Press release

Paint Manufacturing Plant Setup 2026, Investment Breakdown, CapEx/OpEx and Business Plan

The global construction and manufacturing sectors continue to experience robust growth, driving unprecedented demand for protective and decorative coatings across residential, commercial, and industrial applications. Paint, as a colored substance applied to surfaces for protection, decoration, and texture enhancement, has evolved from basic formulations to sophisticated eco-friendly and specialized products serving diverse industries. As urbanization expands, construction and infrastructure development accelerates, and consumer awareness regarding environmentally friendly low-VOC paints increases, establishing a paint manufacturing plant presents a strategically compelling investment opportunity for entrepreneurs and industrial investors seeking to capitalize on this dynamic market that serves construction, automotive, furniture, marine, and industrial equipment manufacturing sectors with essential coating solutions.Request for a Sample Report: https://www.imarcgroup.com/paint-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The paint market is experiencing substantial growth driven by multiple converging factors. Urbanization continues to expand worldwide, while construction and infrastructure development creates growing demand for paints and coatings offering both aesthetic enhancement and protective characteristics. Paint is a colored substance typically comprising pigments, binders, solvents, and additives. It is applied to various surfaces including walls, metal, wood, and diverse materials to enhance appearance and improve durability. Application methods include brushes, rollers, and spray systems. Over time, paint formulations have evolved significantly to include eco-friendly variants and specialized formulas designed for different purposes, reflecting technological advancement and environmental consciousness in the industry.

Plant Capacity and Production Scale

A paint manufacturing plant is a specialized facility designed to produce various types of paints through a series of controlled chemical and mechanical processes. Key operations include raw material handling, dispersion of pigments, mixing of resins and solvents, milling operations, and packaging. The plant typically houses essential equipment including high-speed mixers, sand mills, storage tanks, and filling machines. Strict environmental controls, comprehensive dust management systems, and robust safety protocols are essential due to the flammable and volatile nature of some ingredients. Paint manufacturing plants serve diverse industries including construction, automotive, marine, furniture, and industrial coatings sectors, demonstrating the versatility and broad market applicability of paint products.

Financial Viability and Profitability Analysis

The financial projections for paint manufacturing facilities have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These comprehensive projections provide a detailed view of project financial viability, return on investment potential, profitability trajectory, and long-term sustainability. The economic analysis encompasses capital costs, techno-economic parameters, income projections, expenditure forecasts, product pricing strategies, taxation implications, and depreciation schedules. In the first year of operations, operating costs are projected to be significant, covering raw materials, utilities, depreciation, taxes, packaging, transportation, and repairs and maintenance. By the fifth year, total operational costs are expected to increase substantially due to factors including inflation, market fluctuations, potential rises in key material costs, supply chain disruptions, rising consumer demand, and shifts in the global economic environment.

• Gross Profit: 35-45%

• Net Profit: 15-20%

Operating Cost Structure

The operating expenditure structure is characterized by:

• Raw Materials: 60-70% of OpEx

• Utilities: 5-10% of OpEx

Understanding the operating expenditure structure is crucial for effective financial planning and cost management in paint manufacturing. Raw materials constitute a major part of operating costs, with primary inputs including pigments providing color, binders such as resins ensuring adhesion and film formation, solvents facilitating application, additives enhancing specific properties, and fillers improving coverage and texture. Long-term contracts with reliable suppliers help mitigate price volatility and ensure consistent material supply, which is critical for maintaining production quality and cost control. Additional recurring expenses include labor costs for skilled personnel, maintenance operations, quality control systems, environmental compliance activities, packaging materials, transportation logistics, and regulatory adherence.

Buy Now: https://www.imarcgroup.com/checkout?id=7566&method=2175

Capital Investment Requirements

Establishing and operating a paint manufacturing plant involves various cost components requiring strategic planning. The total capital investment depends fundamentally on plant capacity, technology selection, and geographical location. This investment covers land acquisition, site preparation, and necessary infrastructure development.

