Press release

Asian property: A decade after the crisis

A decade after the 1997 Asian Crisis erupted, most housing markets in Asia are well on their way to recovery.Boosted by strong economic growth and strong local and international demand, residential real estate prices in the Philippines, Singapore and South Korea rose by more than 10% in nominal terms y-o-y to Q1 2007.

In Hong Kong, after registering price falls in early 2006, the over-all residential price index is back in positive territory. The index rose 5.2% y-o-y to March 2007. However this is significantly lower than the annual price increases to the first quarter of 2005 and 2004, at 21% and 28%, respectively.

No bubble this time

Although property prices in most Asian countries are still below their peak levels, rapid price appreciation has taken place over the past five years, leading to renewed fears that a speculative property bubble is forming in several Asian countries.

The fear is not unfounded; one has only to recall Asia’s spectacular and disastrous property bubbles of the 1990s.

However, the recent price increases are actually recoveries from the previous slump caused by the Asian crisis and other phenomena.

As of Q1 2007, property prices in most Asian countries are in fact still below their peak levels in real terms.

Strong housing demand

Current economic and monetary conditions suggest continued strong demand for housing. All economies affected by the Asian Crisis grew by 5% or more in 2006. GDP growth from 2002 to 2006 has been markedly stronger than during the crisis period - 1997 to 2001, although slower compared to the tail-end of the “Asian Economic Miracle”.

As a result of financial and monetary reforms implemented after the crisis, banks and other financial institutions are in much better shape now. Asia’s mortgage market is set for a boom. This is despite the fact that mortgage lenders are more cautious of over-exposing themselves to particular sectors (some pundits worry that banks are actually being too cautious).

Despite recent interest hikes, in line with global interest rates, base interest rates for mortgage lending are generally lower now than before the crisis.

Socio-economic conditions also point to continued strong demand for residential properties. Strong urbanization and population growth has led to high population densities in several Asian cities.

In view of the relatively restrained dwelling price rises, strong economic growth and banking sector caution and healthy yields to be enjoyed on properties in Asia, talk of another bubble seems far-fetched.

Other problems

A more pressing concern for Asian economies is the continuation of reforms to improve real estate efficiency and transparency. Transaction costs remain high and the property registration is still cumbersome in several countries.

While Malaysia is encouraging foreign property buyers, Thailand’s military junta is pushing them away. Thailand announced that it is completing a crackdown on foreign companies established for the sole purpose of buying landed properties. While the motivation for this move is unclear, the signal is clear “foreigners are not welcome.” Political uncertainty and policy flip-flaps by the ruling junta are undoubtedly hurting the real estate market.

In the Philippines, proposed property market reforms are languishing in congress. These laws include the establishment of a centralized agency for registering property and a standard property valuation system.

Full Report:

http://www.globalpropertyguide.com/articleread.php?article_id=93&cid=

Economics Team:

Prince Christian Cruz, Senior Economist

Phone: (+632) 750 0560

Email: prince@globalpropertyguide.com

Publisher and Strategist:

Matthew Montagu-Pollock

Phone: (+632) 867 4220

Cell: (+63) 917 321 7073

Email: editor@globalpropertyguide.com

Terms of Use:

On-line newspapers, magazines, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com.

Address:

Global Property Guide

http://www.globalpropertyguide.com

5F Electra House Building

115-117 Esteban Street

Legaspi Village, Makati City

Philippines 1229

info@globalpropertyguide.com

The Global Property Guide is an on-line property research house.

