Press release

Polysilicon Imports into China Drop to Level of 2011

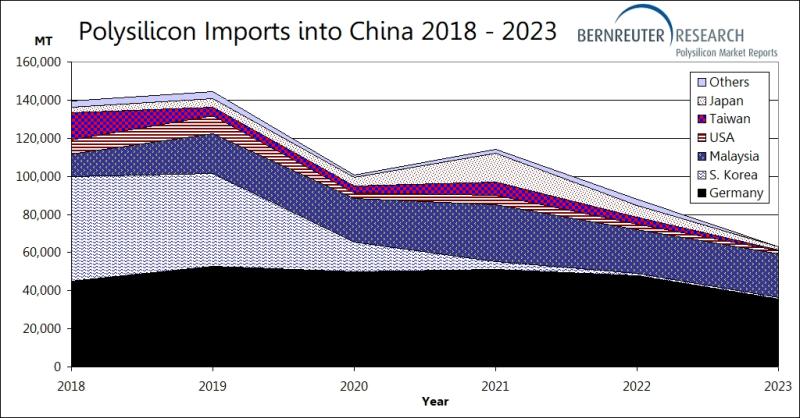

Polysilicon imports into China slid from 88,093 tons in 2022 by 28.5% to 62,965 tons in 2023 - Source: Chinese customs statistics

Würzburg (Germany), February 28, 2024 - Polysilicon imports into China have fallen to the lowest level since 2011. According to Chinese customs statistics, imports of the feedstock for solar cells and semiconductors slumped by 28.5% from 88,093 metric tons (MT) in 2022 to 62,965 MT in 2023. This volume is even slightly less than the 64,614 MT reached in 2011.

"The non-Chinese polysilicon manufacturers Wacker, Hemlock Semiconductor and OCI Malaysia are increasingly shifting their shipments from China to Vietnam, where three of the four largest Chinese solar module suppliers have established wafer plants," explains Johannes Bernreuter, head of the polysilicon market specialist Bernreuter Research and author of the Polysilicon Market Outlook 2027. In 2018/2019 JA Solar started to produce wafers in Vietnam with an annual capacity of 1.5 GW, which it expanded to 4 GW in the first half of 2023. JinkoSolar followed with a 7 GW wafer plant in early 2022, and Trina Solar opened a 6.5 GW wafer factory in August 2023.

U.S. regulations trigger wafer production facilities in Vietnam

Two influencing factors have pushed this development:

• On August 18, 2023 the U.S. Department of Commerce confirmed its preliminary determination made in December 2022 that several manufacturers in Cambodia, Malaysia, Thailand and Vietnam, which produce solar cells or modules with wafers from China, are circumventing anti-dumping and countervailing duties on Chinese solar cells and modules; these companies have to pay duties starting on June 6, 2024.

• On June 21, 2022, the Uyghur Forced Labor Prevention Act came into effect, which bans products made with forced labor in Xinjiang in northwestern China from entering the United States. Hence, the leading Chinese solar module suppliers began to create separate supply chains based on polysilicon from non-Chinese manufacturers for the export of solar modules to the U.S.: JA Solar could already build on a legacy polysilicon supply contract with Hemlock Semiconductor; Trina is a long-standing customer of Wacker, and Jinko closed two supply contracts with Hemlock and Wacker in September 2021.

Soaring exports from China to Vietnam raise dobts about separate supply chains

Having the wafer production facility outside China makes it easier for the manufacturers to document at the U.S. Customs and Border Protection (CBP) agency that no silicon metal or polysilicon from Xinjiang has entered their supply chains for modules destined for the U.S. However, customs statistics show that polysilicon exports from China to Vietnam soared from 639 MT in 2022 to 4,970 MT in 2023. "That raises doubts about the claims of a separate supply chain and should sound alarm bells at the CBP," comments Bernreuter.

