Press release

E-Waste Processing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Forecast

The global electronic waste management industry is witnessing unprecedented growth driven by the rapidly expanding digital economy and increasing demand for sustainable recycling solutions. At the heart of this expansion lies a critical environmental imperative e-waste processing. As industries and consumers transition toward responsible disposal methods and circular economy practices, establishing an e-waste processing plant presents a strategically compelling business opportunity for entrepreneurs and environmental investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global e-waste management market demonstrates strong growth trajectory, valued at USD 88.88 Billion in 2025. According to multiple comprehensive market analyses, the market is projected to reach USD 229.21Billion by 2034, exhibiting a robust CAGR of 11.1% from 2026-2034. This sustained expansion is driven by rapidly increasing electronic consumption, shorter product lifecycles, rising adoption of circular economy principles, and expanding regulatory requirements across developed and developing economies.

E-waste comprises discarded electrical and electronic equipment including computers, smartphones, household appliances, and batteries. Modern e-waste processing involves systematic collection, sorting, dismantling, material recovery, and safe disposal of hazardous components. Electronic waste contains valuable materials including metals (copper, gold, aluminum, silver, palladium), plastics, glass, and rare earth elements. Due to its complex composition and presence of hazardous substances like lead, cadmium, and mercury, professional e-waste processing prevents environmental contamination while recovering economically valuable materials. Its high recyclability, resource recovery potential, and alignment with circular economy principles make it a critical solution in sustainable waste management and resource conservation.

Request for a Sample Report: https://www.imarcgroup.com/e-waste-manufacturing-plant-project-report/requestsample

The e-waste management market is witnessing robust demand due to the accelerating volume of discarded electronics worldwide. Regulatory enforcement, especially mandatory Extended Producer Responsibility (EPR) rules, is shifting the cost of collection and processing from municipalities to device makers, creating stronger incentives for formal recycling and supporting market growth across developed and emerging economies.

Plant Capacity and Production Scale

The proposed e-waste processing facility is designed with an annual processing capacity ranging between 10,000-20,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows processors to handle diverse electronic waste streams-from consumer electronics and IT equipment to household appliances and industrial electronics-ensuring steady feedstock supply and consistent revenue streams across multiple material recovery segments including metals, plastics, and glass recovery.

Financial Viability and Profitability Analysis

The e-waste processing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 30-40%

Net Profit Margins: 12-18%

These margins are supported by stable demand across industrial and consumer sectors, value generation from material recovery, and the critical nature of e-waste processing in environmental sustainability. The project demonstrates strong return on investment (ROI) potential with break-even typically achieved within 3-5 years, making it an attractive proposition for both new entrants and established waste management companies looking to diversify their service portfolio in the electronics recycling sector.

Speak to Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=19345&flag=C

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an e-waste processing plant is primarily driven by:

Raw Materials (E-Waste Collection): 40-50% of total OpEx

Utilities and Processing: 20-25% of OpEx

Other Expenses: Including labor, transportation,

maintenance, depreciation, regulatory compliance, and taxes

Collection and procurement of e-waste feedstock constitute a significant portion of operating costs. Establishing collection networks, partnerships with OEMs, municipalities, and corporate take-back programs helps ensure consistent e-waste supply. Processing costs including sorting, dismantling, shredding, and material separation represent the second major cost component, with efficiency improvements through automation and advanced technologies helping reduce per-unit processing costs.

