Press release

Polysilicon Industry Faces Third Shakeout Wave

Bernreuter Research predicts new global PV installations of 425 gigawatts-direct current (GW-DC) in 2023.

Würzburg (Germany), November 28, 2023 - Chinese polysilicon market leader Tongwei will usher in a phase of fierce cut-throat competition in 2024. "Tongwei is planning to bring 575,000 tons of new production capacity on stream next year, whereas we expect a market growth of 200,000 tons at most," says Johannes Bernreuter, head of Bernreuter Research and author of the Polysilicon Market Outlook 2027, which was released today.

The polysilicon shortage in 2021 and 2022, which drove the spot price up to almost US$40/kg, has lured many Chinese aspirants into the industry. The new report from polysilicon market expert Bernreuter Research screens 36 companies; among them, 14 have started to construct or already to ramp up a new polysilicon plant. Besides Tongwei, however, other leading manufacturers have also expanded production. "If all new capacities were ramped up in 2024, oversupply would swell to 1.4 million tons," says Bernreuter. "With its low manufacturing costs and proven product quality, Tongwei will push most, if not all, new entrants out of the market."

In total, the third shakeout wave in the polysilicon industry will eliminate a capacity of up to 2,400,000 metric tons (MT), compared to 275,000 MT during the second wave - from 2018 through 2020 - and 135,000 MT during the first - between late 2010 and early 2013. For 2024, Bernreuter expects the polysilicon price to undercut the all-time low of US$6.75/kg reached in June 2020.

While China's share in the global polysilicon output will further increase to 90% in 2023 (to even 92.5% in solar-grade material), the non-Chinese manufacturers Wacker, OCI, Hemlock Semiconductor and REC Silicon will remain exempt from the shakeout. The reason for that is the Uyghur Forced Labor Prevention Act in the United States, which bans products from the Xinjiang Uyghur Autonomous Region in northwestern China. The legislation has created a separate, higher-price market for non-Chinese polysilicon manufacturers, which do not use silicon metal from Xinjiang as feedstock.

The shakeout in China is coming even though the polysilicon industry's largest customer, the solar sector, is growing rapidly. In contrast to other market researchers, Bernreuter assumes that annual PV installations will rise from 425 GW in 2023 to 1,100 GW in 2027, which is equivalent to an average annual growth rate of 26.8%. "Traditional forecast models have mostly underestimated PV growth. Therefore, we have adopted a more aggressive approach," explains the analyst. The rapid growth will fuel strong demand for silicon metal, which is made of quartz (SiO2). "The consequence is inevitable: Quartz for silicon metal will run short in the second half of this decade," predicts Bernreuter.

More details on the polysilicon, solar and semiconductor markets are provided in The Polysilicon Market Outlook 2027. The 102-page report contains sophisticated scenarios of supply and demand, detailed forecasts of polysilicon prices through 2027, the latest purity and cost data on the dominant Siemens process and fluidized bed reactor technology, as well as many other market trends. For more information on the report, please go to:

https://www.bernreuter.com/polysilicon/industry-reports/polysilicon-market-outlook-2027/

Bernreuter Research • Polysilicon Market Reports

Lessingstr. 6 • 97072 Würzburg, Germany

Your Contact Partner:

Johannes Bernreuter, Company Head

Telephone: +49/931/784 77 81

About Bernreuter Research

Bernreuter Research was founded in 2008 by Johannes Bernreuter, one of the most reputable photovoltaic journalists in Germany, to publish global poly-silicon market reports. As early as 2001, Bernreuter authored his first analysis of an upcoming polysilicon bottleneck and new production processes. Since publishing its first report in 2010, Bernreuter Research has gained a reputation for providing the most comprehensive and accurate polysilicon reports on the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polysilicon Industry Faces Third Shakeout Wave here

News-ID: 3307504 • Views: …

More Releases from Bernreuter Research

Top Ten Polysilicon Makers Nearly All Chinese

Wacker will stay in the ranking as only western producer, says Bernreuter Research

Würzburg (Germany), November 25, 2025 - Nine of the world's top ten polysilicon manufacturers are based in China today. "The Chinese polysilicon industry reached a share of 93.5% in the global output of 2024. This dominance is also reflected in the ranking of the world's largest manufacturers," says Johannes Bernreuter, author of the Polysilicon Market Outlook 2029 and…

Polysilicon Industry Is Risking New Shortage

Bernreuter Research: Shutdown of overcapacity could create undersupply by 2028

Würzburg (Germany), June 25, 2025 - The Chinese polysilicon industry will face a difficult balancing act in the next three years. "If too much overcapacity is eliminated, the market could run into a new shortage by 2028," predicts Johannes Bernreuter, head of Bernreuter Research and author of the new Polysilicon Market Outlook 2029 report.