Land and Site Development: The location must offer convenient access to key raw materials including pigments, binders such as resins, solvents, additives, and fillers. Proximity to target markets minimizes distribution costs and enables rapid response to customer requirements. The site must provide robust infrastructure including reliable transportation networks, adequate utilities, and comprehensive waste management systems. Compliance with local zoning laws and stringent environmental regulations must be ensured.

Machinery and Equipment: Machinery costs account for the largest portion of total capital expenditure. High-quality, corrosion-resistant machinery tailored for paint production must be selected. Essential equipment includes:

• High-speed dispersers for pigment dispersion

• Ball mills or sand mills for fine grinding operations

• Mixing tanks for formulation preparation

• Storage vessels for raw materials and finished products

• Filtration units for quality assurance

• Automated filling and packaging machines for efficient finishing

All machinery must comply with rigorous industry standards for safety, efficiency, and reliability. The scale of production and automation level directly determine total machinery costs.

Civil Works: The layout should be optimized to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities. Separate areas must be designated for raw material storage, production operations, quality control laboratories, and finished goods storage. Space for future expansion should be incorporated to accommodate business growth. The cost of land and site development, including charges for land registration and boundary development, forms a substantial part of overall investment, ensuring a solid foundation for safe and efficient plant operations.

Major Applications and Market Segments

Paint products serve extensive applications across diverse end-use industries:

Construction: Used extensively for surface protection, decoration, waterproofing, and aesthetic appeal in residential, commercial, and industrial buildings.

Automotive: Providing protective coatings and aesthetic finishes for vehicle exteriors, interiors, and components.

Furniture: Offering decorative and protective coatings for wooden, metal, and composite furniture products.

Marine: Delivering specialized corrosion-resistant coatings for ships, offshore structures, and maritime equipment.

Industrial Equipment Manufacturing: Providing protective and functional coatings for machinery, equipment, and industrial structures requiring durability and chemical resistance.

Why Invest in Paint Manufacturing?

Increasing Demand from Automotive Industry: The growing automotive market represents a major contributor to global paint market growth. In 2023, total global automobile production reached approximately 94 million units, indicating significant demand for passenger and commercial vehicles. This directly correlates to substantial need for high-performance paints and coatings for vehicle exteriors, interiors, and component protection. The global automotive components market was valued at USD 2 Trillion with exports of nearly USD 700 Billion, indicating a strong and growing supply chain increasingly reliant on performance-based, corrosion-resistant, and aesthetic coatings.

Urbanization and Infrastructure Development: Rapid infrastructure development and urbanization serve as major contributors to the global paint market. Estimates indicate that by 2025, China alone will add the equivalent of 10 New York-sized cities. Industry projections suggest that by 2050, China will add another 255 million urban residents, substantially increasing demand for residential, commercial, and industrial construction and associated paints and coatings. Public-sector initiatives such as New York City's Future Housing Initiative in March 2023, with an initial commitment of USD 15 Million to build 3,000 energy-efficient, all-electric affordable homes, heighten demand for decorative, protective, and environmentally sound paints.

Environmental Awareness and Innovation: Increasing consumer awareness regarding environmentally friendly and low-VOC paints shapes overall demand patterns, particularly in developed regions. Technological advances in paint formulations, including fast-drying and anti-bacterial paints, attract both commercial and residential users. Government initiatives stimulating housing markets and smart city construction continue supporting long-term paint demand. In March 2023, the United States government announced a USD 2 Trillion investment to develop and beautify roads, public facilities, and hospital buildings, further stimulating demand for various coatings across production and consumption segments.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=7566&flag=C

Industry Leadership

Leading manufacturers in the global paint industry include several multinational companies with extensive production capacities. Key players include:

• Jotun

• The Sherwin-Williams Company

• Axalta Coating Systems

• PPG Industries, Inc.

• RPM INTERNATIONAL, INC

• BASF SE

These industry leaders operate large-scale facilities and serve end-use sectors including construction, automotive, furniture, marine, and industrial equipment manufacturing, demonstrating the broad market applicability and strategic importance of paint products.

