Press release

Surgical Gloves Manufacturing Plant DPR - 2026: Investment Cost, Market Growth and Machinery

The global healthcare and medical devices sector is experiencing transformative growth driven by increasing awareness of health and hygiene, growing demand for infection prevention in medical settings, and the rising prevalence of chronic diseases requiring surgical interventions. At the forefront of this critical healthcare protection revolution stands surgical gloves-an indispensable medical product valued for its essential role in protecting both healthcare professionals and patients from cross-contamination, bloodborne pathogens, and hospital-acquired infections across surgical procedures, medical examinations, pharmaceutical research, and industrial safety applications. As global regulatory pressures for sterile medical procedures intensify and the number of surgical procedures rises with chronic disease prevalence, establishing a surgical gloves manufacturing plant presents a strategically compelling business opportunity for medical device manufacturers, healthcare product suppliers, and personal protective equipment investors seeking to capitalize on the expanding market for high-quality, sterile protective gloves with rigorous quality certifications, reliable tactile sensitivity, and consistent performance across healthcare, pharmaceutical, food processing, and industrial safety segments worldwide.IMARC Group's report, "Surgical Gloves Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a manufacturing plant. The surgical gloves manufacturing plant report offers insights into the manufacturing process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/surgical-gloves-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global surgical gloves market demonstrates robust growth trajectory, valued at USD 5.10 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 7.54 Billion by 2034, exhibiting a solid CAGR of 4.4% from 2026-2034. This sustained expansion is fueled by increasing awareness of health and hygiene, growing demand for infection prevention in medical settings, rising prevalence of chronic diseases requiring surgical interventions, and the lasting impact of the COVID-19 pandemic that accelerated demand for PPE items across global healthcare settings.

Surgical gloves are designed to protect both the wearer and the patient from infection during surgical procedures. They are made from natural latex, synthetic latex (nitrile), or vinyl, offering different levels of protection, tactile sensitivity, and durability. Surgical gloves are rigorously tested for quality and sterility to ensure that they meet stringent medical standards. They are typically worn by surgeons, nurses, and other healthcare professionals during surgical procedures, examinations, and patient care to prevent cross-contamination and protect against bloodborne pathogens. Surgical gloves are available in various sizes and are tested for puncture resistance, ensuring that they offer maximum protection during surgeries.

The surgical gloves market is driven by increasing demand for infection control in medical and healthcare settings, the growing emphasis on patient safety, and the rise in chronic diseases requiring surgical procedures. Approximately 1 in 10 patients experiences healthcare-associated infections (HAIs). According to research, there are an estimated 136 million cases of antibiotic-resistant infections in healthcare settings globally each year. This alarming statistic is driving the demand for infection control measures, such as surgical gloves, to minimize the risk of transmission, thereby propelling the market for protective PPE and sterile equipment in healthcare facilities. Regulatory pressures for sterile medical procedures, rising awareness of health hygiene, and the growing adoption of non-latex gloves due to allergy concerns further propel market growth. Technological advancements, such as improved manufacturing processes and new material innovations like nitrile and synthetic latex, have also increased glove availability and quality.

Plant Capacity and Production Scale

The proposed surgical gloves manufacturing facility is designed with an annual production capacity of 300 million pairs per year, enabling economies of scale while maintaining operational flexibility. This capacity allows manufacturers to serve diverse market segments-from healthcare applications in hospitals, clinics, and surgical centers to pharmaceuticals, research and laboratories, food processing, and industrial safety-ensuring steady demand and consistent revenue streams across multiple distribution channels serving the expanding global healthcare and safety products market.