Fueled by the shortage that culminated in a…

PV Installations Will Reach up to 660 GW in 2024

Bernreuter Research: Low module price will fuel demand in the second half of the year

Würzburg (Germany), June 18, 2024 - Global photovoltaic (PV) installations will land in a range of 600 to 660 gigawatts-direct current (GWdc) in 2024, according to the latest analysis from polysilicon market expert Bernreuter Research. "Once market participants come to the conclusion that the crash of the solar module price has reached its bottom, demand will…

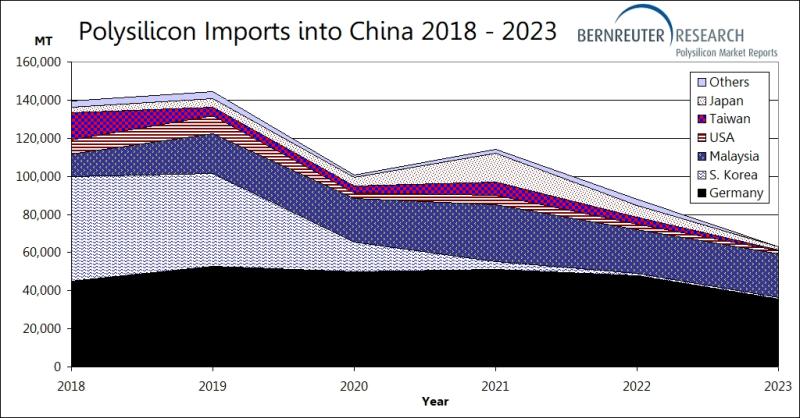

Polysilicon Imports into China Drop to Level of 2011

Bernreuter Research: Non-Chinese producers shift shipments to wafer plants in Vietnam

Würzburg (Germany), February 28, 2024 - Polysilicon imports into China have fallen to the lowest level since 2011. According to Chinese customs statistics, imports of the feedstock for solar cells and semiconductors slumped by 28.5% from 88,093 metric tons (MT) in 2022 to 62,965 MT in 2023. This volume is even slightly less than the 64,614 MT reached in 2011.

"The…

More Releases for Chinese

Xiaogua Chinese Introduces a New Way to Reach Conversational Fluency in Mandarin …

Xiaogua Chinese is helping Chinese learners reach conversational fluency in just 6-12 months.

Image: https://www.globalnewslines.com/uploads/2025/12/7f9ed0a7ee9eefbd588a48bb47dbf8df.jpg

Xiaogua Chinese [https://gamma.app/docs/Speak-Chinese-Confidently-in-6-12-Months-guaranteed-xt2eg13q5p14fsx?mode=doc], an emerging language platform, is transforming the way people learn Mandarin by introducing a revolutionary approach to language mastery -one that mirrors how babies learn their first words: through daily immersion, natural interaction, and continuous speaking practice. The result is accelerated conversational fluency for adult learners, typically within 6 to 12 months.

At the heart…

Gao Yuan at UN Chinese Language Day: Bridging Cultures Through Traditional Chine …

On April 20, 2025, CCTV host Gao Yuan participated in the UN Chinese Language Day celebrations at the United Nations Headquarters in New York, showcasing the profound heritage and innovative vitality of traditional Chinese arts to a global audience.

Image: https://www.globalnewslines.com/uploads/2025/04/556563a6bf5cb3de8982c8ef94cb6380.jpg

During the thematic forum "Civilizational Dialogue and Artistic Symbiosis," Gao Yuan moderated a cultural salon titled "Digital Technology Empowers Traditional Arts." She highlighted China's recent efforts to reinterpret calligraphy and ink…

The TV program "Chinese Practice with Chinese Wisdom" Officially Airs: The Endur …

Chinese Practice with Chinese Wisdom is a 10-episode TV program produced by Jiangsu Broadcasting Corporation, one of the most influential media groups in China. It gives a vivid presentation of traditional Chinese cultural elements such as poetry, calligraphy, seal-cutting, traditional Chinese operas, dance, and martial arts, aiming to enrich audiences with cultural enlightenment and aesthetic enjoyment. Through questions, disucssions, elaborations, feelings, and stories shared by guests from around the world,…

Chinese Fenjiu Shines at SCWC Conference, Bridging Chinese Liquor and Western Cu …

Fenjiu Debuts at the International Stage, Blending Tradition, Innovation, and Cultural Fusion, while Captivating Global Food and Beverage Experts.

Barcelona, Spain - November 22, 2024 - Fenjiu, a premier Chinese liquor brand, made a landmark appearance at the Science and Cooking World Congress (SCWC) in Barcelona, Spain. Renowned for its light-fragrance style and rich cultural heritage, Fenjiu captivated global food and beverage professionals as it showcased its unique blend of tradition,…

Online Chinese Language School

Taiwan Chinese Education Center is an online Chinese language school.

You can learn Chinese one-on-one from the best Chinese teachers in Taiwan.

We opened our school in Japan in 2010 and have over 12 years of rich experience in online Mandarin teaching.

In November 2022, we started Mandarin education service for people in Europe, America, and other countries.

Chinese is the world's No. 1 native language, spoken by about 15% of the world's population.

About…

Introducing A New Chinese Reader to Enable Chinese Language Students to Master C …

Capturing Chinese presents a new advanced Chinese reader helping students master the literature of China's best authors. Allowing students to put down their dictionaries and instead curl up with a book of Chinese literature, Capturing Chinese is a must have for intermediate and advanced Chinese language students.

The new book, titled Capturing Chinese Stories: Prose and Poems by Revolutionary Authors, features five of the most influential authors in recent Chinese history…