Capital Investment Requirements

Setting up an e-waste processing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to major e-waste generation centers including urban areas, industrial zones, and collection networks. The site must have robust infrastructure, including reliable transportation access, utilities, and compliance with environmental regulations. Proximity to metal refineries and material buyers helps minimize logistics costs for recovered materials.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized processing equipment essential for operation. Key machinery includes:

- Manual dismantling stations for initial sorting and component separation

- Industrial shredders for size reduction of electronic components and plastics

- Magnetic separators for ferrous metal extraction from mixed material streams

- Eddy current separators for non-ferrous metal recovery including aluminum and copper

- Density separation systems for plastic and glass sorting based on material properties

- Circuit board processing equipment for precious metal recovery from PCBs

- Dust collection and air filtration systems for worker safety and environmental compliance

- Material storage and handling equipment including conveyors and sorting bins

- Hazardous waste containment and treatment systems for safe handling of toxic components

Buy Now: https://www.imarcgroup.com/checkout?id=19345&method=2175

Civil Works: Building construction, facility layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the processing operation. The layout should be optimized with separate areas for receiving and storage, manual dismantling zone, mechanical processing area, material separation section, recovered materials storage, hazardous waste storage, quality control laboratory, administrative offices, and pollution control facilities.

Other Capital Costs: Pre-operative expenses, machinery installation costs, environmental clearances and regulatory compliance certifications, initial working capital requirements for collection network establishment, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

E-waste processing facilities serve extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Metal Recovery: Primary revenue source through extraction and sale of valuable metals including copper, aluminum, gold, silver, palladium, and rare earth elements. Metals constitute approximately 61% of e-waste composition and represent significant economic value, with the metals in global e-waste valued at over USD 91 billion annually.

Plastic Recycling: Recovery and processing of engineering plastics from electronic housings and components. Plastics represent approximately 20% of e-waste and can be recycled into new products or used as feedstock in chemical recycling processes, contributing to circular economy goals.

Glass Processing: Extraction and processing of glass from displays, screens, and other electronic components for use in new glass manufacturing or specialized applications, representing approximately 5% of e-waste composition.

Hazardous Waste Management: Safe handling, treatment, and disposal of hazardous components including batteries, capacitors, mercury-containing switches, and brominated flame retardants, ensuring environmental protection and regulatory compliance.

Data Destruction Services: High-margin specialized services for secure data destruction from storage devices, meeting corporate and government requirements for information security and privacy protection.

End-use industries include electronics manufacturing, metal refining, plastic processing, construction materials, automotive manufacturing, and waste management services, all of which contribute to sustained market demand and diverse revenue opportunities.

Why Invest in E-Waste Processing?

Several compelling factors make e-waste processing an attractive investment opportunity:

Critical Environmental Solution: E-waste processing serves as an essential environmental service preventing toxic materials from contaminating soil and water, making it indispensable for sustainable development and environmental protection in the digital age.

Rapid Market Growth: Global e-waste generation is increasing from 62 million tonnes in 2022 to projected 82 million tonnes by 2030, driven by accelerating electronic consumption, shorter product lifecycles, and digital transformation across industries.

High-Value Material Recovery: E-waste contains valuable materials worth USD 91 billion annually, including USD 19 billion in copper, USD 15 billion in gold, and USD 16 billion in iron, offering significant revenue potential through material recovery and resale.

Circular Economy Alignment: E-waste processing directly supports circular economy principles by recovering materials for reuse in manufacturing, reducing dependence on virgin resource extraction, and contributing to resource conservation and sustainability goals.

Strong Regulatory Support: Governments worldwide are implementing Extended Producer Responsibility (EPR) rules, e-waste management regulations, and recycling mandates, creating strong policy frameworks and market incentives for formal e-waste processing infrastructure.

Low Current Recycling Rates: Only 22.3% of global e-waste is formally collected and recycled, representing massive untapped market potential for new processing facilities to capture additional market share and improve collection rates.

Urban Mining Opportunity: E-waste processing, often called urban mining, offers higher concentrations of precious metals than natural ore deposits, with gold concentrations reaching 140 grams per ton in mobile phones and computers versus 5-10 grams per ton in conventional mining.

