Press release

The Role of Alternative Funding Platforms in Supporting Small Businesses

Running a small business is no easy task. It's a constant battle of balancing books, growing the brand, and figuring out how to pay for that extra espresso shot to keep you going. But one of the biggest challenges? Finding funding.Enter alternative funding platforms, superheroes in disguise for small businesses everywhere.

A New Era for Small Business Funding

Gone are the days when banks ruled the lending scene. If you didn't have a stellar credit score or a stack of paperwork that could double as a doorstop, good luck getting a loan. For small businesses, this often meant hitting dead ends.

Alternative funding platforms are flipping that script. These platforms, ranging from crowdfunding sites to peer-to-peer lenders, offer a breath of fresh air for entrepreneurs looking to secure capital. They're fast, flexible, and often way more approachable than your average banker.

If you're exploring alternative funding options, why not visit Capixa for funding https://capixa.com/ ? Capixa offers tailored solutions designed specifically for small businesses, providing the flexibility and speed you need to grow.

Why Traditional Funding Doesn't Always Work

Let's be honest, the traditional loan process is about as exciting as watching paint dry. It's bureaucratic, time-consuming, and heavily reliant on criteria that don't favor small businesses.

Banks often prioritize bigger clients with established revenue streams. This leaves smaller ventures, particularly startups, out in the cold. Even if a business qualifies for a loan, the terms might not make sense for their cash flow. High interest rates and rigid repayment plans can turn a lifeline into a financial noose.

This is where alternative funding steps in, waving a friendly "we've got you" banner.

Types of Alternative Funding Platforms

1. Crowdfunding Platforms

Ever heard of Kickstarter, Indiegogo, or GoFundMe? These platforms are the rockstars of alternative funding. Crowdfunding allows businesses to pitch their ideas directly to the public and raise money in exchange for products, perks, or even equity.

Take Sarah, for example, who wanted to launch her line of eco-friendly candles. Instead of going through a bank, she turned to Kickstarter, offering backers a free candle for their support. Within a month, she had the funds she needed, and a list of eager customers waiting for her product.

Crowdfunding doesn't just raise money; it builds hype and validates your business idea. Win-win!

2. Peer-to-Peer Lending

Think of this as borrowing money from a friend, except the friend is an online platform that matches you with individual investors. Sites like LendingClub and Funding Circle allow small businesses to get loans without the red tape.

Peer-to-peer lending usually offers lower interest rates than traditional loans and faster approval times. Plus, there's something cool about knowing real people are rooting for your success.

3. Invoice Factoring Platforms

Got unpaid invoices piling up? Invoice factoring platforms like BlueVine and Fundbox let you turn those IOUs into immediate cash. You sell your invoices to these platforms at a discount, and they give you the money upfront.

Sure, you lose a small percentage of the invoice amount, but sometimes cash flow is king. If you're tired of chasing clients for payments, this option can feel like a godsend.

4. Revenue-Based Financing

Revenue-based financing platforms, such as Clearco or Pipe, provide capital in exchange for a percentage of your future revenue. This type of funding is ideal for businesses with consistent sales but limited capital to grow.

No fixed monthly payments. If your sales dip, your payments dip too. It's like having a lender who actually understands the ups and downs of running a business. Imagine that!

The Perks of Alternative Funding

So, why are alternative funding platforms stealing the show? Let's break it down:

1. Speedy Approvals

No one enjoys waiting, especially when your business is on the line. Traditional loans can take weeks, if not months, to process, leaving entrepreneurs in limbo.

Alternative funding platforms cut through the red tape, often delivering decisions in days or even hours. It's like ordering fast food but getting a financial solution instead of fries. Instant gratification for the business world.

2. Flexibility

Not every business needs the same funding solution. Whether you're a small bakery looking for $5,000 to upgrade equipment or a tech startup eyeing $500,000 for a product launch, alternative platforms can tailor their offerings to your needs.

You're no longer forced into rigid models that don't fit your business size or goals. It's like having a custom suit made instead of wearing one off the rack, everything feels just right.

3. Access for All

A shaky credit score doesn't mean your dreams are out of reach. Unlike traditional lenders who see a low score as a big red flag, alternative platforms consider other factors like your business potential, sales history, or even customer loyalty.

They look beyond the numbers to the heart of your business. It's a refreshing change from the "computer says no" mentality of traditional lenders.

4. Community Engagement

Crowdfunding does more than just put cash in your pocket. Iit brings you closer to your customers. By pitching your idea directly to the public, you're building a tribe of supporters who believe in your vision.