Financial Viability and Profitability Analysis

The surgical gloves manufacturing business demonstrates strong profitability potential under normal operating conditions. The financial projections reveal healthy margins supported by stable demand and value-added applications:

• Gross Profit Margins: 25-40%

• Net Profit Margins: 12-20%

These margins position surgical gloves manufacturing among the higher-profitability ventures in the medical device manufacturing sector, supported by growing global focus on infection control driving indispensable product demand, strict regulatory compliance requirements creating consistent institutional purchasing, increasing surgical procedures fueling sustained healthcare demand, technological advancements in nitrile and synthetic latex materials, and essential PPE status ensuring resilient market performance regardless of economic cycles.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a surgical gloves manufacturing plant reflects balanced resource allocation:

• Raw Materials: 50-60% of total OpEx

• Utilities: 20-25% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, quality control, depreciation, and taxes

Natural rubber latex or nitrile latex constitutes the primary raw material cost driver at 50-60% of operating expenses. Additional key inputs include chemicals such as vulcanizing agents essential for the curing process. The relatively high utility cost of 20-25% of OpEx reflects the energy-intensive nature of the dipping, curing, and sterilization processes. The balanced cost structure combined with premium pricing for medically certified sterile gloves creates favorable profit margins, positioning surgical gloves manufacturing as an attractive venture with significant value captured through rigorous quality standards, medical certifications, and growing demand across healthcare, pharmaceutical, food safety, and industrial applications.

Buy Now: https://www.imarcgroup.com/checkout?id=13237&method=2175

Capital Investment and Project Economics

Establishing a surgical gloves manufacturing plant requires comprehensive capital investment covering land acquisition, site preparation, civil works, machinery procurement, and working capital. Machinery costs account for the largest portion of total capital expenditure, with essential equipment including dipping machines, mold and curing systems, sterilization chambers, automated inspection systems, and packaging systems. Operating costs in the first year cover raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to factors such as inflation, market fluctuations, potential rises in the cost of key materials, supply chain disruptions, rising consumer demand, and shifts in the global economy.

The capital investment depends on plant capacity, technology selection, and location. This investment covers land acquisition, site preparation, and necessary infrastructure. Equipment costs represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery. Raw material expenses, including natural rubber latex or nitrile latex and chemicals such as vulcanizing agents, are a major part of operating costs. Long-term contracts with reliable suppliers help mitigate price volatility and ensure consistent material supply. Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan. Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for.

Major Applications and End-Use Industries

Surgical gloves serve multiple critical applications across diverse sectors:

• Healthcare: Surgical gloves are primarily used in medical environments including hospitals and clinics, where sterile conditions are essential. They are required in surgical operations, sterile procedures, and patient examinations to protect both medical professionals and patients from infection and cross-contamination

• Pharmaceuticals: Surgical gloves are used in pharmaceutical manufacturing and research facilities to protect workers from exposure to hazardous substances, chemicals, and biological materials during laboratory tests and drug production processes

• Food Industry: Latex-free gloves are increasingly used in food processing to ensure sanitation and hygiene during food handling, especially in high-risk environments such as slaughterhouses, meatpacking, and restaurants

• Industrial Safety: Nitrile surgical gloves are used in industrial settings to protect workers in environments involving exposure to chemicals, oil-based substances, and sharp objects

Why Invest in Surgical Gloves Manufacturing?

Several compelling factors make surgical gloves manufacturing an attractive investment opportunity:

• Infection Control Needs: The growing global focus on infection control and the prevention of hospital-acquired infections (HAIs) is driving the demand for surgical gloves. Their role in reducing the transmission of infections has made them an indispensable part of the healthcare sector

• Regulatory Compliance: Healthcare facilities and medical professionals are required to comply with strict regulatory standards, such as those outlined by the FDA, ISO, and CDC, which mandate the use of sterile surgical gloves during invasive medical procedures to minimize contamination risks

• Increased Surgical Procedures: The rising prevalence of chronic diseases and surgical procedures, such as heart surgeries, cancer treatments, and orthopedic surgeries, continues to fuel demand for surgical gloves across hospitals and surgical centers

Manufacturing Process Overview

The surgical gloves manufacturing process involves several critical stages ensuring product sterility and protective performance. The process begins with latex or nitrile preparation where raw materials are compounded with vulcanizing agents and additives to achieve desired properties. Molding involves dipping ceramic hand-shaped formers into the latex compound to build up the glove layers. Curing under controlled heat conditions vulcanizes the latex to achieve the required strength, elasticity, and durability. Sterilization using gamma radiation or ethylene oxide ensures complete sterility for medical-grade products. Automated inspection systems perform visual and mechanical testing to detect defects and ensure puncture resistance. Finally, packaging operations seal the sterile gloves in appropriate medical-grade packaging for distribution, with comprehensive quality control throughout ensuring consistent protective performance, sterility, and regulatory compliance across all surgical and healthcare applications.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=13237&flag=C

