Press release

Implantable Cardioverter Defibrillators (ICDs) Market Size Forecasted To Achieve 4.99 Billion By 2029 With Steady Growth

Our market reports now include the latest updates on global tariffs, trade impacts, and evolving supply chain dynamics.What Is the Implantable Cardioverter Defibrillators (ICDs) Market Size and Projected Growth Rate?

In recent times, the implantable cardioverter defibrillators (ICDs) market has seen significant growth. It is projected to escalate from $3.76 billion in 2024 to $3.99 billion in 2025, boasting a compound annual growth rate (CAGR) of 6.0%. The growth in the past period can be credited to factors such as a surge in sudden cardiac arrest cases, endorsement of implantable cardioverter defibrillator for preventing secondary sudden cardiac arrest, enhanced public comprehension, an increase in the elderly population, and encouraging strategies from governments and healthcare bodies, along with improved healthcare accessibility.

In the coming years, the market for implantable cardioverter defibrillators (ICDs) is anticipated to witness substantial growth, reaching $4.99 billion in 2029 with a compound annual growth rate (CAGR) of 5.8%. This expansion over the forecast period can be credited to the increasing acceptance of implantable defibrillators, the rising demand for more customized cardiac treatment, growing instances of cardiac rhythm disorders, and heightened demand in developing markets. Key trends for the projected period are advancements in technology, the launch of subcutaneous ICDs that bypass transvenous leads, the demand for combination ICD devices with pacemaker functionality, enhancements in sensing and detection algorithms, ongoing developments in wireless charging and battery technology, and the incorporation of artificial intelligence (AI) in healthcare and data analytics.

Purchase the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=20839

What Are the Major Segments in the Implantable Cardioverter Defibrillators (ICDs) Market?

The implantable cardioverter defibrillators (ICDs) market covered in this report is segmented -

1) By Type: Single Chamber Implantable Cardioverter Defibrillators (ICDs), Dual Chamber Implantable Cardioverter Defibrillators (ICDs), Biventricular Devices

2) By Applications: Bradycardia, Tachycardia, Heart Failure, Other Applications

3) By End User: Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Other End Users

Subsegments:

1) By Single Chamber Implantable Cardioverter Defibrillators (ICDs): Standard Single Chamber ICDs, MRI-Compatible Single Chamber ICDs, Wireless Single Chamber ICDs

2) By Dual Chamber Implantable Cardioverter Defibrillators (ICDs): Standard Dual Chamber ICDs, MRI-Compatible Dual Chamber ICDs, Wireless Dual Chamber ICDs

3) By Biventricular Devices: CRT-D (Cardiac Resynchronization Therapy Defibrillator), CRT-P (Cardiac Resynchronization Therapy Pacemaker), Biventricular ICDs With Advanced Features (Remote Monitoring, Wireless Capabilities)

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=20839&type=smp

What Are The Driving Implantable Cardioverter Defibrillators (ICDs) Market Evolution?

The surge in cardiovascular diseases (CVDs) is predicted to fuel the expansion of the implantable cardioverter defibrillators (ICDs) market in the future. CVDs consist of heart and blood vessel disorders, such as heart attacks, hypertension and stroke, which are often due to factors like poor dietary habits, lack of physical activity, smoking, and heredity. The escalating incidence of CVDs is primarily influenced by aging populations, unhealthy lifestyle habits, and an increase in risk factors such as obesity, diabetes, and high blood pressure. Implantable cardioverter defibrillators (ICDs) aid in managing CVDs by delivering life-saving electrical shocks to reinstate normal heart rhythms in patients who are prone to sudden cardiac arrest. For example, in December 2023, the Australian Institute of Health and Welfare, a government agency based in Australia, documented a rise in doctor-certified deaths due to coronary heart disease (CHD) from 14,100 in 2021 to 14,900 in 2022. Thus, the rising incidence of cardiovascular diseases (CVDs) is bolstering the growth of the implantable cardioverter defibrillators (ICDs) market.

Which Firms Dominate The Implantable Cardioverter Defibrillators (ICDs) Market Segments?

Major companies operating in the implantable cardioverter defibrillators (ICDs) market are Abbott Laboratories, Medtronic Inc., Koninklijke Philips N.V., Boston Scientific Corporation, ZOLL Medical Corporation, St. Jude Medical Inc., BIOTRONIK SE & Co. KG, Nihon Kohden Corporation, Fukuda Denshi Co. Ltd., LivaNova PLC, MicroPort Scientific Corporation, Japan Lifeline Co. Ltd., AtriCure Inc., Physio-Control Inc., BPL Medical Technologies Private Limited, Kestra Medical Technologies Inc., CU Medical Germany GmbH, Metrax GmbH, Intermedics Inc., Sorin Group S.p.A.

