Press release

Graphite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

The global graphite manufacturing industry is witnessing robust growth driven by the rapidly expanding lithium-ion battery, steel, electronics, and advanced materials sectors and increasing demand for high-purity carbon materials essential for energy storage and industrial applications. At the heart of this expansion lies a critical material-graphite. As industries worldwide transition toward electric vehicles, renewable energy storage, and advanced manufacturing technologies, establishing a graphite manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and materials processing investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global graphite market demonstrates a strong growth trajectory, valued at USD 8.35 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 15.22 Billion by 2034, exhibiting a robust CAGR of 6.9% from 2026-2034. This sustained expansion is driven by rising demand from lithium-ion batteries, steelmaking refractories, lubricants, and advanced electronics applications.

Graphite, a carbon variant, has qualities of being crystalline with high electrical conductivity, great thermal stability, chemical inertness, and natural lubricating abilities that come from its hexagonal layered structure. Raw forms include flake, amorphous, and vein graphite while synthetic graphite is obtained through high-temperature processing of carbon-rich feedstocks. Very high melting point, low friction coefficient, and excellent corrosion resistance make graphite suitable for very harsh industrial atmospheres. One of the main reasons why graphite has become so popular among lithium-ion batteries is its capability to intercalate lithium ions during the charging process, hence being used as anode material.

The graphite market is driven by the rapid expansion of lithium-ion battery production for electric vehicles and stationary energy storage systems. Increasing steel production continues to support demand for graphite electrodes and refractories, while growth in electronics manufacturing has further increased consumption of high-purity graphite for thermal management and conductive applications. Additionally, in July 2023, Mersen inaugurated new graphite manufacturing facilities at its Columbia plant in the United States, strengthening its advanced materials capabilities. The site now includes isostatic graphite production, primarily serving the semiconductor industry. Backed by nearly USD 70 million in investments since 2019, such developments highlight the growing importance of graphite across sectors.

Plant Capacity and Production Scale

The proposed graphite manufacturing facility is designed with an annual production capacity ranging between 10,000-20,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from lithium-ion battery anodes and refractory linings to electrodes, lubricants, seals, gaskets, and conductive components-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Request for a Sample Report: https://www.imarcgroup.com/graphite-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The graphite manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 35-45%

Net Profit Margins: 15-20%

These margins are supported by stable demand across energy storage, metallurgy, refractories, electronics, and industrial manufacturing sectors, value-added specialty material positioning, and the critical nature of graphite in energy transition and industrial processing applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established materials manufacturers looking to diversify their product portfolio in the advanced carbon materials segment.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a graphite manufacturing plant is primarily driven by:

Raw Materials: 50-60% of total OpEx

Utilities: 25-30% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with natural graphite ore, petroleum coke, and coal tar pitch being the primary input materials. Establishing long-term contracts with reliable graphite ore and carbon feedstock suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that feedstock procurement represents the most significant cost factor in graphite manufacturing.

Capital Investment Requirements

Setting up a graphite manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to natural graphite deposits or petroleum coke and coal tar pitch suppliers. Proximity to battery manufacturing, steel production, and electronics markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Crushers and jaw crushers for initial size reduction of natural graphite ore or synthetic graphite feedstock into smaller fragments

• Mills and grinding equipment for further particle size reduction to achieve specific mesh sizes required for different applications

• Flotation cells and purification units for separating graphite from impurities and gangue minerals through froth flotation processes

• High-temperature furnaces and graphitization kilns for converting carbon materials into crystalline graphite structures at temperatures exceeding 2500°C

• Classifiers and screening equipment for particle size distribution control and quality grading of finished graphite products

• Packaging systems for automated bagging, bulk loading, and containerization of graphite products for transportation

• Environmental control and dust collection systems for managing particulate emissions and ensuring worker safety and regulatory compliance

• Quality control laboratory equipment for particle size analysis, purity testing, carbon content verification, and electrochemical performance characterization

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize environmental impact throughout the production process. The layout should be optimized with separate areas for raw material storage, crushing and grinding zone, flotation and purification unit, high-temperature processing section, classification area, quality control laboratory, finished goods warehouse, utility block, environmental control systems, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, environmental and quality certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=9036&flag=C

Major Applications and Market Segments

Graphite products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Battery Manufacturing Industry: Used as anode material in lithium-ion batteries for electric vehicles, portable electronics, and grid-scale energy storage systems due to excellent lithium intercalation properties and electrical conductivity.

Steel and Metallurgy Industry: Utilized in refractories, crucibles, and electrodes for electric arc furnaces due to exceptional heat resistance, chemical inertness, and electrical conductivity in high-temperature metal processing.

Electronics Industry: Used in conductive coatings, heat dissipating elements, and electromagnetic interference shielding applications where thermal management and electrical conductivity are critical performance requirements.

Automotive and Aerospace Industry: Used in brake linings, seals, gaskets, and lightweight composite materials where high-temperature stability, low friction, and durability are essential for demanding operational environments.

