with increases of 80.8% and 38.9% respectively.

(487 words, 2329 characters)

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Gabriel Juhas

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-250

Fax: +49 69 95930-333

Email: gabriel.juhas@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release French True Fleet secures its 2nd consecutive month of positive growth here

News-ID: 631171 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…