Hemlock Semiconductor (USA), Wacker (Germany/USA) and OCI Malaysia together were able to increase their polysilicon exports to Vietnam from 18,672 MT in 2022 by 14,593 MT (+78.2%) to 33,265 MT in 2023. This growth more than compensated for the 13,918 MT they lost in business volume in China in 2023. While Hemlock and OCI achieved a net increase from their exports to both countries, Wacker's two German polysilicon plants exhibit a negative balance: Although they were able to boost the exports to Vietnam by 7,617 MT (+151%) to 12,662 MT, their imports into China plummeted from 48,070 MT in 2022 by 12,627 MT (-26.3%) to 35,443 MT in 2023.

Wacker and OCI account for 98% of Chinese polysilicon imports now

During the polysilicon shortage, China imported extraordinarily large volumes from Japan (2021: 15,431 MT; 2022: 6,129 MT) and Taiwan (2021: 6,899 MT; 2022: 3,480 MT). At high market prices, the Japanese solar module producer Sharp converted into cash considerable inventories, which resulted from a long-term purchase contract with Hemlock Semiconductor running through 2020. Likewise, the former Taiwanese wafer producer Danen sold polysilicon stocks from a long-term contract with OCI, which expired in 2023. These two sources have obviously been exhausted now: Japan's monthly import rate melted down to a range of 50 MT to 20 MT in the fourth quarter of 2023; shipments from Taiwan have already gone down to zero since last August.

Imports from the United States and South Korea developed in a very similar way to those from Japan in 2023. As a result, the combined share of Germany's Wacker and OCI Malaysia in total Chinese polysilicon imports rose to 97.8% in the fourth quarter. Moreover, there has been a striking drop in overall volumes since October: While total imports lay between roughly 15,000 MT and 20,000 MT per quarter in the first three quarters, the amount fell abruptly to less than 10,000 MT in the fourth. "If the fourth quarter is any indicator for 2024, then polysilicon imports into China will plunge by another 40% to no more than 38,000 MT this year," concludes Bernreuter.

Analysis of silicon metal suppliers and many other market trends

Chinese import data from 2011 through 2022 are contained in the Polysilicon Market Outlook 2027. In particular, the new 102-page report analyzes the impact of the Uyghur Forced Labor Prevention Act and reveals who the main silicon metal suppliers of the top seven polysilicon manufacturers in China are. The report also provides sophisticated scenarios of supply and demand, detailed forecasts of polysilicon prices through 2027, the latest purity and cost data on the dominant Siemens process and fluidized bed reactor technology, as well as many other market trends. For more information on the report, please go to the Polysilicon Market Outlook 2027:

https://www.bernreuter.com/polysilicon/industry-reports/polysilicon-market-outlook-2027/

Bernreuter Research • Polysilicon Market Reports

Lessingstr. 6 • 97072 Würzburg, Germany

Your Contact Partner:

Johannes Bernreuter, Company Head

Telephone: +49/931/784 77 81

About Bernreuter Research

Bernreuter Research was founded in 2008 by Johannes Bernreuter, one of the most reputable photovoltaic journalists in Germany, to publish global poly-silicon market reports. As early as 2001, Bernreuter authored his first analysis of an upcoming polysilicon bottleneck and new production processes. Since publishing its first report in 2010, Bernreuter Research has gained a reputation for providing the most comprehensive and accurate polysilicon reports on the market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polysilicon Imports into China Drop to Level of 2011 here

News-ID: 3405105 • Views: …

More Releases from Bernreuter Research

Top Ten Polysilicon Makers Nearly All Chinese

Wacker will stay in the ranking as only western producer, says Bernreuter Research

Würzburg (Germany), November 25, 2025 - Nine of the world's top ten polysilicon manufacturers are based in China today. "The Chinese polysilicon industry reached a share of 93.5% in the global output of 2024. This dominance is also reflected in the ranking of the world's largest manufacturers," says Johannes Bernreuter, author of the Polysilicon Market Outlook 2029 and…

Polysilicon Industry Is Risking New Shortage

Bernreuter Research: Shutdown of overcapacity could create undersupply by 2028

Würzburg (Germany), June 25, 2025 - The Chinese polysilicon industry will face a difficult balancing act in the next three years. "If too much overcapacity is eliminated, the market could run into a new shortage by 2028," predicts Johannes Bernreuter, head of Bernreuter Research and author of the new Polysilicon Market Outlook 2029 report.

