Press release

The Global Property Guide – relaunched

The Global Property Guide today re-launched its web site to make its data more accessible. The home page has been simplified. Major categories have been spelled out. The new Home Page has been organized around an expanded menu, to help the reader navigate the site. Key data items are easier to find, more obvious.The Global Property Guide

The Global Property Guide is the authoritative source of information on buying residential property. It covers every investible country in the world, from the perspective of income, tax, and capital gains. We provide research and information on 131 countries to residential property investors, with brief information on 85 countries.

Property, as an asset class, is highly susceptible to booms and busts. Across the Western world major countries have experienced a prolonged residential property boom.

Like stock prices (but with markedly different dynamics) residential property prices are now coming back down to earth. We help investors make sense of these swings by providing tools of analysis, and displaying data in a clear, comprehensive and accurate format.

Our fundamental residential property market data includes

• Price change 1 year

• Price change 5 year

• Price change 10 year

• Square metre price city centre

• Total round-trip transaction cost

• Gross yield

• Price to rent (P/R) ratio

• Price to Gross Domestic Product

• Change in interest rates

• Taxes on income (effective rates)

• Capital gains tax (effective)

• Inheritance taxes (effective)

• Buying process (graded by quality)

• Tenant legislation (graded as landlord-friendly)

• Residence (high tax / low tax)

• Economic growth

• Competitiveness

• GDP per capita

• Competitiveness rank, improvement over 5 years

• Stage of economic cycle

“Our aim is to be the Bloomberg of international residential property,” says publisher Matthew Montagu-Pollock, referring to the financial site on trading desks around the world (http://www.bloomberg.com/). “Bloomberg provides data - but also makes it easy to use.”

“It’s important for a residential investor be able to see what his likely return on investment will be. What his taxes will be. To be able quickly to check whether the laws are landlord-friendly. To survey the inheritance laws. All this is now available, for almost every country in the world, on our site, without any marketing material or any attempt to sell you anything – just the facts.”

###

Publisher:

Matthew Montagu-Pollock Phone: (+632) 867 4220 Mobile: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide is an on-line property research house.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Property Guide – relaunched here

News-ID: 43002 • Views: …

More Releases from Global Property Guide

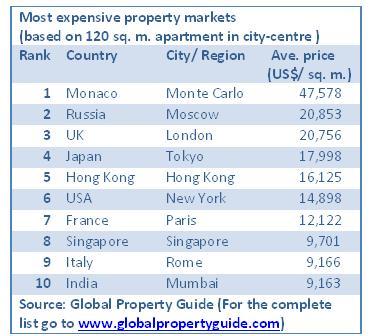

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…