Press release

Insulin Pens Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials

The global insulin pens manufacturing industry is witnessing robust growth driven by the rapidly expanding diabetes care sector and increasing demand for convenient self-administration devices. At the heart of this expansion lies a critical medical device: insulin pens. As healthcare systems transition toward patient-centric treatment delivery and improved diabetes management solutions, establishing an insulin pens manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and medical device investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global insulin pens market demonstrates strong growth trajectory, valued at USD 8.40 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 17.07 Billion by 2034, exhibiting a robust CAGR of 8.2% from 2026-2034. This sustained expansion is driven by rapidly expanding diabetic population, increasing demand for user-friendly insulin delivery systems, rising adoption of self-administration devices, and expanding healthcare access across developing economies.

Insulin pens are advanced medical devices designed for subcutaneous insulin injection, offering a convenient and accurate alternative to traditional vial-and-syringe methods. They consist of an insulin cartridge, a dose selector mechanism, and a disposable needle. Insulin pens are available in two primary types: reusable pens with replaceable cartridges and prefilled disposable pens. These devices provide precise dosing, portability, ease of use, and improved patient compliance. Due to their user-friendly design and discreet administration capabilities, insulin pens have become the preferred insulin delivery method for millions of diabetes patients worldwide, particularly those requiring multiple daily injections.

The insulin pens market is witnessing robust demand due to the rising prevalence of diabetes globally and the growing need for convenient self-administration devices that support better glycemic control. Healthcare systems increasingly transitioning toward patient-centered care-particularly in ambulatory settings, home healthcare, and chronic disease management-are driving large-scale adoption. According to the International Diabetes Federation, over 537 million adults were living with diabetes in 2021, with projections reaching 643 million by 2030 and 783 million by 2045. Government-led diabetes awareness programs, healthcare insurance coverage expansion, and initiatives promoting self-care management further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/insulin-pens-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed insulin pens manufacturing facility is designed with an annual production capacity ranging between 10-50 million units, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from Type 1 and Type 2 diabetes patients to pediatric and geriatric populations-ensuring steady demand and consistent revenue streams across multiple healthcare verticals.

Financial Viability and Profitability Analysis

The insulin pens manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 35-45%

Net Profit Margins: 10-20%

These margins are supported by stable demand across healthcare and pharmaceutical sectors, value-added medical device positioning, and the critical nature of insulin pens in diabetes management applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established medical device manufacturers looking to diversify their product portfolio in the diabetes care sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an insulin pens manufacturing plant is primarily driven by:

Raw Materials: 40-50% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute a significant portion of operating costs, with precision-engineered plastic components, insulin cartridges, needle assemblies, and electronic components being the primary input materials. Establishing long-term contracts with reliable component suppliers and insulin manufacturers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that component quality and regulatory compliance represent the most significant factors in insulin pen manufacturing.

Capital Investment Requirements

Setting up an insulin pens manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to pharmaceutical manufacturers and insulin suppliers. Proximity to target healthcare markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and cleanroom facilities. Compliance with local zoning laws, GMP standards, and medical device regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Injection molding machines for precision plastic component manufacturing

• Automated assembly lines for pen device assembly and cartridge integration

• Dose mechanism calibration and testing equipment for accuracy verification

• Clean room facilities with HVAC systems for contamination-free production

• Automated inspection systems for quality control and defect detection

• Sterile packaging lines for blister packing and final product sealing

• Quality control laboratory equipment for mechanical testing and dose accuracy validation

• Serialization and track-and-trace systems for regulatory compliance and anti-counterfeiting

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, injection molding zone, assembly area, quality control laboratory, sterile packaging unit, finished goods warehouse, utility block, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications (FDA, CE Mark, ISO 13485), initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Insulin pens products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Type 1 Diabetes Management: Primary use for patients requiring intensive insulin therapy with multiple daily injections, where precision dosing and ease of administration are essential for effective glycemic control.

Type 2 Diabetes Treatment: Growing applications in Type 2 diabetes patients transitioning to insulin therapy, where user-friendly devices improve treatment adherence and patient outcomes.

Pediatric Diabetes Care: Specialized applications in children and adolescents with diabetes, where simplified administration and reduced injection anxiety support better disease management.

Geriatric Patient Populations: Critical applications for elderly patients with dexterity limitations, visual impairments, or cognitive challenges, where ergonomic design and ease of use are paramount.

Hospital and Clinical Settings: Institutional applications in hospitals, clinics, and diabetes care centers for patient training, acute care situations, and supervised insulin administration.

End-use segments include Type 1 diabetes patients, Type 2 diabetes patients, pediatric populations, geriatric patients, and institutional healthcare facilities, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=9600&method=2175

Why Invest in Insulin Pens Manufacturing?

