Press release

Whey Protein Powder Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability

The global whey protein powder manufacturing industry is experiencing robust growth driven by the rapidly expanding health and fitness sector and increasing demand for high-quality protein supplements. At the heart of this expansion lies a critical nutritional product-whey protein powder. As consumers worldwide increasingly prioritize health, wellness, and active lifestyles, establishing a whey protein powder manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and nutraceutical investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global whey protein (powder and concentrate) market demonstrates strong growth trajectory, valued at USD 11.45 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 19.34 Billion by 2034, exhibiting a steady CAGR of 6.0% from 2026-2034. This sustained expansion is driven by increasing health and fitness consciousness among consumers, escalating demand for sports nutrition and bodybuilding products, rising adoption of protein-enriched diets, and emerging technological advancements in manufacturing technologies that enhance product quality and variety.

Whey protein is a high-quality, complete protein derived from milk during the cheese-making process. It is extracted from the liquid whey that remains after milk is curdled and strained, then undergoes filtration and spray-drying to produce a concentrated powder. Whey protein contains all nine essential amino acids required by the human body, features rapid absorption and high bioavailability, and supports muscle protein synthesis, recovery, and overall health. Available primarily in three forms-whey protein concentrate (WPC), whey protein isolate (WPI), and whey protein hydrolysate (WPH)-this versatile supplement is widely used in sports nutrition products, dietary supplements, functional foods and beverages, infant formula, and clinical nutrition applications.

The whey protein powder market is witnessing robust demand due to the growing health and wellness movement across demographics. Athletes, bodybuilders, fitness enthusiasts, health-conscious professionals, and aging populations seeking to preserve muscle mass are driving large-scale adoption. The surge in gym memberships, rising participation in fitness activities, and growing awareness of protein's role in weight management, muscle building, and recovery are creating unprecedented opportunities. Additionally, technological innovations producing flavored varieties, ready-to-drink formats, and specialized formulations for lactose-intolerant consumers further expand market reach and consumer accessibility.

Plant Capacity and Production Scale

The proposed whey protein powder manufacturing facility is designed with an annual production capacity ranging between 5,000-10,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from sports nutrition and dietary supplements to functional foods, infant formula, and clinical nutrition applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Request for a Sample Report: https://www.imarcgroup.com/whey-protein-powder-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The whey protein powder manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 40-50%

Net Profit Margins: 15-25%

These margins are supported by sustained demand across health, fitness, and nutrition sectors, premium product positioning in the nutraceutical category, strong brand loyalty among fitness enthusiasts, and the essential nature of protein supplementation in modern dietary patterns. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established food and beverage manufacturers looking to diversify their product portfolio in the high-growth nutritional supplements sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a whey protein powder manufacturing plant is primarily driven by:

Raw Materials: 50-60% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, quality control, packaging, flavoring agents, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with liquid whey (sourced from cheese manufacturers), processing aids, and flavoring ingredients being the primary inputs. Establishing long-term supply agreements with reliable cheese processors and dairy cooperatives helps secure consistent whey supply and mitigates price volatility, which is critical for maintaining production continuity and cost predictability in this dairy-dependent manufacturing sector.

Capital Investment Requirements

Setting up a whey protein powder manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to cheese manufacturing facilities and dairy processing clusters to ensure fresh whey supply. Proximity to target consumer markets and distribution hubs will help minimize logistics costs. The site must have robust infrastructure, including reliable power supply, water resources for processing, effluent treatment capability, and cold storage facilities. Compliance with food safety regulations, dairy processing standards, and environmental guidelines must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized processing equipment essential for production. Key machinery includes:

Whey reception and storage tanks with temperature control for raw material handling

Clarification and separation systems for removing casein fines and fat particles

Ultrafiltration (UF) and microfiltration (MF) membrane systems for protein concentration

Ion exchange equipment for whey protein isolate production and demineralization

Evaporation systems for moisture reduction and concentration of protein solution

Spray drying towers with hot air systems for converting liquid concentrate to powder

Cooling and instantizing equipment for improving powder dispersibility and solubility

Blending systems for incorporating flavors, sweeteners, and functional ingredients

Sieving and milling equipment for uniform particle size distribution

Nitrogen flushing and packaging lines for moisture-resistant, oxygen-barrier packaging

Cold storage facilities for raw material and finished product preservation

Quality control laboratory with analytical instruments for protein content, amino acid profiling, microbiological testing, and moisture analysis

Clean-in-place (CIP) and sterilization systems for maintaining hygiene standards

Effluent treatment plant for managing dairy wastewater and ensuring environmental compliance

