Press release

Cannabis Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, & ROI

The global cannabis industry is undergoing rapid transformation, driven by progressive legalization of medical and adult-use cannabis across North America, Europe, and emerging markets, growing clinical recognition of cannabis-based therapies, and expanding consumer demand for wellness and plant-based alternatives. As pharmaceutical supply chains adopt GMP-certified cannabis manufacturing standards and product diversification accelerates across oils, extracts, edibles, and pre-rolls, establishing a cannabis processing plant offers one of the highest-margin manufacturing investment opportunities available in the regulated consumer health and wellness sector today.IMARC Group's report, titled "Cannabis Processing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a cannabis processing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

Request for Sample Report: https://www.imarcgroup.com/cannabis-processing-plant-project-report/requestsample

Market Overview and Growth Potential

The global cannabis market demonstrates exceptional growth trajectory, valued at USD 36.87 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 119.90 Billion by 2034, exhibiting a strong CAGR of 14.0% from 2026-2034. This sustained expansion is driven by expanding medical use, gradual adult-use legalization, growth in GMP-certified pharmaceutical cannabis supply chains, increasing product diversification across oils, extracts, and edibles, and continued investment in regulated cultivation and processing capacity across global markets.

Cannabis refers to plant material and derived products obtained primarily from Cannabis sativa L. containing cannabiss such as (tetrahydrocannabinol) and (cannabidiol), along with terpenes and other phytochemicals. In regulated markets, cannabis may be manufactured as dried flower, extracts such as oils, or dose-controlled finished forms for medical or adult-use channels, with specifications set for potency, microbiological safety, residual solvents for extracts, heavy metals, mycotoxins, and pesticides. Manufacturing quality is defined by traceability, contamination control, standardized cannabis profiles, stability, and compliance with frameworks such as EU-GMP for medical-grade products.

Reinforcing the market's momentum, NIH data revealed that anxiety and depression are common among cancer patients, impacting almost half and one-fifth of patients respectively. Research further indicated that a third of cancer patients among the over 2 million cancer patients in the U.S. in 2025 have used cannabis, contributing to rising demand for cannabis-based therapies. The growing wellness and plant-based alternatives movement has also driven demand for oil, edibles, and topical products.

Plant Capacity and Production Scale

The proposed cannabis processing facility is designed with an annual production capacity of 1,000-5,000 Kg dried flower, enabling economies of scale while maintaining operational flexibility. This range serves diverse end-use segments-including pharmaceuticals and medical cannabis providers, adult-use retail, wellness and hemp-derived cannabis products, and licensed research and clinical development-delivering medical cannabis therapies, adult-use products (flower, pre-rolls, extracts, and edibles/beverages), and research-grade material for clinical studies and product development.

Financial Viability and Profitability Analysis

The cannabis processing business demonstrates outstanding profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 60-75%

• Net Profit Margins: 30-50%

These industry-leading margins are supported by strong pricing power in pharmaceutical and adult-use segments, value addition from processing and finished-product manufacturing enabling standardized dosing and broader SKU portfolios, GMP-grade medical supply chain access to pharmacy channels, long-term distribution agreements with institutional buyers, and product differentiation through consistent cannabis profiles and compliant packaging. With gross margins of 60-75% and net margins of 30-50%, cannabis processing delivers among the highest return profiles of any manufacturing plant investment category.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is essential for effective financial planning. The cost structure for a cannabis processing plant is primarily driven by:

• Raw Materials - Cannabis Biomass: 50-60% of total OpEx

• Utilities: 15-20% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Cannabis biomass constitutes the dominant raw material cost, alongside solvents required for extraction and carrier oils for finished product formulation. Establishing reliable biomass supply agreements with licensed cultivators helps stabilize input costs and ensures consistent cannabis profiles critical for pharmaceutical-grade and adult-use product consistency. Utilities represent a significant cost component given the controlled environment requirements for drying, curing, and extraction processes.

