Press release

Property Management Market Size US$ 40.7 Billion by 2031, CAGR 7.5%, North America Leads with 38% Share | Key Players IBM & AppFolio

The global Property Management Market reached US$ 23.4 billion in 2023 and is expected to reach US$ 40.7 billion by 2031, growing at a CAGR of 7.5% during the forecast period 2024-2031. The market is expanding steadily due to the rising number of residential, commercial, and mixed-use properties worldwide, along with increasing demand for professional property management services. These services support property owners by managing tenants, leases, rent collection, maintenance activities, and regulatory compliance, helping improve operational efficiency and asset value.Digital transformation is a key growth driver, with the adoption of cloud-based property management platforms, mobile applications, automation, and data analytics enhancing workflow efficiency and tenant experience. The integration of smart building technologies and IoT-enabled systems is further improving real-time monitoring and predictive maintenance capabilities. North America continues to dominate the market due to its well-established real estate sector, while Asia Pacific is emerging as the fastest-growing region, driven by rapid urbanization, increasing construction activity, and rising institutional investments in real estate.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/property-management-market?sai-v

The Property Management Market refers to the global industry focused on services and software solutions used to manage, operate, and maintain residential, commercial, and industrial real estate assets.

Key Developments

✅ January 2026: In North America, demand increased for cloud-based property management platforms with integrated tenant engagement and AI-driven maintenance prediction features.

✅ December 2025: In Europe, property managers expanded use of lease automation and digital payment solutions to streamline billing and reduce administrative workload.

✅ November 2025: In Asia-Pacific, adoption of smart building integrations - linking IoT sensors with property management systems - grew to enhance energy efficiency and occupant comfort.

✅ October 2025: In Latin America, real estate firms accelerated implementation of mobile-first property management tools to support remote operations and tenant communications.

✅ September 2025: In the Middle East, real estate developers leveraged analytics dashboards within property management suites to improve portfolio performance insights.

✅ August 2025: In Africa, affordable SaaS-based property management solutions saw increased uptake among small and mid-size landlords to manage rentals and payments more efficiently.

Mergers & Acquisitions

✅ January 2026: In North America, a leading real estate software provider acquired a tenant engagement and facilities automation startup to strengthen its property management offerings.

✅ December 2025: In Europe, a major technology firm acquired a lease automation and analytics platform to expand its integrated real estate solutions portfolio.

✅ November 2025: In Asia-Pacific, a regional property management tech group acquired a mobile property management app developer to broaden its product suite for landlords and property managers.

Key Players

IBM | Accruent | AppFolio, Inc. | Archidata Inc. | Buildium | CIC Properties | Entrata, Inc. | FSI Architecture PC | Hemlane, Inc. | Indus Systems

Key Highlights

IBM holds 24.9% share, driven by enterprise-grade asset and property management solutions, strong analytics and AI capabilities, and widespread adoption across large commercial real estate portfolios.

AppFolio, Inc. holds 18.6% share, supported by cloud-native property management software, strong presence in residential and mixed-use properties, and high adoption among small to mid-sized property managers.

Entrata, Inc. holds 16.8% share, benefiting from an all-in-one property management platform, strong customer retention, and expanding functionality across leasing, accounting, and resident engagement.

Accruent holds 13.7% share, driven by its strength in facilities, asset, and real estate lifecycle management, particularly across enterprise and regulated environments.

Buildium holds 9.5% share, supported by intuitive property management tools, strong penetration in SMB property management firms, and integration with accounting and payment systems.

Hemlane, Inc. holds 6.2% share, benefiting from hybrid property management models, automation of leasing and tenant communication, and growing adoption among independent landlords.

Indus Systems holds 4.2% share, driven by customizable real estate and property management software solutions and regional enterprise deployments.

Archidata Inc. holds 3.1% share, supported by specialized property data management and niche real estate software offerings.

CIC Properties holds 2.0% share, focused on internal property management platforms and selective commercial deployments.