Industrial Lubricants Industry: Employed as dry lubricant in high-temperature and high-pressure applications where conventional oil-based lubricants would decompose or fail under extreme operating conditions.

Why Invest in Graphite Manufacturing?

Several compelling factors make graphite manufacturing an attractive investment opportunity:

Critical Material for Energy Transition: Graphite is a major input for lithium-ion batteries which are essential for electric vehicles, renewable energy storage, and grid-scale battery systems supporting global decarbonization efforts.

High Entry Barriers with Value Addition: Technological purification, quality uniformity, particle size regulation, and strict customer qualification requirements present formidable barriers that favor technically skilled and quality-focused manufacturers.

Strong Alignment with Global Megatrends: Long-term graphite demand growth is sustained by electrification, decarbonization, advanced metallurgy, high-temperature industrial processing, and semiconductor manufacturing expansion globally.

Policy and Industrial Support: Government initiatives supporting EV adoption, battery manufacturing, steel production, and domestic mineral processing have positive impacts on graphene demand across various regions worldwide.

Supply Chain Localization Opportunities: OEMs and battery makers are seeking reliable local suppliers to reduce import dependence, mitigate raw material price volatility, and ensure supply chain security for critical battery materials.

Import Substitution Potential: Emerging economies are expanding local graphite processing capacity to reduce dependence on imported graphite products, creating significant market opportunities for domestic manufacturers with efficient operations.

Diverse Application Portfolio: Graphite's use across batteries, steel, electronics, lubricants, and advanced materials provides multiple revenue streams and reduces dependence on any single end-use sector.

Manufacturing Process Excellence

The graphite manufacturing process involves several precision-controlled stages:

• Crushing: Natural graphite ore or synthetic carbon feedstock is crushed using jaw crushers and impact crushers to reduce particle size and prepare material for subsequent grinding

• Grinding: Crushed material undergoes fine grinding in ball mills or roller mills to achieve specific mesh sizes required for different graphite product specifications

• Purification: Ground graphite is processed through flotation cells using chemical reagents to separate graphite flakes from silicate and carbonate impurities through selective froth flotation

• Milling: Purified graphite undergoes additional milling and micronization to produce ultra-fine graphite powders for specialized applications requiring precise particle size distributions

• Classification: Milled graphite is classified using air classifiers or screening equipment to sort particles by size and remove off-spec material, ensuring uniform product quality

• Graphitization (Synthetic): For synthetic graphite production, carbon materials are heated to temperatures exceeding 2500°C in graphitization furnaces to convert amorphous carbon into crystalline graphite structures

• Quality Control and Packaging: Finished graphite products undergo comprehensive testing for carbon content, particle size, purity, and electrochemical performance before automated packaging for distribution

Industry Leadership

The global graphite industry is led by established materials manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Focus Graphite

• GrafTech International

• Graphite India Limited

• Mason Resources Inc.

• Nippon Carbon Co Ltd.

• AMG Graphite (Graphit Kropmühl GmbH)

These companies serve diverse end-use sectors including energy storage, metallurgy, refractories, electronics, and industrial manufacturing, demonstrating the broad market applicability of graphite products.

Buy Now:

https://www.imarcgroup.com/checkout?id=9036&method=2175

Recent Industry Developments

December 2025: Graphite India Limited entered into an exclusive distribution and commercial partnership with Kivoro, a graphene technology innovator spun out of Graphenea. The agreement enables Graphite India to market Kivoro's advanced graphene-based heat transfer additive in India's corrugated paperboard sector, aiming to improve thermal efficiency, reduce energy usage, enhance productivity, and support the modernization of corrugation facilities nationwide.

July 2025: Graphite One Inc. signed a memorandum of understanding with electric vehicle maker Lucid Group as part of the newly formed MINAC initiative, aimed at strengthening the U.S. automotive minerals supply chain. The partnership supports domestic sourcing of natural and synthetic graphite for batteries, reducing import dependence and advancing a fully U.S.-based graphite and battery materials ecosystem.

Conclusion

The graphite manufacturing sector presents a strategically positioned investment opportunity at the intersection of energy storage, advanced materials, and industrial processing innovation. With favorable profit margins ranging from 35-45% gross profit and 15-20% net profit, strong market drivers including rapid EV adoption, expanding renewable energy storage, growing steel and electronics production, and supportive government policies promoting domestic battery materials manufacturing, establishing a graphite manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential energy transition applications, critical role in EV battery production, expanding industrial demand across metallurgy and electronics, and import substitution opportunities in emerging economies creates an attractive value proposition for serious materials processing investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Graphite Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI here

News-ID: 4377334 • Views: …

More Releases from IMARC Group

Tyre Pyrolysis Manufacturing Plant DPR 2026: Cost Structure, Production Process …

The global tyre pyrolysis manufacturing industry is witnessing robust growth driven by the rapidly expanding waste management sector and increasing demand for sustainable energy solutions. At the heart of this expansion lies a critical waste-to-energy technology-tyre pyrolysis. As industries transition toward circular economy principles and sustainable disposal methods, establishing a tyre pyrolysis manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and environmental technology investors seeking to capitalize on…

