Press release

The Gold Bull Market-Is it Bull?

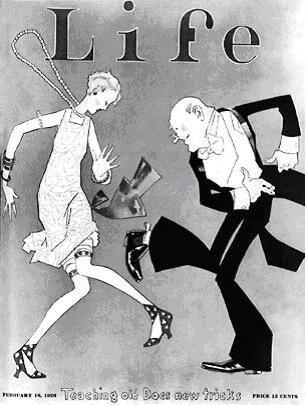

The gold bull market is in full force. How long it will continue I have no earthly idea. This gold bull market very much reminds me of the real estate bull market. I have a difficult time recalling all the conversations I had during the technology bull market that ended in March of 2000. But I can certainly remember all of the attitudes and all of the people and the way that they acted during the great real estate bull market. I remember the confidence level of people at church and all the different people in the real estate industry that were making money. I remember people that didn’t have real estate licenses going out and getting real estate licenses just so they could buy and sell (flip) homes. They had no knowledge of doing this. I had clients of mine, pull money out of their accounts to buy real estate that they had never seen before. And on and on it goes. And now, here we are in the middle of another bull market…gold!I have recently seen someone that I consider to be a herd investor. This person is intelligent and certainly does a lot of things good financially. This person is particularly good at making money and not wasting money on car purchases. Some people think that because they’re good at making money that means they’re also a good investor or because they’re intelligent and they’re good at math that means they’re automatically a good investor. And that’s simply not the case. This person’s typical strategy, ever since I’ve know them, has been the typical most employed Herd strategy, which is dollar cost averaging. And so this person has been doing the dollar cost averaging in U. S. stocks and has now finally decided he’s going to buy some gold here in year number 11 of the great gold bull market.

As I drive down the streets, I see signs that say “We buy gold”. I see advertisements in magazines that I receive from the financial industry, and on the internet advertising, about investing in gold. One of my favorite conversations I’ve had during this gold bull market is when I was talking to a client.

I said to one my client, “you know I was looking at the previous bubbles that we’ve had throughout history.” [I have this chart sitting in my desk and this chart looks at the different bubbles that we’ve had and gold is up 414% in its current bull market.] And that’s really not that high on the bubble chart. So in other words, gold can certainly increase a whole lot more before it gets to even what it’s previous bubble level was where it went up 2,200%. Gold is only up 414% right now.” So I told my client, “I could see gold going up to $6,000 an ounce as kind of a maximum target during this current bull market.”

He quickly and brilliantly replied that he was reading an article [and I sensed that he found this article to be very useful and well written and probably correct.] And he said that this article stated that “the great thing about gold was that there was just no limit on how high it could go.” And so here we are in this wild bull market and you hear phrases like that, “there’s no limit on how high” something can go. Certainly that’s just like any other bull market that’s ever occurred in investor psychology.

We’re there, we’re in the heart of it. Where this gold bull market will end, I have no idea. Is it going to end tomorrow? Is it going to end at $3,000 an ounce, at $4,000 an ounce, at $5,000 an ounce, $6,000 an ounce? We don’t know. Is it going to end at $10,000 an ounce? Only God knows. One thing is for certain and I can’t write this enough. I can’t state this enough. The gold bull market will end with an enormous crash, just like every other bull market has ended in the history of mankind. So that much you can be certain of. How high it’s going to go, how much longer it’s going to last; only the Messiah Jesus Christ knows that information.

On an interesting note, this bond bull market that’s been going on for roughly 30 years, I don’t see the same euphoria that I see with gold and real estate. I haven’t heard people talk about it as much. So the bond bull that we’ve been in, that’s been going on for so long, is not as talked about. The bond bull market, to me, is much more interesting than the gold or the real estate bull markets. People don’t want to talk about bonds, as much as gold. People aren’t as crazy and goo-goo for bonds as they are for gold right now. Gold is the latest “buy and hold” darling. The bottom line here is that yes, we’re in the middle of a gold bull market which I think will continue for now, but don’t be lulled into thinking that this bull has no end…That’s just a bunch of bull.

Eleven Two Fund Management is a Registered Investment Advisor (RIA) located in Marietta, GA. We are proud to be working with Christian Individuals, small business owners, and Families in over 16 states.