These early backers often become your biggest advocates, spreading the word about your business. Funding a business and creating fans at the same time? That's like hitting a home run while waving to the crowd.

The Downsides (Because Nothing's Perfect)

Before you jump headfirst into the alternative funding pool, know the risks:

1. Higher Costs

Alternative funding isn't always the cheapest route. Some platforms come with higher interest rates, transaction fees, or service charges that can eat into your profits if you're not careful. This doesn't mean they're not worth it, but you need to do your homework.

Think of it like signing up for a streaming service. Great content, but check how much you're really paying before hitting "subscribe."

2. Short-Term Focus

Alternative funding platforms are great for solving immediate cash flow issues, but they're not always built for the long haul. Options like invoice factoring provide quick relief but don't address the root cause of financial problems.

It's like putting a Band-Aid on a cut. It helps for now, but you might need stitches later. Small businesses need to weigh short-term benefits against long-term impact carefully.

3. Unpredictability

Crowdfunding feels like the wild west of funding. A killer idea and a polished campaign might rake in thousands, but a poorly executed pitch could leave you with nothing but crickets.

Success often depends on timing, marketing, and how well you connect with your audience. It's a roll of the dice, but for many, the chance to win big is worth the risk.

Still, for many small businesses, the pros far outweigh the cons.

Who Should Consider Alternative Funding?

If you're nodding along to any of these scenarios, alternative funding might be your best bet:

You Need Quick Cash: Traditional loans take forever. If time isn't on your side, alternatives can deliver.

You're a Startup: No track record? No problem. Many platforms cater specifically to startups and entrepreneurs.

You Want to Avoid Debt: Crowdfunding and revenue-based financing let you raise capital without taking on traditional loans.

You're Building Buzz: A crowdfunding campaign doubles as a marketing tool. Two birds, one stone.

Success Stories Worth Sharing

Alternative funding platforms aren't just theoretical solutions; they've created real-world success stories.

Pebble: This smartwatch brand started as a Kickstarter campaign, raising over $10 million. They didn't just fund their product, they launched a global phenomenon.

Glossier: Before becoming a beauty empire, Glossier secured seed funding through nontraditional means, including venture platforms that focused on startups.

Small Town Coffee Shop: Okay, maybe this one doesn't have a Netflix documentary, but countless local businesses have kept their doors open thanks to platforms like Kiva or Square Capital.

Wrapping It Up (And Adding a Bow)

Alternative funding platforms aren't just an option for small businesses. They're a game-changer. They open doors where traditional lending slams them shut, offer flexibility that matches the unpredictable world of entrepreneurship, and provide more than just cash. They build community, create buzz, and validate dreams.

So, whether you're launching a new product, expanding your team, or just need a little extra help keeping the lights on, consider looking beyond the bank. Who knows? Your next big break might be just a click away.

Now go out there, secure that funding, and take your business to the next level. And hey, if you become the next Pebble or Glossier, don't forget to send a thank-you note. Or at least a free sample.

P.O Bagarji Town Bagarji Village Ghumra Thesil New Sukkur District Sukkur Province Sindh Pakistan 65200.

Wiki Blogs News always keeps careful online users to provide purposeful information and to keep belief to provide solution based information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Role of Alternative Funding Platforms in Supporting Small Businesses here

News-ID: 3796414 • Views: …

More Releases from Wikiblogsnews

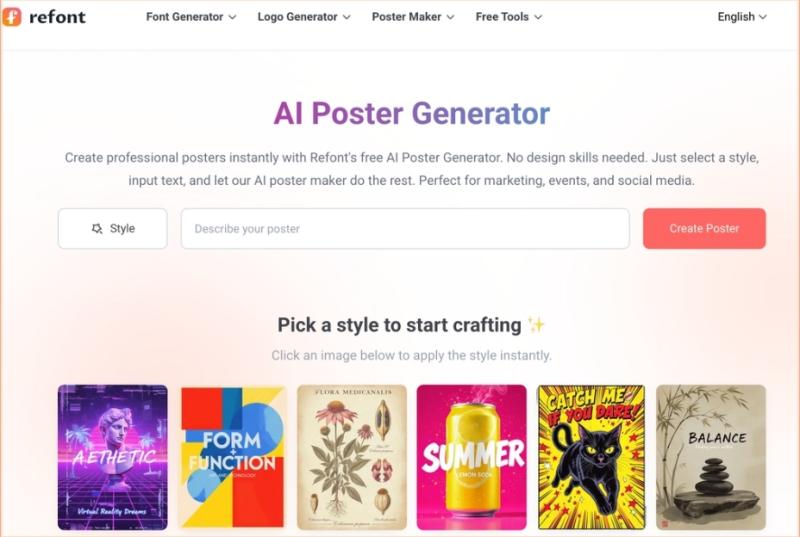

Tired of the Design Bottleneck? How I Finally Found a Practical AI Poster Genera …

