Press release

Tyre Pyrolysis Manufacturing Plant DPR 2026: Cost Structure, Production Process & ROI

The global tyre pyrolysis manufacturing industry is witnessing robust growth driven by the rapidly expanding waste management sector and increasing demand for sustainable energy solutions. At the heart of this expansion lies a critical waste-to-energy technology-tyre pyrolysis. As industries transition toward circular economy principles and sustainable disposal methods, establishing a tyre pyrolysis manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and environmental technology investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global tyre pyrolysis oil market demonstrates strong growth trajectory, valued at USD 383.32 Million in 2025. According to industry analysis, the market is projected to reach USD 622.75 Million by 2034, exhibiting a robust CAGR of 5.5% from 2026 to 2034. This sustained expansion is driven by rapidly expanding waste management needs, increasing demand for alternative fuels, rising adoption of circular economy practices, and expanding environmental compliance requirements across developing economies.

Request for a Sample Report: https://www.imarcgroup.com/tyre-pyrolysis-manufacturing-plant-project-report/requestsample

Tyre pyrolysis is a thermochemical decomposition process that converts waste tyres into valuable products through thermal cracking in the absence of oxygen. It appears as a sustainable waste-to-energy solution with high efficiency and resource recovery properties. Tyre pyrolysis produces multiple revenue streams including pyrolysis oil, carbon black, steel wire, and syngas, making it an efficient multi-product operation used primarily in industrial fuel applications, carbon black recovery, and renewable energy generation. Due to its strong resource recovery nature, it helps convert waste into valuable products and prevents environmental pollution from tyre waste accumulation. Its high conversion efficiency, non-combustion structure, and compatibility with various tyre feedstocks make it a preferred option in sustainable waste management and circular economy initiatives.

The tyre pyrolysis market is witnessing robust demand due to the rising need for sustainable waste management solutions that support environmental protection and resource recovery. Industrial sectors increasingly transitioning toward waste-to-energy conversion-particularly in manufacturing, energy generation, and chemical production-are driving large-scale adoption. With millions of end-of-life tyres generated annually worldwide and stringent environmental regulations on tyre disposal, the tyre pyrolysis industry represents a critical solution. Government-led waste management programs, incentives for circular economy projects, and carbon emission reduction initiatives further strengthen market prospects.

Plant Capacity and Production Scale

The proposed tyre pyrolysis manufacturing facility is designed with an annual production capacity ranging between 20,000 - 50,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from industrial fuel production and carbon black recovery to steel recycling and syngas generation-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The tyre pyrolysis manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 35-45%

Net Profit Margins: 15-20%

These margins are supported by stable demand across industrial and energy sectors, value-added waste-to-energy positioning, and the critical nature of tyre pyrolysis in sustainable waste management applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established industrial manufacturers looking to diversify their product portfolio in the environmental technology sector.

Speak to Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=19444&flag=C

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a tyre pyrolysis manufacturing plant is primarily driven by:

Raw Materials: 30-40% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with waste tyres being the primary input material. Establishing long-term contracts with reliable waste tyre suppliers and collection networks helps mitigate price volatility and ensures consistent feedstock supply, which is critical given that waste tyre procurement represents the most significant cost factor in tyre pyrolysis manufacturing.

Capital Investment Requirements

Setting up a tyre pyrolysis manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to waste tyre collection centers and industrial fuel customers. Proximity to target industrial markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and environmental compliance systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes: Pyrolysis reactors for thermal decomposition under controlled temperature and oxygen-free conditions; Cooling and condensation systems for oil vapor liquefaction; Gas scrubbing and purification units for syngas cleaning; Carbon black separation and collection equipment; Steel wire extraction and recovery systems; Storage tanks for pyrolysis oil and carbon black; Quality control laboratory equipment for product testing and analysis; Environmental protection systems including emission control and wastewater treatment; Automated feeding and discharge mechanisms for continuous operation.

Buy Now: https://www.imarcgroup.com/checkout?id=19444&method=2175

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for waste tyre storage, pre-processing zone, pyrolysis reactor section, cooling and condensation area, carbon black collection unit, steel wire separation zone, oil storage tanks, quality control laboratory, environmental protection systems, utility block, and administrative facilities.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, environmental clearances, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Tyre pyrolysis products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Industrial Fuel: Primary use as alternative fuel in cement kilns, steel plants, boilers, and power generation facilities, particularly valuable in energy-intensive industries where cost-effective fuel alternatives are essential.

Carbon Black Recovery: Applications in rubber manufacturing, plastic production, and construction materials where recovered carbon black provides a sustainable alternative to virgin carbon black.

Steel Recycling: Extraction and recovery of steel wire from waste tyres for reprocessing into metal products, contributing to circular economy principles.

Chemical Feedstock: Utilization of pyrolysis oil as feedstock for chemical synthesis and refining processes where sustainable raw materials are increasingly valued.

Energy Generation: Applications in power plants and industrial heating systems where pyrolysis oil serves as a renewable fuel alternative.

