Press release

Foreign Exchange Market: Global Trends, Trading Insights, and Future Growth Outlook

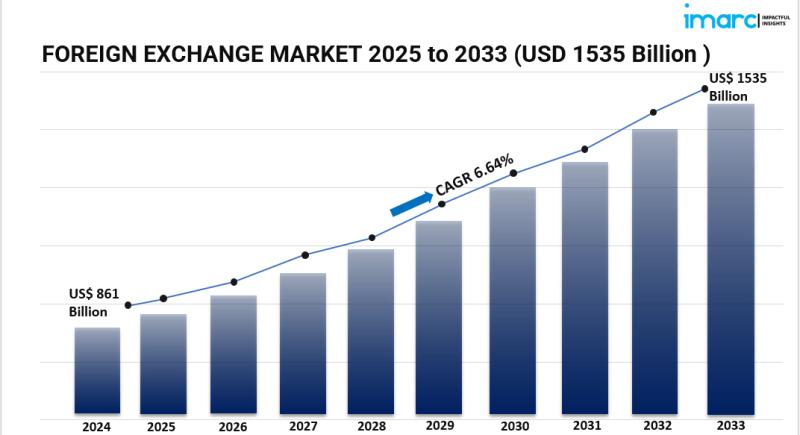

Foreign Exchange Market OverviewThe global foreign exchange market is experiencing strong momentum, with its value expected to grow from USD 861 billion in 2024 to USD 1,535 billion by 2033, expanding at a CAGR of 6.64% during the forecast period. This growth is primarily attributed to factors such as international interest rate differentials, the central role of the U.S. dollar, and the increasing globalization of businesses that rely on efficient currency exchange. Additionally, continuous technological advancements and the introduction of advanced digital trading platforms are enhancing accessibility and efficiency across the forex ecosystem.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Key Takeaways from the Foreign Exchange Market

The market is projected to expand from USD 861 billion in 2024 to USD 1,535 billion by 2033, growing at a CAGR of 6.64%.

North America is expected to capture a 25.8% share of the global market in 2024, supported by advanced technology and the global dominance of the U.S. dollar.

Interest rate differentials remain one of the most influential drivers of currency valuations and global trade volumes.

The U.S. dollar maintains its dominance, accounting for nearly 88% of all forex transactions worldwide.

Artificial intelligence and algorithmic trading are transforming market operations by boosting transparency, speed, and overall efficiency.

Request for a sample copy of this report:

https://www.imarcgroup.com/foreign-exchange-market/requestsample

Market Growth Drivers

1. Influence of Interest Rate Differentials

Interest rate decisions by central banks significantly affect currency movements. Countries offering higher interest rates attract international capital inflows, which strengthens their currencies and increases trading volumes. This pursuit of higher yields drives overall market liquidity and activity.

2. Dominance of the U.S. Dollar

The U.S. dollar remains the leading reserve currency and is involved in nearly 90% of global forex trades. Its broad acceptance ensures liquidity, facilitates trade, and reinforces its pivotal role in the international currency market.

3. Technological Innovations in Forex Trading

The adoption of digital trading platforms, AI-powered analytics, and automated trading systems is reshaping the forex industry. These technologies reduce costs, improve execution speeds, and broaden market participation for institutional as well as retail investors.

Market Segmentation

Breakup by Counterparty

Reporting Dealers: Large financial institutions executing high-volume trades and supplying liquidity.

Other Financial Institutions: Mid-sized entities focusing on asset management and hedging.

Non-financial Customers: Corporations and individuals using forex for trade settlements, investments, and travel.

Breakup by Type

Currency Swap: Agreements exchanging principal and interest in different currencies at future dates, widely used for hedging.

Outright Forward and FX Swaps: Contracts allowing currency exchange at predetermined rates and dates, enabling strategic planning.

FX Options: Contracts granting the right (but not obligation) to exchange currencies under agreed terms, ensuring flexible risk management.

Breakup by Region

North America: United States, Canada

Asia Pacific: China, Japan, India, South Korea, Australia, Indonesia, Others

Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Others

Latin America: Brazil, Mexico, Others

Middle East and Africa

Regional Insights

North America is projected to remain a dominant region in 2024, holding a 25.8% share of the global foreign exchange market. This leadership is driven by the region's advanced digital infrastructure, the centrality of the U.S. dollar, and stable economic fundamentals, which collectively promote high levels of trading activity.

Recent Developments & News

The adoption of AI-powered analytics and algorithmic trading is accelerating, enabling enhanced automation and improved decision-making. Furthermore, the growth of digital trading platforms has broadened accessibility, allowing diverse participants-including corporates, financial institutions, and individuals-to engage actively in forex trading. These advancements are positively shaping the market landscape.