What Trends Are Expected to Dominate the Acquired Autoimmune Hemolytic Anemia Market in the Next 5 Years?

Leading businesses in the implantable cardioverter defibrillators (ICDs) market are honing their focus on technological innovations like low current consumption defibrillators to boost device performance, increase battery longevity, and improve patient comfort levels. These defibrillators, engineered to give electrical shocks to the heart with less energy consumption, efficiently extend their battery life while confirming effective arrhythmia treatment. To illustrate, MicroPort CRM, a France-situated medical device company, unveiled the ULYS implantable cardioverter defibrillator (ICD) and the INVICTA defibrillation lead in Japan in October 2023, signalling a significant progression in heart care technology. These devices are equipped with cutting-edge features, such as low current consumption that prolongs battery life along with MRI compatibility for patients requiring imaging procedures. The ULYS ICD comes with the PARAD+ arrhythmia discernment algorithm and AutoMRI capability, amplifying patient safety during MRI assessments. Moreover, the INVICTA lead demonstrates its reliability and effectiveness, evidencing 100% successful implantations and a 97.4% zero-complication rate in clinical trials.

Get the full report for exclusive industry analysis:

https://www.thebusinessresearchcompany.com/report/implantable-cardioverter-defibrillators-icds-global-market-report

Which Is The Largest Region In The Implantable Cardioverter Defibrillators (ICDs) Market?

North America was the largest region in the implantable cardioverter defibrillators market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the implantable cardioverter defibrillators (ICDs) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Frequently Asked Questions:

1. What Is the Market Size and Growth Rate of the Implantable Cardioverter Defibrillators (ICDs) Market?

2. What is the CAGR expected in the Implantable Cardioverter Defibrillators (ICDs) Market?

3. What Are the Key Innovations Transforming the Implantable Cardioverter Defibrillators (ICDs) Industry?

4. Which Region Is Leading the Implantable Cardioverter Defibrillators (ICDs) Market?

Why This Report Matters:

Competitive overview: This report analyzes the competitive landscape of the 3D imaging software market, evaluating key players on market share, revenue, and growth factors.

Informed Decisions: Understand key strategies related to products, segmentation, and industry trends.

Efficient Research: Quickly identify market growth, leading players, and major segments.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Implantable Cardioverter Defibrillators (ICDs) Market Size Forecasted To Achieve 4.99 Billion By 2029 With Steady Growth here

News-ID: 4067396 • Views: …

More Releases from The Business Research Company

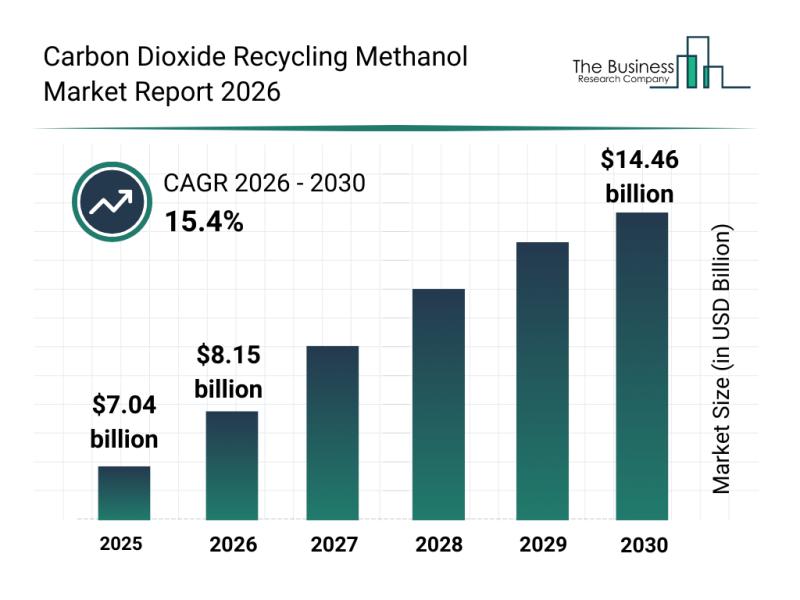

Top Players and Competitive Environment in the Carbon Dioxide Recycling Methanol …

The carbon dioxide recycling methanol market is poised for remarkable expansion as the world intensifies efforts toward sustainability and carbon neutrality. With increasing emphasis on reducing greenhouse gas emissions and boosting renewable energy sources, this market is set to play a pivotal role in the global transition to cleaner fuels and circular carbon economies. Here's a detailed look at its projected growth, influential players, emerging trends, and segmentation.