Terms of Use:

On-line newspapers, magazines, etc wishing to use material from this press release MUST provide a clickable link to www.globalpropertyguide.com.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asian property: A decade after the crisis here

News-ID: 25712 • Views: …

More Releases from Global Property Guide

Most expensive real estate markets in 2009

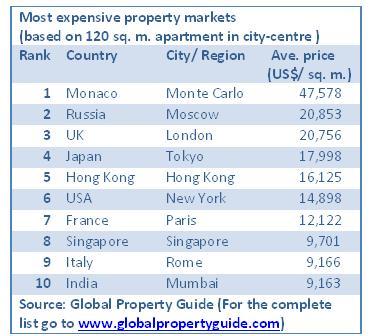

No surprise - Monte Carlo is No 1 in the Global Property Guide’s list of World’s Most Expensive Residential Real Estate Markets 2009, more than twice as expensive, at US$45,000 per square metre, as the runner up. [globalpropertyguide.com]

Battling for the number 2 position are prime central Moscow and London. Prime central Moscow’s US$20,853 per square metre price tag slightly outpaces core Prime London’s US$20,756 per square metre, though it…

World property market slide worsens

As financial markets tumble, the world’s housing markets have continued to slide during the year to end-Q2 2008. Inflation-adjusted house prices fell in 21 out of the 33 countries for which there is up-to-date published data.

The Baltics, the US, the UK and Ireland led the global decline during the year to end-Q2 2008, the latest date for which comprehensive global statistics are available.

The biggest house price declines…

The end of the global house price boom

Weighed down by the credit crunch and high inflation, the global house price boom has ended, according to the latest Global Property Guide survey of house price indicators.

Only 13 countries in which dwelling price indices are regularly published saw prices rise during the year to end Q1 2008, while 21 countries saw dwelling prices fall in real terms, i.e., after adjusting for inflation.

In most countries…

Gloomy days ahead for Asia’s housing markets

Asian property markets, though still relatively unaffected by the credit crunch, will soon be affected by inflation and higher interest rates, warns the Global Property Guide, because of rising food, fuel and other commodity prices.

“Higher food, fuel and other commodity prices affect the housing market negatively in several ways,” says Prince Christian Cruz, senior economist at the Global Property Guide.

“At the micro level, households may postpone their decision to…

More Releases for Asia

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

South East Asia Business Jet Market And Top Key Players are Asia Corporate Jet, …

By 2022, the South East Asia Business Jet Markets estimated to reach US$ XX Mn, up from US$ XX Mn in 2016, growing at a CAGR of XX% during the forecast period. The Global Business Jet Market, currently at 21 million USD, contributes the highest share in the market and is poised to grow at the fastest rate in the future. The three broad categories of business jets are Small,…

LIXIL Asia Presents Asia Pacific Property Awards

Through its power brands GROHE and American Standard, LIXIL Asia signs a three-year deal to become the Headline Sponsor of the Asia Pacific Property Awards from 2019 until 2022.

23rd January 2019: The International Property Awards, first established in 1993, are open to residential and commercial property professionals from around the globe. They celebrate the highest levels of achievement by companies operating within the architecture, interior design, real estate and property…

PEOPLEWAVE WINS ASIA TECH PODCAST PITCHDECK ASIA 2019 AWARDS

15 January 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, won the Asia Tech Podcast (ATP) Pitchdeck Asia 2019 Awards, being awarded “Startup Most Likely to Succeed in 2019".

The 2019 Pitchdeck Asia Awards is an opportunity for the Asian Startup Ecosystem to shine a spotlight on some of its best startups. The awards were decided by a public vote. More than 7,200 votes were cast by registered LinkedIn…

Undersea Defence Technology Asia, UDT Asia 2011

Latest Military Diving Technologies featured in UDT Asia

Equipping Asia’s navies with the latest diving technology for asymmetric warfare and

operations

SINGAPORE, 17 October 2011 - Naval diving and underwater special operations is a field that is

seeing increased attention and investment amongst navies in Asia. Units such as the Indonesian Navy‟s KOPASKA, the Republic of Singapore Navy‟s Naval Diving Unit (NDU), the Royal Malaysian Navy‟s PASKAL are increasingly utilising specialised equipment for conducting…

Asia Diligence – Specialist Investigative Due Diligence for Asia & Beyond

Asia Diligence today announced the opening of its European Customer Services office in the United Kingdom. The office is to be managed by Steve Fowler and will focus on providing services to Asia Diligence’s European customers. Asia Diligence is also planning to open a US office in the near future, which will provide customer service to its US and North American clients.

Asked to comment on the move, Luke Palmer, the…