Capital Investment Requirements

Setting up a cannabis processing plant requires strategic capital investment across several critical categories:

Land and Site Development: Selection of a location with easy access to key raw materials including cannabis biomass, solvents for extraction, carrier oils, and packaging. Proximity to medical dispensaries, adult-use retail networks, and research institutions minimizes distribution costs. The site must have robust infrastructure including reliable utilities, waste management systems, and security installations. Full compliance with local zoning laws, cannabis licensing regulations, and environmental standards is mandatory.

Machinery and Equipment: The largest component of capital expenditure (CapEx) covers specialized cannabis processing equipment:

• Harvesting machines for efficient biomass collection and handling

• Drying equipment for post-harvest moisture reduction to target specifications

• Trimming and grading equipment for product quality classification and consistency

• Extraction and purification systems for producing oils, concentrates, and standardized extracts

• Packaging equipment for compliant labeling, dosing, and tamper-evident sealing

• Quality testing instruments for cannabis potency, microbiological safety, and contaminant analysis

Civil Works: GMP-compliant facility construction with controlled environment zones, cleanroom areas for pharmaceutical-grade processing, secure storage for cannabis biomass and finished products, and plant layout optimization across cultivation, drying and curing, milling and extraction, purification, and quality testing and packaging operations.

Other Capital Costs: Licensing and regulatory compliance costs, track-and-trace system implementation, pre-operative expenses, quality management system (QMS) setup, initial working capital, and contingency provisions for regulatory approval timelines.

Buy Now: https://www.imarcgroup.com/checkout?id=7626&method=2175

Major Applications and Market Segments

Cannabis processing serves four high-value, regulated application segments:

Pharmaceuticals/Medical Cannabis: Manufactured into standardized dried flower, oils, and dose-controlled formats under GMP-style systems, emphasizing reproducible cannabis content, stability, and contamination limits for pharmacy channel distribution.

Adult-Use Retail (Regulated Markets): Produced as branded flower and pre-rolls and manufactured products such as vapes and edibles where permitted, focusing on consistency, sensory profile, compliant labeling, and shelf-life performance.

Wellness/Hemp-Derived Cannabiss: Used in dose-defined consumer products including beverages and edibles in jurisdictions allowing hemp-derived products, with manufacturing emphasizing food-grade controls, cannabis QA, and labeling compliance.

Research and Clinical Development: Supplied as characterized plant material or extracts with documentation suitable for trials and controlled studies, requiring strong chain-of-custody and analytical reproducibility.

Why Invest in Cannabis Processing?

Exceptional Market Growth Rate: With a projected CAGR of 14.0% and market expanding from USD 36.87 Billion to USD 119.90 Billion by 2034, cannabis processing offers one of the strongest growth outlooks across all manufacturing plant investment categories.

Regulated Patient and Consumer Safety Requirements: Licensed cannabis manufacturing builds consistency into cannabis profiles, microbial safety, and contaminant control, reducing batch variability and supporting safer products through validated processes and documented release testing-creating strong compliance moats.

Value Addition Beyond Cultivation: Processing and finished-product manufacturing-including oils and formulated products-increases realization per kilogram compared to unprocessed flower by enabling standardized dosing, broader SKU portfolios, and differentiated product positioning.

GMP-Grade Medical Supply Chain Opportunity: In medical markets, EU-GMP and GMP-aligned capabilities support access to pharmacy channels and cross-border supply where permitted, especially as jurisdictions tighten quality requirements for pharmaceutical cannabis.

Traceability and Compliance as a Competitive Moat: Track-and-trace systems, compliant packaging and labeling, and auditable QA systems create barriers to entry and help established processors gain institutional buyers and long-term distribution agreements.

Strong Medical Demand from Cancer and Anxiety Patients: With over 2 million cancer patients in the U.S. in 2025, a third using cannabis, and anxiety and depression affecting nearly half of cancer patients respectively, demand for medically validated cannabis therapies is substantial and growing.

