Press release

Catheter Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

The global catheter manufacturing industry is witnessing robust growth driven by the rapidly expanding healthcare sector and increasing demand for minimally invasive medical procedures. At the heart of this expansion lies a critical medical device: the catheter. As healthcare systems transition toward advanced patient care technologies and minimally invasive treatment methods, establishing a catheter manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and medical device investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global catheter market demonstrates strong growth trajectory, valued at USD 25.44 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 46.30 Billion by 2034, exhibiting a robust CAGR of 6.9% from 2026-2034. This sustained expansion is driven by rapidly expanding healthcare sector, increasing demand for minimally invasive procedures, rising prevalence of chronic diseases, and expanding healthcare infrastructure across developing economies.

A catheter is a flexible, thin tube made from medical-grade materials such as silicone, latex, or polyurethane that is inserted into the body to treat diseases or perform surgical procedures. Catheters appear as sterile medical devices with high precision and biocompatibility properties. Catheters serve multiple medical purposes including draining fluids, administering medications, performing diagnostic procedures, and facilitating surgical interventions. Due to their versatile applications, they help improve patient outcomes and enable minimally invasive treatments. Their high safety standards, sterility requirements, and compatibility with various medical procedures make them a preferred option in modern healthcare delivery and hospital operations.

The catheter market is witnessing robust demand due to the rising need for advanced medical devices that support minimally invasive procedures. Healthcare facilities increasingly transitioning toward patient-centered care-particularly in cardiology, urology, neurology, and vascular interventions are driving large-scale adoption. According to healthcare industry reports, the medical device sector contributes significantly to global healthcare GDP and supports millions of healthcare workers worldwide. Government-led healthcare modernization programs, subsidies for medical infrastructure development, and patient safety enhancement initiatives further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/catheter-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed catheter manufacturing facility is designed with an annual production capacity ranging between 50 Million-100 Million units per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from hospitals and clinics to home healthcare, diagnostic centers, and specialty medical facilities-ensuring steady demand and consistent revenue streams across multiple healthcare verticals.

Financial Viability and Profitability Analysis

The catheter manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 55-65%

Net Profit Margins: 25-30%

These margins are supported by stable demand across healthcare and medical sectors, value-added specialty medical device positioning, and the critical nature of catheters in life-saving and quality-of-life applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established medical device manufacturers looking to diversify their product portfolio in the medical devices sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a catheter manufacturing plant is primarily driven by:

Raw Materials: 40-50% of total OpEx

Utilities: 15-20% of OpEx

Other Expenses: Including labor, packaging, sterilization, quality control, transportation, maintenance, depreciation, and regulatory compliance costs

Raw materials constitute a significant portion of operating costs, with medical-grade polymers, silicone, latex, and specialized coatings being the primary input materials. Establishing long-term contracts with reliable medical-grade material suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that high-quality polymer price fluctuations represent a significant cost factor in catheter manufacturing.

Capital Investment Requirements

Setting up a catheter manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to medical-grade material suppliers. Proximity to target healthcare markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and cleanroom facilities. Compliance with local zoning laws, medical device regulations, and environmental standards must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Extrusion machines for catheter tube production with precise dimensional control

• Injection molding systems for catheter components and connectors

• Tip forming equipment for specialized catheter tip configurations

• Coating application systems for hydrophilic and antimicrobial coatings

• Laser cutting and hole-making machinery for drainage catheters

• Bonding and assembly equipment for multi-lumen catheters

• Cleanroom facilities with controlled environment systems (Class 10,000 or better)

• Sterilization equipment (ETO, gamma radiation, or steam sterilization)

• Quality control and testing equipment for biocompatibility and performance testing

• Packaging lines for sterile medical device packaging

Civil Works: Building construction, cleanroom facility development, and infrastructure designed to meet stringent medical device manufacturing standards including ISO 13485 certification requirements, FDA compliance, and Good Manufacturing Practices (GMP). The layout should be optimized with separate controlled areas for raw material storage, extrusion zone, molding unit, coating section, assembly area, sterilization unit, quality control laboratory, finished goods warehouse with climate control, utility block, waste management area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications including FDA 510(k) or CE marking, ISO 13485 certification, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Catheter products find extensive applications across diverse medical segments, demonstrating their versatility and critical importance:

Cardiovascular Applications: Primary use in cardiac catheterization, angioplasty, stent placement, and electrophysiology procedures where precision navigation through blood vessels is essential for diagnosis and treatment of heart conditions.

Urology: Specialized applications in urinary catheterization, bladder drainage, intermittent catheterization, and urological procedures where patient comfort and infection prevention are critical priorities.

Neurology: Utilized for neurological interventions, intracranial pressure monitoring, and neurovascular procedures requiring ultra-fine precision and biocompatible materials.

Specialty Procedures: Applications in intravenous therapy, dialysis access, wound drainage, peritoneal dialysis, and various surgical procedures where temporary or permanent fluid management is required.

Home Healthcare: Growing segment for long-term catheterization needs, intermittent self-catheterization, and chronic disease management in home settings.

