Press release

India Credit Card Market to Reach USD 38.3 Billion by 2034 | 7.41% CAGR | Get Free Sample Report

According to IMARC Group's report titled "India Credit Card Market Size, Share, Trends and Forecast by Type, Service Providing Company, Credit Score, Credit Limit, Card Type, Benefits and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.India Credit Card Market Overview

The India credit card market size reached USD 20.1 Billion in 2025. Looking forward, IMARC Group forecasts the market to grow to USD 38.3 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.41% during the forecast period 2026-2034. This growth is driven by factors such as high digital adoption, increasing disposable incomes, expanding e-commerce, and greater financial literacy.

Note: For the most recent data, insights, and industry updates, please click on "Request Free Sample Report".

Request Free Sample Report: https://www.imarcgroup.com/india-credit-card-market/requestsample

India Credit Card Market Key Takeaways

• Current Market Size: USD 20.1 Billion (2025)

• CAGR: 7.41%

• Forecast Period: 2026-2034

• The growth of the India credit card market is fueled by rising digital adoption and growing disposable incomes.

• Increasing e-commerce activities and rising financial literacy contribute significantly to market expansion.

• Attractive rewards schemes and convenience in accessing credit enhance the market share.

• The trend towards cashless transactions is accelerating credit card usage in India.

India Credit Card Market Growth Factors

The credit card market has the potential to grow due to macroeconomic tailwinds and excitement around new modes of managing consumer finance. In addition to income growth and urbanization, issuance is expected to be driven by metro and Tier-1 cities, with accelerating penetration in Tier-2/3 cities expected to follow in due course. In addition, the emergence of Account Aggregators for credit scoring is allowing lenders to onboard new-to-credit customers from segments of the market that were previously excluded. Likewise, new regulations around enabling digital payments and for data protection and privacy are easing innovation while safeguarding consumer interests. Women's and freelancers' untapped economic potential is high, and issuers are creating new card accounts for consumers with complex cash flows.

The convergence of credit cards with the travel, healthcare and education ecosystems may support consumer use cases beyond use at retail point-of-sale terminals as the market continues to develop. With advent of enabling technology such as UPI-linked credit card and biometric authentication, card-based payments can move from premium markets towards mass-affluent markets and finally drive financial inclusivity through responsible credit availability. The next phase of growth could be driven by finding the right balance between innovation and managing risk to ensure sustainable growth across India's socio-economic spectrum.

India Credit Card Market Trends

The Indian credit card market is transforming because people adopt digital technology, consumer preferences change, and financial products innovate. Digital-native credit cards represent one of the fastest growing segments in the Indian credit card landscape because millennials and Gen Z consumers prefer them due to their app-based management and instant rewards. Also, hyper-personalization driven through the advance of AI-powered solutions is growing as banks begin to customize features like the categories eligible for cashback and credits based on customers' spending patterns. Partnering with e-commerce companies and co-branding cards that combine discounts and loyalty points for purchases strengthens the connection between payment processing and shopping.

At the same time, NFC-enabled cards and tokenization as a fraud prevention measure have made contactless payments the new table stakes, and the introduction of cards with subscription-based credit and rewards has helped satisfy the increasing demand for lifestyle privileges among affluent customers. In addition, green credit cards that come with a carbon offsetting program signal more environmental awareness on the part of urban customers. Also, embedded credit cards that connect directly to buy-now-pay-later (BNPL) are on the rise within a younger demographic, in particular. These innovations exist as part of a broader trend, where the market is evolving from a transactional tool to a holistic financial companion, blending convenience, personalization, and value-added services.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=30861&method=3462

India Credit Card Market Segmentation

Type Insights:

• General Purpose

• Private Label

Service Providing Company Insights:

• Visa

• Mastercard

• RuPay

• Others

Credit Score Insights:

• 300-500

• 501-700

• 701-850

• Above 851

Credit Limit Insights:

• Up to 25K

• 25-50K

• 51K-2L

• 2L-5L

Card Type Insights:

• Base

• Signature

• Platinum

Benefits Insights:

• Cashback

• Voucher

Regional Insights

• North India

• South India

• East India

• West India

The India credit card market is dominated by the North India region, which holds the largest market share. The market is forecasted to grow at a CAGR of 7.41% during 2026-2034, driven by economic activities and higher adoption of credit card usage across these regions.