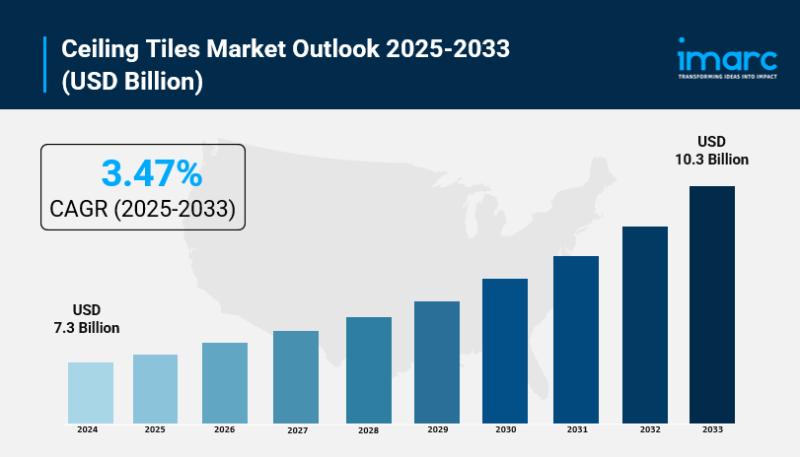

Ceiling Tiles Market is Expected to Grow USD 16.3 Billion by 2033 | At CAGR 3.77 …

IMARC Group, a leading market research company, has recently released a report titled "Ceiling tiles Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Ceiling tiles market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Ceiling Tiles Market Overview

The…

Almond Processing Plant DPR - 2026: Investment Cost, Market Growth and Machinery

The global almond processing industry is witnessing robust growth driven by the rapidly expanding health and wellness, plant-based food, and confectionery sectors and increasing demand for nutritious, versatile, and high-value nut products. At the heart of this expansion lies a critical food processing segment-almond processing. As consumers worldwide transition toward healthier snacking habits and plant-based dietary alternatives, establishing an almond processing plant presents a strategically compelling business opportunity for entrepreneurs…

India Hospital Market Overview: Size, Industry Expansion & Growth Potential 2026 …

India Hospital Market Report Introduction:

According to IMARC Group's report titled "India Hospital Market Size, Share, Growth & Forecast 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the India Hospital Industry?

The India hospital market size was valued at USD 193.42 Billion in 2025 and is projected to reach USD 364.55 Billion by 2034, growing at a compound annual growth…

More Releases for Graphit

Global Vein Graphite Market Report 2022-2028 Spotlighting Top Key Players - GK G …

The research report includes specific segments by region (country), by manufacturers, by Type and by Application. Each type provides information about the production during the forecast period of 2017 to 2028. by Application segment also provides consumption during the forecast period of 2017 to 2028. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

Segment by Type

- Fixed Carbon 85%

- Fixed Carbon 90%

- Fixed…

Stone Mining & Quarrying Market is Anticipated to Display Substantial Progress i …

This in-depth Stone Mining & Quarrying market report includes information on market restraints, segment analysis, size of the market by region, competition landscape, and development factors. It also makes predictions for the worldwide market scenario from 2021 to 2027. This market study provides data in the form of improved data visualizations, going beyond the fundamental sketch of the market. The important findings in this global market research report are gathered…

Stone Mining & Quarrying Market to Eyewitness Stunning Growth by 2027 Covid-19 A …

This Stone Mining & Quarrying market report provides a clear picture of key players' growth as well as the qualitative aspects of business in each area. This Stone Mining & Quarrying Market Report provides a current report on revenue generation, recent trends, financial status, and costing, as well as business profiles and financial status. The competitive landscape and potential growth factors are presented in this Stone Mining & Quarrying Market…

Synthetic Graphite Powder Market Analysis, Size, Outlook, Share By Key Players:: …

Chicago, United States, -- Chicago, United States, -- The report comes out as a keen and intensive assessment device just as an extraordinary asset that will assist you with securing a place of solidarity in the worldwide Synthetic Graphite Powder Market. We have given profound investigation of the vendor landscape to give you a complete picture of present and future competitive situations of the worldwide Synthetic Graphite Powder market. Our…

Extensive R&D On Vein Graphite Market Size and Analysis Outlook (2020-2026) | GK …

Los Angeles, United States, FEB 2020 - Top Research Specialist Present Completer research study here is a brilliant compilation of different types of analysis of critical aspects of the global Vein Graphite Market. Its focuses on how the global Vein Graphite market is expected to grow during the course of the forecast period, With SWOT analysis it gives a complete explanation of the strengths and weaknesses of the global…

Granular Graphite Market: Competitive Dynamics & Global Outlook 2024– Top Key …

Market Research Report Store offers a latest published report on Granular Graphite Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This report focuses on the key global Granular Graphite players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Granular Graphite with respect to individual growth…