Press release

Asia-Pacific leads house price boom

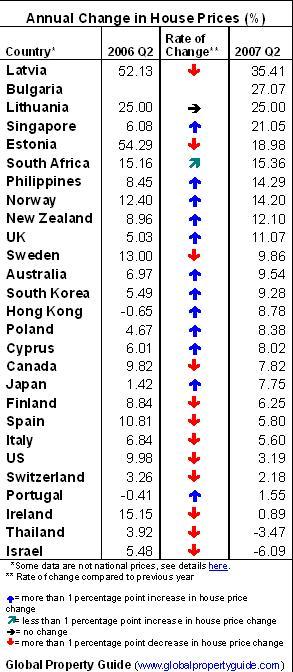

Europe’s house price growth continues to moderate, whereas prices in Asia-Pacific are heating up, according to indices assembled by the Global Property Guide (www.globalpropertyguide.com) based on country sources, for the second quarter (Q2) of 2007.House prices in the Baltics skyrocketed in 2005 and 2006. Latvia, Lithuania and Estonia experienced at least 25% annual increases during 2005-2006. House price growth peaked at 71% y-o-y to Q1 2006 in Estonia.

Despite the slowing of house prices in the Baltics in Q2 2007, over the past year the Baltic countries were still among the top five performers in the world.

In Latvia, house prices started dropping in June 2007, according to Latio, Latvia’s leading research-oriented realtor. Over the year, house price growth slowed to 35.41% in Q2 2007, from 52.13% y-o-y to Q2 2006. Latvia’s economy is the fastest-growing in Europe but signs of overheating have been observed.

Estonia’s slowdown was in evidence early this year when a meager house price increase of 5% y-o-y to Q1 2007 was revealed. House prices rose by 18.98% y-o-y to Q2 2007, still inferior compared to the 54.29% increase y-o-y to Q2 2006. Higher interest rates and stricter mortgage policies contributed to the slowdown.

Lithuania’s house price growth remained at 25% y-o-y to Q2 2007. Indicators suggest Lithuania is the most economically stable among Baltic countries.

The US housing crisis

In the US, house prices have increased by only 3.19% y-o-y to Q2 2007, down from 9.98% y-o-y to Q2 2006. This is the lowest annual growth recorded in almost ten years. Compared to Q1 2007, house prices were up by only 0.1% in Q2 2007.

According to OFHEO, house prices have dropped between Q2 2006 to Q2 2007 in five states, namely Nevada, Michigan, California, Massachusetts and Rhode Island. These states experienced dramatic house price increases during the housing boom.

Inflationary pressures from oil prices and other commodities have elevated interest rates. The US Federal Reserve has progressively pushed up rates, from a low of 1% in 2004 to 5.25% in June 2006. The most recent hikes caused many subprime borrowers to default on their payments, and consequently, file for foreclosure.

In an effort to control possible damage brought by the subprime crisis to the economy, on September 18, 2007, the Fed slashed interest rates by 50 basis points to 4.75%. The world has yet to see whether this cut will protect the US economy from recession.

Canada, on the other hand, has experienced a 7.82% house price increase y-o-y to Q2 2007, only a slight slowdown from 9.82% y-o-y to Q2 2006. Canada’s solid economy and strict mortgage policy are expected to guard the country from the malaise experienced by the US. No further slowdown is expected in the next few quarters.

Higher interest rates slow Europe

Many European housing markets have continued to cool as higher interest rates bit in Q2 2007. The European Central Bank raised key interest rates to 4% in June 2007, the highest level for six years.

A notable slowdown was experienced in Ireland where house prices rose by only 0.89% y-o-y to Q2 2007, a dramatic decline from 15.15% growth y-o-y to Q2 2006. Ireland’s monthly house price index has been dropping since March 2007 by an average of 0.6% per month.

Spain experienced its lowest house price increase in nine years. House prices rose by 5.80% y-o-y to Q2 2007, from a peak of 17% in 2003. Most house purchases in Spain are made with variable- rate mortgages, making the market vulnerable to interest rate changes.

Other European countries that so far this year experienced lower house price increases than in 2006 were Sweden, Finland, Italy and Switzerland.

Bulgaria experienced a remarkable house price increase of 27.07% y-o-y to Q2 2007, ranking second in the global house price growth list behind Latvia.

House prices in Norway and the UK registered double-digit growth. In Norway they rose by 14.20% y-o-y to Q2 2007.

UK house prices increased by 11.07% y-o-y to Q2 2007, up from 5.03% y-o-y to Q2 2006. They rose by an average of 19% per year from 2002-2004. At the end of 2004, growth started to slow in response to rising interest rates; up five times to 4.75% in August 2004, from a low of 3.5% in July 2003. At the end of 2005, the rise in house prices resumed despite continued interest rate hike.

Poland and Cyprus both experienced house price increases of 8% y-o-y to Q2 2007.

Asia-Pacific maintains momentum

Singapore led the charge in Asia with remarkable house price growth of 21.05% y-o-y to Q2 2007, up from 6.08% y-o-y to Q2 2006. Thanks to its booming economy, Singapore’s housing market has recovered from an 8- year house price slump.