End-use industries include energy, cement, steel, rubber, chemical, construction, and manufacturing sectors, all of which contribute to sustained market demand.

Why Invest in Tyre Pyrolysis Manufacturing?

Several compelling factors make tyre pyrolysis manufacturing an attractive investment opportunity:

Essential Waste-to-Energy Segment: Tyre pyrolysis serves as a critical environmental technology supporting sustainable waste management, circular economy practices, and resource recovery, making it indispensable for industries focused on environmental compliance and carbon footprint reduction.

Rising Environmental Regulations: Industrial sectors increasingly facing stringent waste disposal regulations and carbon emission targets-particularly in manufacturing, energy, and construction-are driving large-scale adoption of waste-to-energy technologies like tyre pyrolysis.

Multi-Product Revenue Streams: The technology's ability to generate multiple valuable products including pyrolysis oil, carbon black, steel wire, and syngas in a single operation, combined with its waste reduction properties, offers significant economic advantages and positions it favorably against conventional waste disposal methods.

Waste Management Solutions: The technology's effectiveness in handling millions of end-of-life tyres and converting them into valuable industrial products positions it as a preferred solution in regions facing tyre waste challenges, especially across Asia, North America, and Europe.

Government Support: Government-led environmental protection programs, subsidies for circular economy initiatives, waste management incentives, and carbon credit mechanisms further strengthen market prospects and support industry growth.

Capacity Expansion Opportunities: Emerging economies such as India, China, Brazil, and Southeast Asian countries are expanding local manufacturing as part of their strategy to address tyre waste accumulation and reduce dependence on virgin raw materials, creating opportunities for domestic producers.

Circular Economy Alignment: The circular economy agenda and increasing demand for sustainable industrial practices are expected to enhance long-term growth opportunities for waste-to-energy technologies.

Manufacturing Process Excellence

The tyre pyrolysis manufacturing process involves several precision-controlled stages: Raw Material Pre-Processing where waste tyres are collected, inspected, and prepared for processing; Thermal Decomposition in pyrolysis reactors under controlled temperature (400-600°C) and oxygen-free conditions to break down rubber polymers; Oil Vapor Condensation where pyrolysis vapors are cooled and condensed into liquid pyrolysis oil; Carbon Black Separation where solid carbon black is collected and processed for various applications; Steel Wire Recovery through magnetic separation and mechanical extraction systems; Syngas Purification where combustible gases are cleaned and either used for energy or collected separately; Quality Testing where final products undergo analysis for compliance with industry standards; Product Storage and Packaging where pyrolysis oil, carbon black, and steel wire are stored and prepared for distribution.

Industry Leadership

The global tyre pyrolysis industry is led by established equipment manufacturers and waste management companies with extensive production capabilities and diverse application portfolios. Key industry players include: Beston Machinery Co., Ltd.; Kingtiger Environmental Technology Co., Ltd.; Henan Doing Environmental Protection Technology Co., Ltd.; Klean Industries Inc.; Niutech Environment Technology Co., Ltd.; Quantafuel ASA; Alterra Energy, LLC; Bridgestone Corporation. These companies serve diverse end-use sectors including energy, cement, steel, rubber, chemical, and construction industries, demonstrating the broad market applicability of tyre pyrolysis technology.

Recent Industry Developments

2024: The tyre pyrolysis plant market witnessed significant technological advancements with continuous pyrolysis systems achieving conversion efficiency improvements of 22% since 2021, with average yields of 38% liquid oil, 33% carbon black, and 23% gas output per ton of feedstock processed. Automation adoption has surged, with 45% of manufacturers now deploying smart temperature control systems improving energy efficiency by 15-20%. The integration of carbon capture technologies and enhanced emission control systems has positioned modern plants for compliance with increasingly stringent environmental regulations.

Conclusion

The tyre pyrolysis manufacturing sector presents a strategically positioned investment opportunity at the intersection of sustainable waste management, circular economy practices, and renewable energy generation. With favorable profit margins ranging from 35-45% gross profit and 15-20% net profit, strong market drivers including rising environmental regulations, growing demand for alternative fuels, expanding circular economy initiatives, and supportive government policies promoting waste-to-energy projects, establishing a tyre pyrolysis manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of multi-product revenue streams, critical role in environmental protection, expanding industrial applications, and capacity expansion opportunities in emerging economies creates an attractive value proposition for serious environmental technology investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tyre Pyrolysis Manufacturing Plant DPR 2026: Cost Structure, Production Process & ROI here

News-ID: 4377332 • Views: …

More Releases from IMARC Group

Graphite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global graphite manufacturing industry is witnessing robust growth driven by the rapidly expanding lithium-ion battery, steel, electronics, and advanced materials sectors and increasing demand for high-purity carbon materials essential for energy storage and industrial applications. At the heart of this expansion lies a critical material-graphite. As industries worldwide transition toward electric vehicles, renewable energy storage, and advanced manufacturing technologies, establishing a graphite manufacturing plant presents a strategically compelling business…