Key Players

Barclays

BNP Paribas

Citibank

Deutsche Bank

Goldman Sachs

HSBC Holdings plc

JPMorgan Chase & Co.

The Royal Bank of Scotland

UBS AG

Standard Chartered PLC

State Street Corporation

XTX Markets Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1976&flag=C

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include in-depth market assessment, feasibility studies, company incorporation support, factory setup assistance, regulatory approvals and licensing, branding, marketing and sales strategies, competitive benchmarking, pricing analysis, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Foreign Exchange Market: Global Trends, Trading Insights, and Future Growth Outlook here

News-ID: 4169782 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

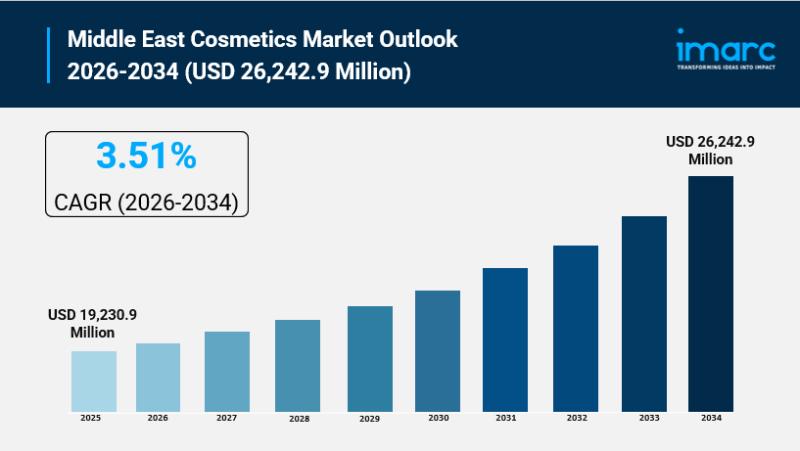

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Foreign

New York City Foreign Investment Lawyer Natalia Sishodia Explains Property Optio …

Natalia Sishodia (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), a New York City foreign investment lawyer and the managing attorney at Sishodia PLLC, has recently published a comprehensive blog post titled, "What Type of Property Can a Foreigner Buy in New York?" This insightful article provides a detailed overview of the various types of properties available for purchase by foreign investors in New York, a subject that is increasingly relevant in today's globalized real estate market.

As…

New York State Foreign Investment Attorney Natalia A. Sishodia Releases Comprehe …

New York State foreign investment attorney Natalia A. Sishodia (https://sishodia.com/step-by-step-guide-for-foreigners-buying-real-estate-in-new-york-city/) of Sishodia PLLC has released a pivotal article aimed at clarifying the complex process of purchasing real estate in New York City for foreign investors. The detailed guide provides invaluable insights and a clear path for international buyers navigating the bustling New York real estate market.

The real estate landscape in New York presents a unique set of opportunities and challenges,…

China courts concluded 295,000 foreign-related civil, commercial and foreign-rel …

Wang Shumei, the President of the Fourth Civil Trial Division of the Supreme People's Court of China, reported at a press conference on the 27th that from January 2013 to June 2022, China's courts at all levels concluded 295000 foreign-related civil, commercial and maritime cases in the first instance.

At the meeting, when introducing the main achievements of foreign-related commercial maritime trials in the new era, Wang Shumei talked about "the…

FOREIGN INVESTMENT IN SAUDI ARABIA

The Saudi Arabian government, in recent years, have taken steps to make company set up and operating in the Kingdom easier. Through economic reforms, the government have created a market that’s welcoming to foreign investors. The introduction of online portals, easing of processes and implementing new licenses have all contributed to the rapid increase in foreign investment in the Kingdom.

We created this whitepaper to give insight into setting up a…

A Foreign Exchange Solution to optimize the foreign currency value and control

The transaction of foreign exchange greatly depends on the current exchange rates. To ensure the stability of the currency value, our Sweden-based client required a Foreign Exchange Solution that administered the transaction of the various currencies in an organization. TatvaSoft had developed a Windows-based Application that controls the currency sell and buy, current currency value, and administer ledger by imposing the branch specific validations and rules.

A large amount of foreign…

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

Foreign Staffing Expanding Global Services to Include Foreign Payroll Services

With Foreign Staffing’s global presence expanding each month, clients have been growing as well. They have not only been seeking a solution to find new staff in other countries but they have also been seeking an efficient and compliant way to quickly employee this staff without having to establish a legal entity in the foreign country.

Foreign Staffing has spent the last…