Press release

HDPE Prices Weaken Globally, Market Eyes Demand Correction

North America HDPE Prices Movement Q4:HDPE Prices in Mexico:

During Q4 2024, Mexican High-Density Polyethylene (HDPE) prices witnessed a significant drop to 1227 USD/MT in December. The decrease was largely due to an oversupplied market and weak downstream demand, creating a large imbalance. The problem was also worsened by an increase in low-cost HDPE imports, putting further downward pressure on local prices. With domestic customers unable to soak up the quantities on offer, suppliers were forced to cut back their price quotes in order to stay competitive. Consequently, Mexico's HDPE market experienced consistent pricing issues across the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/hdpe-pricing-report/requestsample

Note: This analysis can be adjusted to align with the customer's individual preferences

Regional Analysis: The price analysis can be extended to provide detailed HDPE price information for the following list of countries.

Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries.

APAC HDPE Prices Movement Q4:

HDPE Prices in Japan:

During Q4 2024, Japanese High-Density Polyethylene (HDPE) prices fell sharply to 987 USD/MT in December. This decline was largely due to reduced export and domestic demand, specifically from major end-use industries such as agriculture and packaging, which usually witness slack seasonal consumption at this time. Moreover, the buildup of surplus inventory also pressured prices, with supply outstripping market demand. Although some of the refiners came back on line, the market was still slow, not creating sufficient activity to stabilize or increase HDPE prices for the quarter.

Regional Analysis: The price analysis can be extended to provide detailed HDPE price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Northwestern Europe HDPE Prices Movement Q4:

HDPE Prices in United Kingdom:

During the fourth quarter of 2024, United Kingdom high-density polyethylene (HDPE) prices fell, reaching 1277 USD/MT in December. The decline was fueled mainly by poor industrial demand and wider economic issues that stifled overall market activity. Slow consumption in major end-use markets and tepid holiday-season activities restricted purchasing interest and negatively impacted prices. Even though reduced freight rates softened, this only resulted in somewhat lower import prices, which failed to generate meaningful stimulation in transactions. Also, falling upstream values and current market uncertainty prompted buyers and sellers to take a risk-averse attitude, further cooling momentum in the HDPE market during the quarter.

MEA HDPE Prices Movement Q4:

HDPE Prices in Saudi Arabia:

During Q4 2024, Saudi Arabian HDPE prices fluctuated notably, reaching a high of 1047 USD/MT in December. The market initially found some support in the initial crude oil price surge and regional volatility, which transiently contracted supply and supported prices. But as the cost of ethylene decreased and both domestic and international demand was weak, the direction of pricing reversed. Producers tried to balance supply by lowering operating costs, but this did little to change overall market attitude. Even as global competition heated up, export interest remained steady but subdued, further helping to contribute to the lackluster performance of HDPE prices throughout the quarter.

Regional Analysis: The price analysis can be extended to provide detailed HDPE price information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

South America Prices Movement Q4:

HDPE Prices in Brazil:

In Q4 2024, HDPE prices in Brazil fell considerably, to 1072 USD/MT in December, mainly because of poor demand and a supply overhang. Traders had to reduce their prices to remain competitive relative to a surge in low-priced imports, further stressing local rates. It was further accentuated by a huge port worker strike in October, which created severe logistical delays and jams, impairing the supply of materials. Also, weak recovery in major industries like automotive and construction, along with end-of-year inventory clearing, resulted in low order levels and helped the price slump.

Regional Analysis: The price analysis can be extended to provide detailed HDPE price information for the following list of countries.

Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries.

What will the price forecast of HDPE?

Conversely, the expansion of production capacities and new investments in the petrochemical sector could contribute to stabilizing supply over time, potentially mitigating price increases. Demand from critical industries such as packaging, automotive, and construction will continue to influence pricing trends, with sustainability initiatives and advancements in recycling playing a crucial role in the market. Analysts suggest that while HDPE prices may experience volatility in the short term, they could stabilize in the latter half of 2025 as supply and demand find equilibrium.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22516&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "HDPE Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2024 Edition," presents a detailed analysis of HDPE price trend, offering key insights into global HDPE market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines HDPE demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release HDPE Prices Weaken Globally, Market Eyes Demand Correction here

