Press release

Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

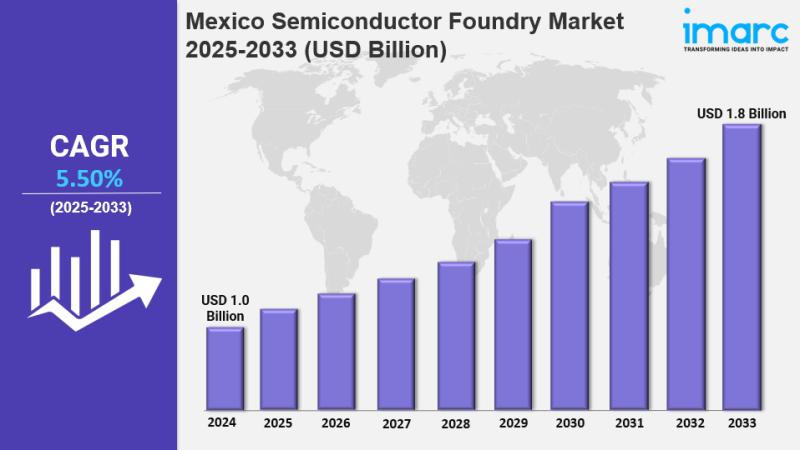

The Mexico semiconductor foundry market size reached USD 1.0 Billion in 2024. It is projected to grow to USD 1.8 Billion by 2033, expanding at a CAGR of 5.50% during the forecast period of 2025-2033. This growth is driven primarily by strong demand for automotive chips supported by Mexico's robust auto manufacturing sector. Additional factors include nearshoring trends, cost benefits, USMCA trade advantages, government incentives, and efforts to diversify supply chains, positioning Mexico as a key semiconductor hub in North America.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Mexico Semiconductor Foundry Market Key Takeaways

• Current Market Size: USD 1.0 Billion in 2024

• CAGR: 5.50% during 2025-2033

• Forecast Period: 2025-2033

• Mexico is the fourth-largest auto parts producer globally and is expected to become the fifth-largest vehicle manufacturer by 2025, boosting demand for automotive semiconductors.

• Over 170 Tier 1 and Tier 2 EV component suppliers operate in Mexico, supporting the country's automotive semiconductor growth.

• Nearshoring and supply chain diversification have attracted over USD 7.8 Billion FDI in electronics manufacturing, including USD 206 Million in 2023 alone.

• Tax incentives of up to 76% on semiconductor manufacturing equipment encourage investments.

• Key manufacturing hubs include Monterrey, Tijuana, and Reynosa, hosting major companies like LG, Samsung, and Time Interconnect.

• The USMCA agreement strengthens integration with the U.S., enhancing regional semiconductor production.

Sample Request Link: https://www.imarcgroup.com/mexico-semiconductor-foundry-market/requestsample

Mexico Semiconductor Foundry Market Growth Factors

The Mexico semiconductor foundry market is primarily growing due to the rising demand for automotive semiconductors. Mexico has become the fourth-largest auto parts producer worldwide and is expected to be the fifth-largest vehicle manufacturer by the end of 2025. With production exceeding 200,000 units and 68 new investments in electromobility this year alone, the shift toward electric vehicles (EVs) and advanced automotive technologies like ADAS and connected car systems is accelerating chip demand. Mexico's strategic role in North America's automotive tech ecosystem is underscored by over 170 Tier 1 and Tier 2 suppliers specializing in EV components, backed by government incentives and foreign investments.

The market also benefits significantly from nearshoring semiconductor production. As companies aim to mitigate supply chain risks, Mexico's proximity to the U.S., cost-effective labor, and well-developed manufacturing infrastructure attract investments. Since 2023, Mexico has drawn over USD 7.8 Billion in FDI for electronics manufacturing, including USD 206 Million in the current year. This has been supported by tax breaks reaching 76% on semiconductor manufacturing equipment. Cities such as Monterrey, Tijuana, and Reynosa have emerged as key electronics centers, attracting prominent firms like LG, Samsung, and Time Interconnect.

Furthermore, governmental initiatives and trade agreements bolster growth. The USMCA trade arrangement fosters supply chain integration with the U.S., enhancing the regional chip-making ecosystem. Continuous supply chain diversification efforts, tax incentives, and R&D support encourage local fabrication. This favorable environment combined with growing demand from automotive, telecommunications, consumer electronics, IoT, and industrial automation sectors widens the market's reach, making Mexico an increasingly important global player in semiconductor foundries.

Buy Report Now: https://www.imarcgroup.com/checkout?id=32847&method=980

Mexico Semiconductor Foundry Market Segmentation

Breakup By Technology Node:

• 10/7/5nm: Cutting-edge technology nodes focusing on advanced semiconductor manufacturing for high-performance applications.

• 16/14nm: Widely used nodes balancing performance and cost for various semiconductor devices.

• 20nm: Mid-range technology nodes used for diverse semiconductor types.

• 45/40nm: Older nodes serving less complex semiconductor production needs.

• Others

Breakup By Foundry Type:

• Pure Play Foundry: Companies dedicated solely to semiconductor foundry services.

• IDMs: Integrated Device Manufacturers that design and manufacture their own semiconductor products.

Breakup By Application:

• Communication: Chips used in telecommunication and networking devices.

• Consumer Electronics: Semiconductors for everyday consumer devices like smartphones and home electronics.

• Computer: Chips designed for computing devices including PCs and servers.

• Automotive: Semiconductor components used within automotive systems, including EVs and ADAS.

• Others

Regional Insights

Northern Mexico is identified as the dominant region in the semiconductor foundry market. The report highlights major manufacturing hubs including Monterrey, Tijuana, and Reynosa, which serve large industry players such as LG, Samsung, and Time Interconnect. This regional strength supports Mexico's positioning as a nearshoring destination with robust electronics and semiconductor infrastructure, fostering growth driven by automotive and telecommunications demand.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32847&flag=C

Recent Developments & News

On October 09, 2024, Foxconn announced the construction of an Nvidia super chip GB200 assembly factory in Guadalajara, Mexico. This move responds to the growing global demand for AI servers. Foxconn has already invested over USD 500 Million in Mexico. The new facility will support next-generation Blackwell platforms, incorporating advanced liquid cooling and thermal technologies. This investment reinforces Mexico's emerging role as a hub for high-performance semiconductor assembly and AI-driven foundry activities.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Semiconductor Foundry Market Size, Share, Latest Insights and Forecast 2025-2033 here

News-ID: 4332496 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…