Industry Leadership and Key Players

The global surgical gloves industry features several established multinational companies with extensive production capacities and diverse application portfolios. Leading manufacturers include Top Glove Corporation, Hartalega Holdings, Sempermed, Globus Group, Kanam Latex Industries Pvt. Ltd., Narang Medical Limited, MRK Healthcare Pvt. Ltd., Cardinal Health Inc., and Ansell Ltd., all serving end-use sectors across healthcare, pharmaceuticals, research and laboratories, food processing, and industrial safety. These industry leaders demonstrate the viability and scalability of surgical gloves manufacturing operations serving global markets with consistent quality, rigorous sterility standards, and regulatory compliance.

Recent Developments and Market Dynamics

Recent industry developments highlight growing market momentum. In September 2025, ZAS Corporation officially launched its DECA series of sterile surgical gloves, marking a major advancement in surgical safety, comfort, and skin protection. The DECA Surgical Glove Series are designed to address the diverse demands of modern surgeries. In May 2025, Wadi Surgicals launched accelerator-free nitrile gloves under its leading brand Enliva. These gloves eliminate the use of common chemical accelerators like thiurams, carbamates, and MBT compounds, which are known to cause allergic contact dermatitis (Type IV hypersensitivity) in frequent glove users. Manufactured using non-sensitizing crosslinking agents, these gloves have undergone extensive testing to ensure dermatological safety, mechanical strength, and chemical resistance.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surgical Gloves Manufacturing Plant DPR - 2026: Investment Cost, Market Growth and Machinery here

News-ID: 4393982 • Views: …

More Releases from IMARC Group

Cannabis Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, & …

The global cannabis industry is undergoing rapid transformation, driven by progressive legalization of medical and adult-use cannabis across North America, Europe, and emerging markets, growing clinical recognition of cannabis-based therapies, and expanding consumer demand for wellness and plant-based alternatives. As pharmaceutical supply chains adopt GMP-certified cannabis manufacturing standards and product diversification accelerates across oils, extracts, edibles, and pre-rolls, establishing a cannabis processing plant offers one of the highest-margin manufacturing investment…

Generic Drug Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/ …

The global generic drug manufacturing industry is witnessing robust growth driven by the growing demand for affordable medicines, increasing prevalence of chronic diseases, and rising penetration of healthcare services across emerging economies. At the heart of this expansion lies a critical pharmaceutical segment-generic drugs. As healthcare systems worldwide focus on cost containment, broader coverage, and ensuring equitable access to essential medicines, establishing a generic drug manufacturing plant presents a strategically…

Precision Medicine Market Size to Surpass USD 179.4 Billion by 2034 | At CAGR 8. …

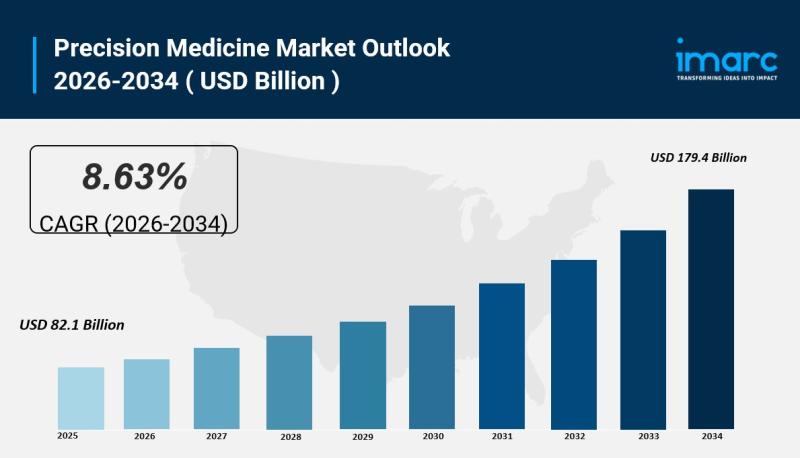

IMARC Group has recently released a new research study titled "Precision Medicine Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The global precision medicine market size reached USD 82.1 Billion in 2025 and is expected to grow to USD 179.4…

