Press release

Transforming the Environmental, Social And Governance (ESG) Investment Analytics Market in 2025: Increasing Demand For ESG Information On The Growth ESG Investment Analytics Market

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can be associated with improvements in economic reductions, enhancements in risk management, a surge in requirement for tools and solutions, increased focus on supply chain management, and management of company reputation.

The market for environmental, social and governance (ESG) investment analytics is anticipated to experience substantial expansion in the coming years, reaching a valuation of $3.88 billion in 2029 and an annual compound growth rate (CAGR) of 17.9%. This projected growth during the forecast period can be attributed to factors such as an increasing focus on corporate social responsibility, enhancements in operational efficiency, the growing significance of diversity and inclusion metrics, evolving consumer preferences, and advancements in data quality. The forecast period is also expected to witness considerable trends including the integration of blockchain technology, the use of ESG ratings, the emergence of real-time monitoring tools, sophisticated visualization tools, and the incorporation of internet of things (IoT) sensors.

What Factors Are Fueling Growth in the Environmental, Social And Governance (ESG) Investment Analytics Market?

As investors continue to seek out ESG (Environmental, Social, and Governance) information, it's predicted that the ESG investment analytics market will experience growth. ESG data provides insights into a company's various business practices, covering aspects of sustainability, ethics, and social responsibility. There's a growing pressure on companies to disclose detailed ESG metrics, such as information about their environmental impact, social initiatives, and governance procedures, adding transparency to their operations. This level of transparency allows investors to make more educated investment decisions and holds companies accountable for their actions. ESG investment analytics allows investors to gain a more comprehensive understanding of how businesses manage risks and opportunities related to ethical and sustainability practices, by incorporating ESG factors into their analysis. For instance, in May 2022, the ESG Global Study by Capital Group, a US-based financial services firm, showed that 89% of investors utilized ESG information in 2022, a rise from 84% in 2021, based on a survey of 1,130 individuals. Moreover, ESG information is considered a key investment determinant by 31% of European investors, compared to 26% of global investors. The increasing demand for ESG data among investors is set to boost the ESG investment analytics market.

Get Your Free Sample Now - Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19415&type=smp

Which Leading Companies Are Shaping the Growth of the Environmental, Social And Governance (ESG) Investment Analytics Market?

Major companies operating in the ESG investment analytics market are Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers International Limited, Ernst & Young Global Limited, KPMG International Limited, RSM International Ltd., Covestro AG, S&P Global Inc., LSEG Data & Analytics, Wolters Kluwer N.V., MSCI Inc., Conservice ESG, Institutional Shareholder Services Inc., Sustainalytics B.V., Intelex Technologies Inc., RepRisk AG, Vigeo Eiris, Persefoni AI Inc., Measurabl Inc., IdealRatings Inc., Arabesque S-Ray GmbH, Truvalue Labs Inc., Verisk Maplecroft, ESG Enterprise

What Are the Major Trends Shaping the Environmental, Social And Governance (ESG) Investment Analytics Market?

Leading corporations in the ESG investment analytics field are putting considerable effort into incorporating Artificial Intelligence (AI) to improve the precision of data, automate ESG metrics evaluation, and offer intricate insights into corporate behaviour and sustainability hazards. AI comes in handy in ESG investment analytics by competently processing and scrutinizing a broad variety of unstructured information, such as articles, reviews, and social media, to identify ESG-related trends and threats. This delivers insights to investors about the sustainability and ethical conduct of companies. For example, in November 2023, Nasdaq, a US financial services corporation, introduced the Nasdaq Sustainable Lens. This is an AI-empowered SaaS platform developed to streamline and analyse ESG data management for the financial sector, providing tools for summarization, benchmarking, and observing trends across over 9,000 companies' sustainability revelations. It makes ESG reporting effortless using an analytical approach, replacing manual research with advanced AI functionalities.