End-use facilities include hospitals, specialty clinics, ambulatory surgical centers, diagnostic laboratories, home healthcare services, and long-term care facilities, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=16234&method=2175

Why Invest in Catheter Manufacturing?

Several compelling factors make catheter manufacturing an attractive investment opportunity:

Essential Medical Device Segment: Catheters serve as critical medical devices supporting minimally invasive procedures, diagnostic interventions, and life-sustaining treatments, making them indispensable for modern healthcare operations focused on patient safety and clinical outcomes.

Rising Minimally Invasive Procedure Adoption: Healthcare facilities increasingly transitioning toward minimally invasive treatments-particularly in cardiology, interventional radiology, and endovascular surgery-are driving large-scale adoption of specialty catheters.

Multi-Application Versatility: The product's ability to serve diverse medical specialties including cardiology, urology, neurology, and critical care, combined with its life-saving properties, offers significant clinical advantages and positions it favorably against alternative treatment methods.

Aging Population Demographics: The growing elderly population worldwide with increased prevalence of chronic conditions such as cardiovascular disease, urological disorders, and diabetes positions catheters as preferred medical devices in geriatric care and chronic disease management.

Government Healthcare Support: Government-led healthcare infrastructure development programs, medical device manufacturing incentives, and universal healthcare coverage initiatives further strengthen market prospects and support industry growth.

Import Substitution Opportunities: Emerging economies such as India, China, Brazil, and Southeast Asian nations are expanding local medical device manufacturing as part of their strategy to reduce dependence on imported medical devices, creating opportunities for domestic producers.

Healthcare Access Expansion: The global healthcare access agenda and increasing investments in hospital infrastructure, particularly in developing regions, are expected to enhance long-term growth opportunities for essential medical devices.

Manufacturing Process Excellence

The catheter manufacturing process involves several precision-controlled stages:

• Raw Material Preparation: Medical-grade polymers are prepared and quality-tested for biocompatibility and specifications

• Extrusion: Polymer materials are extruded into catheter tubes with precise wall thickness and diameter control

• Tip Forming: Catheter tips are shaped using heat-forming or molding processes for specific medical applications

• Component Manufacturing: Connectors, hubs, and other components are produced through injection molding

• Surface Treatment: Catheters receive specialized coatings (hydrophilic, antimicrobial, or lubricious) as required

• Assembly: Components are assembled with precision bonding and welding techniques

• Inspection: 100% visual inspection and dimensional verification ensure quality standards

• Sterilization: Products undergo validated sterilization processes (ETO, radiation, or steam)

• Packaging: Sterile catheters are packaged in medical-grade barrier packaging for shelf-life protection

Industry Leadership

The global catheter industry is led by established medical device manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Medtronic

• Boston Scientific Corporation

• Becton, Dickinson and Company

• B. Braun Melsungen AG

• Teleflex Incorporated

• Cardinal Health

• ConvaTec Group

• Cook Medical

These companies serve diverse healthcare sectors including hospitals, specialty clinics, home healthcare, and long-term care facilities, demonstrating the broad market applicability of catheter products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=16234&flag=C

Recent Industry Developments

June 2024: A leading medical device manufacturer launched India's first antimicrobial-coated urinary catheter with advanced infection prevention technology. These products are designed to reduce catheter-associated urinary tract infections (CAUTIs) by over 70%, compared to traditional catheters, by using silver-ion coating technology for better antimicrobial protection and controlled bacterial resistance, as well as improving patient safety outcomes.

Conclusion

The catheter manufacturing sector presents a strategically positioned investment opportunity at the intersection of advanced healthcare, medical device innovation, and patient-centered care practices. With favorable profit margins ranging from 55-65% gross profit and 25-30% net profit, strong market drivers including rising adoption of minimally invasive procedures, growing demand for advanced medical devices, expanding healthcare infrastructure, and supportive government policies promoting medical device manufacturing and healthcare access, establishing a catheter manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of multi-specialty applications, critical role in life-saving procedures, expanding aging population demographics, and import substitution opportunities in emerging economies creates an attractive value proposition for serious medical device investors committed to quality manufacturing, regulatory compliance, and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Catheter Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4377363 • Views: …

More Releases from IMARC Group

Paint Manufacturing Plant Setup 2026, Investment Breakdown, CapEx/OpEx and Busin …

The global construction and manufacturing sectors continue to experience robust growth, driving unprecedented demand for protective and decorative coatings across residential, commercial, and industrial applications. Paint, as a colored substance applied to surfaces for protection, decoration, and texture enhancement, has evolved from basic formulations to sophisticated eco-friendly and specialized products serving diverse industries. As urbanization expands, construction and infrastructure development accelerates, and consumer awareness regarding environmentally friendly low-VOC paints increases,…

India Coconut Oil Market Set for Robust Growth, Market to Hit USD 408.0 Million …

India Coconut Oil Market Market : Report Introduction

According to IMARC Group's report titled "India Coconut Oil Market Size, Share, Trends and Forecast by Source, Type, Application, Distribution Channel, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights,…