Our Services

•Comprehensive Financial Planning including insurance planning.

•Investment Planning (including tax advantaged alternative investments with audited track records going back over 15 years.)

•Money Management (Active and truly diversified to avoid big losses or drops in our clients' account values)

•Individual Stock Management

•Tax Planning - A proactive approach recommended in plain English to reduce your income tax bill every year (works best for six figure incomes and higher).

Eleven Two Fund Management gives investment advice that is different because it uses true or proper diversification with active management. Much of the financial planning advice we give is always right, never changes, and is relevant because it is based on Biblical principles.

We offer a free "Get Acquainted" meeting to describe our services and fees, and to see if our services are right for you.

Eleven Two Fund Management

3162 Johnson Ferry Road #260-27

Marietta, GA 30062

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Gold Bull Market-Is it Bull? here

News-ID: 196127 • Views: …

More Releases from Eleven Two Fund Management

Giving, Saving, Investing

Luke 3:11 - And he would answer and say to them, “The man who has two tunics is to share with him who has none; and he who has food is to do likewise.”

Going back to God’s word can often be challenging. And when I read these verses on giving, I feel my faith being challenged. Why did Jesus tell us to do such things? It’s easy for Him to…

Investing Notes Sept 2011-Treacherous Waters Ahead

The US stock market hit a peak this year on April 29th, and we have not seen stocks that high since then. Behind much of the stock market’s volatility, at the end of August, are two different investment approaches. One group of investment managers believes that a lack of economic stimulus by governments around the world will lead to a severe recession. They sold on Friday when Ben Bernanke announced…

Jittery Joe's and Patient Patty's...Biggest Investing Mistakes Revealed

I just wanted to review some of my thoughts about short term tracking of investment strategies. One of the biggest mistakes I see my clients make is to switch strategies after a few months when their accounts go down. I have witnessed this for years. Then inevitably, right after they switch investment strategies (with me) the investment strategy they just left starts to go up and the investment strategy they…

Is the U.S. Heading for the next "Roaring 20's" or "Great Depression"?

The average 12 month CD is paying .75%. I just looked at 2 year corporate bond yields and the best I could find was 2.4%. Right now, fixed income investors are really seeing their interest payments go down. The US government bond crashed (interest rates went up) in the 4th quarter of 2010 but it didn’t cause interest rates to go up for CDs and corporates. With commodities up 28.9%…

More Releases for Gold

Gold Concentrate Market Is Going to Boom | Major Giants - Barrick Gold, Gold Fie …

HTF MI just released the Global Gold Concentrate Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered:

Barrick Gold (CAN), Newmont (US), AngloGold Ashanti…

Gold Mining Market - Key Players & Qualitative Insights 2025 | Gold Corp, Barric …

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Global Gold Mining Market to 2025: Newmont Mining, Gold Reserve, Royal Gold, Hom …

Researchmoz added Most up-to-date research on "Global Gold Mining Market Insights, Forecast to 2025" to its huge collection of research reports.

This report researches the worldwide Gold Mining market size (value, capacity, production and consumption) in key regions like North America, Europe, Asia Pacific (China, Japan) and other regions.

This study categorizes the global Gold Mining breakdown data by manufacturers, region, type and application, also analyzes the market status, market share, growth…

Gold Metals Market Demands with Major Quality Things: Pure Gold, Mixed Color Gol …

Gold Metals Market By Product (Pure Gold, Mixed Color Gold, Color Gold and Other Products) and Application (Luxury Goods, Automotive, Electronics and Other Applications) - Global Industry Analysis And Forecast To 2025.

Industry Outlook:

The gold is an element having the symbol Au (from the Latin name: aurum) and the atomic number been 79, making it the element with higher atomic number that happen normally. In the most pure form, it is…

Gold Mining Market Highlights On Product Demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…

Gold Mining Market - Heightened demand 2025 | Gold Corp, Barrick Gold

Global Gold Mining Market: Overview

A variety of techniques are typically used to obtain gold from gold ores in the ground. They are: placer mining, sluicing, gold panning, dredging, hard-rock mining, rocker box, and by product mining. Gold mining has been carried out since ages and is a flourishing market even today. The high demand for gold as a potential mode of investment and the use of gold for making jewelry…