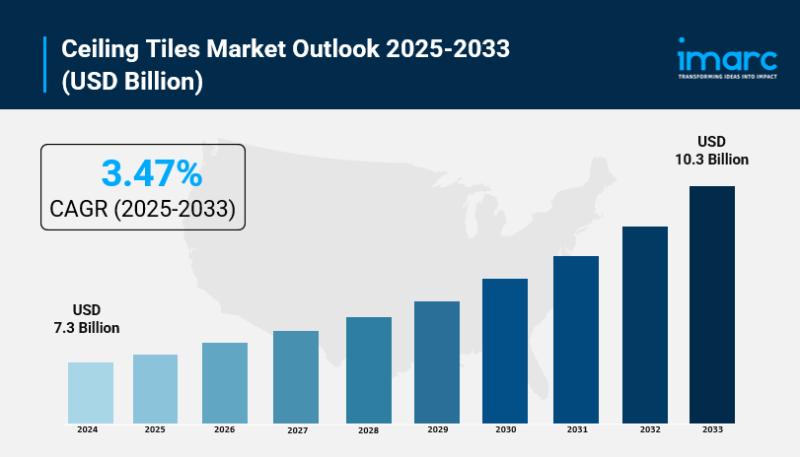

Ceiling Tiles Market is Expected to Grow USD 16.3 Billion by 2033 | At CAGR 3.77 …

IMARC Group, a leading market research company, has recently released a report titled "Ceiling tiles Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Ceiling tiles market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Ceiling Tiles Market Overview

The…

Almond Processing Plant DPR - 2026: Investment Cost, Market Growth and Machinery

The global almond processing industry is witnessing robust growth driven by the rapidly expanding health and wellness, plant-based food, and confectionery sectors and increasing demand for nutritious, versatile, and high-value nut products. At the heart of this expansion lies a critical food processing segment-almond processing. As consumers worldwide transition toward healthier snacking habits and plant-based dietary alternatives, establishing an almond processing plant presents a strategically compelling business opportunity for entrepreneurs…

India Hospital Market Overview: Size, Industry Expansion & Growth Potential 2026 …

India Hospital Market Report Introduction:

According to IMARC Group's report titled "India Hospital Market Size, Share, Growth & Forecast 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Hospital Industry?

The India hospital market size was valued at USD 193.42 Billion in 2025 and is projected to reach USD 364.55 Billion by 2034, growing at a compound annual growth…

More Releases for Tyre

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

According to a recent report published by Allied Market Research, titled, "Pakistan rubber tyre Market by Tyre, Component, Design, and Vehicle Type: Opportunity Analysis and Industry Forecast, 2018 - 2025," Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type design segment was the highest contributor to…

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

The global Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type by design segment was the highest revenue contributor in 2017, accounting for $207.7 million, and is estimated to reach $1,196.4 million by 2025, registering a CAGR of 24.6% during the forecast period.

Download Sample Report at…

Pakistan Rubber Tyre Market : Pneumatic Rubber Tyre, Retreaded Rubber Tyre, Cush …

According to a recent report published by Allied Market Research, titled, "Pakistan rubber tyre Market by Tyre, Component, Design, and Vehicle Type: Opportunity Analysis and Industry Forecast, 2018 - 2025," Pakistan rubber tyre market size was valued at $272.10 million in 2017, and is projected to reach $1,592.90 million by 2025, registering a CAGR of 24.8% from 2018 to 2025. The radial type design segment was the highest contributor to…

Off-road Tyre Market See Huge Growth for New Normal | AEOLUS TYRE, TOYO Tyre, Co …

The latest report on the "Off-road Tyre Market" study has evaluated the future growth potential and provides information and useful stats on market structure and size. The research provides a comprehensive analysis of development trends, revenue growth, and market share for the forecast period of 2022 to 2028. It highlights an overview of the market dynamics of the Off-road Tyre market, which includes drivers, restraints, and opportunities that are influencing…

Rubber Tyre and Tube Market 2020: Key Players – General Tyre and Rubber, Servi …

Rubber Tyre and Tube Industry

Description

Wiseguyreports.Com Adds “Rubber Tyre and Tube -Market Demand, Growth, Opportunities and Analysis Of Top Key Player Forecast To 2025” To Its Research Database

Rubber Tyre and Tube market is segmented by Type, and by Application. Players, stakeholders, and other participants in the global Rubber Tyre and Tube market will be able to gain the upper hand as they use the report as a powerful resource. The segmental…

Pakistan Rubber Tyre and Tube Market Players to See Huge Investments Opportuniti …

Key Findings of the Pakistan Rubber Tyre and Tube Market:

o In 2017, based on channel, aftermarket generated the highest revenue.

o In 2017, by vehicle type, the commercial vehicles type was the highest revenue contributor.

o In 2017, by design, the radial segment was the highest revenue contributor.

Download Report Sample (177 Pages PDF with Insights): https://www.alliedmarketresearch.com/request-sample/6242

The key players analyzed in this pakistan rubber tyre and tube market report include General Tyre and Rubber Co. Ltd.,…