Civil Works: Building construction, cleanroom facilities, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, maintain stringent hygiene standards, and minimize cross-contamination risks throughout the production process. The layout should be optimized with separate zones for whey reception area, clarification and separation section, membrane filtration zone, evaporation unit, spray drying tower, powder handling and blending area, packaging section, quality control laboratory, raw material cold storage, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs, food safety certifications (FSSAI, HACCP, ISO 22000), regulatory compliance documentation, initial working capital for raw material procurement, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=10228&flag=C

Major Applications and Market Segments

Whey protein powder products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Sports Nutrition: Primary application in protein powders, protein bars, ready-to-drink shakes, and performance supplements targeting athletes, bodybuilders, and fitness enthusiasts seeking muscle growth, enhanced recovery, and improved athletic performance.

Dietary Supplements: Widespread use in protein supplements for general health, weight management products, meal replacement formulations, and wellness supplements serving health-conscious consumers, busy professionals, and aging populations seeking convenient nutrition solutions.

Functional Foods and Beverages: Growing applications in protein-enriched snacks, fortified dairy products, functional beverages, protein-enhanced bakery items, and nutrition bars where protein fortification adds value and meets consumer demand for healthier food options.

Infant Formula: Specialized applications in infant nutrition products where whey protein's amino acid profile closely matches human breast milk, supporting healthy growth, muscle development, and immune system function in infants and young children.

Clinical Nutrition: Therapeutic applications in medical nutrition products for patients requiring high-quality protein for wound healing, muscle preservation during illness, post-surgery recovery, and elderly care nutrition management.

End-use industries include sports and fitness, dietary supplements, food and beverage manufacturing, infant nutrition, clinical and medical nutrition, and personal wellness, all of which contribute to sustained market demand.

Why Invest in Whey Protein Powder Manufacturing?

Several compelling factors make whey protein powder manufacturing an attractive investment opportunity:

Health and Wellness Megatrend: The global shift toward health-conscious lifestyles, preventive nutrition, and active living creates unprecedented and sustained demand for high-quality protein supplements, positioning whey protein manufacturing at the center of the wellness economy.

Superior Nutritional Profile: Whey protein's complete amino acid composition, high biological value, rapid absorption rate, and proven efficacy in muscle protein synthesis make it the gold standard among protein supplements, ensuring consistent consumer preference and brand loyalty.

Expanding Consumer Base: Growing market penetration beyond traditional athletes and bodybuilders to mainstream consumers, including working professionals, women, seniors, and health-conscious millennials, significantly expands addressable market opportunity and revenue potential.

Premium Product Positioning: High-quality whey protein products command premium pricing due to their superior nutritional benefits, scientifically validated health claims, and strong brand differentiation, supporting attractive profit margins throughout the value chain.

Innovation Opportunities: Continuous product development in flavored variants, ready-to-drink formats, plant-whey blends, lactose-free formulations, clean-label products, and specialized formulations for specific health goals creates ongoing market excitement and consumer engagement.

Fitness Industry Growth: Rapid expansion of gym memberships, fitness centers, sports activities, wellness programs, and fitness influencer marketing dramatically amplifies awareness and adoption of protein supplementation across demographic segments.

E-Commerce Acceleration: The rise of online retail, subscription models, direct-to-consumer brands, and digital marketing platforms provides efficient market access, reduces distribution costs, and enables rapid scaling of whey protein businesses.

Manufacturing Process Excellence

The whey protein powder manufacturing process involves several precision-controlled stages:

Whey Reception and Storage: Fresh liquid whey is received from cheese manufacturing facilities and stored in temperature-controlled tanks to preserve protein quality and prevent microbial growth

Clarification and Separation: Whey undergoes centrifugal separation to remove casein fines, fat particles, and other impurities, producing clarified whey for further processing

Membrane Filtration: Ultrafiltration (UF) or microfiltration (MF) concentrates the protein content by removing lactose, minerals, and water while retaining beneficial bioactive compounds

Ion Exchange (for WPI): For whey protein isolate production, ion exchange chromatography further purifies and concentrates protein content to 90-95% purity levels

Evaporation: Concentrated liquid protein undergoes vacuum evaporation to reduce moisture content and increase total solids before spray drying

Spray Drying: Hot air spray drying converts liquid protein concentrate into fine powder particles with controlled moisture content and particle size distribution

Instantization: Powder undergoes agglomeration and lecithin treatment to improve dispersibility, solubility, and mixing characteristics in liquids

Blending and Flavoring: Base protein powder is blended with flavoring agents, sweeteners, vitamins, minerals, and other functional ingredients according to product specifications

Sieving and Quality Control: Final product is sieved for uniform particle size and subjected to rigorous quality testing for protein content, amino acid profile, moisture, microbiological safety, and sensory attributes

Packaging: Quality-approved powder is filled into moisture-resistant, nitrogen-flushed packaging (pouches, jars, sachets) with appropriate labeling and sealed for distribution

Industry Leadership

The global whey protein powder industry is led by established nutrition and dairy companies with extensive production capabilities and diverse product portfolios. Key industry players include:

Arla foods

Saputo Inc.