Recent Industry Developments

April 2025: Jotun entered a strategic partnership with Thoresen Shipping Singapore Pte. Ltd., introducing Hull Skating Solutions technology aboard the bulk carrier Thor Brave, marking a significant step forward in advancing the maritime industry's transition to more sustainable and proactive hull maintenance methods.

January 2025: Axalta Coating Systems joined forces with Dürr Systems AG to advance digital painting technologies in automotive manufacturing. This partnership combines Axalta's NextJet precision paint application system with Dürr's cutting-edge robotics, enabling overspray-free, maskless applications for multi-tone designs and vehicle graphics.

March 2024: Sherwin-Williams introduced Repacor SW-1000, an innovative coating solution tailored for steel infrastructure maintenance, including offshore wind installations and industrial equipment. This 100% solid, VOC-free system replaces traditional multi-coat processes with a single 500-micron application, meeting NORSOK M-501 standards.

February 2023: AkzoNobel Powder Coatings unveiled its latest Interpon Futura Collection, featuring three new color themes. Free from solvents and VOCs, the collection aligns with AkzoNobel's broader sustainability goals and responds to growing demand for environmentally responsible coating solutions.

Conclusion

The paint manufacturing sector presents a strategically positioned investment opportunity supported by robust market fundamentals including global automobile production of 94 million units in 2023, automotive components market valued at USD 2 Trillion, U.S. infrastructure investment of USD 2 Trillion announced in March 2023, and massive urbanization trends with China adding 255 million urban residents by 2050. With applications spanning construction, automotive, furniture, marine, and industrial equipment manufacturing, coupled with increasing consumer awareness regarding environmentally friendly low-VOC formulations, technological advances in fast-drying and anti-bacterial paints, and strong policy support through housing and smart city initiatives, establishing a paint manufacturing plant offers significant potential for long-term business success and sustainable returns supported by industry leaders demonstrating proven operational capabilities and continuous innovation in coating technologies.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Paint Manufacturing Plant Setup 2026, Investment Breakdown, CapEx/OpEx and Business Plan here

News-ID: 4377341 • Views: …

More Releases from IMARC Group

India Coconut Oil Market Set for Robust Growth, Market to Hit USD 408.0 Million …

India Coconut Oil Market Market : Report Introduction

According to IMARC Group's report titled "India Coconut Oil Market Size, Share, Trends and Forecast by Source, Type, Application, Distribution Channel, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights,…

Indian Fish Market Report 2026: Industry Trends, Share, Scope, and Growth Outloo …

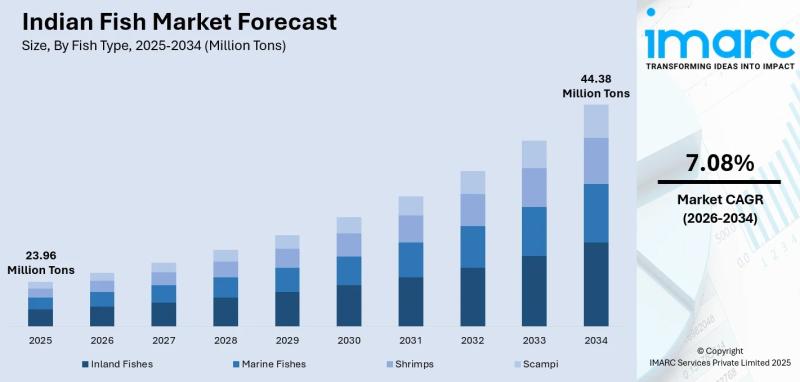

According to IMARC Group's report titled "Indian Fish Market Size, Share, Trends and Forecast by Fish Type, Product Type, Distribution Channel, Sector, and State, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Indian Fish Market Overview

The Indian fish market reached a size of 23.96 Million Tons in 2025 and is projected to grow to 44.38 Million Tons by 2034, expanding at…

Latin America Logistics Market Projected to Reach USD 580.1 Billion by 2034: Key …

Market Overview

The Latin America logistics market size was USD 366.1 Billion in 2025 and is expected to reach USD 580.1 Billion by 2034, growing at a CAGR of 5.25% during the forecast period 2026-2034. The market growth is driven by rapid economic expansion, manufacturing sector growth, e-commerce rise, infrastructure development, technology integration, and increasing free trade agreements.

