Press release

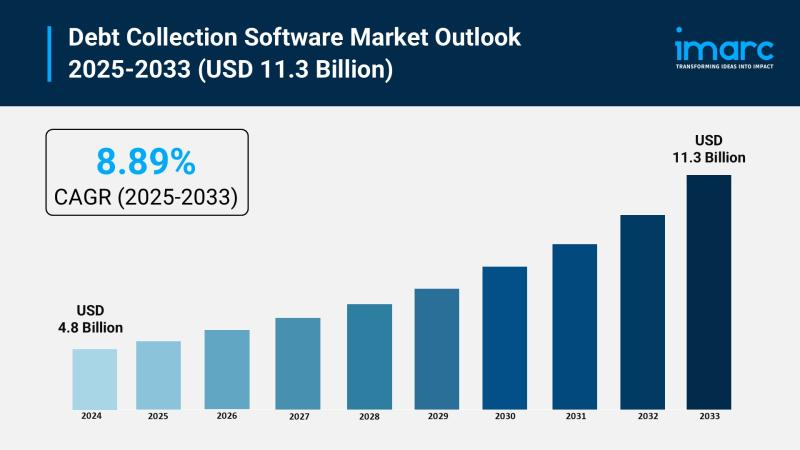

Debt Collection Software Market Size to Hit USD 11.3 Billion by 2033 | With a 8.89% CAGR

Market Overview:The debt collection software market is experiencing rapid growth, driven by rising consumer debt and delinquencies, technological advancements and automation, and stringent regulatory compliance and data security. According to IMARC Group's latest research publication, "Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033", The global debt collection software market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.3 Billion by 2033, exhibiting a CAGR of 8.89% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/debt-collection-software-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Debt Collection Software Market

● Rising Consumer Debt and Delinquencies

The global debt collection software industry is experiencing substantial growth fueled by escalating consumer debt levels and rising rates of delinquency across various economies. As household credit obligations, particularly from personal loans, credit cards, and new financial products like Buy Now, Pay Later (BNPL) services, continue to swell, financial institutions and collection agencies are compelled to seek more effective and automated recovery solutions. The sheer volume and complexity of these debt portfolios necessitate advanced software platforms to manage case segmentation, optimize workflow, and ensure timely communication. The expansion of fintech and digital lending platforms further contributes to this growth by generating a continuous flow of new, often fragmented, debt accounts that require sophisticated digital collection tools for efficient management and resolution.

● Technological Advancements and Automation

The infusion of advanced technologies, notably Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA), is a primary catalyst driving the market. These innovations are transforming the historically manual and labor-intensive process of debt collection into a highly efficient and data-driven operation. AI algorithms, for instance, are employed by major industry players like FICO and Experian to analyze thousands of data points to predict debtor behavior, such as the likelihood of repayment, and automatically suggest the optimal collection channel and time for outreach. This automation significantly reduces operational costs, which can represent a substantial percentage of total collection costs in manual processes, and allows human collectors to focus only on complex, high-value accounts, thereby maximizing overall recovery rates.

● Stringent Regulatory Compliance and Data Security

An increasingly complex and strict global regulatory landscape is a non-negotiable factor mandating the adoption of sophisticated software. Governments and regulatory bodies worldwide, including those overseeing regions with comprehensive consumer protection frameworks, are imposing tighter rules on ethical debt recovery practices, communication frequency, and the handling of sensitive personal data. Debt collection software is now essential for ensuring adherence to these constantly evolving compliance mandates, such as automated documentation of all debtor interactions and built-in controls for communication methods. Companies are prioritizing solutions that integrate multi-layered security measures and compliance reporting, as non-compliance can result in substantial fines and severe reputational damage, making modern, compliant software an indispensable investment.

Key Trends in the Debt Collection Software Market

● Adoption of Hyper-Personalized Omnichannel Communication

A key emerging trend is the shift from single-channel, aggressive collection tactics to hyper-personalized, omnichannel communication strategies designed to enhance the debtor experience. Modern platforms offer seamless interaction across various digital channels, including SMS, email, secure customer portals, and even popular messaging apps like WhatsApp. For example, some specialized collection software providers offer intelligent platforms that use predictive analytics to determine a debtor's preferred communication method and best time to contact them, resulting in a higher engagement rate. This customer-centric approach, which often includes self-service options and tailored repayment plans accessible online, is proving to lead to faster and more complete debt resolution, transforming collections into a more relationship-focused process.

● Migration to Cloud-Based and Software-as-a-Service (SaaS) Models

There is a rapid industry-wide migration towards cloud-based and Software-as-a-Service (SaaS) deployment models, moving away from legacy on-premises systems. This trend is driven by the need for greater scalability, reduced initial capital expenditure, and the ability to integrate effortlessly with other financial and enterprise systems. The cloud segment currently holds a significant share of the debt collection software market, demonstrating its dominant appeal. This shift allows small and medium-sized collection agencies to access advanced tools, including sophisticated AI and analytics, via a subscription model, which previously were only affordable for large enterprises. Moreover, cloud-based architectures facilitate real-time data synchronization and remote access, which is crucial for agile and geographically dispersed collection operations.