Fonterra Co-operative Group Ltd

Glanbia plc

Olam International Ltd

Carbery Group.

Agri-Mark, Inc

Agropur, Inc

The Milky Whey, Inc

Fairway Dairy & Ingredients

These companies serve diverse end-use sectors including sports nutrition, dietary supplements, functional foods, infant nutrition, and clinical nutrition applications, demonstrating the broad market applicability of whey protein powder products.

Buy Now:

https://www.imarcgroup.com/checkout?id=10228&method=2175

Recent Industry Developments

July 2025: Foodpharmer, a prominent Indian health and nutrition influencer, introduced a clean-label whey protein brand named Only What's Needed (OWN). The brand centers on ingredient simplicity and formulation transparency, with key decisions-including product naming and ingredient selection-driven through public participation and community voting.

March 2025: French biotechnology company Verley unveiled FermWhey, the world's first animal-free whey protein portfolio developed using precision fermentation. The launch includes functional variants such as FermWhey Native, Microstab, and Gel, which will be supplied to food manufacturers and ingredient partners globally, providing a sustainable, dairy-free protein solution for a wide range of nutritional applications.

Conclusion

The whey protein powder manufacturing sector presents a strategically positioned investment opportunity at the intersection of health, wellness, nutrition, and active lifestyle trends. With favorable profit margins ranging from 40-50% gross profit and 15-20% net profit, strong market drivers including rising fitness consciousness, growing health awareness, expanding sports nutrition adoption, increasing demand for convenient protein supplementation, and supportive consumer trends toward preventive health and wellness, establishing a whey protein powder manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of superior nutritional profile, expanding consumer demographics, premium product positioning, continuous innovation opportunities, and strong distribution channel growth creates an attractive value proposition for serious nutraceutical investors committed to quality manufacturing, food safety excellence, and operational efficiency.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding client business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Whey Protein Powder Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4373447 • Views: …

More Releases from IMARC Group

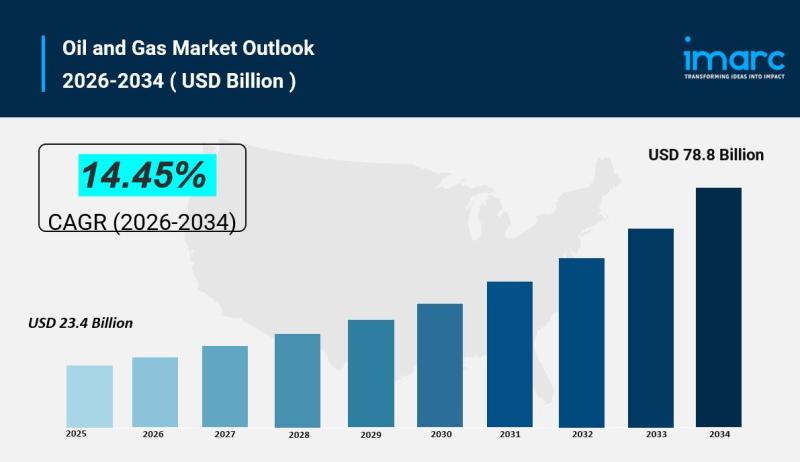

Oil and Gas Market Size, Growth Key Players, Latest Insights and Forecast 2026-2 …

IMARC Group has recently released a new research study titled "Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The global oil and gas market was valued at USD 23.4 Billion in 2025 and is forecast to reach USD 78.8…