Download a sample copy of the report: https://www.imarcgroup.com/Latin-America-Logistics-Market/requestsample

Study Assumption Years

Base Year: 2025

Historical Years: 2020-2025

Forecast…

Europe Carbon Black Market Report 2025: Valuation Projected to Hit USD 3,086.3 M …

Market Overview

The Europe carbon black market was valued at USD 3,086.3 Million in 2024 and is projected to reach USD 4,992.0 Million by 2033, growing at a CAGR of 5.21% during 2025-2033. This growth is driven by increasing demand from the automotive industry, technological advancements, and a shift towards sustainable practices, alongside expanding applications in electronics and renewable energy sectors.

Download a sample copy of the report: https://www.imarcgroup.com/Europe-Carbon-Black-Market/requestsample

Study Assumption Years

Base Year:…

More Releases for Paint

SKSHU Paint: Life Enjoyment Wall Repair Paint

Image: https://www.abnewswire.com/uploads/6c917f12026802adfd22d2c0dd8f5805.png

This product is a fast-drying waterborne aerosol paint composed of waterborne acrylic resin, pigments and fillers. Odorless and environment-friendly, it has the advantages of easy application, good atomization, high spray rate, high film richness, excellent adhesion and strong hiding power.

Product Introduction

This product is a fast-drying waterborne aerosol paint composed of waterborne acrylic resin, pigments and fillers. Odorless and environment-friendly, it has the advantages of easy application, good atomization, high…

How to Solve the Paint Selection Problem? Understanding the Mystery of Latex Pai …

Introduction

Before starting this paint exploration journey, let's first think about why the choice of paint is so important. A warm and comfortable home, a smooth, brightly colored wall, not only can bring us visual enjoyment, but also create a unique atmosphere and mood. The coating, as a wall coat, its quality, performance and environmental protection directly affect our quality of life and health.

1. Definition and component analysis

Latex paint:

Definition: Latex paint…

Water Based Enamel Paint Market is Booming Worldwide | Intercoastal Paint, Nippo …

The latest study released on the Global Water Based Enamel Paint Market by AMA Research evaluates market size, trend, and forecast to 2027. The Water Based Enamel Paint market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Global Refinish Paint for Automotive Market By Key Players: Akzo Nobel, BASF, 3M …

Qyresearchreports include new market research report Global Refinish Paint for Automotive Market Professional Survey Report 2018 to its huge collection of research reports.

This report studies the global Refinish Paint for Automotive market status and forecast, categorizes the global Refinish Paint for Automotive market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, India, Southeast Asia and…

Road Marking Paint Market Report 2018: Segmentation by Product (Thermoplastic Ma …

Global Road Marking Paint market research report provides company profile for Ennis Flint, Hempel, Geveko Markings, PPG Industries, Asian Paints PPG, SealMaster, 3M, Sherwin-Williams, Swarco AG, Nippon Paint and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…

China Paint and Coatings Market Research Report 2017 - PPG, Akzo Nobel, Kansai P …

This report studies Paint and Coatings in China market, focuses on the top players in China market, with capacity, production, price, revenue and market share for each manufacturer, covering

PPG

Akzo Nobel

Kansai Paint

Nippon Paint

BASF

Axalta (formerly DuPont)

Chugoku Marine Paint

Valspar

Sherwin-Williams

Hempel

Market Segment by Regions (provinces), covering

South China

East China

Southwest China

Northeast China

North China

Central China

Northwest China

Split by product Type, with production, revenue, price, market share and growth rate of each type, can be divided into

Waterborne Coatings

High-solids Coatings

Powder Coatings

Others

Split…