What Are the Key Segments of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The environmental, social and governance (ESG) investment analytics market covered in this report is segmented -

1) By Type: Addressing Environmental, Social And Governance (ESG) Expectations, Preparing Environmental, Social And Governance (ESG) Reports

2) By Organization Size: Large Enterprises, Small And Medium Enterprises (SMEs)

3) By Application: Financial Industry, Consumer, Retail

Subsegments:

1) By Addressing Environmental, Social, and Governance (ESG) Expectations: Environmental Performance Analytics, Social Impact Assessment, Governance Risk Analysis, Regulatory Compliance Tracking, Stakeholder Engagement Tools

2) By Preparing Environmental, Social, and Governance (ESG) Reports: ESG Reporting Software, Data Collection and Management Solutions, Benchmarking and Performance Measurement, Audit and Assurance Services, Customization and Framework Alignment

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/environmental-social-and-governance-esg-investment-analytics-global-market-report

Which Region Dominates the Environmental, Social And Governance (ESG) Investment Analytics Market?

Asia-Pacific was the largest region in the ESG investment analytics market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the ESG investment analytics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Environmental, Social And Governance (ESG) Investment Analytics Global Market Report?

- Market Size Analysis: Analyze the Environmental, Social And Governance (ESG) Investment Analytics Market size by key regions, countries, product types, and applications.

- Market Segmentation Analysis: Identify various subsegments within the Environmental, Social And Governance (ESG) Investment Analytics Market for effective categorization.

- Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

- Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

- Market Contribution: Evaluate contributions of different segments to the overall Environmental, Social And Governance (ESG) Investment Analytics Market growth.

- Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

- Industry Challenges: Analyze challenges and risks affecting the Environmental, Social And Governance (ESG) Investment Analytics Market.

- Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights - Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19415

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transforming the Environmental, Social And Governance (ESG) Investment Analytics Market in 2025: Increasing Demand For ESG Information On The Growth ESG Investment Analytics Market here

News-ID: 3868022 • Views: …

More Releases from The Business Research Company

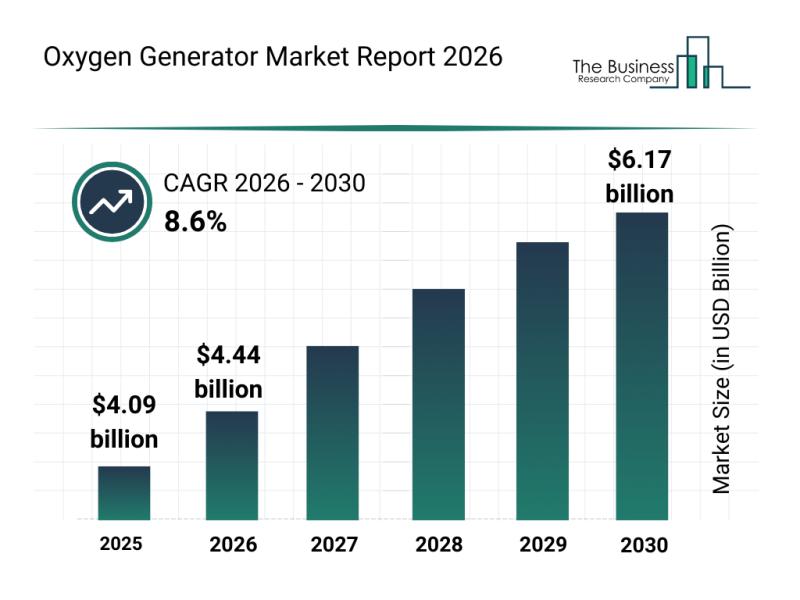

Worldwide Insights: The Rapid Development of the Oxygen Generator Market

"The oxygen generator market is positioned for significant expansion over the coming years, driven by diverse industrial and healthcare demands. With advancements in technology and increasing applications across various sectors, this market is set to witness robust growth as it adapts to evolving needs and innovations.

Projected Expansion and Market Size of Oxygen Generators Through 2030

The oxygen generator market is anticipated to grow steadily, reaching a value of $6.17 billion…