News-ID: 3960325 • Views: …

More Releases from IMARC Group

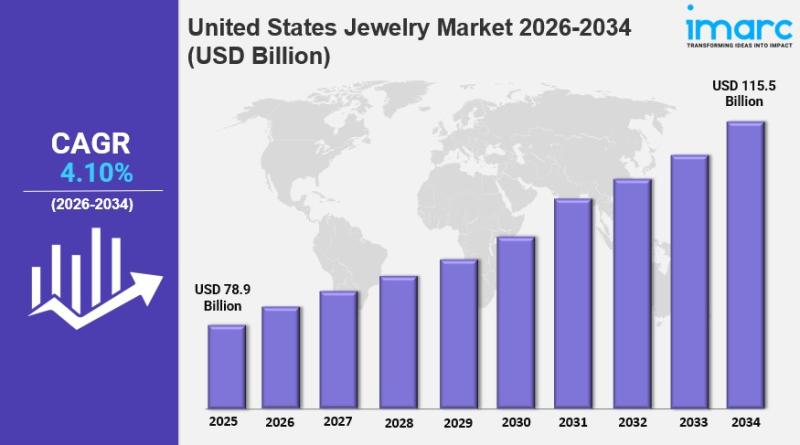

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for HDPE

Beyond Numbers: Understanding PCR HDPE Market Size

In this comprehensive report, analysts conduct an in-depth study of the global PCR HDPE market, delving into key factors such as drivers, challenges, recent trends, opportunities, advancements, and the competitive landscape. Utilizing research techniques like PESTLE and Porter's Five Forces analysis, the researchers provide a clear understanding of both the current and future scenarios within the global PCR HDPE industry. Accurate data on PCR HDPE production, capacity, price, cost, margin,…

Latest Trends In Global Recycled HDPE Market

Recycled HDPE, or High-Density Polyethylene, is a versatile and environmentally friendly material derived from the recycling of plastic products made from HDPE.

HDPE is a type of plastic commonly used for items like milk jugs, detergent bottles, and plastic bags. The recycling process for HDPE involves collecting, cleaning, and melting down these used plastic items to create new products.

Request for Sample@

https://mobilityforesights.com/contact-us/?report=20042

Recycled HDPE is valued for its durability, resistance…

Geomembrane manufacturer, HDPE geomembrane factory, geosynthetics supplier

MTTVS® Geosynthetics company specializes in research ,development,production,promotion and application of geosynthetics.And is the world's leading supplier of geosynthetics. Founded in 2014,located in Shandong China.With ISO9001,ISO14001,ISO45001 international authoritative management system certification of powerful large manufucture.We have more than 10 international advanced equipment production lines and a huge professional engineering and technical team.and has successfully consolideated and developed core markets to maximize value for customers.Through the processing of synthetic raw materials.we develop,manufacture…

hdpe geomembrane liner fabric manufacturer,geotextile manufacturer Company,HDPE …

GD Geosynthetics Company is a comprehensive processing enterprise of composite geosynthetics, geotextiles, geomembranes, geogrids, geounits, three-dimensional composite drainage nets, ecological bags, drainage boards. High-level management, high-level scientific research team, conform to the trend of domestic and international chemical fiber market, constantly innovate and update, cater to the market and meet the needs of consumers. Gained the trust of consumers.

Geosynthetics are widely used in anti-seepage treatment of roads, bridges, reservoirs, tunnels,…

Research Focuses on Global HDPE Geomembrane

HDPE Geomembrane Report by Material, Application, and Geography – Global Forecast to 2021 is a professional and in-depth research report on the world's major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, united Kingdom, Japan, South Korea and China).

The report firstly introduced the HDPE Geomembrane basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures,…

Global HDPE Decking Market Research Report 2017

HDPE Decking Revenue, means the sales value of HDPE Decking This report studies HDPE Decking in Global market, especially in North America, Europe, China, Japan, Southeast Asia and India, focuses on top manufacturers in global market, with capacity, production, price, revenue and market share for each manufacturer, covering UPM Kymmene Universal Forest Products Advanced Environmental Recycling Technologies Fiberon Azek Building Products Cardinal Building Products Certainteed Corporation Duralife Decking and Railing…