Press release

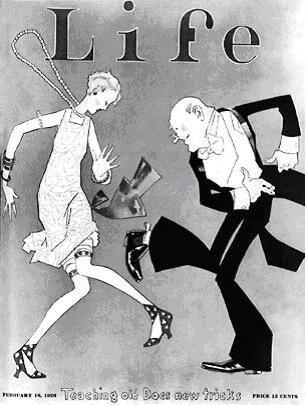

Jittery Joe's and Patient Patty's...Biggest Investing Mistakes Revealed

I just wanted to review some of my thoughts about short term tracking of investment strategies. One of the biggest mistakes I see my clients make is to switch strategies after a few months when their accounts go down. I have witnessed this for years. Then inevitably, right after they switch investment strategies (with me) the investment strategy they just left starts to go up and the investment strategy they move into goes down.It happened last year (2010), with the TDP(R). From January 1 to August 31, the TDP(R) investment strategy was down 4.03%. I had roughly 2 clients decide to get out of the TDP(R) and move to my short term bond strategy. There thinking was that the TDP(R) wasn't growing and that they had waited long enough (8 months). They wanted to be "good stewards". I advised them to stay the course because even though their account wasn't growing they weren't down that much. I only recommend changing strategies, for a client, if they experience a big loss. A big loss, because of how important it is not to have big losses, is the only "unpardonable sin" for an investing strategy in my opinion. That is why I changed the TDP® strategy after October 2008 to be more active (long, short, cash) with the diversified positions.

Then from August 31st to December 31st, 2010 the TDP(R) went up over 10% and finished 2010 with a nice gain. Meanwhile the short term bonds my clients moved into went down about 2%. So now these clients are really feeling regret over their impulsive and ill-advised decision. They essentially cost themselves about 12% during that time period. Oh by the way, my short term bond strategy, designed to outperform CDs by 2%/year after all fees, was up tremendously during the first 3 quarters of 2010 and went down only in the 4th quarter. This short term bond strategy also finished up 4.47% for the year, thus outgaining the 1 year CD by 3.47% for 2010.

A decade or so ago clients would only receive yearly statements. Then it went to quarterly. The stock brokers (Schwab, Merrill Lynch, etc.) and Wall Street learned quickly that the more often they sent out account updates to clients the more money they made because, in general, people lack patience and can't control their emotions so they made changes (trades), not based on a strategy but feelings. Then brokers moved to monthly statements and finally landed on 24/7 access of accounts and trade confirmations (you gotta have those trade confirmations, its just being a wise steward;)! Custodians and brokers have never been more profitable. I am fee only and don’t get paid on trades.

As an investor you should understand: There will be consecutive months (up to 12) where we will have a small loss or little/no gain with money you are taking more risk with to grow. There should not be huge losses (because those are too important and avoiding huge losses are the single most important aspect of any long term growth investing strategy, in my opinion).

I have a long term growth investment strategy in place for all my clients and taking it "out of the ground" every 30 days to check progress may not be the wisest thing because it may cause us (client and advisor) to make investment decisions based on the next 30 days. As a client, you don't want your investment advisor making moves with your money based on the next month. In other words, you don't want me worrying about how a move will affect your account over the next 30 days because this will hurt your long term returns. My advice is to use the 30 day checkup only to check for big losses (10+ percent).

In summary, I don't think it is important to look at an investment strategy over a 30 day period. I believe 3 years is the most valuable of all time frames to judge an investment because it gives the investor a chance to truly gauge whether or not the goal of long term growth is being achieved. If a big loss happens during one of the quarters then, yes, I would consider making a change to the strategy.

Eleven Two Fund Management is a Registered Investment Advisor (RIA) located in Marietta, GA. We are proud to be working with Christian Individuals, small business owners, and Families in over 16 states.

Our Services

Comprehensive Financial Planning including insurance planning.

Investment Planning (including tax advantaged alternative investments with audited track records going back over 15 years.)

Money Management (Active and truly diversified to avoid big losses or drops in our clients' account values)

Individual Stock Management

Tax Planning - A proactive approach recommended in plain English to reduce your income tax bill every year (works best for six figure incomes and higher).

Eleven Two Fund Management gives investment advice that is different because it uses true or proper diversification with active management. Much of the financial planning advice we give is always right, never changes, and is relevant because it is based on Biblical principles.

Eleven Two Fund Management

3162 Johnson Ferry Road #260-27

Marietta, GA 30062

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Jittery Joe's and Patient Patty's...Biggest Investing Mistakes Revealed here

News-ID: 166009 • Views: …

More Releases from Eleven Two Fund Management

The Gold Bull Market-Is it Bull?