● Integration of Predictive Analytics for Portfolio Segmentation

The growing use of predictive analytics driven by Machine Learning (ML) is fundamentally changing how debt portfolios are managed, moving beyond simple stratification to nuanced segmentation. Companies are now leveraging ML models that process thousands of variables, including socio-economic and behavioral data, to assign a dynamic risk or propensity-to-pay score to each debtor account. This level of detail enables collection teams to segment accounts for targeted action: for instance, automatically routing high-propensity-to-pay accounts to digital self-service channels and dedicating the most experienced human agents to complex, high-value, but lower-propensity cases. This data-driven prioritization improves the efficiency of resource allocation, with some agencies reporting substantial increases in collector productivity by streamlining focus to the most recoverable accounts.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/checkout?id=4528&method=1670

Leading Companies Operating in the Global Debt Collection Software Industry:

● AgreeYa.com

● Chetu Inc.

● Debtrak

● EbixCash Financial Technologies

● Experian Information Solutions Inc.

● Fair Isaac Corporation

● Katabat Corporation (Ontario System)

● Nucleus Software Exports Ltd.

● Pegasystems Inc.

● Seikosoft

● TietoEVRY

● TransUnion LLC

Debt Collection Software Market Report Segmentation:

By Component:

● Software

● Services

Software leads with 65.2% market share in 2024, driven by digital transformation in financial institutions that enhances debt recovery processes through advanced functionalities and integration.

By Deployment Mode:

● On-premises

● Cloud-based

On-premises solutions dominate due to their security and control advantages, allowing organizations to manage sensitive data internally and integrate seamlessly with existing systems.

By Organization Size:

● Small and Medium Enterprises

● Large Enterprises

Large Enterprises hold 55.0% market share in 2024, requiring robust debt collection software to manage extensive financial data, optimize recovery strategies, and accommodate diverse debtor profiles.

By End User:

● Financial Institutions

● Collection Agencies

● Healthcare

● Government

● Telecom and Utilities

● Others

Financial Institutions lead the market by utilizing debt collection software to manage customer debts efficiently, improve cash flow, enhance customer relationships, and leverage data-driven insights.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America captures over 30.7% market share in 2024, fueled by the adoption of advanced technologies, a robust ecosystem of key players, and the integration of cloud-based solutions for efficient debt recovery.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Debt Collection Software Market Size to Hit USD 11.3 Billion by 2033 | With a 8.89% CAGR here

News-ID: 4284485 • Views: …

More Releases from IMARC Goup

Southeast Asia E-commerce Market Size, Share, Growth, Trends, Outlook and Indust …

According to IMARC Group's report titled "Southeast Asia E-Commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Country 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Southeast Asia E-commerce Market Outlook

The Southeast Asia e-commerce market size was valued at USD 269.63 Billion in 2025 and is projected to reach USD 1,480.47 Billion by 2034, growing at a compound annual…

India Generative AI Market: Emerging Trends, Growth Outlook and Industry Forecas …

According to IMARC Group's report titled "India Generative AI Market Size, Share, Trends and Forecast by Component, Technology, Application, Model, Customers, End Use, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Generative AI Market Overview

The India generative AI market size reached USD 1.30 Billion in 2024 and is expected to grow to USD 5.40 Billion by 2033, exhibiting…

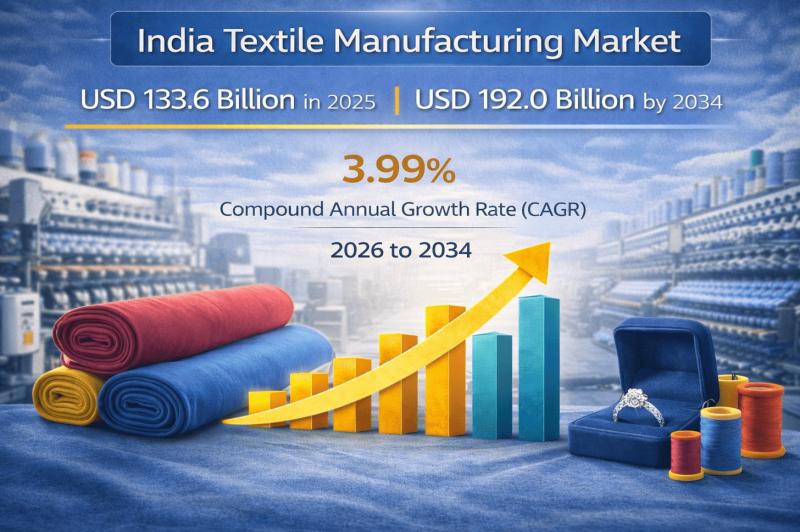

India Textile Manufacturing Market Report 2026-2034: Industry Size, Share, Growt …

According to IMARC Group's report titled "India Textile Manufacturing Market Size, Share, Trends and Forecast by Process Type, Textile Type, Equipment and Machinery, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Textile Manufacturing Market Outlook

The India textile manufacturing market size reached USD 133.6 Billion in 2025. The market is projected to grow at a compounded annual growth rate…

India Whey Protein Market Outlook 2026-2034: Size, Share, Growth, Trends and Ind …

According to IMARC Group's report titled "India Whey Protein Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Whey Protein Market Outlook

The India whey protein market size reached USD 185.9 Million in 2025. The market is projected to grow at a CAGR of 3.27% during the forecast period from…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…