Press release

Global Sustainable Finance Market Forecast to Surge at 24.19% CAGR, Europe Commands Largest 40% Market Share | DataM Intelligence

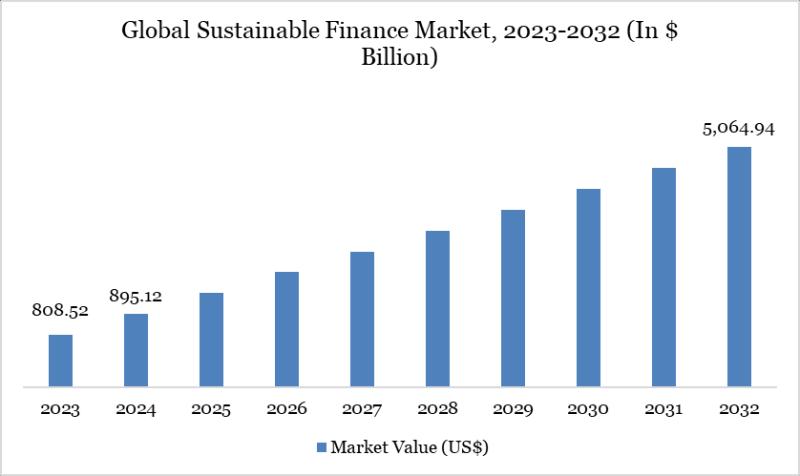

The Global Sustainable Finance Market reached approximately US$895.12 billion in 2024 and is expected to reach about US$ 5,064.94 billion by 2032, growing at a CAGR of around 24.19% during the forecast period from 2025 to 2032.This rapid growth is driven by factors including increasing investments in sustainable and ESG-aligned assets, supportive government policies promoting clean energy and resilient infrastructure, as well as advancements in AI and fintech technologies enhancing transparency and efficient sustainable investment management. Additionally, the growing awareness of climate change risks and the need for sustainable economic activities are accelerating the market growth globally.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/sustainable-finance-market?ram

United States: Key Industry Developments

✅ November 2025: Tech Mahindra launched i.GreenFinance, an AI-driven sustainable lending platform developed on AWS cloud infrastructure, designed to transform green and sustainability-linked loans origination and management for financial institutions worldwide.

✅ September 2025: SEB reported that in the first eight months of 2025, the sustainable finance market in the US recorded $1.45 trillion in new issuances, with an increase in green bond issuances focused on decarbonization in hard-to-abate industries.

✅ March 2025: The U.S. Equal Employment Opportunity Commission and Department of Justice issued new guidance promoting diversity, equity, and inclusion (DEI) policies at work, indirectly influencing sustainable finance by emphasizing social governance factors.

Japan: Key Industry Developments

✅ March 2025: Japan's Sustainability Standards Board announced IFRS-aligned Sustainability Disclosure Standards aimed at mandatory sustainability reporting for Prime Market-listed companies in Tokyo, setting a robust regulatory framework for sustainable finance.

✅ September 2025: MUFG highlighted its roadmap to net zero by 2030 with initiatives focusing on sustainable finance, engagement, and emission reductions, reinforcing Japan's commitment to climate action through finance.

✅ August 2025: The Japanese government increased subsidies for companies investing in sustainable finance and eco-conscious manufacturing, encouraging innovations supporting ESG goals aligned with global climate targets.

Key Merges and Acquisitions (2025):

✅ TotalEnergies: The company doubled its electricity production capacity with a $5.9 billion acquisition.

✅ Invest Green Acquisition Corporation: This special purpose acquisition company (SPAC) completed a $172.5 million IPO in November 2025 with plans to target mergers or acquisitions in the renewable energy, sustainable finance, and nuclear energy sectors.

✅ Apollo: Acquired a 50% stake in a UK offshore wind farm from Ørsted for $6.5 billion.

✅ Allianz, BlackRock, and T&D Holdings: Agreed to acquire Viridium, a manager of closed life-insurance policies, for $3.8 billion.

✅ Meiji Yasuda Life Insurance Company: Made a $2.3 billion acquisition of Legal & General Group's US insurance entity.

✅ ESG data and tools providers: Several acquisitions took place in this segment, such as Carbon Direct acquiring Pachama, Denominator acquiring Equileap, and Novata acquiring Atlas Metrics.

Market Segmentation Analysis:

-By Investment Type: Fixed Income Leads with 41% Market Share

The fixed income segment holds around 41% share in 2024, driven by widespread demand for stable returns and sustainable bonds, such as green bonds and social bonds, issued by governments and corporations. Equity comes next, representing over 35-65% of sustainable fund assets globally, fueled by strong stock market performance and investor interest in ESG-compliant companies. Mixed allocation and others make up the remaining share, supporting diversified sustainable investment strategies.