FSI Architecture PC holds 1.0% share, contributing through niche architecture-integrated property and facilities management solutions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=property-management-market?sai-v

Market Drivers

- Growing urbanization and expansion of residential, commercial, and mixed-use properties increasing demand for professional property management services.

- Rising adoption of digital property management platforms for tenant management, rent collection, and maintenance coordination.

- Increasing focus on operational efficiency, compliance, and cost optimization among property owners and real estate investors.

- Growth of rental housing, co-living, and commercial leasing markets globally.

- Integration of smart building technologies and data analytics into property management operations.

Industry Developments

- Continuous innovation in cloud-based property management software and mobile applications.

- Integration of AI-driven analytics for predictive maintenance, tenant insights, and asset optimization.

- Strategic partnerships between property management firms and proptech solution providers.

- Expansion of service offerings to include facility management, energy management, and sustainability services.

- Growing focus on cybersecurity, data privacy, and regulatory compliance in property management systems.

Regional Insights

North America - 38% share: "Driven by a mature real estate market, high adoption of property management software, and strong demand for professional management services."

Europe - 27% share: "Supported by established rental housing markets, increasing digitization of property operations, and strong regulatory frameworks."

Asia Pacific - 29% share: "Fueled by rapid urbanization, expanding rental and commercial property markets, and growing adoption of digital property management solutions."

Latin America - 4% share: "Driven by growing urban housing demand and increasing adoption of professional property management services."

Middle East & Africa - 2% share: "Supported by large-scale real estate developments, smart city initiatives, and increasing investments in property management technologies."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/property-management-market?sai-v

Key Segments

By Offering

Solutions dominate the market, driven by increasing adoption of integrated platforms for lease accounting and real estate management. Asset maintenance management holds a significant share, supported by the need to optimize asset lifecycle and reduce operational costs. Workspace and relocation management is gaining traction due to rising workplace optimization initiatives. Reservation management contributes notably by enabling efficient space utilization and scheduling.

Services represent a substantial segment, supported by demand for deployment and integration, consulting, support and maintenance, and service level agreement management to ensure seamless implementation and long-term system performance.

By Deployment

Cloud-based deployment accounts for the largest share, driven by scalability, cost efficiency, and ease of access. On-premise deployment remains relevant, particularly among organizations with strict data security, regulatory compliance, and customization requirements.

By Application

Construction and real estate represent the leading application segment, driven by complex property portfolios and increasing digitization of real estate operations. Government adoption is growing steadily, supported by public infrastructure management and compliance needs. Retail holds a significant share, driven by demand for efficient space and asset management across multiple locations. Hospitality applications are expanding due to focus on optimizing property utilization and guest experience. Other applications contribute through diverse enterprise asset management needs.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Property Management Market Size US$ 40.7 Billion by 2031, CAGR 7.5%, North America Leads with 38% Share | Key Players IBM & AppFolio here