Several compelling factors make insulin pens manufacturing an attractive investment opportunity:

Essential Medical Device Segment: Insulin pens serve as critical medical devices supporting diabetes management and patient self-care, making them indispensable for modern healthcare systems focused on chronic disease management and patient empowerment.

Rising Diabetes Prevalence: The global diabetic population is increasing at an alarming rate-particularly in developing regions experiencing lifestyle changes, urbanization, and aging demographics-driving large-scale adoption of insulin delivery devices.

Superior Patient Compliance: The devices' ability to provide accurate dosing, portability, and discreet administration in a single convenient format, combined with reduced injection pain, offers significant advantages over traditional vial-and-syringe methods and positions them favorably in the market.

Healthcare Access Expansion: The growing accessibility of diabetes care in emerging markets and increasing health insurance coverage for diabetes management devices positions insulin pens as preferred delivery systems in regions with expanding healthcare infrastructure.

Government Support: Government-led diabetes prevention programs, healthcare reimbursement policies for insulin delivery devices, and initiatives promoting self-care management further strengthen market prospects and support industry growth.

Import Substitution Opportunities: Emerging economies such as India, China, Brazil, and Southeast Asian nations are expanding local medical device manufacturing as part of their strategy to reduce dependence on imported diabetes care products, creating opportunities for domestic producers.

Technological Innovation: Advances in smart insulin pens with digital connectivity, dose memory, and mobile app integration are creating premium product segments and enhancing long-term growth opportunities for innovative manufacturers.

Manufacturing Process Excellence

The insulin pens manufacturing process involves several precision-controlled stages:

• Component Manufacturing: Precision plastic parts are produced through injection molding with tight dimensional tolerances

• Insulin Cartridge Preparation: Insulin cartridges are filled, sealed, and sterilized by pharmaceutical partners or in-house facilities

• Dose Mechanism Assembly: Mechanical components including dose selector, plunger, and spring mechanisms are assembled with precision

• Pen Body Assembly: Plastic housing components, cartridge holders, and internal mechanisms are integrated into complete pen devices

• Calibration and Testing: Each unit undergoes dose accuracy verification, mechanical function testing, and quality inspection

• Needle Integration: Disposable needle assemblies are packaged separately or integrated for prefilled pens

• Sterile Packaging: Final products are sealed in tamper-evident, sterile packaging under cleanroom conditions

• Serialization: Products receive unique identification codes for track-and-trace compliance and anti-counterfeiting protection

Industry Leadership

The global insulin pens industry is led by established pharmaceutical and medical device manufacturers with extensive production capabilities and diverse product portfolios. Key industry players include:

• Novo Nordisk

• Sanofi

• Eli Lilly and Company

• Biocon

• Ypsomed

These companies serve diverse patient populations including Type 1 diabetes, Type 2 diabetes, pediatric, and geriatric segments, demonstrating the broad market applicability of insulin pen products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9600&flag=C

Recent Industry Developments

October 2024: Novo Nordisk announced the expansion of its insulin pen manufacturing facility in Kalundborg, Denmark, with a USD 1.1 billion investment. This expansion is designed to increase production capacity for next-generation smart insulin pens with integrated digital health features, including dose tracking and mobile connectivity, supporting the company's commitment to advancing diabetes care technology and meeting growing global demand.

Conclusion

The insulin pens manufacturing sector presents a strategically positioned investment opportunity at the intersection of diabetes care, medical device innovation, and patient-centric healthcare delivery. With favorable profit margins ranging from 35-45% gross profit and 10-20% net profit, strong market drivers including rising global diabetes prevalence, growing adoption of self-administration devices, expanding healthcare access and insurance coverage, and supportive government policies promoting chronic disease management, establishing an insulin pens manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of superior patient compliance advantages, critical role in improving treatment outcomes, expanding diabetes care infrastructure in emerging markets, and technological innovation opportunities in smart connected devices creates an attractive value proposition for serious medical device investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insulin Pens Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials here

News-ID: 4377367 • Views: …

More Releases from IMARC Group

Catheter Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Projec …

The global catheter manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for minimally invasive medical procedures. At the heart of this expansion lies a critical medical device: the catheter. As healthcare systems transition toward advanced patient care technologies and minimally invasive treatment methods, establishing a catheter manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and medical device investors seeking to…

Paint Manufacturing Plant Setup 2026, Investment Breakdown, CapEx/OpEx and Busin …

The global construction and manufacturing sectors continue to experience robust growth, driving unprecedented demand for protective and decorative coatings across residential, commercial, and industrial applications. Paint, as a colored substance applied to surfaces for protection, decoration, and texture enhancement, has evolved from basic formulations to sophisticated eco-friendly and specialized products serving diverse industries. As urbanization expands, construction and infrastructure development accelerates, and consumer awareness regarding environmentally friendly low-VOC paints increases,…

India Coconut Oil Market Set for Robust Growth, Market to Hit USD 408.0 Million …