-By Transaction Type: Green Bonds Dominate

Green bonds are the leading transaction type segment due to their extensive adoption for financing environmentally friendly projects and climate initiatives by governments, financial institutions, and corporations. Other transaction types include social bonds, mixed-sustainability bonds, and ESG integrated investment funds, which contribute smaller but growing market shares as the sustainable finance ecosystem expands.

-By End-User: Institutional Investors Command 79% Market Share

Institutional investors dominate the sustainable finance market with 79% of the market, reflecting their large asset bases and strong commitments to ESG and climate goals. Retail investors represent the remaining share, growing steadily as awareness and sustainable product offerings increase. This segmentation by end-user highlights institutions as the primary growth drivers and fund sources.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=sustainable-finance-market?ram (Purchase 2 or more Reports and get 50% Discount)

Growth Drivers:

-Increasing global awareness of climate change and the urgent need for a low-carbon economy, which drives demand for sustainable financial products.

-Regulatory bodies and governments implementing stricter ESG (Environmental, Social, and Governance) policies compel corporations and investors to adopt sustainable finance practices.

-Technological advancements in green tech, data analytics, and fintech enhance ESG risk assessment and management. Rising investor demand, particularly from institutional and retail investors, favors sustainable investment vehicles like green bonds and impact investments.

-Expansion in emerging markets seeking funding for clean energy and sustainable infrastructure also fuels market growth.

-Additionally, consumer preference shifts towards ethical and environmentally responsible financial products contribute significantly to this market's expansion.

Regional Insights:

-Europe: Europe holds the largest market share in sustainable finance, with market shares cited between 40% in 2024. This is driven by its proactive regulatory environment, including initiatives like the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR). Strong governmental support and high investor demand for ESG-compliant assets also contribute to its market leadership.

-North America: North America is a major market for sustainable finance, with reported market shares ranging from 35% in 2024. The region benefits from a well-established financial ecosystem, high investor awareness, and strong regulatory support for sustainable investments. The U.S. and Canada have shown increasing adoption of ESG-focused strategies, with significant institutional investment.

-Asia-Pacific: The Asia-Pacific region is the fastest-growing market, projected to expand at a Compound Annual Growth Rate (CAGR) of 27.3% from 2025 to 2030. While its 2024 market share is estimated to be smaller than Europe and North America (around 19%), its rapid growth is fueled by increasing government initiatives promoting green finance, significant investments in green projects, rising investor awareness, and ambitious sustainability goals in countries like China, Japan, and South Korea.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/sustainable-finance-market?ram

Key Players:

BlackRock, Inc. | HSBC Holdings plc | The Goldman Sachs Group, Inc. | Morgan Stanley | BNP Paribas S.A. | Amundi S.A. | The Vanguard Group, Inc. | State Street Global Advisors, Inc. | UBS Group AG | Triodos Bank N.V.

Key Highlights (Top 5 Key Players) for Sustainable Finance Market:

-HSBC Holdings plc reported USD 54.1 billion in sustainable finance deals in the first half of 2025, marking a 19% increase year-over-year. The bank has provided a cumulative total of USD 447.7 billion in sustainable finance since 2020, with targets of USD 750 billion to 1 trillion by 2030.

-The Goldman Sachs Group, Inc. is recognized as a key player in the sustainable finance market, actively involved in offering sustainable financing solutions contributing significantly to the market growth.

-Morgan Stanley is also among the major contributors to the sustainable finance market, driving growth through innovative financial products and services geared toward sustainability.

-BNP Paribas S.A. is a prominent participant actively engaged in sustainable finance, helping shape the market with its suite of finance products tailored for sustainability goals.

-UBS Group AG plays a vital role in the global sustainable finance market, with substantial investments and financing activities aligned with environmental and social governance principles.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Sustainable Finance Market Forecast to Surge at 24.19% CAGR, Europe Commands Largest 40% Market Share | DataM Intelligence here

News-ID: 4290659 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

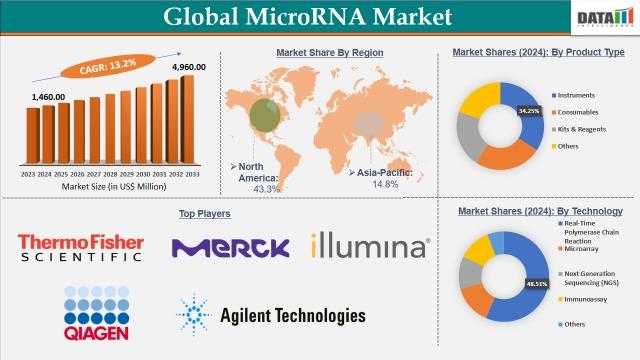

MicroRNA Market to Reach US$ 4,960.0 Million by 2033 at 13.2% CAGR; North Americ …

The MicroRNA market reached US$ 1,640.00 million in 2024 and is expected to reach US$ 4,960.00 million by 2033, growing at a CAGR of 13.2% during the forecast period 2025-2033. Market growth is supported by the expanding use of microRNAs as biomarkers and therapeutic targets in cancer, cardiovascular diseases, neurological disorders, and infectious conditions, along with rising demand from research and clinical applications.