News-ID: 4338838 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

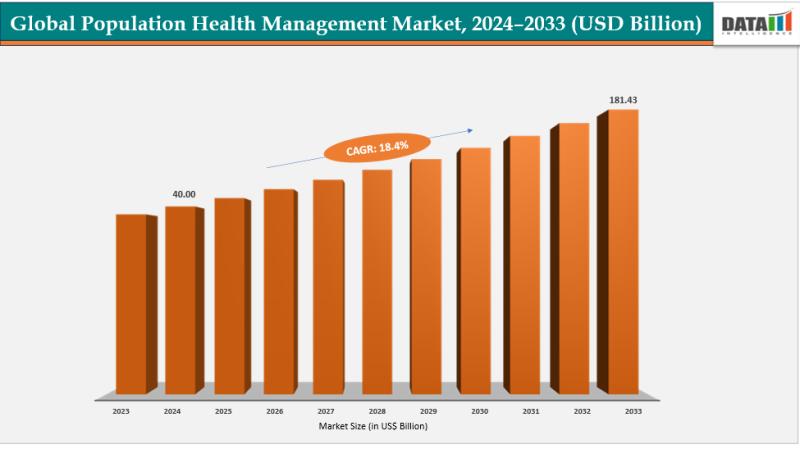

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

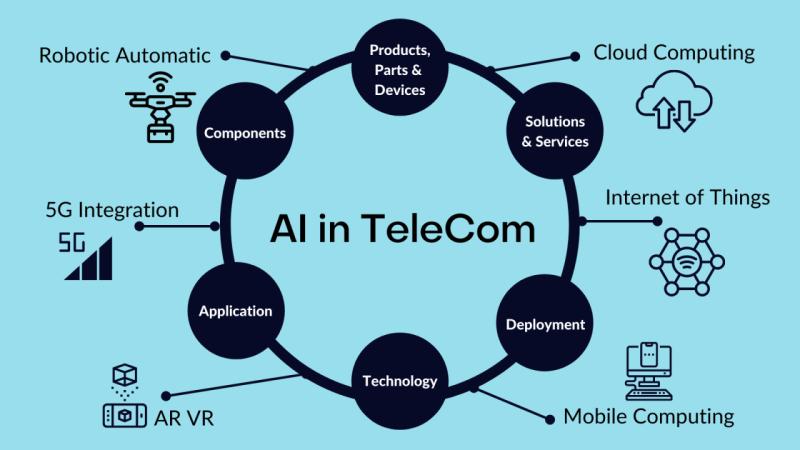

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Property

A Fresh Beginning: Property Geek's New Property Portfolio

Bangalore, 07 Sep 2023

Property Geek, the industry leader in real estate innovation, is thrilled to unveil its latest jewel in the crown: a spectacular portfolio of newly launched properties that redefine luxury living. With a commitment to excellence and an eye for perfection, Property Geek is proud to present a collection that surpasses expectations.

Why Property Geek Stands Out

"Our newly launched properties boast a stunning array of amenities that cater to…

Property abroad. French property price increase

French property prices showed a steady increase in 2005 with more property sales passing through the books of local French estate agents.

According to investment property experts, apartment prices rose by 10.6 per cent in 2005, while the price of a house or Villa rose by 9.9 per cent. Although both figures are lower than those for 2004, the FNAIM was very happy with the fact that there was…

Property abroad: Costa Blanca property sales increase

Over 50,000 Costa Blanca property sales will take place over next decade

The thirst for Spanish property on the Costa Blanca in Spain has grown enormously over the past two years. British investors looking for the ideal property abroad have moved here in droves buying holiday,retirement or investment property. Costa Blanca is the most popular location for buying property in Spain at the moment . Its warm climate…

Property abroad. Bulgarian property. Bansko or the beach for Investment property …

As authorities in Bulgaria prepare to debate legislation on the Black Sea building regulations. Bansko gains momentum.

Bulgarian property is still gaining momentum. The number of Britons buying Bulgarian property in 2005 rose by 77 per cent on the previous year. With the promise of E.U. entry in 2007 or 2008 and flight increases to regional airports, and analysts' expecting a 15-20 per cent rise over the next year, demand…

Off Plan Property - Property Investment Made Simple?

Over the past 5 years several property investment companies have sprung up offering naive property investors the chance to share in the growth in the UK property investment industry. some companies offer excellent advice and resources but the majority of them have jumped on the property investment bandwagon and offer nothing more than slick marketing without any substance or very little experience.

Damian Qualter, MD of www.BuyProperty4Less.com, states " The Property…

Property Investment UK - Buying Off Plan Property Advice

"Property Investment - How can we do that?"

"Many of our clients are first time investors who want to jump on the Property investment bandwagon. Most have ailing pension funds and need someone who can just guide them in the off plan property maize to make an informed decision based on facts and potential of the investment NOT based on how much commission the sales person can make "rail-roading" unsuspecting…