The gold bull market is in full force. How long it will continue I have no earthly idea. This gold bull market very much reminds me of the real estate bull market. I have a difficult time recalling all the conversations I had during the technology bull market that ended in March of 2000. But I can certainly remember all of the attitudes and all of the people and…

Giving, Saving, Investing

Luke 3:11 - And he would answer and say to them, “The man who has two tunics is to share with him who has none; and he who has food is to do likewise.”

Going back to God’s word can often be challenging. And when I read these verses on giving, I feel my faith being challenged. Why did Jesus tell us to do such things? It’s easy for Him to…

Investing Notes Sept 2011-Treacherous Waters Ahead

The US stock market hit a peak this year on April 29th, and we have not seen stocks that high since then. Behind much of the stock market’s volatility, at the end of August, are two different investment approaches. One group of investment managers believes that a lack of economic stimulus by governments around the world will lead to a severe recession. They sold on Friday when Ben Bernanke announced…

Is the U.S. Heading for the next "Roaring 20's" or "Great Depression"?

The average 12 month CD is paying .75%. I just looked at 2 year corporate bond yields and the best I could find was 2.4%. Right now, fixed income investors are really seeing their interest payments go down. The US government bond crashed (interest rates went up) in the 4th quarter of 2010 but it didn’t cause interest rates to go up for CDs and corporates. With commodities up 28.9%…

More Releases for TDP

Frontotemporal Dementia Pipeline Insight 2025: 25+ Emerging Therapies Target Tau …

The Frontotemporal Dementia (FTD) treatment landscape is rapidly evolving, with more than 15 biotech and pharmaceutical companies advancing clinical-stage programs targeting key genetic and pathological drivers of the disease, including tau aggregation, TDP-43 pathology, GRN mutations, and neuroinflammation. As a leading cause of early-onset dementia, FTD represents a major unmet need, with no currently approved disease-modifying therapies.

DelveInsight's "Frontotemporal Dementia (FTD) - Pipeline Insight, 2025 [https://www.delveinsight.com/report-store/frontotemporal-dementia-pipeline-insight?utm_source=abnewswire&utm_medium=pressrelease&utm_campaign=jpr]" delivers an in-depth analysis of…

Tdp Therapeutic Apparatus Market Overall Study Report 2024-2032 | Ningbo Tunhe E …

The Tdp Therapeutic Apparatus Market research report offers crucial insights into how the industry is evolving, highlighting key drivers of growth and the main revenue streams expected between 2024 and 2032. It's like a compass guiding business through the complexities of the market, presenting not only the current landscape but also the latest innovations shaping its future. This report becomes a strategic ally for companies, stakeholders, and industry players, offering…

MINI-ITX Motherboard with 8/9/10th Gen. 45W TDP Processor

MINI-ITX Motherboard [https://www.iesptech.net/mini-itx-sbc/] with 8/9/10th Gen. H Series Processor (45W TDP)

IESP-6486-XXXXH [https://www.iesptech.net/mini-itx-industrial-sbc-high-performance-8910-h-series-processor-product/] Industrial Embedded MINI-ITX SBC is designed to accommodate Intel 8th/9th/10th High Performance H Series Processors. It offers high-performance computing capabilities suitable for industrial applications. Memory: It features 2 SO-DIMM slots that support DDR4 2666MHz memory modules, with a maximum capacity of up to 64GB. Displays: The board supports multiple display options, including HDMI, DEP2, VGA, and LVDS/DEP1, providing…

TDP-43 Proteinopathies Market Report 2024-2034 | Industry Size, Growth and Lates …

Market Overview:

The TDP-43 proteinopathies market reached a value of US$ 661.9 Million in 2023 and expected to reach US$ 925.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.09% during 2024-2034.

The TDP-43 proteinopathies market report offers a comprehensive analysis of the market in the United States, EU5 (including Germany, Spain, Italy, France, and the United Kingdom), and Japan. It covers aspects such as treatment methods, drugs available in the market, drugs…

TDP-43 Proteinopathies Market Growth, Opportunity, Analysis & Trends 2023-2033

TDP-43 Proteinopathies Market Report Overview:

Report Attribute Details

Base Year 2022

Forecast Years …

TDP Therapeutic Apparatus Market | Chongqing Aerospace Launch Vehicle Electronic …

The global tdp therapeutic apparatus market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the tdp therapeutic apparatus market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…