Strong momentum is coming from advancements in next-generation…

United States Grid-Scale Battery Market Establishes Storage as a Strategic Asset …

DataM Intelligence has published a new research report on "Grid-Scale Battery Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

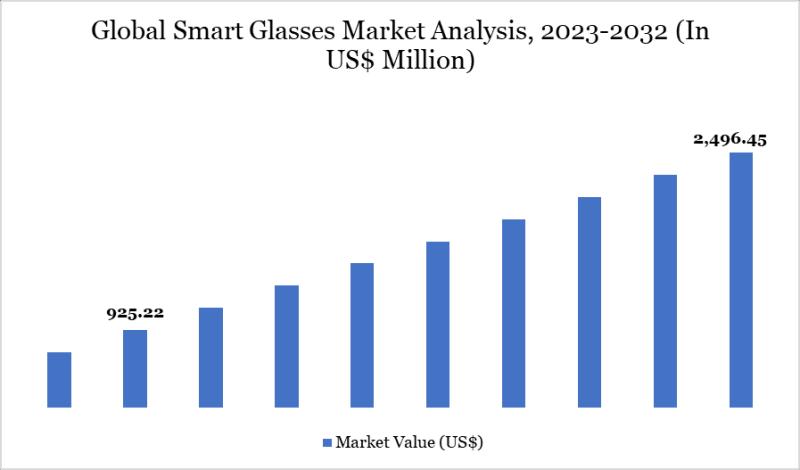

Smart Glasses Market Set for Explosive Growth to USD 2,496.45 Million by 2032, L …

The Global Smart Glasses Market size reached USD 925.22 million in 2024 and is expected to reach USD 2,496.45 million by 2032, growing with a CAGR of 13.21% during the forecast period 2025-2032.

Market growth is driven by rising demand for augmented reality (AR) in consumer electronics, enterprise applications like remote assistance, and integration with AI assistants. Advancements in lightweight optics, extended battery life, expanding use cases in healthcare training and…

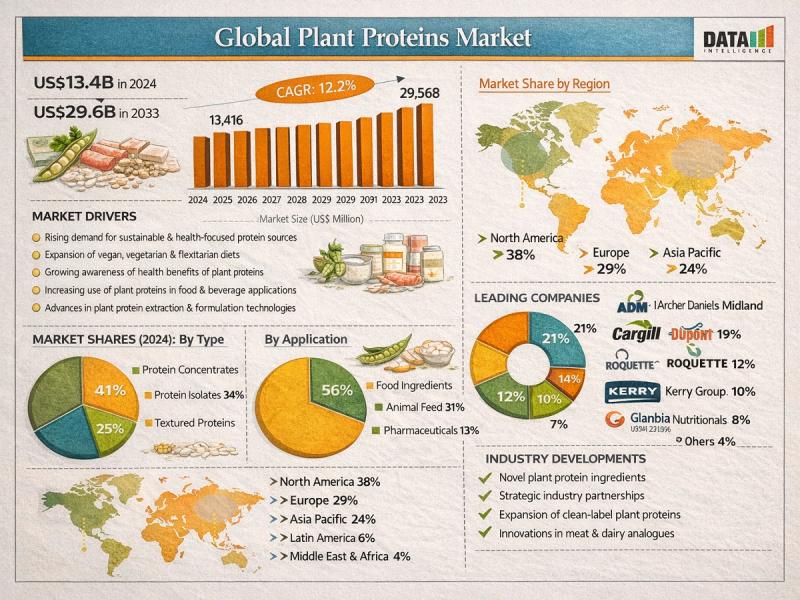

Plant Proteins Market to Reach US$ 29.6 Billion by 2033 at 12.2% CAGR; North Ame …

The global Plant Proteins market was valued at US$ 13.4 billion in 2024 and is projected to reach US$ 29.6 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2025-2033. Market growth is driven by rising consumer demand for sustainable, health-focused, and plant-based food options, increasing awareness of protein's role in nutrition, and expanding use of plant proteins in food and beverage applications such as meat…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…