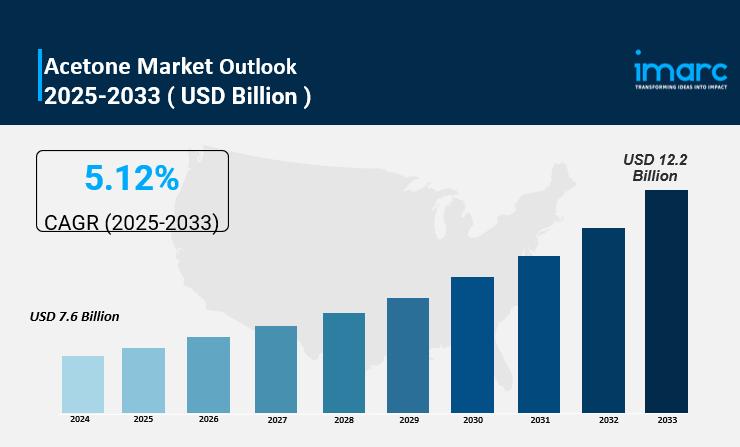

acetone market is Anticipated to Rise USD 12.2 Billion by 2033 | At CAGR 5.12%

IMARC Group, a leading market research company, has recently released a report titled " Acetone Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Acetone market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Acetone Market Overview

The global acetone…

Peanut Butter Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Ma …

The global food and beverage industry is experiencing a remarkable transformation driven by rising health consciousness, growing demand for plant-based protein products, and the increasing popularity of nutritional snack foods. At the forefront of this evolution stands peanut butter manufacturing-a dynamic segment that converts raw peanuts into nutrient-dense, protein-rich spreads consumed worldwide. As consumers increasingly seek convenient, healthy, and versatile food options that align with vegan, vegetarian, and gluten-free dietary…

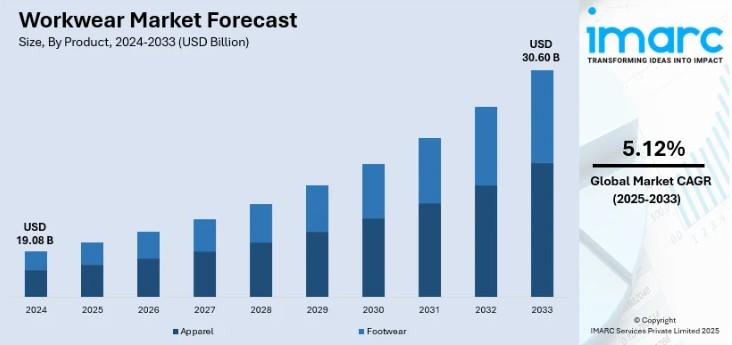

Workwear Market Size Share, Trends, Growth Drivers and Forecast 2034

IMARC Group has recently released a new research study titled "Workwear Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Workwear Market Size Overview

The global workwear market size was valued at USD 19.08 Billion in 2025. Looking forward, IMARC Group estimates…

More Releases for Whey

Clear Whey Isolate Market Report 2024 - Clear Whey Isolate Market Demand And Siz …

"The Business Research Company recently released a comprehensive report on the Global Clear Whey Isolate Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The clear whey isolate…

Pure Whey Protein Market Seeking Excellent Growth : New Whey Nutrition, Myprotei …

Advance Market Analytics published a new research publication on "Pure Whey Protein Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Pure Whey Protein market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Whey Deproteinized Whey Powder Market to Witness Robust Expansion by 2025

LP INFORMATION recently released a research report on the Whey Deproteinized Whey Powder market analysis and elaborate the industry coverage, current market competitive status, and market outlook and forecast by 2025. Moreover, it categorizes the global Whey Deproteinized Whey Powdermarket by key players, product type, applications and regions,etc.

The main objective of this market research is to help the readers understand the structure of Whey Deproteinized Whey Powdermarket, market definition,…

Medicated Fitness Supplements Market Segmentation, Industry trends and Developme …

Medicated Fitness Supplements are taken to maintain a healthy and fit lifestyle. These medicated fitness supplements are especially taken by gym goers. High disposable income, is a factor, which is playing an important role in driving the growth of the medicated fitness supplements market. The medicated fitness supplements include proteins, vitamins, which are taken for various purposes.

With the urbanization and increased intake of junk food, especially amongst teenagers, has increased…

Delctosed Whey Market

https://www.qandqmarketresearch.com/reports/7455554/delctosed-whey-market-99

The global Delctosed Whey market is valued at xx million US$ in 2018 and will reach xx million US$ by the end of 2025, growing at a CAGR of xx% during 20192025. The objectives of this study are to define, segment, and project the size of the Delctosed Whey market based on company, product type, end user and key regions.

This report studies the global market size of Delctosed Whey in…

Whey Protein Concentrates Market Segmentation By type of concentrates Deminerali …

Whey protein concentrates Market Outlook:

Whey protein refers to proteins derived from whey - the watery portion of milk formed during the production of cheese. Whey protein concentrate is a common bodybuilding supplement that is used to increase the intake of dietary protein. Whey protein concentrate is commonly available as a dietary supplement and has the highest nutritional value. Whey protein concentrate has various functional, biological and nutritional properties, which make…