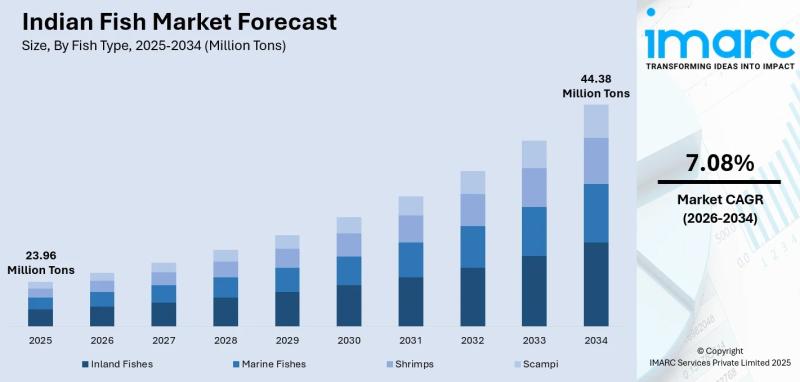

Indian Fish Market Report 2026: Industry Trends, Share, Scope, and Growth Outloo …

According to IMARC Group's report titled "Indian Fish Market Size, Share, Trends and Forecast by Fish Type, Product Type, Distribution Channel, Sector, and State, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Indian Fish Market Overview

The Indian fish market reached a size of 23.96 Million Tons in 2025 and is projected to grow to 44.38 Million Tons by 2034, expanding at…

Latin America Logistics Market Projected to Reach USD 580.1 Billion by 2034: Key …

Market Overview

The Latin America logistics market size was USD 366.1 Billion in 2025 and is expected to reach USD 580.1 Billion by 2034, growing at a CAGR of 5.25% during the forecast period 2026-2034. The market growth is driven by rapid economic expansion, manufacturing sector growth, e-commerce rise, infrastructure development, technology integration, and increasing free trade agreements.

Download a sample copy of the report: https://www.imarcgroup.com/Latin-America-Logistics-Market/requestsample

Study Assumption Years

Base Year: 2025

Historical Years: 2020-2025

Forecast…

More Releases for Catheter

Midline Catheter Market

The midline catheter market plays a crucial role in healthcare, providing a safer and more effective means for intravenous (IV) therapies. Midline catheters are long, thin, flexible tubes that are inserted into a patient's veins, typically for periods ranging from a few days to a few weeks. They offer a minimally invasive alternative for administering medications, fluids, and nutrients directly into the bloodstream without the need for repeated needle sticks.…

Catheter Stabilization Devices Market

The "Catheter Stabilization Devices Market" is expected to reach USD xx.x billion by 2031, indicating a compound annual growth rate (CAGR) of xx.x percent from 2024 to 2031. The market was valued at USD xx.x billion In 2023.

Growing Demand and Growth Potential in the Global Catheter Stabilization Devices Market, 2024-2031

Verified Market Research's most recent report, "Catheter Stabilization Devices Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2030," provides…

Catheter Stabilization Devices Market: Enhancing Patient Safety and Care through …

The Catheter Stabilization Devices Market occupies a pivotal position in the healthcare industry, providing essential solutions for securing catheters and enhancing patient care. As indwelling catheters become integral to various medical procedures and treatment protocols, the need for effective stabilization and securement is paramount. This market addresses this crucial requirement by offering a diverse range of devices designed to prevent catheter-related complications, including dislodgement and infection.

𝗧𝗼 𝗮𝗰𝗰𝗲𝘀𝘀 𝘁𝗵𝗲 𝗳𝘂𝗹𝗹 𝗺𝗮𝗿𝗸𝗲𝘁…

Catheter Introducer Sheaths Market - Safeguarding Vascular Health: Advanced Shea …

Newark, New Castle, USA: The "Catheter Introducer Sheaths Market" provides a value chain analysis of revenue for the anticipated period from 2023 to 2031. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors.

Catheter Introducer Sheaths Market: https://www.growthplusreports.com/report/catheter-introducer-sheaths-market/8787

This latest report researches the industry structure,…

Catheter-related Blood Infections Market - Empowering Catheter Safety: Leading t …

Newark, New Castle, USA: The "Catheter-related Blood Infections Market" provides a value chain analysis of revenue for the anticipated period from 2023 to 2031. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors.

Catheter-related Blood Infections Market: https://www.growthplusreports.com/report/catheterrelated-blood-infections-market/8671

This latest report researches the industry structure,…

Exclusive Report on Catheter Stabilization Devices Catheter Securement Devices M …

According to the study published by Evolve business intelligence, “The global Catheter Stabilization Devices Catheter Securement Devices market size is expected to reach $ Billion by 2028 growing at the CAGR of 15% from 2021 to 2028. The report provides the reader with a deep-dive understanding of business opportunities, competitor analysis, market size and forecast, go-to-market strategy, and market share. After evaluating the next-gen business analytic report, the reader is…