Processing Technology Excellence

The e-waste processing operation involves several precision-controlled stages:

- Collection and Transportation: E-waste is collected from multiple sources including households, businesses, collection centers, and take-back programs, then transported to the processing facility

- Sorting and Categorization: Incoming e-waste is sorted by device type, material composition, and processing requirements

- Manual Dismantling: Devices are manually disassembled to remove hazardous components, recover reusable parts, and separate material categories

- Mechanical Processing: Remaining materials undergo shredding, crushing, and size reduction for efficient material separation

- Material Separation: Advanced separation technologies including magnetic separation, eddy current separation, and density separation isolate metals, plastics, and glass fractions

- Precious Metal Recovery: Circuit boards and high-value components undergo specialized processing for gold, silver, and palladium extraction

- Material Refining and Sale: Recovered materials are refined to market specifications and sold to metal refineries, plastic processors, and manufacturing industries

Industry Leadership

The global e-waste management industry is led by established recycling companies with extensive processing capabilities and diverse service portfolios. Key industry players include:

- Aurubis AG

- Boliden Group

- Sims Lifecycle Services (Sims Limited)

- Electronic Recyclers International (ERI)

- Umicore N.V.

- Stena Metall AB

- Veolia Environment S.A.

These companies serve diverse end-use sectors including electronics manufacturing, metal refining, waste management, corporate asset disposition, and government e-waste programs, demonstrating the broad market applicability and essential nature of professional e-waste processing services.

Recent Industry Developments

October 2024: MTM Critical Metals Limited announced successful extraction of tin and palladium from electronic waste, including printed circuit boards (PCBs), utilizing their proprietary Flash Joule Heating (FJH) technology, demonstrating advancement in efficient precious metal recovery methods.

May 2024: Tadweer Group and Dubal Holding completed the acquisition of Enviroserve, an e-waste management company, strengthening capabilities in handling electronic waste and supporting commitment to sustainable environmental practices in the Middle East region.

Conclusion

The e-waste processing sector presents a strategically positioned investment opportunity at the intersection of environmental sustainability, resource recovery, and circular economy practices. With favorable profit margins ranging from 30-40% gross profit and 12-18% net profit, strong market drivers including rapid growth in electronic consumption (62 million tonnes in 2022 to 82 million tonnes by 2030), only 22.3% current formal recycling rate representing massive untapped market potential, high-value material recovery opportunities (USD 91 billion in recoverable materials annually), expanding regulatory mandates through Extended Producer Responsibility programs, and alignment with global circular economy and sustainability goals, establishing an e-waste processing plant offers significant potential for long-term business success and sustainable returns. The combination of critical environmental service, valuable material recovery, regulatory support, technological advancement in automated sorting and processing, and growing corporate and consumer awareness creates an attractive value proposition for serious environmental investors committed to quality processing infrastructure and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release E-Waste Processing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4377351 • Views: …

More Releases from IMARC Group

Graphite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global graphite manufacturing industry is witnessing robust growth driven by the rapidly expanding lithium-ion battery, steel, electronics, and advanced materials sectors and increasing demand for high-purity carbon materials essential for energy storage and industrial applications. At the heart of this expansion lies a critical material-graphite. As industries worldwide transition toward electric vehicles, renewable energy storage, and advanced manufacturing technologies, establishing a graphite manufacturing plant presents a strategically compelling business…

Tyre Pyrolysis Manufacturing Plant DPR 2026: Cost Structure, Production Process …

The global tyre pyrolysis manufacturing industry is witnessing robust growth driven by the rapidly expanding waste management sector and increasing demand for sustainable energy solutions. At the heart of this expansion lies a critical waste-to-energy technology-tyre pyrolysis. As industries transition toward circular economy principles and sustainable disposal methods, establishing a tyre pyrolysis manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and environmental technology investors seeking to capitalize on…