Manufacturing Process Excellence

The cannabis processing operation involves five precision-controlled stages:

• Cultivation: Controlled environment growing of Cannabis sativa L. with strict genetics, nutrient, and environmental management for consistent cannabis profiles

• Drying and Curing: Post-harvest moisture reduction and curing to target specifications for potency, aroma, and microbiological safety

• Milling and Extraction: Size reduction of dried biomass followed by solvent or solventless extraction to produce oils and concentrates

• Purification: Removal of residual solvents, waxes, and contaminants to achieve pharmaceutical or consumer-grade cannabis purity

• Quality Testing and Packaging: Comprehensive analytical testing for potency, safety, and compliance followed by compliant, tamper-evident packaging and labelling

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=7626&flag=C

Industry Leadership

The global cannabis processing industry is led by established licensed producers with extensive production capabilities. Key industry players include:

• Aurora Cannabis Inc.

• Tilray, Inc.

• Canopy Growth Corporation

• CannTrust Holdings Inc.

• VIVO Cannabis Inc.

• Cronos Group Inc.

These companies serve diverse end-use sectors including pharmaceuticals and medical cannabis providers, adult-use retail, wellness and hemp-derived cannabis products, and licensed research and clinical development, establishing the competitive standard for new market entrants.

Recent Industry Developments

December 2025: Canopy Growth Corporation announced an agreement to acquire MTL Cannabis, aiming to strengthen its presence in the Canadian cannabis market. The acquisition is aimed at enhancing Canopy's production capacity and expanding its product offerings by leveraging MTL Cannabis's cultivation, processing, and retail assets.

April 2025: Gelato Canna Co. entered the Arizona adult-use marijuana market, expanding the brand's footprint beyond medical cannabis into recreational retail. The company planned to operate multiple dispensaries and offer its portfolio of premium cannabis products to adult consumers aged 21 and over, in line with Arizona's regulated adult-use framework.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cannabis Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, & ROI here

News-ID: 4393974 • Views: …

More Releases from IMARC Group

Generic Drug Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/ …

The global generic drug manufacturing industry is witnessing robust growth driven by the growing demand for affordable medicines, increasing prevalence of chronic diseases, and rising penetration of healthcare services across emerging economies. At the heart of this expansion lies a critical pharmaceutical segment-generic drugs. As healthcare systems worldwide focus on cost containment, broader coverage, and ensuring equitable access to essential medicines, establishing a generic drug manufacturing plant presents a strategically…

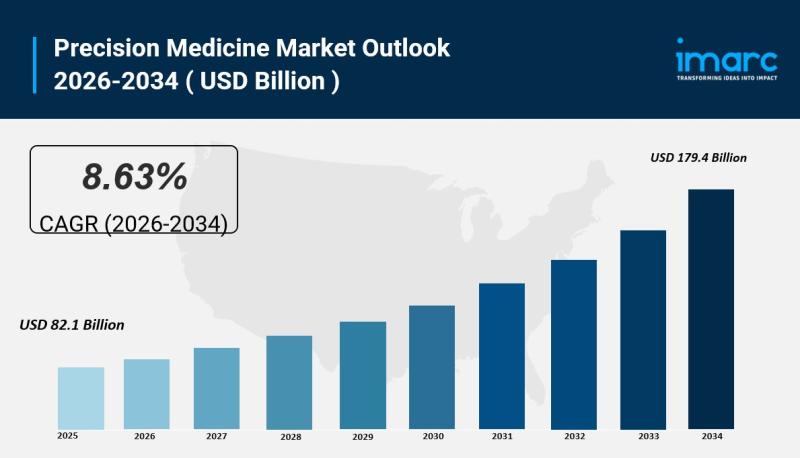

Precision Medicine Market Size to Surpass USD 179.4 Billion by 2034 | At CAGR 8. …

IMARC Group has recently released a new research study titled "Precision Medicine Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The global precision medicine market size reached USD 82.1 Billion in 2025 and is expected to grow to USD 179.4…

Edible Oil Manufacturing Plant DPR 2026: Cost Structure, Production Process & RO …

The global food and beverage industry is experiencing transformative growth driven by rising health-conscious consumer preferences, the expanding food processing industry, and increasing demand in emerging economies. At the forefront of this essential food ingredients revolution stands edible oil-a versatile fat derivative valued for its critical role in cooking, frying, food preparation, and as an ingredient in packaged foods across food and beverage, restaurant and catering, health and wellness, and…