India Credit Card Market Key Players

The report offers an in-depth examination of the competitive landscape, including market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

India Credit Card Market Recent Developments & News

• In July 2024, HDFC Bank, India's largest bank, updated terms for its credit card holders effective from August 1, 2024.

• In December 2024, ICICI Bank and Times Internet launched a super-premium co-branded metal credit card backed by Visa, named 'Times Black ICICI Bank Credit Card.'

• The card offers luxury travel perks and tailored privileges for affluent customers, with distinct metal cards embedded with historical printing plates symbolizing a blend of tradition and modernity.

India Credit Card Market Key Highlights of the Report

• Offers comprehensive quantitative analysis of market segments and historical/current trends.

• Provides insights on market drivers, challenges, and opportunities.

• Includes Porter's five forces analysis to evaluate competitive intensity and market attractiveness.

• Detailed competitive landscape analysis with company positioning and strategy evaluation.

• Extensive segmentation by type, service provider, credit score, credit limit, card type, benefits, and region.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=30861&flag=E

Customization Note: If you require any specific information not covered within this report's scope, we will provide it as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact. The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Credit Card Market to Reach USD 38.3 Billion by 2034 | 7.41% CAGR | Get Free Sample Report here

News-ID: 4350025 • Views: …

More Releases from IMARC Goup

Planning a Calcium Perchlorate Manufacturing Plant? Explore Investment Cost, Pro …

Calcium Perchlorate Production Cost Analysis Report

Calcium perchlorate is a high-performance inorganic salt widely used as a strong oxidizer and desiccant across specialty chemical applications. It finds demand in areas such as chemical synthesis, laboratory reagents, pyrotechnic/ignition formulations (regulated), specialty oxidizing systems, and moisture control/desiccant applications where high hygroscopicity and stable perchlorate chemistry are required.

Setting up a calcium perchlorate production unit can be commercially attractive due to its niche, high-value end-use…

Profitability Anaylsis of Industrial IoT Implementation Business in 2025: Expens …

IMARC Group's "Industrial IoT Implementation Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful industrial IoT implementation business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth…

How to Start an CNC Machining Services Business in 2025: Investment, Revenue Mod …

IMARC Group's "CNC Machining Services Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful CNC machining services business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth…

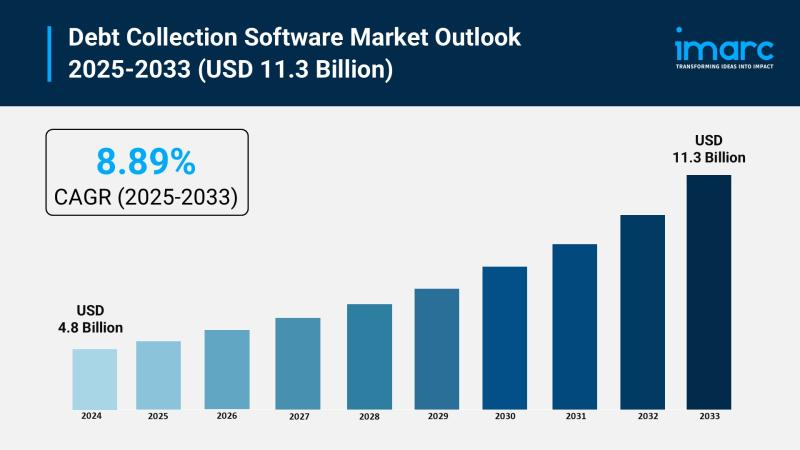

Debt Collection Software Market Size to Hit USD 11.3 Billion by 2033 | With a 8. …

Market Overview:

The debt collection software market is experiencing rapid growth, driven by rising consumer debt and delinquencies, technological advancements and automation, and stringent regulatory compliance and data security. According to IMARC Group's latest research publication, "Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033", The global debt collection software market size was valued at USD 4.8 Billion in 2024.…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…