If you're anything like me, you've probably spent more hours than you'd like to admit fighting with design software. We've all been there: you have a killer idea for a promotion, a social post, or a brand announcement, but by the time you've messed around with layers, alignment, and hunting for stock photos, the inspiration is gone and so is half your afternoon.

I've tried the early wave of generative AI…

Best Exotic Car Rental in Miami: Experience Luxury Without Overspending

Miami has a way of turning every drive into a cinematic experience. Picture yourself cruising down Ocean Drive at sunset with the gentle ocean breeze mixing in with the roar of your high-performance engine, smiling people looking over your car. For those who seek this experience, the best exotic car rental in Miami is your ticket to unlocking this fantasy.

But there's a catch: Miami's luxury car scene is flooded, and…

Cheap Exotic Car Rental in Miami: Drive Luxury Without Overpaying

Miami is a city made for style, speed, and excitement. Exotic cars fit perfectly into this glamorous backdrop, but many travelers immediately assume renting one is out of reach. The good news? Cheap exotic car rentals in Miami are not only possible-they're easier than most think.

When I first looked into it, I expected outrageous prices-until I stumbled upon a guide from a local rental specialist that broke down how everyday…

Top 5 Best Front and Rear Dash Cam Options for Maximum Road Safety

As a driver, ensuring your safety on the road is paramount. One way to do this is by investing in a reliable dash cam that can provide evidence in case of an accident or incident.https://wolfbox.com/collections/dash-cam-front-and-rear is ideal for capturing footage of the road ahead and behind your vehicle. Here are the top 5 best front and rear dash cam options for maximum road safety.

*1. WOLFBOX Mirror Dash Cam: The All-in-One…

More Releases for Alternative

Prominent Alternative Tourism Market Trend for 2025: Innovative Sustainable Ecot …

What Are the Projected Growth and Market Size Trends for the Alternative Tourism Market?

Over the past few years, there has been a consistent growth in the alternative tourism market. Its worth is predicted to rise from $94.58 billion in 2024 to about $98.55 billion in 2025, indicating a compound annual growth rate (CAGR) of 4.2%. The expansion during the historic phase can be credited to the elevated consciousness about the…

Dairy Alternative Market

The Global Dairy Alternative Market growth rate continues to gain remarkable momentum during the present decade. Manufacturers and users have acknowledged the nutritional efficacy of products offered by this industry. This is partially because of the efforts taken to expand the sources of dairy products to meet the heightened demand from growing population. However, the aggressive promotion of the trend for going vegan and animal-friendly is what delivered this market…

Alternative to Pesticide - Dynatrap

The nature’s bounty revel in man’s admiration, not in intervention. No wonder, we are living in an era where clean air and pure water will soon be a matter of past, finding its place only in school textbooks. Another alarming issue is the mounting problem of mosquitoes and mosquito-borne diseases with which the developing countries are grappling with. When the market is mushrooming with myriad options of mosquito repellents claiming…

Alternative Payment Solution: PayPal

ReportsWorldwide has announced the addition of a new report title Alternative Payment Solution: PayPal to its growing collection of premium market research reports.

In terms of transaction value, PayPal is the second-largest alternative payments service provider globally, after Alipay. It enables digital payments and offers acceptance solutions for consumers and merchants. The company specializes in online payments, mobile and e-commerce, fund transfers, payment processing, payment security and monetization services for developers.…

Traveltext's alternative Euro 2016

You don’t even have to be a sports fan to know that this summer, the England football team will be heading off to the latest major international tournament with the hopes of a nation resting on the shoulders of the likes of Wayne Rooney, Jamie Vardy and Dele Alli.

The fact that the tournament has expanded this year to include no fewer than 24 nations means that the eyes of Europe…

Alternative: Stud-Welding

Increased productivity and flexibility for the installation of pipe, tube, hose and cable clamps

In many areas, stud welding is considered to be the most economic fastening method for components and is sometimes even the only technically feasible solution. Because the stud is joined with the substructure over the entire surface of the stud without any hollow areas, a high strength of the joint can be achieved.

Stauff is now using this…