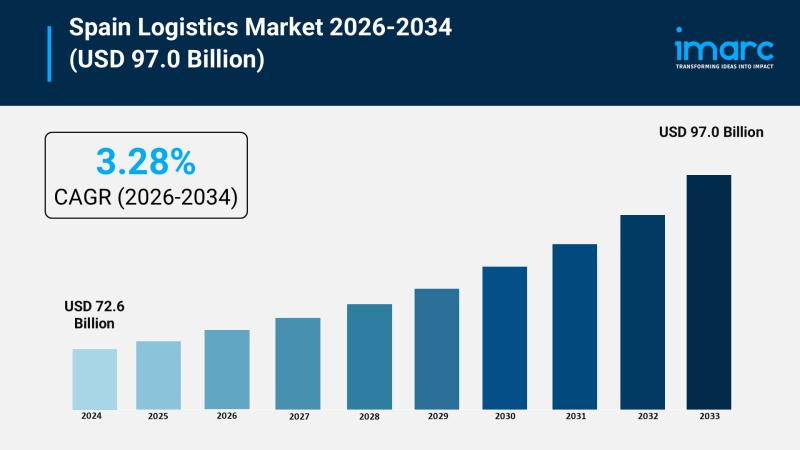

Spain Logistics Market Growth Forecast USD 72.6 Billion in 2025 to USD 97 Billio …

Market Overview

The Spain logistics market size reached USD 72.6 Billion in 2025 and is forecasted to grow to USD 97.0 Billion by 2034. The market is expected to expand at a CAGR of 3.28% during the forecast period 2026-2034. Driving factors include increasing e-commerce users, growing demand for warehousing, urban logistics, ongoing technological advancements, and rising focus on sustainability initiatives.

Study Assumption Years

• Base Year: 2025

• Historical Year/Period: 2020-2025

• Forecast Year/Period: 2026-2034

Spain Logistics Market…

More Releases for Canna

Canna*bidiol Market Growth And Industry Outlook 2024-2033

The Business Research Company recently released a comprehensive report on the Global Canna*bidiol Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Canna*bis Extract Market Report 2024: Strategies And Recent Developments | Canop …

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2168

The Business Research Company offers in-depth market insights through Canna*bis Extract Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The canna*bis extract market size has grown exponentially in recent years. It…

Plant Growing Media Market | Berger, CANNA, FLORAGARD Vertribs, FoxFarm

The global plant growing media market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the plant growing media market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

New Redeemable Cryptocurrency Cana Token Launches, Backed by Canna Seeds

New Redeemable Cryptocurrency Cana Token Launches, Backed by Cannabis SeedsInteractive Cannabis Token Website Encourages Public to Voice Opinions with Rewards

LIVERPOOL, UK — November 5, 2020 — Today, Cana Token announced the launch of a new way of doing business with a cryptocurrency token linked to cannabis seeds. The token, named “Cana,” is exchanged online as an interactive, redeemable crypto-backed product linked to users’ public perception of popular and valuable cannabis…

Monarch Technologies, Inc. Announces New Partnership with Canna Group Consulting …

Monarch Technologies, Inc. (Fintech), a fully licensed Money Transmittal Service Provider, announced today that it has partnered with an industry leader and pioneer Sami Spiezio, Founder/President of Canna Group Consulting LLC Merchant Group, a consulting group that represents independently owned acquisitions and payments offices across the country.

Cannabis Banking Solutions

Currently, Monarch Technologies is a Fintech Banking Platform, serving businesses as well as City and Governmental Agencies/Regulatory compliance entities. Monarch was built…

Localised Canna Cabanna Stores Bring Cannabis Closer to Canada's Communities

Toronto, ON - February 29, 2020

Customers seeking high-quality cannabis and smoking products will be delighted to learn of the latest opening of a Canna Cabana store.

Located at 435B Yonge St, Toronto, Ontario, the newest store is very much part of the Canna Cabana success story.

The store is the third to be opened in Ontario and will join the 23 branches that are available in Alberta State, and one in Swift…