Press release

Buy-to-let investing in the Middle East

As US and European housing markets slow, investors are looking further afield. The Middle East’s housing markets have been rapidly opening - and both opportunities and dangers await property investors, according to a report released today by the Global Property Guide. Buy-to-let investors, particularly, should consider the Middle East.Dubai, the richest and most progressive emirate of the United Arab Emirates (UAE), started it all.

In 2002, Dubai announced that foreigners of any nationality would be able to own freehold residential titles, instead of the originally-proposed leasehold titles.

Soon other countries in the Persian Gulf followed suit, including Bahrain, Qatar and Oman.

Some investors still shy away because of the perceived political and security risks. However, good rewards await those willing to do their homework and explore the market.

Since the Gulf’s ‘for foreigners’ market is still at its infancy, most properties sold to foreigners are off-plan. This has advantages and disadvantages. One advantage is that the buyer saves on the real estate agent’s fee and legal fees, and the developer takes care of the property transfer procedure. In most cases, the developer also takes care of all maintenance and utilities like water, telephone and electricity connection.

The Middle East has low prices

Because of their early stage of economic development, many Middle Eastern markets’ property is still undervalued, leaving room for capital growth.

Property prices are highest in central Tel Aviv at around US$5,000 per sq. m., followed by Dubai at around US$4,000 per sq. m.

Properties in central Cairo, Egypt are quite cheap from a foreigner’s point of view; prices range from US$400 to US$1,400 per sq. m.

Property prices in central areas of the major or secondary city in Jordan, Morocco and Lebanon range from US$1,300 to US$1,900 per sq. m.

Similar properties in Southern Europe would be two to three times more expensive. For instance, apartments in Barcelona, Spain cost around US$7,000 per sq. m.

The Middle East has high rental yields

Rental yields in the Middle East are quite high.

For instance, yields in Cairo's Maadi district are typically in double digits, with earnings of up to 17% achievable on 250 sq. m. apartments. The tax environment is also extremely accommodating.

In Amman, Jordan, rental yields of around 9.6% can be earned on 120 sq. m. units. In Dubai, rental yields can reach up to 10.2% for 50 sq. m. units (with only a 5% tax levied on rental value); in Marrakech, Morocco returns are up to 8.86% for 60 sq. m. units.

By comparison, rental yields in Europe have fallen to relatively low levels, due to over a decade of rapid price increases. Properties in Central Paris earn yields of no more than 4.4%. In Spain, gross rental yields are between 2% and 4% only, barely covering costs.

The Middle East has generally low property transaction costs

Investors will find that housing transaction costs are generally low to moderate in the Middle East.

The roundtrip transaction cost, i.e. the total cost of buying and re-selling a residential property, is highest in Jordan at around 15% of the property’s value.

On the other hand, transaction costs are lowest in Dubai (at only 3.03%) and Bahrain (at 5%).

Roundtrip costs in Lebanon, Israel and Tunisia are around 10%. In Egypt, costs are at 11.7%.

Real estate brokerage fees are lowest in Dubai (1%), Bahrain (2%), and Morocco (2.5%).

In Lebanon, the agent’s fee is typically 5%, split evenly between buyer and seller. In Jordan, the fee is 4%, plus 16% GST. In Israel the agent’s fee is 4%, plus 15.5% GST.

Foreign ownership restrictions

Not all the Middle East is ‘open’. Prospective buyers must check if they can buy in the country of their choice.

Members of the Gulf Cooperation Council (GCC) have harmonized rules for property ownership among their citizens. i.e. citizens of any GCC country can freely buy property in any GCC country. Bahrain, Oman, Kuwait, Qatar, Saudi Arabia, and UAE belong to the GCC.

For other nationalities, there are some ownership restrictions.

Free of restrictions:

Morocco allows foreign ownership of residential and commercial real estate without any conditions or prior approval from the government (though foreigners cannot own agricultural land).

Liberal entry to foreign buyers:

Tunisia, Israel, Jordan and Lebanon generally liberal towards foreign ownership, though there are minor ministerial or regulatory procedures.