Forecasted Market Growth…

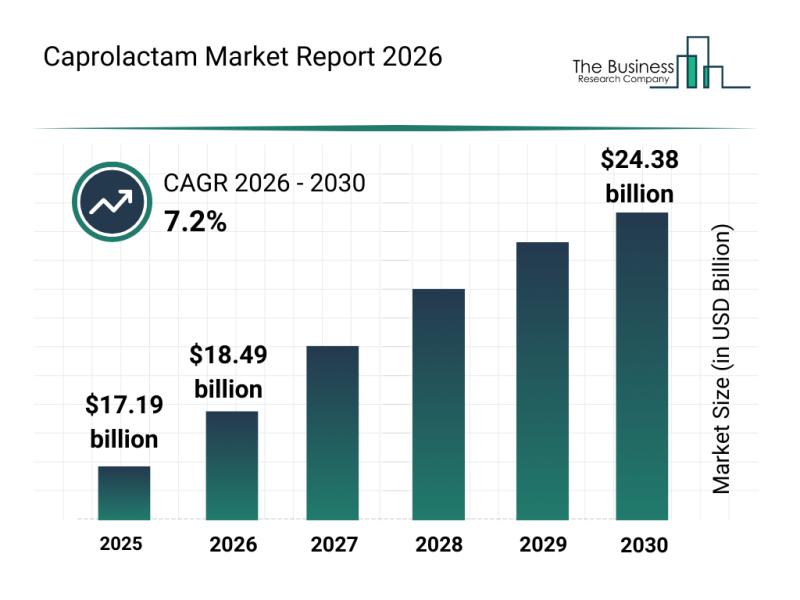

Emerging Sub-Segments Transforming the Caprolactam Market Landscape

The caprolactam market is set for significant expansion in the coming years, driven by evolving industrial needs and sustainability initiatives. This report delves into the anticipated growth, key players, emerging trends, and detailed market segmentation to offer a comprehensive view of the sector's future trajectory.

Caprolactam Market Size Forecast Through 2030

The caprolactam market is projected to reach a value of $24.38 billion by 2030, growing at a compound annual…

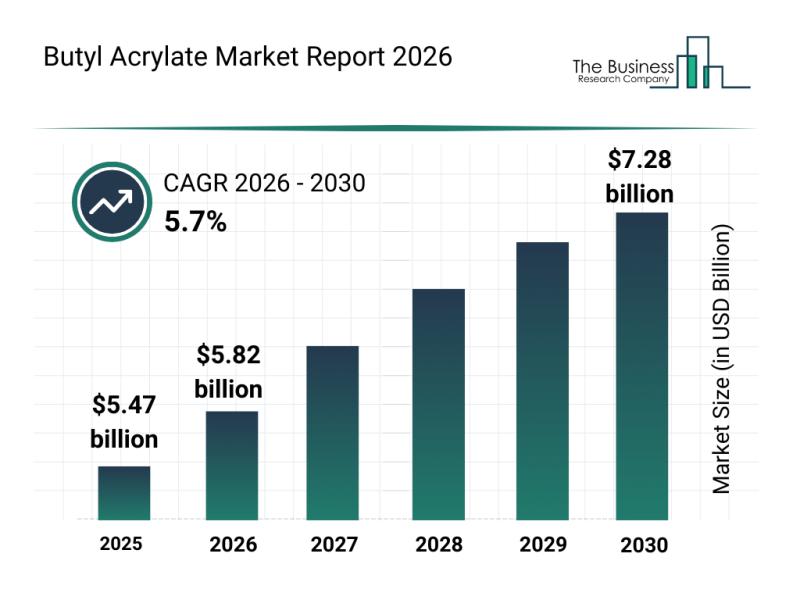

Emerging Growth Patterns Driving Expansion in the Butyl Acrylate Market

The butyl acrylate market is gaining considerable attention as industries increasingly seek versatile chemical compounds to enhance their products. With its broad utility across coatings, adhesives, and textiles, the market is set for significant growth in the coming years. Let's explore the current market size, the main players, key trends, and segment insights shaping this industry.