House prices in the Philippines rose by 14.29% y-o-y to Q2 2007, up from 8.45% y-o-y to Q2 2006. Strong economic growth and the continued inflow of remittances from Overseas Filipino Workers have been fueling the housing market in the Philippines.

Hong Kong is also well on the way to recovery from its recent house price downturn. House prices rose by 8.78% y-o-y to Q2 2007, after a decline of 0.65% y-o-y to Q2 2006, despite relatively high interest rates (HK$ interest rates follow US rates). The interest rate cut in the US is expected to push Hong Kong’s house and apartment prices up further.

In Japan’s six major cities, land prices increased by 7.75% y-o-y to Q2 2007. This shows conclusively that Japan has recovered from its 15- year house price downturn.

Australia’s house prices rose by 9.54% y-o-y to Q2 2007, after a rise of 6.97% y-o-y to Q2 2006, despite the higher interest rates set in November 2006.

New Zealand’s house prices rose by 12.10% y-o-y to Q2 2007, despite the Reserve Bank of New Zealand’s effort to moderate recent sharp house price increases. Interest rates on mortgages shot up to 10.54% last August, the highest rates seen since 1999.

Unlike most Asian countries, Thailand saw a drop of 3.47% y-o-y to Q2 2007, from a rise of 3.92% y-o-y to Q2 2006. As with Israel (whose house prices also declined), political turmoil has taken a toll on its housing markets. Israel’s house prices fell by 6.09% y-o-y to Q2 2007, after a rise of 5.48% y-o-y to Q2 2006.

On the other side of the globe, South Africa’s house prices continue to heat up. House prices rose by 15.36% y-o-y to Q2 2007. However, South Africa’s house price growth is expected to moderate in the next few quarters because banks have increased their mortgage rates to 13.5% after the South African Reserve Bank’s decision to raise the repo rate to tame inflation.

Full Report - http://www.globalpropertyguide.com/articleread.php?article_id=97&cid=

Global housing boom shifts focus - http://www.globalpropertyguide.com/articleread.php?article_id=94&cid=

Asian property: A decade after the crisis - http://www.globalpropertyguide.com/articleread.php?article_id=93&cid=

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Cell: (+63) 917 735 2228

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock Phone: (+632) 867 4220 Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide (www.globalpropertyguide.com) is an on-line property research house. On-line newspapers, magazines, sites, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com Sites found not to be providing the link will be removed from our press list.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific leads house price boom here

News-ID: 29725 • Views: …

More Releases from Global Property Guide

Most expensive real estate markets in 2009

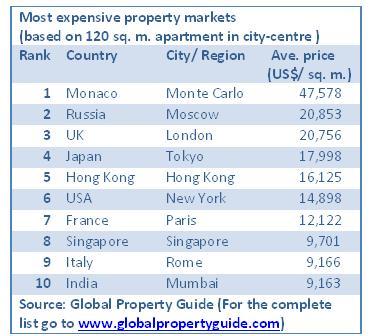

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for House

Electrical House (E-House) Market Demand: Transforming Power Infrastructure Worl …

According to a new report published by Allied Market Research, The global electrical house (E-House) market size was valued at $1.2 billion in 2020, and is projected to reach $2.3 billion by 2030, growing at a CAGR of 6.4% from 2021 to 2030.

An Electrical House (E-House), also known as a Power House or Switchgear House, is a prefabricated modular building that contains electrical equipment and systems necessary for power distribution,…

Major Maids House Cleaners: Trusted House Cleaners in St. Petersburg

Major Maids House Cleaners of St. Pete, a top provider of professional cleaning services, is now offering residents of St. Petersburg the highest quality house cleaning services. Specializing in personalized cleaning solutions, Major Maids is dedicated to delivering exceptional cleanliness, reliability, and efficiency to homes across the St. Petersburg area.

Major Maids House Cleaners of St. Pete, a leading provider of professional cleaning services, is now offering residents of St. Petersburg…

Electrical House (E-House) Market Segmentation CAGR of 7.25% the electrical hous …

"Electrical House (E-House) Market Segmentation: Identifying Core Segments

Global Electrical House (E-House) Market, By Voltage (Medium Voltage Electrical House (E-House) and Low Voltage Electrical House (E-House)), Type (Fixed and Mobile Substation), Application (Mining Industries, Oil and Gas Industry and Metal Industry), Component (Switchgear, Transformer, Bus Bar, Variable Frequency Drive, Power Management System, Heating, Ventilation, and Air Conditioning (HVAC) and Other Auxiliary Systems), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South…

Electrical House (E-House) Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Electrical House (E-House) Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

The Electrical House (E-House) market is experiencing significant growth due to the increasing demand for rapid and flexible power solutions. E-Houses, also known as…

Professional House Removalists In Brisbane For Safe House Removals

Moving and shifting can be a thoroughgoing process and many of the times we often predict that everything will fall in the right place on a moving day. The effort that is being put into moving a house whether it's a 2 room house removal or 5 plus room house removals is often overlooked until you move by yourself. There are a lot of cons of moving by yourself, for…

Latest Electrical House (E-House) Market 2022 | Detailed Report

The Electrical House (E-House) research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market’s key players. Furthermore, the report offers insightful market data and information about the Electrical…