In Egypt, foreigners can readily own real estate for personal use. For buy-to-let purposes, the road to ownership is a bit rough, but certainly possible.

Foreign buyers allowed in selected areas:

Qatar, Bahrain, Oman and UAE allow freehold ownership in selected areas, especially developed or designated for foreigners. Foreign buyers are automatically granted residency, which extends to the owner’s family, for the whole duration of the ownership.

Full Report - http://www.globalpropertyguide.com/investment-analysis/Buy-to-let-investing-in-the-Middle-East

Related links:

http://www.globalpropertyguide.com/investment-analysis/Housing-transaction-costs-in-the-OECD

http://www.globalpropertyguide.com/investment-analysis/Housing-transaction-costs-in-Europe

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Cell: (+63) 917 735 2228

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock Phone: (+632) 867 4220 Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

Description:

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, sites, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com Sites and newspapers found not to be providing a link to us will be removed from our press list.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy-to-let investing in the Middle East here

News-ID: 35066 • Views: …

More Releases from Global Property Guide

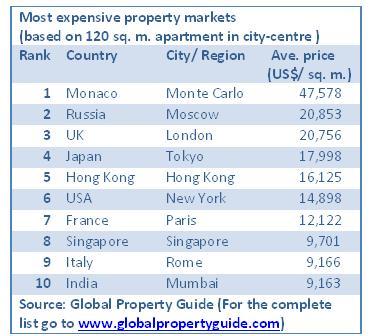

Most expensive real estate markets in 2009

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Middle

Finnovex Middle East 2025: Middle East's Fintech Metamorphosis: Digital, Decentr …

Dubai, UAE, 9th October 2025, ZEX PR WIRE, Exibex is proud to announce the 33rd global edition of Finnovex Middle East, returning on November 11-12, 2025, in Dubai, the innovation capital of the Middle East. Under the theme "Middle East's Fintech Metamorphosis: Digital, Decentralized & Disruptive," this leading summit will convene over 300 banking and fintech leaders, policymakers, regulators, and technology innovators to explore the region's transformative financial journey.

As the…

Coupon Craze Hits the Middle East: Introducing Middle East's Elite Coupon Platfo …

The Middle East is about to experience a great shift with the launch of Claimea, the region's elite coupon platform set to revolutionize how people save while shopping online. Considering the growing trend of online coupons, Claimea offers a comprehensive solution for shoppers looking for working and verified deals.

Claimea aims to enhance the shopping experience for consumers across the Middle East. With an interactive user interface and well-known partner merchants,…

Middle East Travel Retail

Report Overview

The report covers exhaustive analysis of the Middle east travel retail market in terms of qualitative and quantitative aspects. The report provides in-depth information on market size & forecast, current market trends, driving & restraining factors, challenges, and future opportunities of the Middle east travel retail market. The report provides analysis on key market segments along with market size and forecast information for each of the segments. The report…

Middle East Auto Component Market Significant Growth over Forecast Period 2020-2 …

Auto Component Market is those markets which are manufacture components or parts required in the automobile industry. Middle East Auto Components market was valued at $ 28 billion in 2019 and is expected to surpass $ 39.7+ billion by 2028. Projected growth in the market can be recognized as snowballing automobile vehicle fleet and rising manufacture and infrastructural activities across different countries of the region. Moreover, mounting demand for vehicle…

Studying the Middle East Yacht Market,Studying the Middle East Yacht Industry, S …

Latest industry research report on: Studying the Middle East Yacht Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

Our analysts believe that the long-term outlook for the yacht market in the Middle East is positive. Demand for yachts in the Middle East has remained stable and is expected to continue being so. Yachting has emerged as a key aspect of the luxury lifestyle in the…

Middle East Railway Sector Middle East Railway Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Middle East Outlook

1.1 Countries Overview

1.2 Middle East Economy

1.3 Transportation in Middle East

Middle East Rail Transport Outlook

2.1 Overall Status of Rail Transport in Middle East

2.2 Trends in Railway Infrastructure Development in Middle East

Saudi Arabia

3.1 Existing Railway Infrastructure

3.2 Proposed/Planned Railway Infrastructure

3.3 Regulatory Framework

3.4…