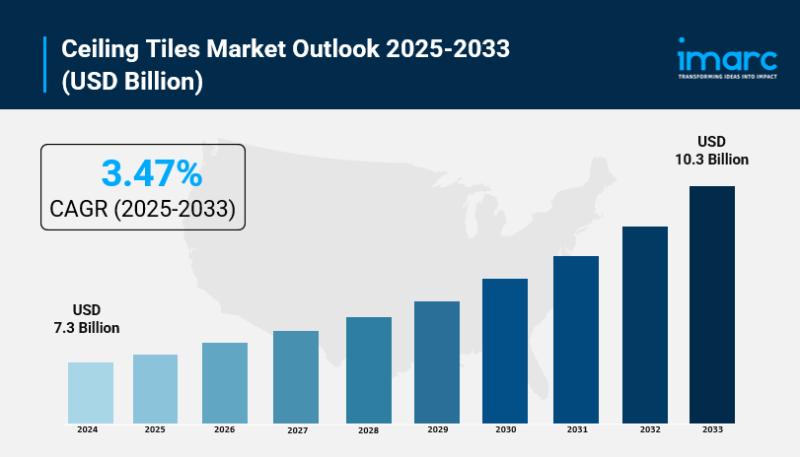

Ceiling Tiles Market is Expected to Grow USD 16.3 Billion by 2033 | At CAGR 3.77 …

IMARC Group, a leading market research company, has recently released a report titled "Ceiling tiles Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Ceiling tiles market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Ceiling Tiles Market Overview

The…

Almond Processing Plant DPR - 2026: Investment Cost, Market Growth and Machinery

The global almond processing industry is witnessing robust growth driven by the rapidly expanding health and wellness, plant-based food, and confectionery sectors and increasing demand for nutritious, versatile, and high-value nut products. At the heart of this expansion lies a critical food processing segment-almond processing. As consumers worldwide transition toward healthier snacking habits and plant-based dietary alternatives, establishing an almond processing plant presents a strategically compelling business opportunity for entrepreneurs…

More Releases for Processing

Egg Processing Market Efficiently Processing Eggs for Food and Industrial Applic …

Egg Processing Market 2023 Forecast: Unveiling Opportunities and Growth

Global "Egg Processing Market" is an exploration report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. These bits of knowledge offered in the Egg Processing Market report would benefit request players to define systems for the future…

Poultry Processing Solutions

Global Info Research announces the release of the report "Global Poultry Processing Solutions Market 2023 by Manufacturers, Regions, Type and Application, Forecast to 2029" . The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets.…

Ice cream processing equipment Market Insights by 2031 & Covid-19 Analysis | ROK …

Global Ice cream processing equipment report from Global Insight Services is the single authoritative source of intelligence on Ice cream processing equipment market. The report will provide you with analysis of impact of latest market disruptions such as Russia-Ukraine war and Covid-19 on the market. Report provides qualitative analysis of the market using various frameworks such as Porters' and PESTLE analysis. Report includes in-depth segmentation and market size…

Steel Processing Market 2022 Global Insights and Business Scenario | Jingye Stee …

Global Steel Processing Market Size, Status, and Forecast for 2022-2028. A comprehensive analysis has been compiled to supply the foremost up-to-date data on key aspects of the wide-reaching market. This analysis report covers major aspects of the Steel Processing Market, as well as drivers, restraints, SWOT analysis, historical and current trends, regulative situations, and technological advancements. The industry's role on the COVID-19 natural occurrence was comprehensively studied. throughout a particular…

Global Cactus Processing Market, Global Cactus Processing Industry, Covid-19 Imp …

A cactus is a special type of plant whose leaves are cut into needles to save the amount of water the plant needs. There are various types of cacti, and they come in many sizes, shapes, and colors. Green is a most common color for cactus. Some cactus plants are round, and some are flat like pancake. Additionally, some cacti are even shaped like starfish or snakes. A cactus plant…

Global Wood Processing Market | Global Wood Processing Industry: Ken Research

The wood processing market involves of sales of processed wood by several entities (organizations, sole traders and partnerships) that saw measurement lumber, boards, beams, timbers, poles, ties, shingles, shakes, siding, and wood chips from the logs or bolts. This industry also embraces establishments that treat planed, sawed and shaped wood with creosote or other preservers such as alkaline copper quat, copper azole, and sodium borates, to safeguard decay and to…