Fueled by the shortage that culminated in a…

PV Installations Will Reach up to 660 GW in 2024

Bernreuter Research: Low module price will fuel demand in the second half of the year

Würzburg (Germany), June 18, 2024 - Global photovoltaic (PV) installations will land in a range of 600 to 660 gigawatts-direct current (GWdc) in 2024, according to the latest analysis from polysilicon market expert Bernreuter Research. "Once market participants come to the conclusion that the crash of the solar module price has reached its bottom, demand will…

Polysilicon Industry Faces Third Shakeout Wave

Bernreuter Research: Oversupply will push new entrants out of the market in 2024

Würzburg (Germany), November 28, 2023 - Chinese polysilicon market leader Tongwei will usher in a phase of fierce cut-throat competition in 2024. "Tongwei is planning to bring 575,000 tons of new production capacity on stream next year, whereas we expect a market growth of 200,000 tons at most," says Johannes Bernreuter, head of Bernreuter Research and author of…

More Releases for China

China fund establishment, China fund management,china investment management

Pandacu China is a leading financial institution that specializes in providing fund establishment and management services for domestic and international investors looking to invest in China. The company was founded in 2015 by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the investment industry.

https://boomingfaucet.com/

China Fund Establishment Consultation

E-mail:nolan@pandacuads.com

Investing in China can be a complex and challenging process, and…

China Finance Advisor, China Debt Finance Corporation,China Investment Corporati …

Investment bank is a financial institution that helps companies and governments raise capital by underwriting and issuing securities, and also provides advice on mergers and acquisitions, strategic investments, and other financial matters. Investment banks typically have a team of professionals with expertise in various areas such as corporate finance, securities underwriting, sales and trading, and market research.

http://pandacuads.com/

China Investment Corporation

Email:nolan@pandacuads.com

Some of the main services provided by investment banks include:

Underwriting: Investment banks…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

china construction company,china engineering company,china major bridge engineer …

List of Top 500 Chinese Construction Enterprises

ranking

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Company Name

province

1

China State Construction Corporation Limited

Beijing

2

China Railway Corporation Limited

Beijing

3

China Railway Construction Corporation Limited

Beijing

4

Shanghai Weimengsi Construction Engineering Co., Ltd.

Shanghai

5

China Communications Construction Group Co., Ltd.

Beijing

6

China Power Construction Corporation Limited

Beijing

7

China Energy Construction Group Co., Ltd.

Beijing

8

Shanghai Construction Engineering Group Co., Ltd.

Shanghai

9

Jiangsu Zhongnan Construction Industry Group Co., Ltd.

Jiangsu

10

China Gezhouba Group Co., Ltd.

Hubei

11

China National Chemical Engineering Co., Ltd.

Beijing

12

Sinoma Group Co., Ltd.

Beijing

13

Guangxi Construction Engineering Group Co., Ltd.

Guangxi

14

Shanghai Urban…

Forehead Thermometer Market Analysis (2019- 2025)| Microlife (China), Radiant (C …

This research study is one of the most detailed and accurate ones that solely focus on the global Forehead Thermometer market. It sheds light on critical factors that impact the growth of the global Forehead Thermometer market on several fronts. Market participants can use the report to gain a sound understanding of the competitive landscape and strategies adopted by leading players of the global Forehead Thermometer market. The authors of…

Global Color Steel Tile Market 2017 - South China, East China, Southwest China, …

Color Steel Tile Market Research Report

A market study based on the " Color Steel Tile Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Color Steel Tile Market 2017’. The research report analyses the historical as well as present performance of the worldwide Color Steel Tile industry, and makes predictions on the future status of Color Steel Tile market on the basis…