India Coconut Oil Market Market : Report Introduction

According to IMARC Group's report titled "India Coconut Oil Market Size, Share, Trends and Forecast by Source, Type, Application, Distribution Channel, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights,…

Indian Fish Market Report 2026: Industry Trends, Share, Scope, and Growth Outloo …

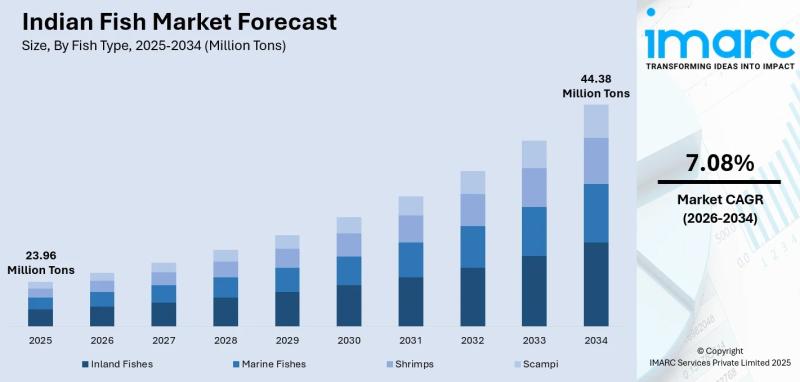

According to IMARC Group's report titled "Indian Fish Market Size, Share, Trends and Forecast by Fish Type, Product Type, Distribution Channel, Sector, and State, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Indian Fish Market Overview

The Indian fish market reached a size of 23.96 Million Tons in 2025 and is projected to grow to 44.38 Million Tons by 2034, expanding at…

More Releases for Insulin

Insulin Delivery System Advancement Drives the Global Insulin Path Pumps Market

Inkwood Research expects the Global Insulin Patch Pumps Market to surge with a 10.63% CAGR by 2032, and is set to generate $2760.98 million during the forecast period 2023-2032.

Browse 50 market data Tables and 47 Figures spread over 173 Pages, along with an in-depth analysis of the Global Insulin Patch Pumps Market by Type, Delivery Mode, Disease Indication, Distribution Channel, & by Geography.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/insulin-patch-pumps-market/#report-summary?utm_source=PaidPRNew&utm_medium=OpenPR&utm_campaign=InkwoodPR

This…

Advancing Insulin Delivery Systems boost the Global Insulin Path Pumps Market

Inkwood Research expects the Global Insulin Patch Pumps Market to surge with a 10.63% CAGR by 2032, and is set to generate $2760.98 million during the forecast period 2023-2032.

Browse 50 market data Tables and 47 Figures spread over 173 Pages, along with an in-depth analysis of the Global Insulin Patch Pumps Market by Type, Delivery Mode, Disease Indication, Distribution Channel, & by Geography.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/insulin-patch-pumps-market/#report-summary

This insightful…

Advancing Insulin Delivery Systems boost the Global Insulin Path Pumps Market

Inkwood Research expects the Global Insulin Patch Pumps Market to surge with a 10.63% CAGR by 2032, and is set to generate $2760.98 million during the forecast period 2023-2032.

Browse 50 market data Tables and 47 Figures spread over 173 Pages, along with an in-depth analysis of the Global Insulin Patch Pumps Market by Type, Delivery Mode, Disease Indication, Distribution Channel, & by Geography.

Refer to the Report Summary Here: https://inkwoodresearch.com/reports/insulin-patch-pumps-market/#report-summary

This insightful…

Insulin Pumps Market Share, Trends and Growth Analysis By Type (Traditional Insu …

Insulin Pumps Market is expected to register a CAGR of 15.5% and acquire the market value of USD 11.5 Billion by 2028 during forecast period 2023-2032. Insulin pumps are discreet, electronic medical devices that can be tucked beneath clothing or fastened to a belt. In order to regulate the rise in blood glucose levels, the pump is used to deliver controlled quantities of insulin within the body at regular intervals…

Insulin Patch Pumps Market Report 2018: Segmentation by Insulin Type (Bolus Insu …

Global Insulin Patch Pumps market research report provides company profile for Roche Holding AG, Cellnovo Group SA, Spring Health Solution Ltd., Debiotech, CeQur SA, Valeritas, Becton Dickenson & Company, Insulet Corporation, Johnson & Johnson, Medtrum Technologies Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue,…

Insulin pump Market Explore Future Growth 2018-2026 by Global Type-Traditional i …

Insulin pump is a portable device attached to the body that continuously delivers preset amounts of short or rapid acting insulin in the body to control diabetes. Insulin therapy is required in type 1 diabetes and sometime in type 2 diabetes. It serves as an effective alternative to insulin injections. Furthermore, insulin pump delivers the insulin according to the need of body as basal rate, where small amount of insulin…