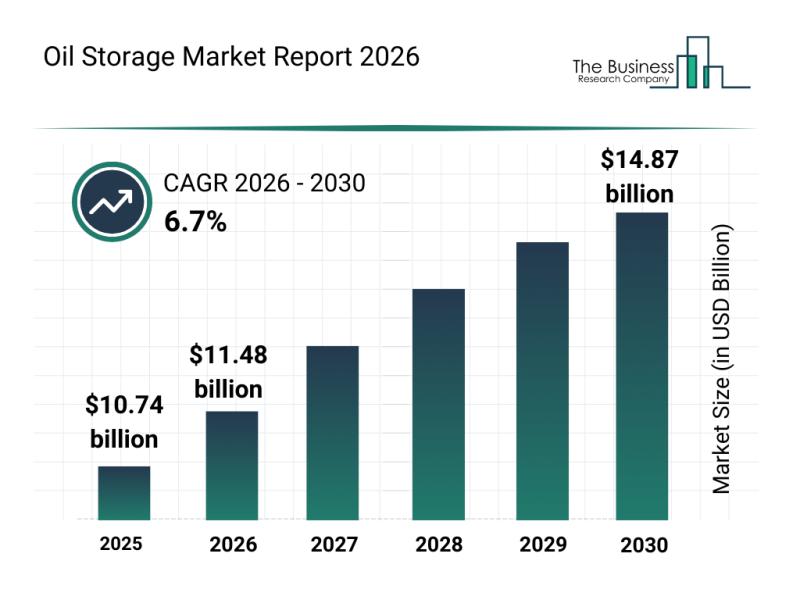

Segmentation, Major Trends, and Competitive Overview of the Oil Storage Market

"The oil storage sector is poised for notable expansion in the coming years, driven by increasing global energy needs and infrastructure development. As demand for efficient and secure storage solutions grows, the market is evolving with advanced technologies and strategic initiatives designed to meet the challenges of modern oil consumption and reserves management. Here's an overview of the market size, key players, emerging trends, and segmentation that define this industry's…

Worldwide Trends Examination: The Fast-Paced Development of the Motion Control M …

The motion control market is poised for significant expansion as industries increasingly adopt advanced automation technologies. With rising investments and technological breakthroughs, this sector is set to transform manufacturing and related fields by 2030. Let's explore the market's size, leading companies, emerging trends, and segment forecasts to understand its evolving landscape.

Expected Growth and Market Size of the Motion Control Market by 2030

The motion control market is on track for…

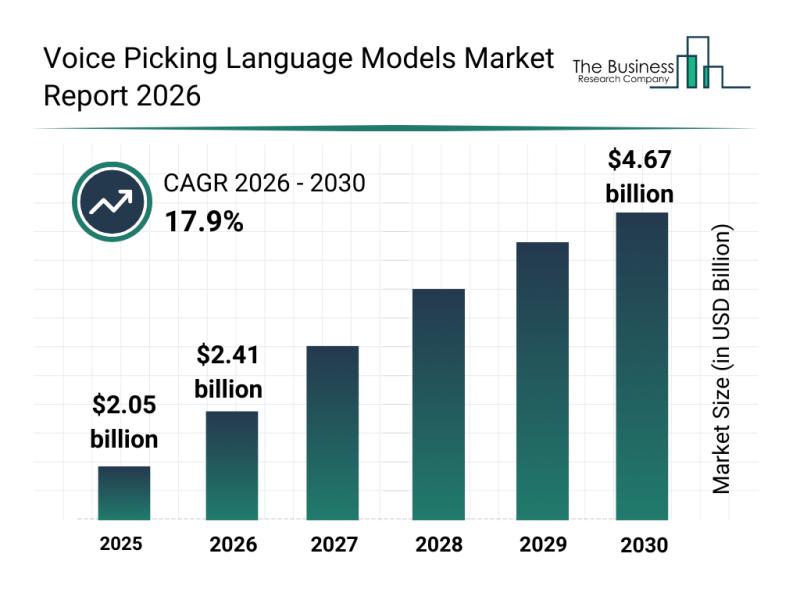

Global Trends Overview: The Rapid Evolution of the Voice Picking Language Models …

The voice picking language models market is poised for significant expansion in the coming years, driven by technological advancements and increasing adoption in logistics and warehouse environments. This sector is rapidly evolving as businesses prioritize efficiency and accuracy in their operations. Let's explore the market's size, growth factors, key companies, segmentation, and emerging trends shaping its future.

Projected Market Size and Growth Trajectory for the Voice Picking Language Models Market …

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…

ESG Reporting Software Market Unlocking Sustainability Performance: A Market Ana …

ESG Reporting Software Market worth $2.25 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global ESG Reporting Software Market- (By Component (Solutions, Services), By Deployment Type (On-premises, Cloud), By Organization Size (Large Enterprises, SMEs), By Vertical (BFSI, Government, Public Sector & Non-Profit, Retail)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the…