Edible Oil Manufacturing Plant DPR 2026: Cost Structure, Production Process & RO …

The global food and beverage industry is experiencing transformative growth driven by rising health-conscious consumer preferences, the expanding food processing industry, and increasing demand in emerging economies. At the forefront of this essential food ingredients revolution stands edible oil-a versatile fat derivative valued for its critical role in cooking, frying, food preparation, and as an ingredient in packaged foods across food and beverage, restaurant and catering, health and wellness, and…

More Releases for Surgical

Surgical Robotics Market to Witness Huge Growth by 2031 -Auris Surgical Robotics …

Surgical Robotics Industry Analysis, according DataM Intelligence. Although data provides an overview, the research explores the hidden aspects of the sector, breaking down its intricate dynamics, charting regional dominance, spotting demand patterns, and spotting prospective breakthroughs that could influence how businesses operate in the future.

Will the Surgical Robotics market emerge as the sector's next great thing? To discover the answer, look at the Surgical Robotics market analysis and projections. In-depth…

Surgical Laser Market - Shaping Surgical Precision: Surgical Laser, Guiding the …

Newark, New Castle, USA - The latest report from Growth Plus Reports analyzes the production, potential applications, demand, major manufacturers, and SWOT analysis of the global Surgical Laser Market.

Surgical Laser Market: https://www.growthplusreports.com/report/surgical-laser-market/9172

The Surgical Laser Market Report assists in determining the optimum distribution methods for certain products as well as possible markets for future product launches. The report also analyses the purchase and supply trends that influence the market's production strategy.…

Surgical Retractor Market - Enabling Surgical Mastery: Retractors for Uncompromi …

Newark, New Castle, USA: The "Surgical Retractor Market" provides a value chain analysis of revenue for the anticipated period from 2023 to 2031. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors

Surgical Retractor Market: https://www.growthplusreports.com/report/surgical-retractor-market/7658

This latest report researches the industry structure, sales,…

Surgical Robots Market Hits USD 17,647.82 million by 2028 Lead By THINK Surgical …

There is a rise in the number of surgeries performed across the world. In the last 25 years, the incidence of cardiovascular diseases has increased globally. The rise in diabetic cases and lifestyle changes are leading to an increase in the number of cardiovascular surgeries and general surgeries. For instance, colorectal cancer is one of the most commonly found and lethal cancers developed in individuals due to the combined influence…

Surgical Robots Market Analysis 2020 - How COVID19 Impacting Surgical Robots Ind …

Report Analyzes Surgical Robots Market Size, Share and Industry Analysis By Type (Implantable Cardioverter Surgical Robots (ICD), Transvenous ICD, External Surgical Robots) By End User (Hospitals & Clinics, Ambulatory, Schools and other Public Places) and Regional Forecast, 2019 - 2026.

Get Sample Report To Know The Impact of Covid19 on this Industry at: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/surgical-robots-market-100948

Key Players: Intuitive Surgical, Medtronic, Stryker, Smith & Nephew, Zimmer Biomet, TransEnterix Surgical, Inc Verb Surgical, THINK Surgical.

An…

Surgical Microscope Market Size, Surgical Microscope Market Share, Surgical Micr …

The global surgical microscope market was valued at USD 610.3 million in 2017 and is estimated to grow at a CAGR of 12.5% during the forecast period 2017-2026.

Request for Sample of This Research Report @ https://bit.ly/2xjcXML

Top Key Players:-

Carl Zeiss AG,

Leica Microsystems,

Takagi Corporation,

Seiler Precision Microscopes,

Topcon Corporation,

Alltion (Wuzhou) Co. Ltd.,

Alcon Laboratories, Inc.,

Haag-Streit Surgical,

Olympus Corporation,

Accu-scope, Inc.,

Novartis AG,

Danaher Corporation,

Labomed Microscopes,

Prescott’s Inc.,…