Projected Market Size and Growth in Butyl Acrylate

The butyl acrylate market is poised…

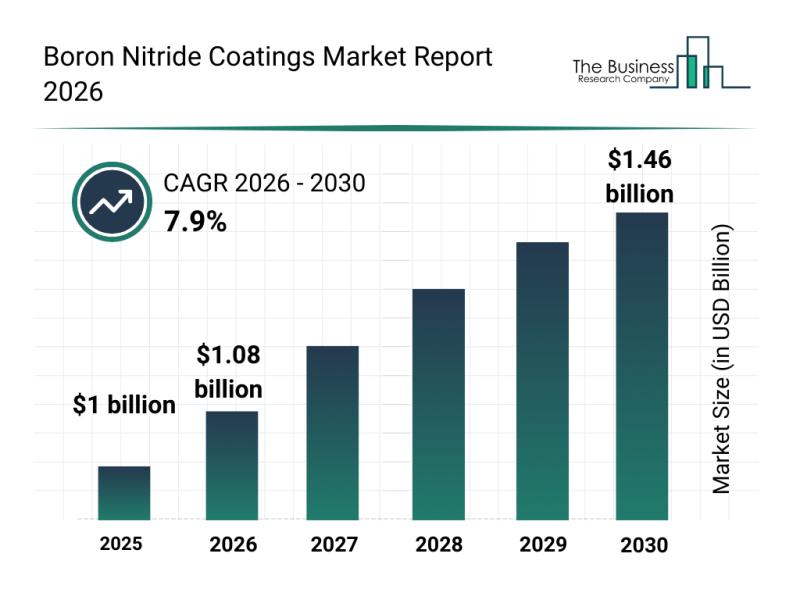

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Bo …

Boron nitride coatings are gaining increased attention due to their versatile applications and enhanced protective qualities. As industries like automotive, aerospace, and electronics evolve, the demand for advanced coating solutions that can withstand extreme conditions is rising. This overview explores the current market size, key players, important trends, and dominant segments shaping the boron nitride coatings market.

Strong Market Growth Expected for Boron Nitride Coatings by 2030

The boron nitride…

More Releases for ICD

International Classification of Diseases (ICD) -10 Market Expecting Worldwide Gr …

International Classification of Diseases (ICD) -10 is a new system, launched in October 2015 by the World Health Organization (WHO). It classifies and monitors diseases, their symptoms, and track causes of injury and abnormal findings. ICD-10 uses codes to classify the diseases. These codes are used to provide better information of diseases thus helping in improving the quality of patient care. For instance, data captured by ICD-10 can help to…

U.S. Dominates International Classification of Diseases (ICD) 10 Market Worldwid …

International Classification of Diseases (ICD) -10 is a new system, launched in October 2015 by the World Health Organization (WHO). It classifies and monitors diseases, their symptoms, and track causes of injury and abnormal findings. ICD-10 uses codes to classify the diseases. These codes are used to provide better information of diseases thus helping in improving the quality of patient care. For instance, data captured by ICD-10 can help to…

ICD Code Converter Now Available

Clearwater, FL- EON Systems, Inc., the provider of The Digital Office™, a complete software suite for healthcare providers, is excited to announce the launch of its ICD Converter App. The company’s new product, which launched on October 31st, 2014, is available on all Android®, iPad® and iPhone® products.

EON’s ICD Converter app features both ICD-9 to ICD-10 conversion and ICD-10 to ICD-9 conversion. In addition…

Career Step Releases Its New ICD-10 FastTrack Course

PROVO, Utah—September 20, 2013— Career Step, an online school offering career-focused education, is pleased to announce the release of its new ICD-10 FastTrack course, which is designed to prepare ICD-9 trained and experienced medical coders for the October 1, 2014 transition to the ICD-10 code set. This streamlined program was developed in collaboration with renowned industry experts Ann Zeisset, RHIT, CCS, CCS-P, and Gail Smith, MA, RHIA, CCS-P, as well…

Career Step Launches ICD-10-CM/ICD-10-PCS Code Set Training at HIMSS13

PROVO, Utah—March 4, 2013— Career Step, an online education company, is pleased to announce the launch of its ICD-10-CM and ICD-10-PCS code set training at the HIMSS13 Annual Conference & Exhibit. The courses are available through Career Step’s ICD-10 education offering, The ICD-10 Solution, developed in partnership with YES HIM Consulting, Inc., a firm specializing in ICD-10 preparation since 2009.

“As healthcare providers move through their ICD-10 transition plans, ICD-10 code…

Avior Computnig Releases ICD-10 Knowledge Module

Avior Computing Corporation, a leader in automated risk and compliance management, announced today the immediate availability of an ICD-10 Knowledge Module for the firm’s BenchMark compliance management solutions.

The ICD-10 Knowledge Module provides all the content for the Avior BenchMark v6 platform, also released today, to streamline management of the complex interactions between health plans and healthcare providers and their trading partners.

Avior’s ICD-10 Knowledge Module is currently in production use…